In a big relief to customers, some major publicly listed Indian banks have eliminated the compulsory requirement of keeping Average Monthly Balance (AMB) in the savings accounts. State Bank of India, Canara Bank, Bank of India are some of these banks.

Some major publicly listed Indian banks have eliminated the compulsory requirement of keeping AMB in the savings accounts.

In a big relief to customers, some major publicly listed Indian banks have eliminated the compulsory requirement of keeping Average Monthly Balance (AMB) in the savings accounts. Some of these banks are: State Bank of India, Canara Bank, Bank of India and others. These banks will no longer follow the policy of keeping a minimum balance in most of their savings accounts.

Why banks keep Average Monthly Balance?

Banks keep an Average Monthly Balance which is the average balance that customers are required to maintain in their savings or current account each month. When the month comes to an end, the bank calculates this balance and any lapse in the amount leads to penalties which differs based on the type of savings account.

Banks that have removed AMB requirement

Bank of Baroda

Bank of Baroda has exempted charges on non-maintenance of minimum balance in their standard savings accounts from July 1, 2025. But this exemption is not applicable to Premium Savings Account schemes.

State Bank of India

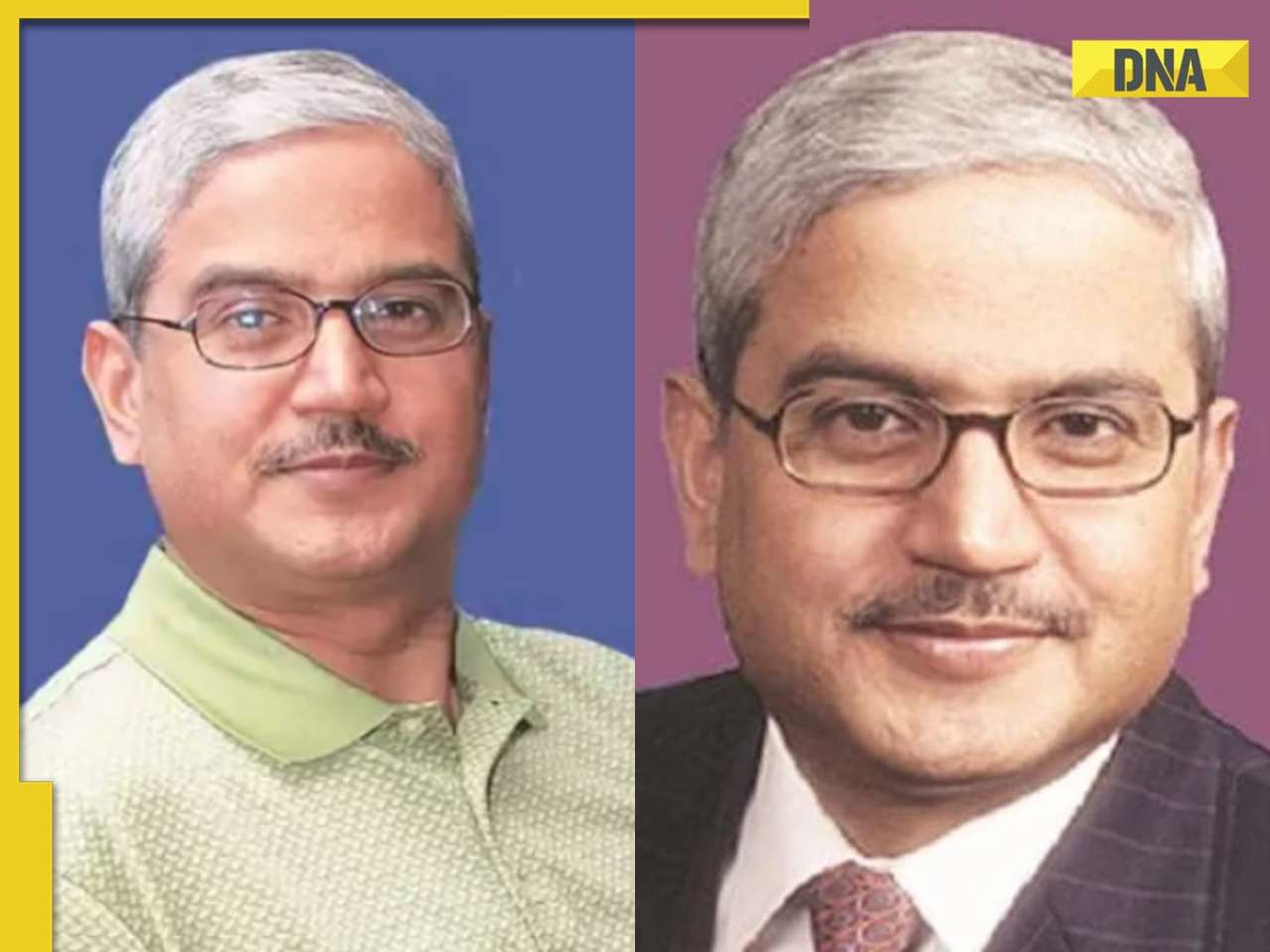

State Bank of India was the first to take the move and waived the average minimum balance requirements in 2020. In a recent interview, SBI Chairman CS Setty revealed that this policy has benefited first-time account holders.

Canara Bank

Canara Bank also exempted the AMB requirement in May this year for all savings bank accounts, like regular savings accounts, salary accounts and NRI savings accounts.

Indian Bank

As recent as July 7, 2025, Indian Bank has also entered the list of banks that will no longer put restriction on AMB. The bank announced a full waiver of minimum balance in all kinds of savings bank accounts.

