The Central Board of Direct Taxes (CBDT) has extended the deadline to file the Income Tax Return (ITR) for Financial Year 2024-2025 from the original date of July 31 to September 15. The extension applies to several categories of taxpayers, including salaried individuals. Read on to know more.

Here are five key points to keep in mind when filing your ITR as a salaried employee.

The Central Board of Direct Taxes (CBDT) has extended the deadline to file the Income Tax Return (ITR) for Financial Year 2024-2025 from the original date of July 31 to September 15. The extension applies to several categories of taxpayers, including salaried individuals. We understand that filing your Income Tax Return can be a stressful task but if you follow some simple rules of thumb, it might just become a cakewalk. Here are five key points to keep in mind when filing your ITR as a salaried employee.

Choose the right ITR form: Picking the right ITR form is instrumental to a smooth return filing. The Income Tax Department offers several different forms tailored to various categories of taxpayers. If you end up filling the wrong form, it will invalidate your ITR, requiring you to file again.

Selecting your tax regime: It is crucial to decide whether to select the old tax regime or switch to the new tax regime. The new tax system is selected by default. So if you want to remain in the old tax regime, timely inform your employer. To make the right choice, it's important to understand the implications of each regime.

Review Form 16: Form 16, which is provided by employers, is a key document that summarises your TDS (Tax Deducted at Source) payments. Make sure to obtain and carefully review this form for accuracy.

Evaluate investment options: In case you have invested in government schemes like Public Provident Fund (PPF) or National Savings Certificate (NSC), carefully assess whether the new tax regime will offer equivalent tax benefits. These schemes typically bring tax exemptions under the old tax regime and can offer advantages in the long run.

Verify details with Form 26AS: Alongside Form 16, verify Form 26AS for a detailed overview of your income. This includes checking your salary, interest earned on savings accounts and fixed deposits, as well as other relevant financial information.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. World’s largest bee is called ‘Flying bulldog’, does not produce honey, it’s size is..., found in...

World’s largest bee is called ‘Flying bulldog’, does not produce honey, it’s size is..., found in... Little Pepe (LILPEPE) Presale Raise Crosses $8,825,000 as Sixth Stage Ends Faster Than Predicted

Little Pepe (LILPEPE) Presale Raise Crosses $8,825,000 as Sixth Stage Ends Faster Than Predicted Will Nitish Kumar replace Jagdeep Dhankhar? BJP may pull him out to beat anti-incumbency in Bihar polls as...

Will Nitish Kumar replace Jagdeep Dhankhar? BJP may pull him out to beat anti-incumbency in Bihar polls as... Not Mumbai, Delhi, Bengaluru, Chennai, Kolkata, Srinagar; Ed Sheeran says this Indian city is his favourite, it is located in...

Not Mumbai, Delhi, Bengaluru, Chennai, Kolkata, Srinagar; Ed Sheeran says this Indian city is his favourite, it is located in... War 2: Yash Raj Films to celebrate the legacy of Hrithik Roshan, Jr NTR by launching the trailer on...

War 2: Yash Raj Films to celebrate the legacy of Hrithik Roshan, Jr NTR by launching the trailer on... Glutathione boost to skin naturally with spinach, avocados and more

Glutathione boost to skin naturally with spinach, avocados and more Warren Buffett's 5 success lessons every young Indian should know

Warren Buffett's 5 success lessons every young Indian should know What are risks of taking Vitamin D shots? Know how it links to blocked arteries

What are risks of taking Vitamin D shots? Know how it links to blocked arteries NASA shares 7 majestic images of 'Star War' planets in solar system

NASA shares 7 majestic images of 'Star War' planets in solar system Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News

Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News

Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Bryan Johnson shutting down his wellness company Blueprint? Millionaire founder says, 'I don't need...'

Bryan Johnson shutting down his wellness company Blueprint? Millionaire founder says, 'I don't need...' Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs...

Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... Mukesh Ambani, Nita Ambani fan of this special sweet, private helicopters sent to get it from UP village, it's name is...

Mukesh Ambani, Nita Ambani fan of this special sweet, private helicopters sent to get it from UP village, it's name is... Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is...

Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is... From CarryMinati to Nischay Malhan: Top 5 Indian gamers who earn in crores

From CarryMinati to Nischay Malhan: Top 5 Indian gamers who earn in crores NISAR satellite launch 2025: Why it is NASA-ISRO’s biggest Earth mission?

NISAR satellite launch 2025: Why it is NASA-ISRO’s biggest Earth mission? Meet men behind Saiyaara’s hit title track, who resigned civil engineering jobs to pursue music, convinced parents to go to Mumbai for 14 days to...

Meet men behind Saiyaara’s hit title track, who resigned civil engineering jobs to pursue music, convinced parents to go to Mumbai for 14 days to... Not MS Dhoni, Hardik Pandya, Rohit Sharma but THIS Indian cricketer has record-breaking followers on Instagram, he is...

