This initiative is meant to open up the credit card market by forcing competition among networks

In an effort to improve customer satisfaction and to increase competition in the electronic payments sector, the Reserve Bank of India (RBI) has recently issued a regulation that would enable the credit card holders to select their desired card network. From September 6, 2024, the customers can choose the card network of their choice whether it is MasterCard, RuPay or Visa while applying for a new credit card or while renewing their current card.

Traditionally, the card network has been selected by the banks on behalf of their clients, and most of the time, this has been due to certain contractual agreements with particular networks. However, the RBI’s circular also states that card issuers must offer the customer a choice of multiple networks at the time of initial issuance as well as at the time of renewal.

This initiative is meant to open up the credit card market by forcing competition among networks. In providing customers the flexibility to pick their network, the RBI’s plan is to force networks to start competing on benefits, fees, and customer satisfaction. This could result in higher rewards, lower fees and more merchant acceptance for the cardholders.

This guideline does not apply to card issuers who issue cards on their own proprietary networks such as the American Express. Some of the banks which have already started these changes include Bank of Baroda and YES Bank where customers can select their preferred network during the application process.

Several advantages are accorded to cardholders. Selecting a preferred network has its benefits like higher acceptance, offers like discounts and coupons and convenience. For instance, there are some networks that may have better acceptance in some regions or countries to enhance the transaction convenience.

This action of RBI is viewed as a strategic one to improve the customer experience in the Indian digital payments space and may lead to more network-specific incentives.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. "Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says...

