The exemption limit will be Rs 12.75 lakh for salaried taxpayers, with a standard deduction of Rs 75,000.

In a big relief to the middle class, Finance Minister Nirmala Sitharaman has extended the exemption limit for salaried taxpayers to Rs 12.75 lakh, with a standard deduction of Rs 75,000. Presenting the Union Budget 2025, the minister announced fresh tax slabs under the new tax regime, under which, there is no tax on annual incomes up to Rs 4 lakh. The new tax regime will come into effect from the new financial year 2025-26, starting on April 1, 2025.

FM Sitharaman said that after the changes made under the new tax regime, there will be a saving of Rs 80,000 on an income of Rs 12 lakh, Rs 70,000 on an income of Rs 18 lakh, and Rs 1,10,000 on an income of Rs 25 lakh.

For income between Rs 4 lakh and Rs 8 lakh, the tax rate will be 5 per cent, while incomes between Rs 8 lakh and Rs 12 lakh will be taxed at 10 per cent. For higher income brackets, the tax rates will increase progressively, with 15 per cent for Rs 12 lakh to Rs 16 lakh, 20 per cent for Rs 16 lakh to Rs 20 lakh, 25 per cent for Rs 20 lakh to Rs 24 lakh, and 30 per cent for incomes above Rs 24 lakh. Check the full tax slab here:

In addition to the revised tax slabs, Finance Minister Sitharaman also announced an increase in the tax rebate available under Section 87A. This means that individuals with a net taxable income of up to Rs 12 lakh will not be required to pay any income tax.

However, if your annual income is exactly Rs 12 lakh, you will still pay tax according to the applicable slab rates but will benefit from the rebate, reducing your final tax liability.

In simpler terms, if you're a salaried individual or earn other types of "regular income" up to Rs 12 lakh, you will not have to pay any tax due to both the enhanced rebate and the revised tax slabs. However, income from capital gains will not be eligible for the rebate and will be taxed separately under different rules.

(With inputs from IANS)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Anupam Kher says he has hurt Kirron Kher, admits not being in best marriage: 'That’s why I have...'

Anupam Kher says he has hurt Kirron Kher, admits not being in best marriage: 'That’s why I have...' Salt consumption among Indians is 2.2 times more than WHO limit: ICMR

