Investors are advised to compare their risk tolerance and investment period before making an investment

Three equity mutual funds have proved that wealth creation over the long term is possible, as Rs 1 lakh invested with them has grown to Rs 1 crore in three decades.

Top Performers Over 30 Years

Franklin India Prima Fund: This midcap fund was started in December 1993 and has given stupendous performance, turning an investment of Rs 1 lakh to Rs 2.31 crore. This has made it to post a compound annual growth rate (CAGR) of 19.59% and is therefore well suited for investors who want to make big gains on their capital.

Franklin India Bluechip Fund: This large-cap fund was also launched in December 1993, and the same Rs 1 lakh investment fetched about Rs 2.13 crore with a CAGR of 19.28%. It mainly invests in large capitalisation stocks, which makes it a good pick for those investors who want steady returns and growth.

SBI Long Term Equity Fund: This fund is one of the oldest schemes in the ELSS category launched in February 1993 and has grown an initial investment of Rs 1 lakh to Rs 1,21,99,300, with an average annualised return of 16.68%. It is especially attractive because of the tax advantages and because the investment comes with a three-year lock-in.

These funds not only demonstrate the principle of compounding but also the need to choose the right investment tools for sustainable development. Franklin India Prima Fund has assets under management of Rs 10,108 crore as of March 31, 2024; Franklin India Bluechip Fund has assets under management of Rs 7,691 crore; and SBI Long Term Equity Fund has assets under management of Rs 21,976 crore as of the same date.

Investors are advised to compare their risk tolerance and investment period before making an investment. The minimum amount required to invest in these schemes begins at as low as Rs 500 in the case of the SIPs, which means that the schemes are available to almost everyone.

However, as they often say, ‘the past performance is not indicative of future results.’ These funds demonstrate how planning and investing can lead to a huge financial gain over time. Of course, the potential investors should do their homework or seek professional advice before making an investment decision.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Mohit Suri reveals Aditya Chopra's first reaction after watching Ahaan Panday, Aneet Padda-starrer Saiyaara: 'What happened to...' | Exclusive