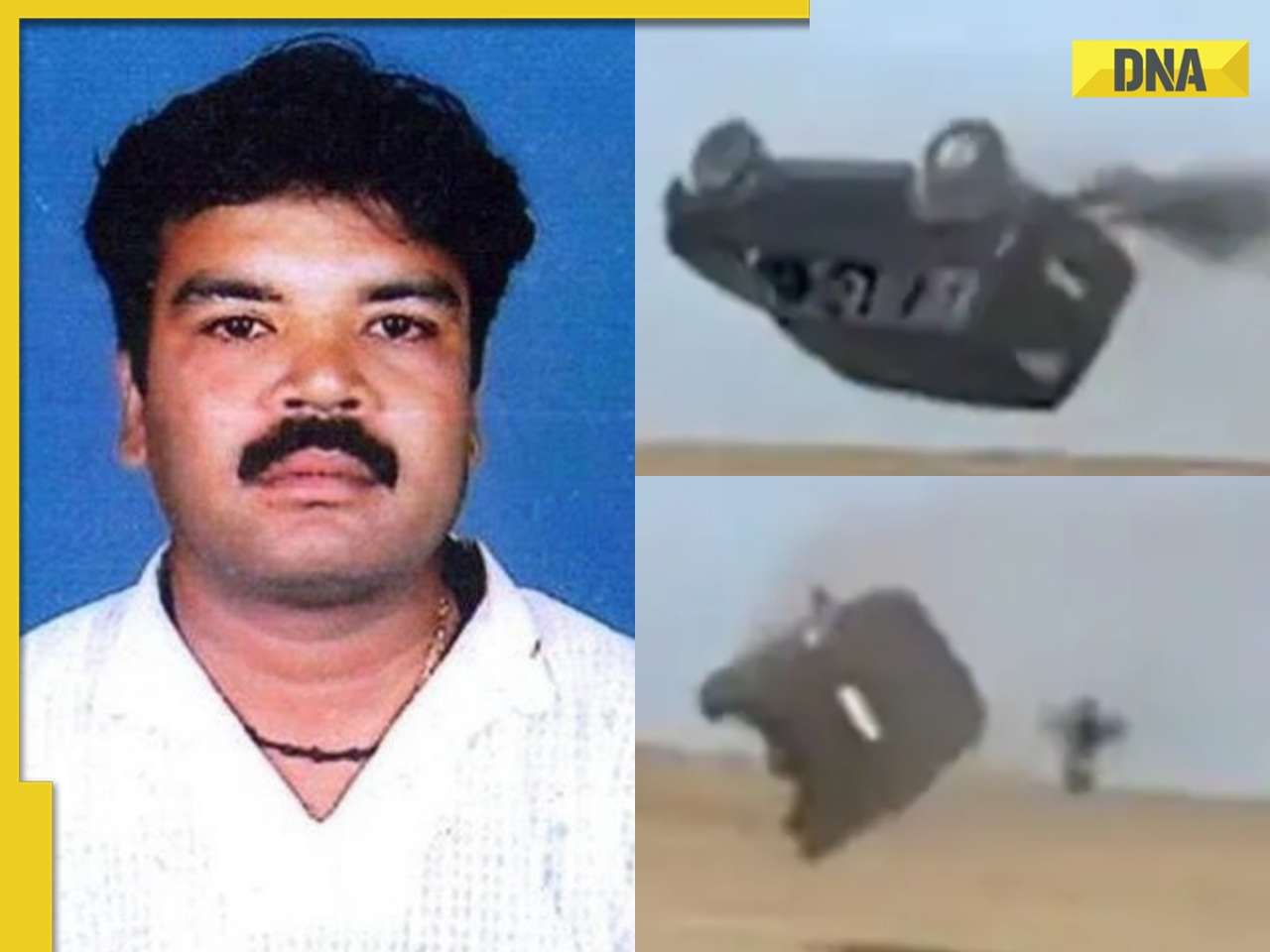

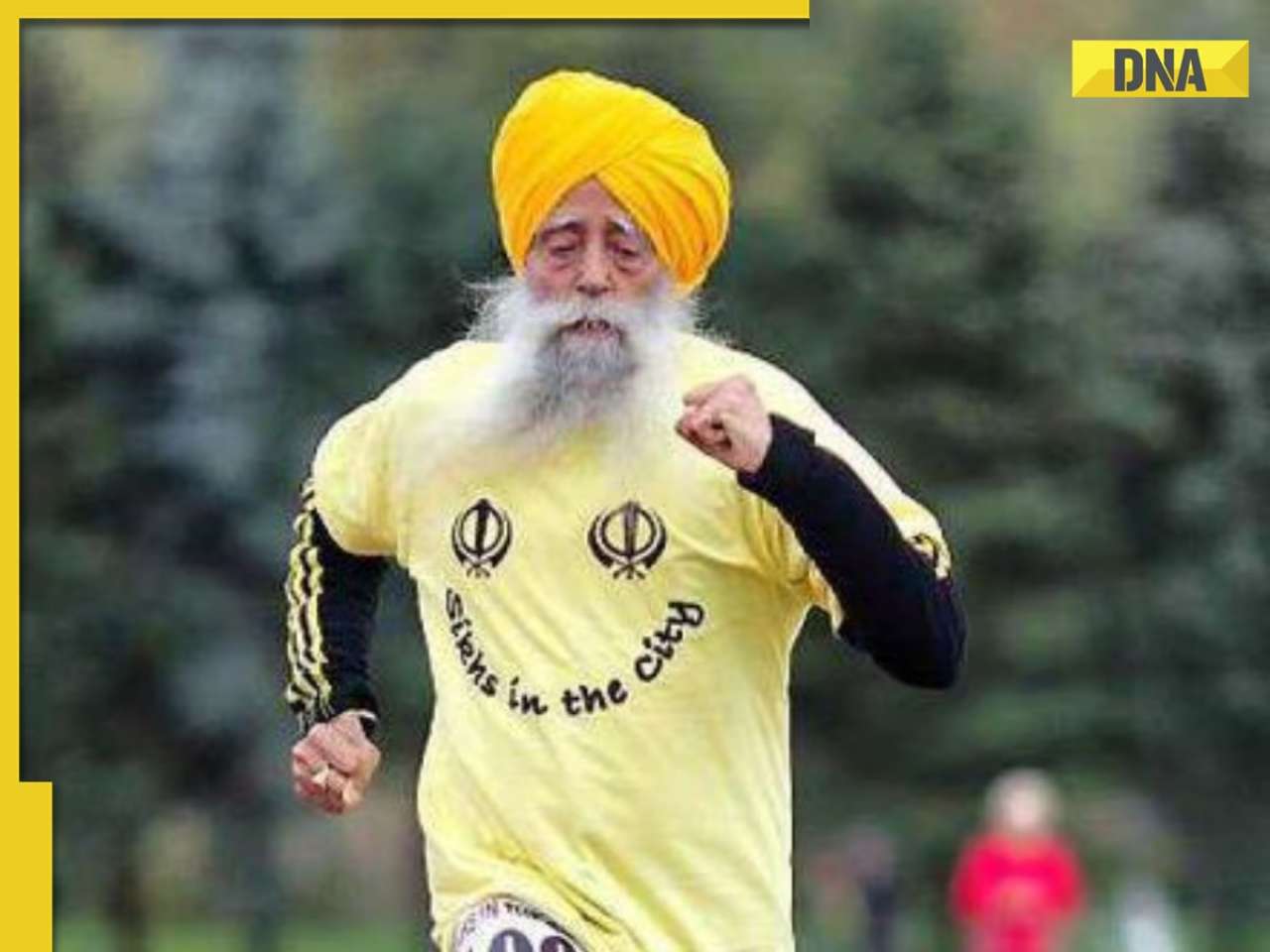

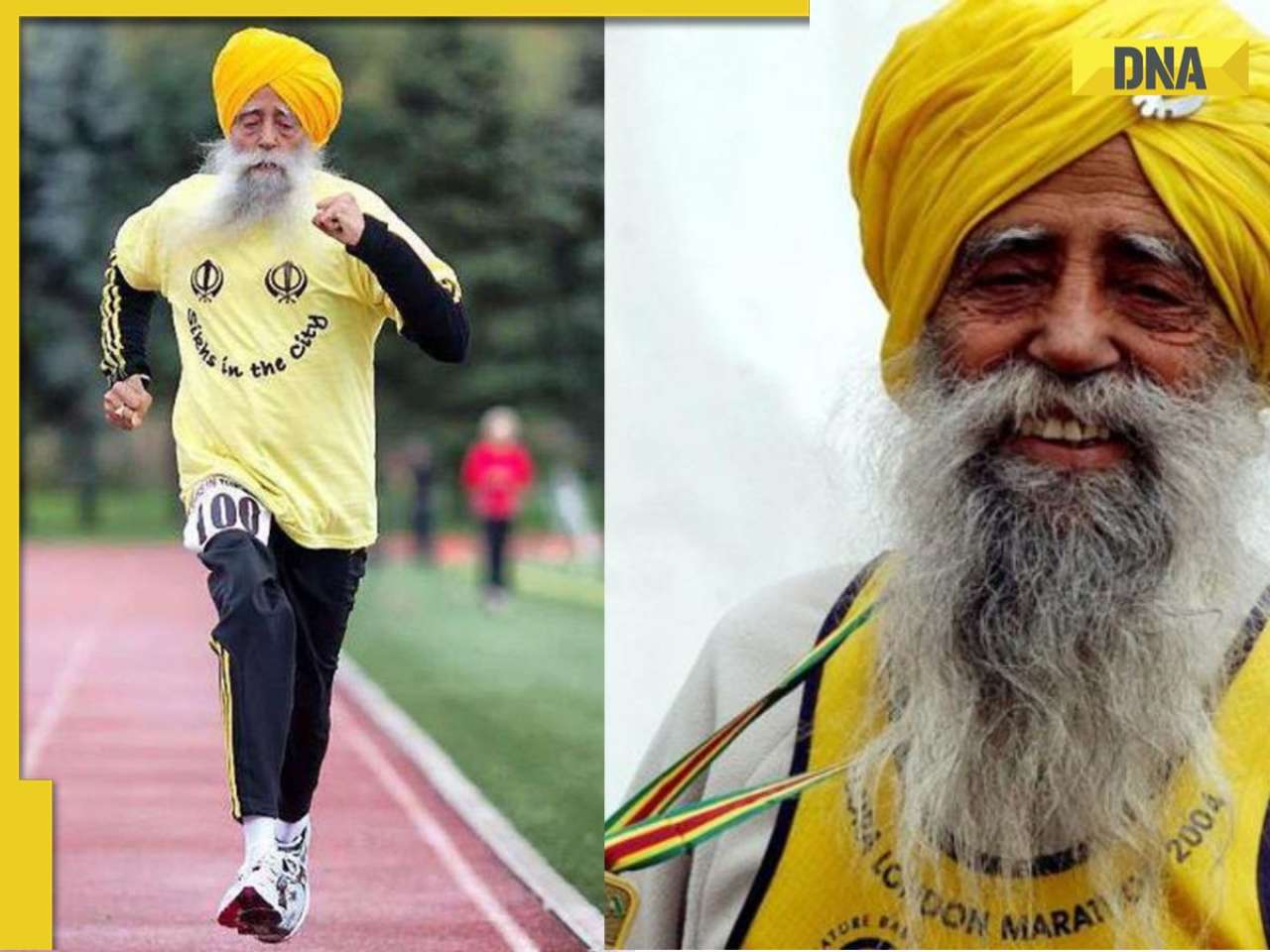

"Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says... Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from...

Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from... Amitabh Bachchan gets emotional for Abhishek Bachchan, says 'no one can stop me...': 'Haan tum mere bete ho aur mujhe....'

Amitabh Bachchan gets emotional for Abhishek Bachchan, says 'no one can stop me...': 'Haan tum mere bete ho aur mujhe....' Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law?

Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law? Mark Zuckerberg makes BIG claim on luring top AI talents with staggering salary packages, joining them to Meta's 'superintelligence lab', says ‘Lol, that’s…’

Mark Zuckerberg makes BIG claim on luring top AI talents with staggering salary packages, joining them to Meta's 'superintelligence lab', says ‘Lol, that’s…’ 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case

Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi

US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics

CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National

Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen

Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen Mark Zuckerberg makes BIG claim on luring top AI talents with staggering salary packages, joining them to Meta's 'superintelligence lab', says ‘Lol, that’s…’

Mark Zuckerberg makes BIG claim on luring top AI talents with staggering salary packages, joining them to Meta's 'superintelligence lab', says ‘Lol, that’s…’ Did Deepinder Goyal-backed firm buy Bombardier private jet? Zomato founder says...

Did Deepinder Goyal-backed firm buy Bombardier private jet? Zomato founder says... Mukesh Ambani-controlled Jio BlackRock gets SEBI nod for four passive schemes, how will Reliance break new ground...

Mukesh Ambani-controlled Jio BlackRock gets SEBI nod for four passive schemes, how will Reliance break new ground... TCS salary hike: Why Ratan Tata's company delayed increment? This is what Chief Human Resources Officer Milind Lakkad said

TCS salary hike: Why Ratan Tata's company delayed increment? This is what Chief Human Resources Officer Milind Lakkad said Meet woman, who left her high-paying job to join her mother's business, now runs Rs 629120000000 empire, their business is...

Meet woman, who left her high-paying job to join her mother's business, now runs Rs 629120000000 empire, their business is... Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen

Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen From 'KJo’s Students' to Parents: All 3 SOTY stars Alia Bhatt, Varun Dhawan, and Sidharth Malhotra embrace baby girl bliss

From 'KJo’s Students' to Parents: All 3 SOTY stars Alia Bhatt, Varun Dhawan, and Sidharth Malhotra embrace baby girl bliss Inside Pankaj Tripathi’s luxurious Madh Island mansion in Mumbai with stunning Arabian Sea view

Inside Pankaj Tripathi’s luxurious Madh Island mansion in Mumbai with stunning Arabian Sea view Elon Musk's Tesla launch in India: Drive through these 5 scenic routes for the ultimate EV experience

Elon Musk's Tesla launch in India: Drive through these 5 scenic routes for the ultimate EV experience Kiara Advani, Sidharth Malhotra welcome baby girl: From normal delivery to family's wish for daughter, all you need to know

Kiara Advani, Sidharth Malhotra welcome baby girl: From normal delivery to family's wish for daughter, all you need to know "Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says...