Not MS Dhoni, Hardik Pandya, Rohit Sharma but THIS Indian cricketer has record-breaking followers on Instagram, he is... Kajol and Twinkle Khanna set to host 'Two Much...': A look at other B-town actresses who owned talk show game

Kajol and Twinkle Khanna set to host 'Two Much...': A look at other B-town actresses who owned talk show game Will Nitish Kumar replace Jagdeep Dhankhar? BJP may pull him out to beat anti-incumbency in Bihar polls as...

Will Nitish Kumar replace Jagdeep Dhankhar? BJP may pull him out to beat anti-incumbency in Bihar polls as... Good news for Olympic winners as Delhi govt hikes cash awards, gold medallist to get Rs…

Good news for Olympic winners as Delhi govt hikes cash awards, gold medallist to get Rs… How did Jagdeep Dhankhar become most controversial vice president? About Sonia, Rahul, SC, RSS, he said...

How did Jagdeep Dhankhar become most controversial vice president? About Sonia, Rahul, SC, RSS, he said... Big tension for Pakistan, China, Indian Army receives first batch of Apache helicopters, it can carry..., is capable of delivering...

Big tension for Pakistan, China, Indian Army receives first batch of Apache helicopters, it can carry..., is capable of delivering... President accepts Jagdeep Dhankhar's resignation as Vice President, confirms Rajya Sabha chair

President accepts Jagdeep Dhankhar's resignation as Vice President, confirms Rajya Sabha chair Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in...

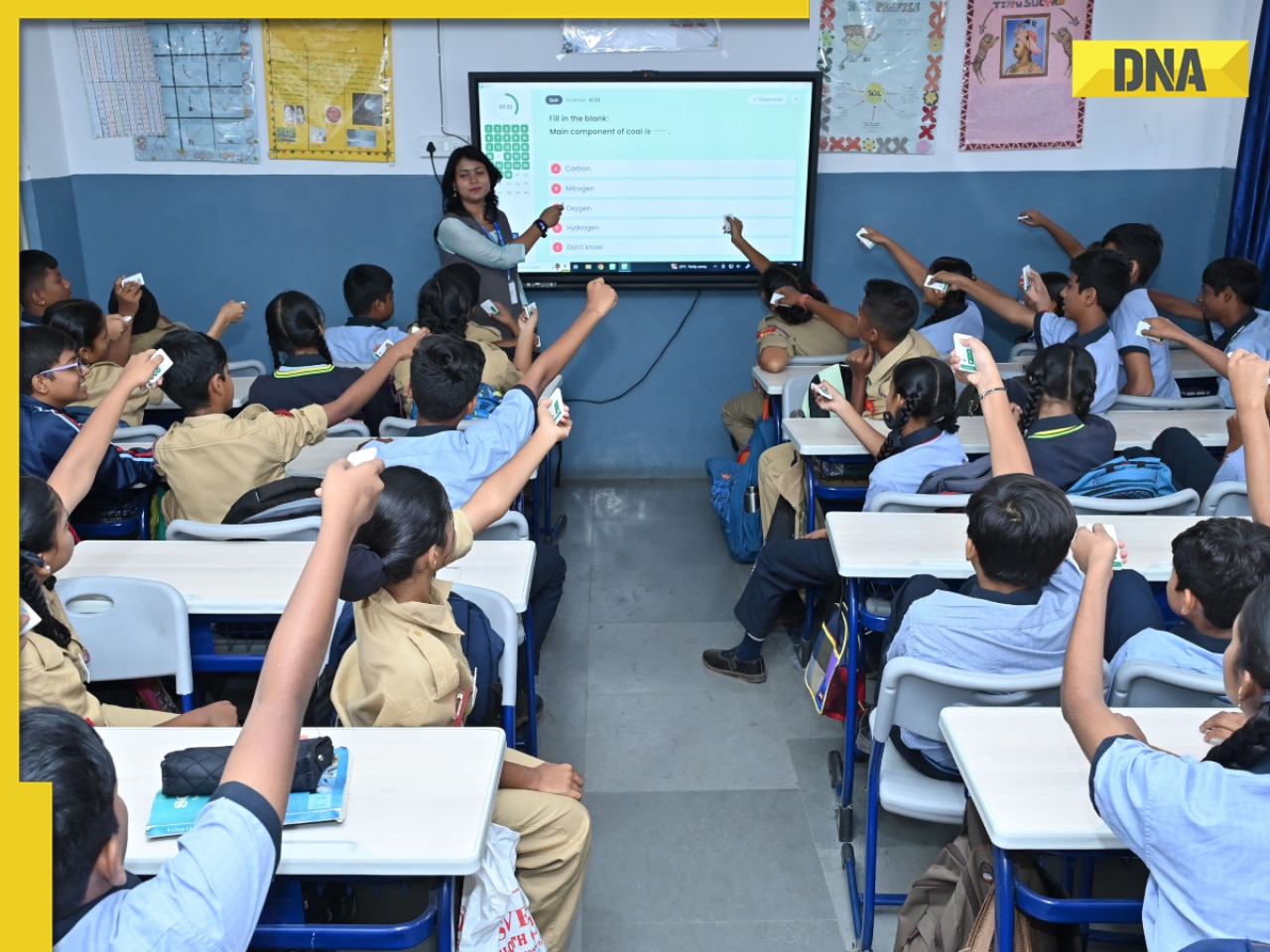

Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in... CBSE takes BIG step to ensure safety of students, directs all affiliated schools to...