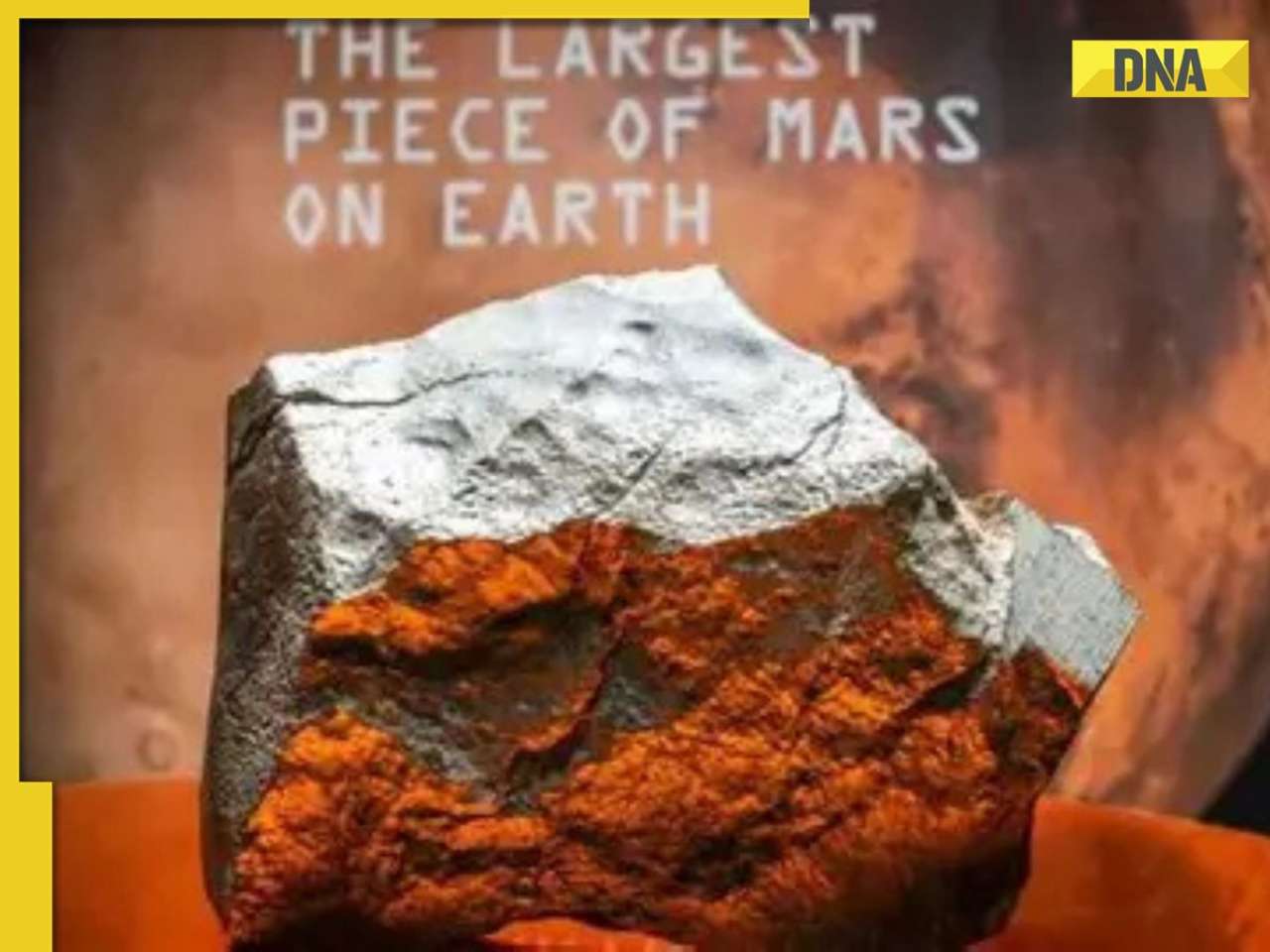

Mohit Suri reveals Aditya Chopra's first reaction after watching Ahaan Panday, Aneet Padda-starrer Saiyaara: 'What happened to...' | Exclusive Largest piece of Mars found on earth sold for Rs..., discovered at Sahara Desert, it weighs..., know how it reached earth

Largest piece of Mars found on earth sold for Rs..., discovered at Sahara Desert, it weighs..., know how it reached earth UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for...

UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for... DNA TV Show: Digvijaya Singh's post on Kanwar Yatra stirs row

DNA TV Show: Digvijaya Singh's post on Kanwar Yatra stirs row Blood crisis solved! This country developed universal artificial blood, beneficial in surgeries, emergencies, it's colour is...

Blood crisis solved! This country developed universal artificial blood, beneficial in surgeries, emergencies, it's colour is...  7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming

Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming Israeli Man Seeks Custody Of Daughters Found In Karnataka Cave | Karnataka News

Israeli Man Seeks Custody Of Daughters Found In Karnataka Cave | Karnataka News Israel Attacks Syria: Trump Admin Voices Concern Over Syria Strikes | USA On Israel Syria

Israel Attacks Syria: Trump Admin Voices Concern Over Syria Strikes | USA On Israel Syria Delhi-Goa IndiGo Plane Makes Emergency Landing In Mumbai | Indigo News

Delhi-Goa IndiGo Plane Makes Emergency Landing In Mumbai | Indigo News Trump News: India-US Trade Deal In Works, Donald Trump Hints Progress | US News

Trump News: India-US Trade Deal In Works, Donald Trump Hints Progress | US News No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details

No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through...

Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through... ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps...