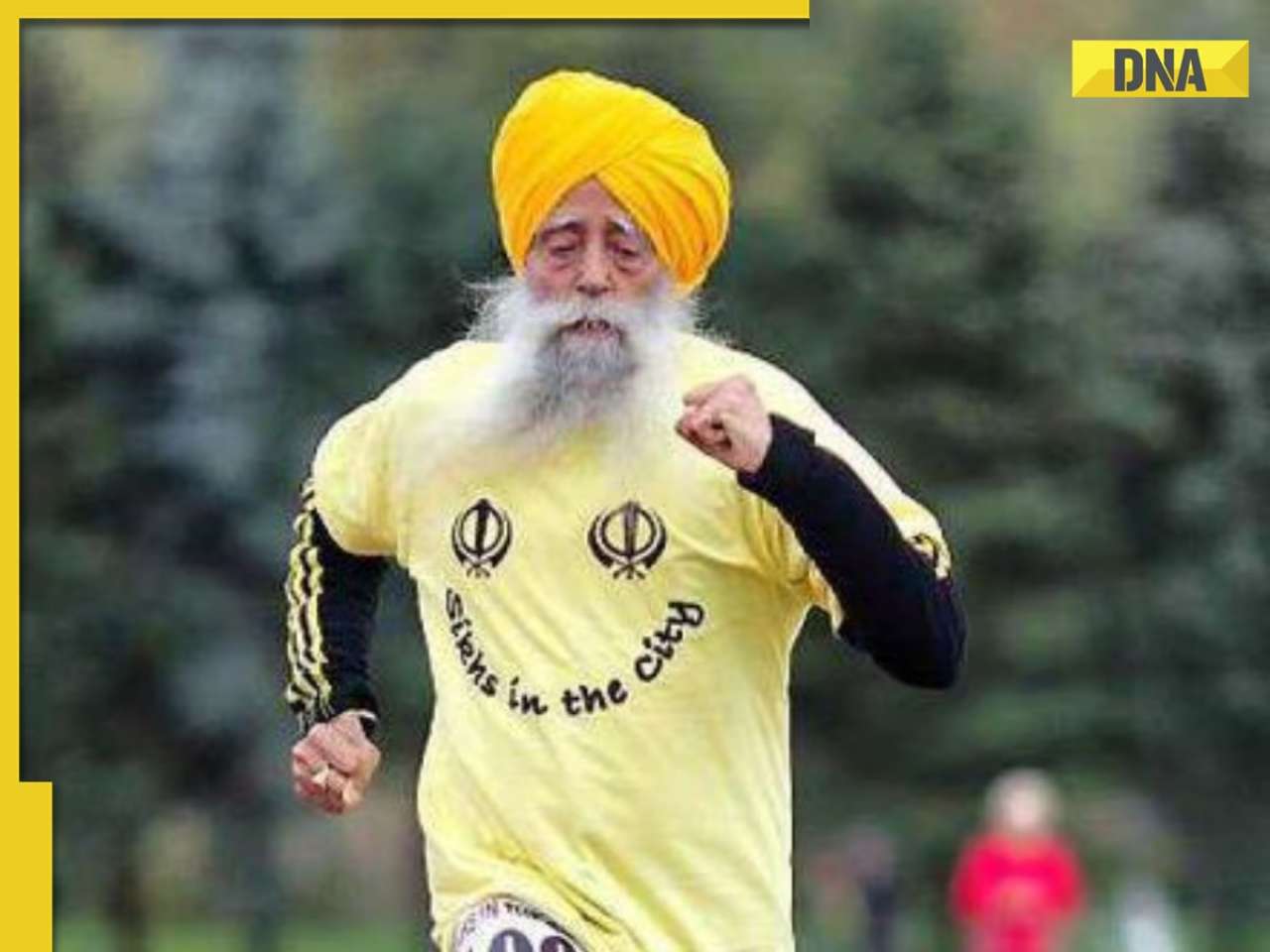

"Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says... Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from...

Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from... Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law?

Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law? Who is ‘Grand Mufti of India' who helped halt Kerala nurse Nimisha Priya's execution in Yemen

Who is ‘Grand Mufti of India' who helped halt Kerala nurse Nimisha Priya's execution in Yemen Fauja Singh death: Police arrest NRI from Canada in hit-and-run case of 114-year-old marathon runner, accused confesses...

Fauja Singh death: Police arrest NRI from Canada in hit-and-run case of 114-year-old marathon runner, accused confesses... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...

Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...  Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now...

Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)