In the interim order, SEBI has charged the Jane Street Group with index manipulation and imposed a recovery of one of the highest ever illegal gains made by the group, amounting to Rs 4,843.57 crore.

The Securities and Exchange Board of India (SEBI) has allowed the US proprietary trading firm Jane Street to resume trading in the Indian stock markets, noting that the company was permitted to resume trading after complying with the regulator's interim order of July 3 and transferring Rs 4,843 crore to the escrow account.

Why did SEBI allow Jane Street to resume trading?

SEBI stated that the entities have been directed to cease and desist from directly or indirectly engaging in any fraudulent, manipulative or unfair trade practice or undertaking any activity, either directly or indirectly, that may be in breach of extant regulations, including by dealing in securities using any of the patterns identified or alluded to in the interim order. The entities have confirmed that they will comply with this. Additionally, the market regulator directed the stock exchanges to continuously monitor the future trading activities and positions of the group to prevent any potential manipulative behaviour until it concluded its investigations and any resulting actions.

SEBI imposes a recovery of over Rs 4800 crore on Jane Street

Earlier, on July 14, as per the SEBI interim order dated July 3, the Jane Street group deposited Rs 4843.57 crore into an escrow account. In the interim order, SEBI has charged the Jane Street Group with index manipulation and imposed a recovery of one of the highest ever illegal gains made by the group, amounting to Rs 4,843.57 crore. The order targets four key entities under the Jane Street Group umbrella: JSI Investments Pvt. Ltd., JSI2 Investments Pvt. Ltd., Jane Street Singapore Pte. Ltd., and Jane Street Asia Trading Ltd.SEBI, in its order, noted that the Group employed a profit-maximising scheme to manipulate the market, booking substantial profits in index options while incurring smaller losses in the cash and futures segments.

The market regulator's 105-page order said that the interim action follows a detailed investigation into manipulative trading practices by the Group, especially around the weekly expiry of index options on the NSE. The interim order further stated that Jane Street Group entities, despite caution letters from NSE in February 2025 and their own commitments to refrain from certain trading behaviours, continued to deploy the same high-risk and market-distorting strategies.

(With inputs from ANI)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is...

Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is... Earth is spinning faster today, marking second-shortest day in history; here's why

Earth is spinning faster today, marking second-shortest day in history; here's why Actor Malcolm-Jamal Warner drowns at Costa Rica beach during family vacation, dies tragically

Actor Malcolm-Jamal Warner drowns at Costa Rica beach during family vacation, dies tragically Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next...

Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next... 'Goliyan chali, ek white gaadi...': Rapper Fazilpuria breaks his silence after being shot in Gurugram

'Goliyan chali, ek white gaadi...': Rapper Fazilpuria breaks his silence after being shot in Gurugram NASA shares 7 majestic images of 'Star War' planets in solar system

NASA shares 7 majestic images of 'Star War' planets in solar system Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it Want healthy liver? Ditch these 7 foods immediately

Want healthy liver? Ditch these 7 foods immediately What is a buffalo hump? Here are 7 ways to treat it naturally and effectively

What is a buffalo hump? Here are 7 ways to treat it naturally and effectively Anushka Sharma's Indian-Chinese, Kangana Ranaut's 'Gol Gappa' and more: Here are Bollywood celebs' favourite street foods

Anushka Sharma's Indian-Chinese, Kangana Ranaut's 'Gol Gappa' and more: Here are Bollywood celebs' favourite street foods Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News

Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News

Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is...

Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is... Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs...

Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs... Another masterstroke by Mukesh Ambani, Isha Ambani, Reliance enters fast fashion delivery market with...

Another masterstroke by Mukesh Ambani, Isha Ambani, Reliance enters fast fashion delivery market with... Sebi lifts ban on Jane Street, allows US firm to resume trading but...

Sebi lifts ban on Jane Street, allows US firm to resume trading but... HUGE blow to Anil Ambani as SBI classifies him, RCom, as 'fraud'; to file complaint with...

HUGE blow to Anil Ambani as SBI classifies him, RCom, as 'fraud'; to file complaint with... Sanjay Dutt, Maanyata Dutt, Priya Dutt: Inside Dutt family's massive multi-crore net worth

Sanjay Dutt, Maanyata Dutt, Priya Dutt: Inside Dutt family's massive multi-crore net worth From Amitabh Bachchan in Fakt Purusho Maate to Ranbir Kapoor in Ramayana: 7 actors who’ve played gods on-screen

From Amitabh Bachchan in Fakt Purusho Maate to Ranbir Kapoor in Ramayana: 7 actors who’ve played gods on-screen Before Ibrahim Ali Khan's Sarzameen, 7 must-watch iconic patriotic films

Before Ibrahim Ali Khan's Sarzameen, 7 must-watch iconic patriotic films iPhone 17 Pro vs iPhone 16 Pro: 5 major upgrades you shouldn't ignore before buying

iPhone 17 Pro vs iPhone 16 Pro: 5 major upgrades you shouldn't ignore before buying Tesla opens first showroom in Mumbai; but is new Model Y worth it?