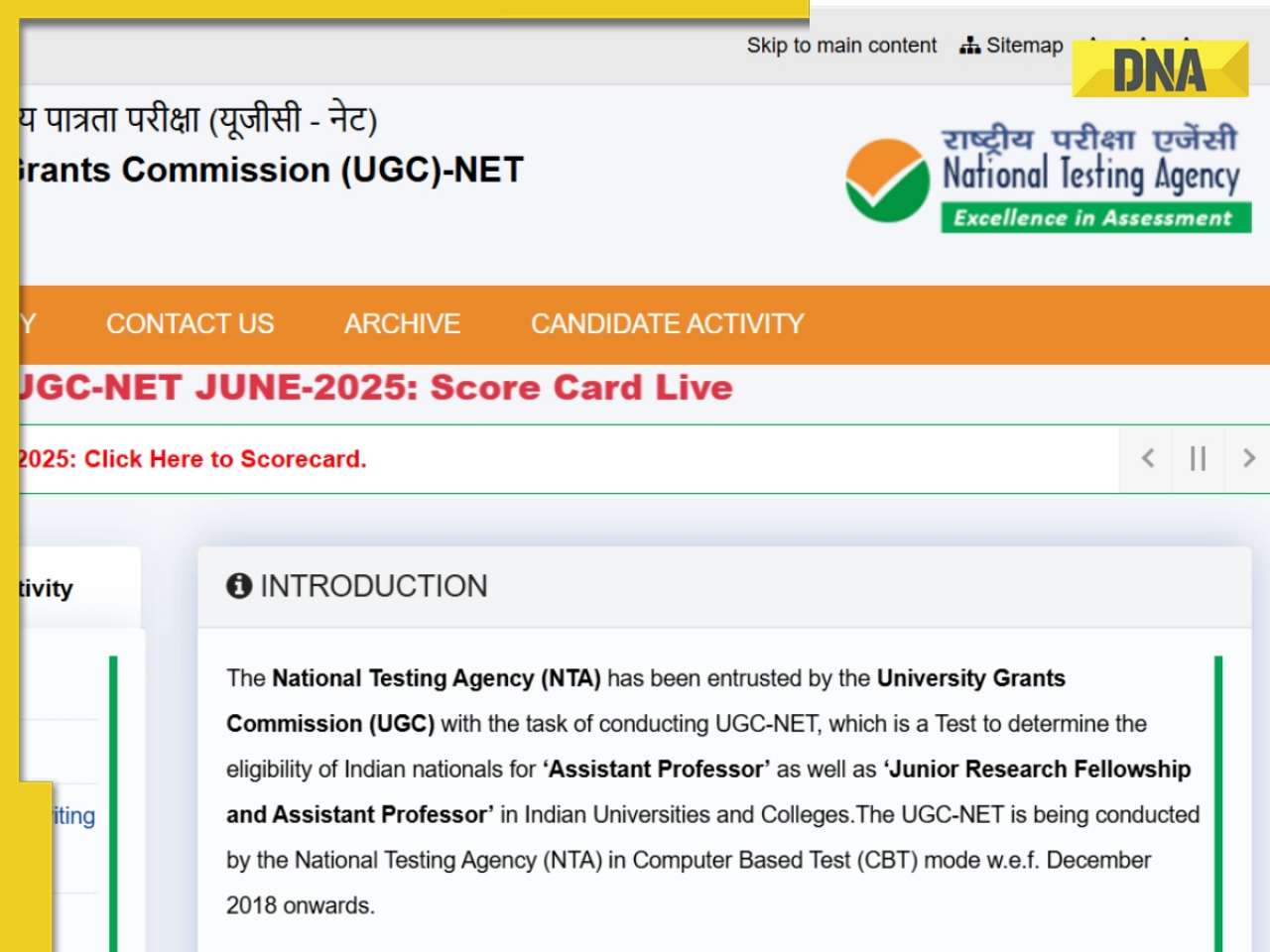

CBSE takes BIG step to ensure safety of students, directs all affiliated schools to... UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here

UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here NEET PG 2025 City Intimation Slip out today, here's how you can download it

NEET PG 2025 City Intimation Slip out today, here's how you can download it Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was...

Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)