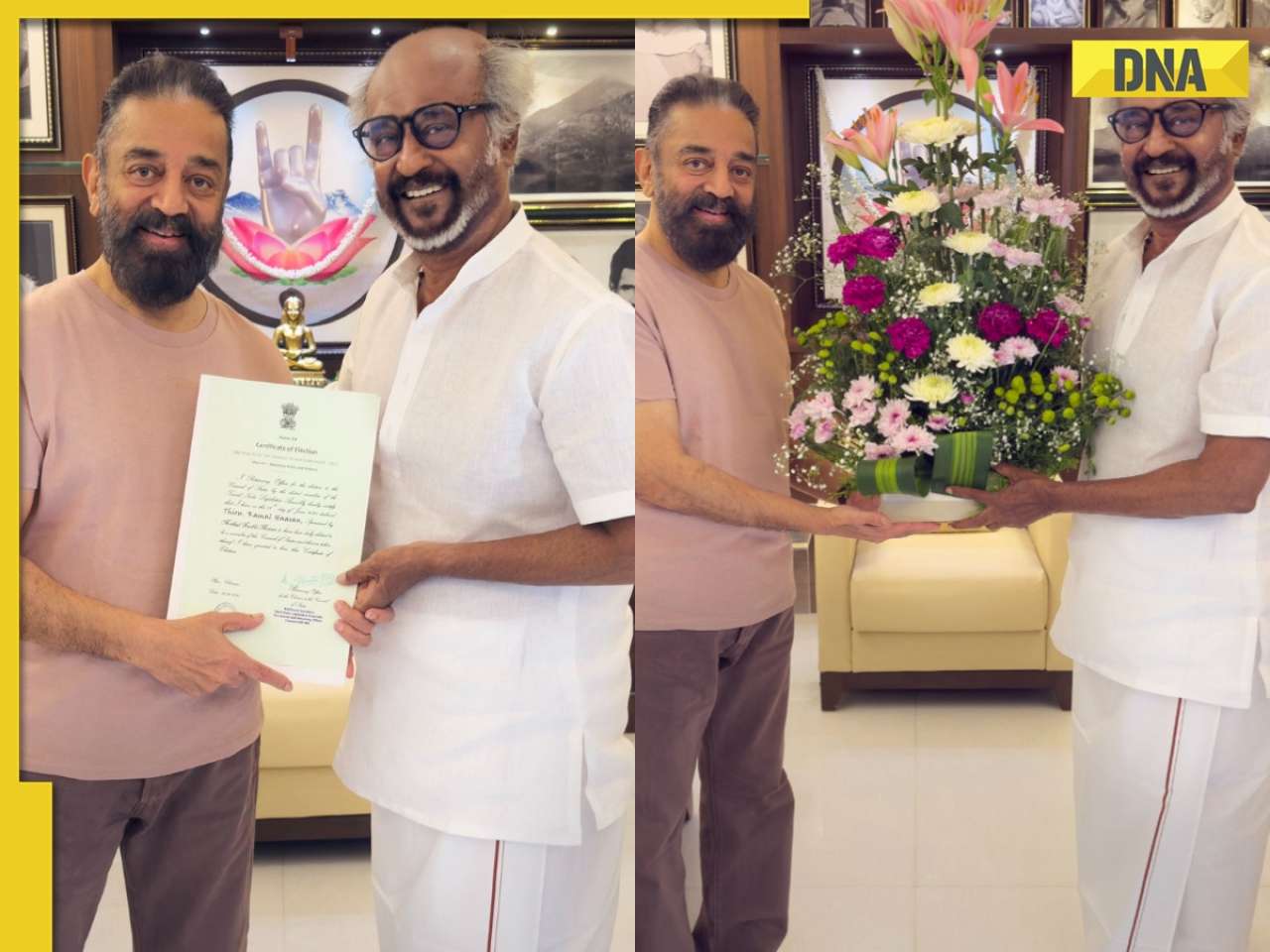

Salt consumption among Indians is 2.2 times more than WHO limit: ICMR Ahead of his Rajya Sabha oath-taking ceremony, Kamal Haasan meets friend Rajinikanth; see viral photos

Ahead of his Rajya Sabha oath-taking ceremony, Kamal Haasan meets friend Rajinikanth; see viral photos Political shakeup in Pakistan? President Asif Ali Zardari to be forced to quit, Asim Munir to take over? Defence Minister says...

Political shakeup in Pakistan? President Asif Ali Zardari to be forced to quit, Asim Munir to take over? Defence Minister says... Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in...

Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in... 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case

Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi

US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics

CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National

Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen

Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in...

Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in... Tesla vs BYD: Long before Tesla’s entry in India, BYD introduced self-driving tech in budget cars, will now integrate DeepSeek in entry level cars

Tesla vs BYD: Long before Tesla’s entry in India, BYD introduced self-driving tech in budget cars, will now integrate DeepSeek in entry level cars  Not Elon Musk's Tesla, Apple: Most bought US stocks by Indians in last 3 months are...

Not Elon Musk's Tesla, Apple: Most bought US stocks by Indians in last 3 months are... Anand Mahindra welcomes Elon Musk's Tesla in India: 'Looking forward to seeing you at...'

Anand Mahindra welcomes Elon Musk's Tesla in India: 'Looking forward to seeing you at...' India’s largest private bank worth Rs 1529000 crore plans to reward its shareholders with...

India’s largest private bank worth Rs 1529000 crore plans to reward its shareholders with... Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes

World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of...

Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of... 10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1

10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1 Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen

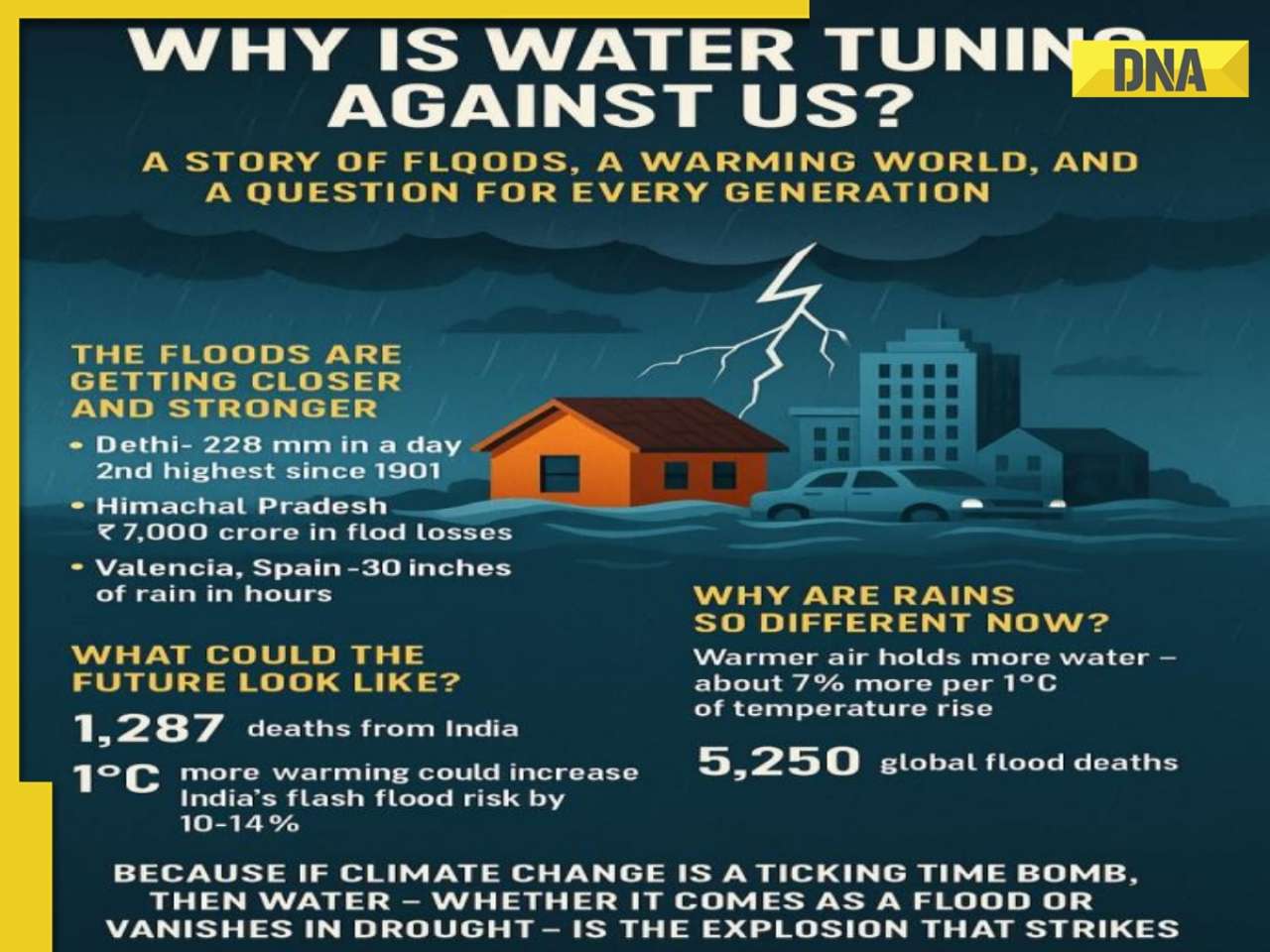

Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen Why is water turning against us? A story of floods, a warming world, and a question for every generation

Why is water turning against us? A story of floods, a warming world, and a question for every generation Axiom-4 Mission: After returning to Earth from ISS, Shubhanshu Shukla will forget THESE things, check full list here

Axiom-4 Mission: After returning to Earth from ISS, Shubhanshu Shukla will forget THESE things, check full list here "Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says...

"Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says... Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from...

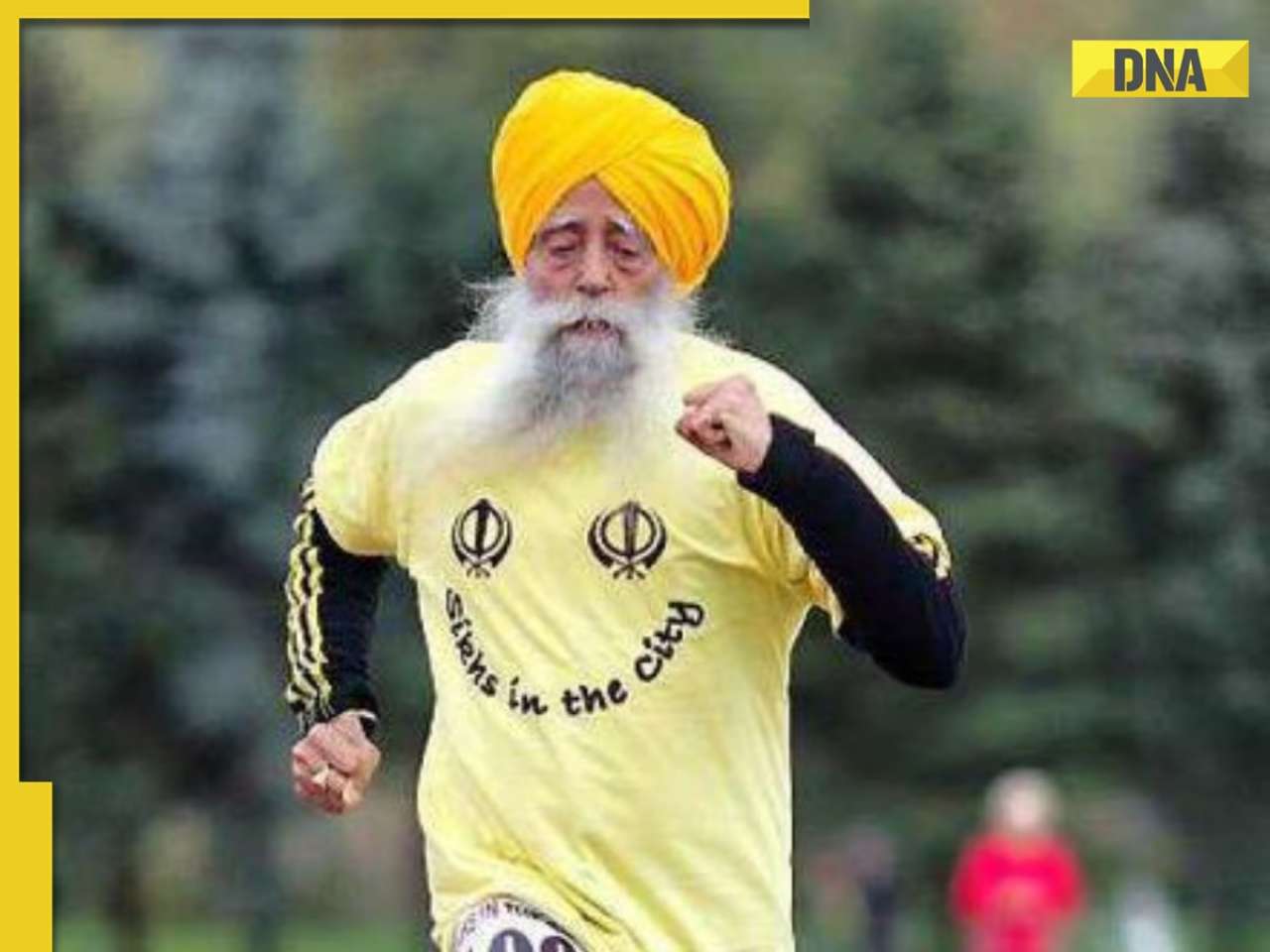

Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from... Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law?

Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law? Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)