Tesla opens first showroom in Mumbai; but is new Model Y worth it? Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next...

Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next... British F-35B fighter jet leaves Kerala after being stranded for 5 weeks: Know how much the airport may have earned from parking

British F-35B fighter jet leaves Kerala after being stranded for 5 weeks: Know how much the airport may have earned from parking Rahul Gandhi in legal trouble, court accepts plea against Congress leader over...

Rahul Gandhi in legal trouble, court accepts plea against Congress leader over... Who will be the next Vice President of India after Jagdeep Dhankhar resigns?

Who will be the next Vice President of India after Jagdeep Dhankhar resigns? Election Commission: This state becomes first in India to have electors less than 12,000

Election Commission: This state becomes first in India to have electors less than 12,000 Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in...

Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in... CBSE takes BIG step to ensure safety of students, directs all affiliated schools to...

CBSE takes BIG step to ensure safety of students, directs all affiliated schools to... UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here

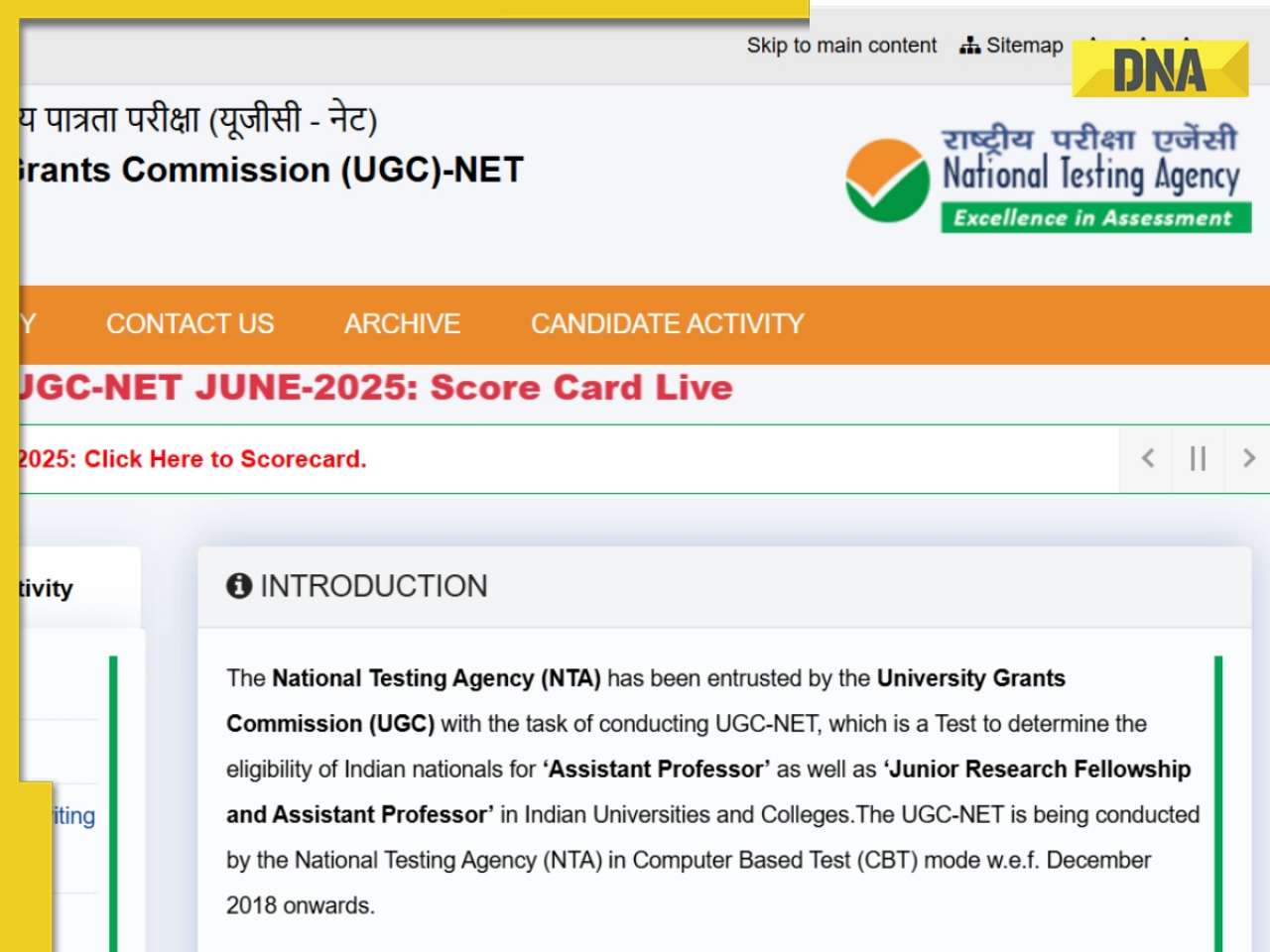

UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here NEET PG 2025 City Intimation Slip out today, here's how you can download it

NEET PG 2025 City Intimation Slip out today, here's how you can download it Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was...

Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)