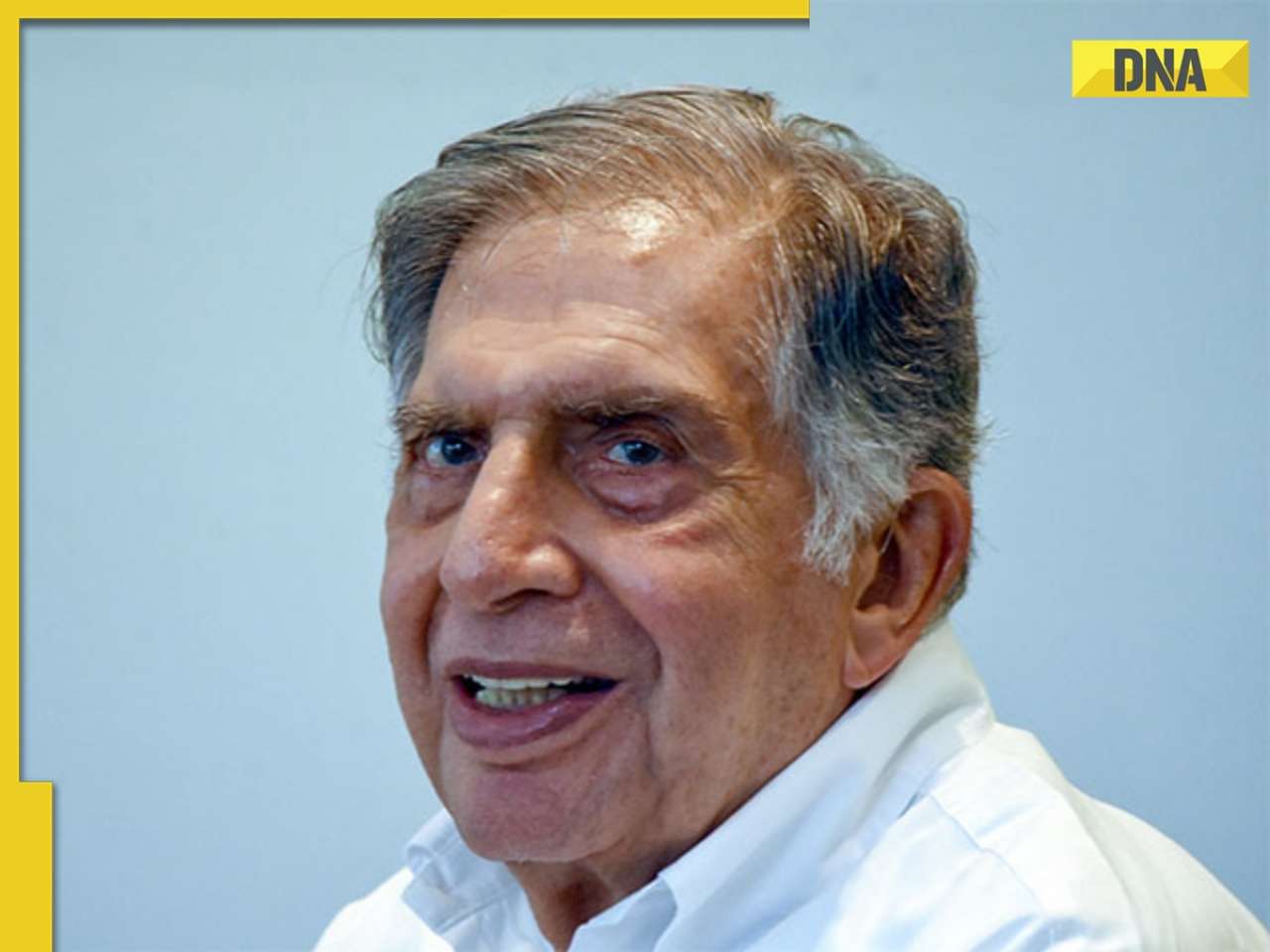

ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps... Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here

Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here  After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India

After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India  From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers

From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers  Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes

World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of...

Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of... 10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1

10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1 UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for...

UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for... Delhi-Goa IndiGo flight makes emergency landing due to a mid-air engine failure

Delhi-Goa IndiGo flight makes emergency landing due to a mid-air engine failure Who is Aditya Saurabh? Cracked UPSC with impressive AIR, became IRS officer, now arrested for...

Who is Aditya Saurabh? Cracked UPSC with impressive AIR, became IRS officer, now arrested for...  Delhi set to launch India's first net-zero e-waste park in...; its cost is Rs...

Delhi set to launch India's first net-zero e-waste park in...; its cost is Rs... Delhi Police makes SHOCKING statement, bomb threat emails sent to schools and colleges via..., makes difficult to probe due to...

Delhi Police makes SHOCKING statement, bomb threat emails sent to schools and colleges via..., makes difficult to probe due to... Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)