Punjab National Bank

The Punjab National Bank (PNB) has also announced levying no fines for lapses in maintaining the AMB in savings accounts, in a move to ease banking and include more financial opportunities. “This customer-first initiative, effective from July 1, 2025, is particularly aimed at supporting priority segments such as women, farmers and low-income households, ensuring easier and more inclusive access to banking services without the stress of balance maintenance penalties,” the bank said in a press release.

Bank of India

Bank of India has also exempted the minimum-balance requirement on savings accounts by lifting off punishments.

These changes are intended to reflect market trends, improve financial adaptability, and provide increased value to customers across various segments.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Want to start a company? Telegram’s CEO picks top subject for future leaders, Elon Musk, Bill Gates call it...

Want to start a company? Telegram’s CEO picks top subject for future leaders, Elon Musk, Bill Gates call it... Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla

Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla China upset over Japan-Philippine defence cooperation in South China Sea, Tokyo hits back by..., Beijing retorts, says...

China upset over Japan-Philippine defence cooperation in South China Sea, Tokyo hits back by..., Beijing retorts, says... Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%...

Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%... This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. 7 stunning cosmic photos captured by NASA James Webb Telescope

7 stunning cosmic photos captured by NASA James Webb Telescope Soya Bean vs Soya Chunks: 8 key differences, nutritional profile, health benefits, more

Soya Bean vs Soya Chunks: 8 key differences, nutritional profile, health benefits, more Improve gut health naturally: 7 foods to improve your bowel movement

Improve gut health naturally: 7 foods to improve your bowel movement  Which vitamin deficiency causes gum bleeding and why?

Which vitamin deficiency causes gum bleeding and why? Sawan Somwar 2025: 7 do’s and don’ts of offering prayers to Lord Shiva

Sawan Somwar 2025: 7 do’s and don’ts of offering prayers to Lord Shiva Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies

Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh

President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building'

Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building' India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%...

Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%... Bad news for employees of THIS comapny as it gives stern warning on return to office, has this Ratan Tata connection

Bad news for employees of THIS comapny as it gives stern warning on return to office, has this Ratan Tata connection Elon Musk launches Tesla's Model Y for Rs 60 lakh in India, check how much it costs in US, China, Germany and other countries

Elon Musk launches Tesla's Model Y for Rs 60 lakh in India, check how much it costs in US, China, Germany and other countries Elon Musk's Tesla opens first India showroom in Mumbai's BKC: Project took ... days to be completed

Elon Musk's Tesla opens first India showroom in Mumbai's BKC: Project took ... days to be completed Meet man, IndiGo co-founder, who is now on Forbes' 'America's Richest Immigrants 2025' list, his net worth is..., name is...

Meet man, IndiGo co-founder, who is now on Forbes' 'America's Richest Immigrants 2025' list, his net worth is..., name is... Ali Fazal-Richa Chadha to Randeep Hooda-Lin Laishram, not just weddings but these Bollywood stars turned invites into art

Ali Fazal-Richa Chadha to Randeep Hooda-Lin Laishram, not just weddings but these Bollywood stars turned invites into art 5 times Salman Khan made moustache his signature statement, from Battle Of Galwan to Dabbang

5 times Salman Khan made moustache his signature statement, from Battle Of Galwan to Dabbang Shubhanshu Shukla to return Earth: Here are 7 experiments Axiom 4 crew conducted in space

Shubhanshu Shukla to return Earth: Here are 7 experiments Axiom 4 crew conducted in space Samantha Ruth Prabhu, Allu Arjun and other South Indian superstars took THIS much salary in their first-ever jobs

Samantha Ruth Prabhu, Allu Arjun and other South Indian superstars took THIS much salary in their first-ever jobs Amitabh Bachchan set THIS one condition before marrying Jaya Bachchan, she's still living by it 52 years later

Amitabh Bachchan set THIS one condition before marrying Jaya Bachchan, she's still living by it 52 years later Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla

Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla LoP Rahul Gandhi lashes out at S Jaishankar over meeting with Xi Jinping, says 'EAM running full blown circus'

LoP Rahul Gandhi lashes out at S Jaishankar over meeting with Xi Jinping, says 'EAM running full blown circus' Will India-China relations improve further after S Jaishankar meets Chinese President Xi Jinping?

Will India-China relations improve further after S Jaishankar meets Chinese President Xi Jinping? Mizoram's Bairabi-Sairang railway line: After 26 years, Aizawl set for rail boost, PM Modi to inaugurate 51.38 km railway line on...

Mizoram's Bairabi-Sairang railway line: After 26 years, Aizawl set for rail boost, PM Modi to inaugurate 51.38 km railway line on... SCO Meet: S Jaishankar meets Chinese President Xi Jinping, first since 2020 Galwan clash

SCO Meet: S Jaishankar meets Chinese President Xi Jinping, first since 2020 Galwan clash This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to...

Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to... Meet IAS officer who was once mocked for not speaking English, left job at Ratan Tata's TCS, cracked UPSC exam, secured AIR..., she is...

Meet IAS officer who was once mocked for not speaking English, left job at Ratan Tata's TCS, cracked UPSC exam, secured AIR..., she is... Meet Hiamli Dabi, mother of IAS officer Tina Dabi and Ria Dabi, who also cracked UPSC exam, worked as..., but later quit job due to...

Meet Hiamli Dabi, mother of IAS officer Tina Dabi and Ria Dabi, who also cracked UPSC exam, worked as..., but later quit job due to... UPSC CSE Mains 2025 schedule out, to be held on THESE dates, check full timetable

UPSC CSE Mains 2025 schedule out, to be held on THESE dates, check full timetable This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)