- Home

- Latest News

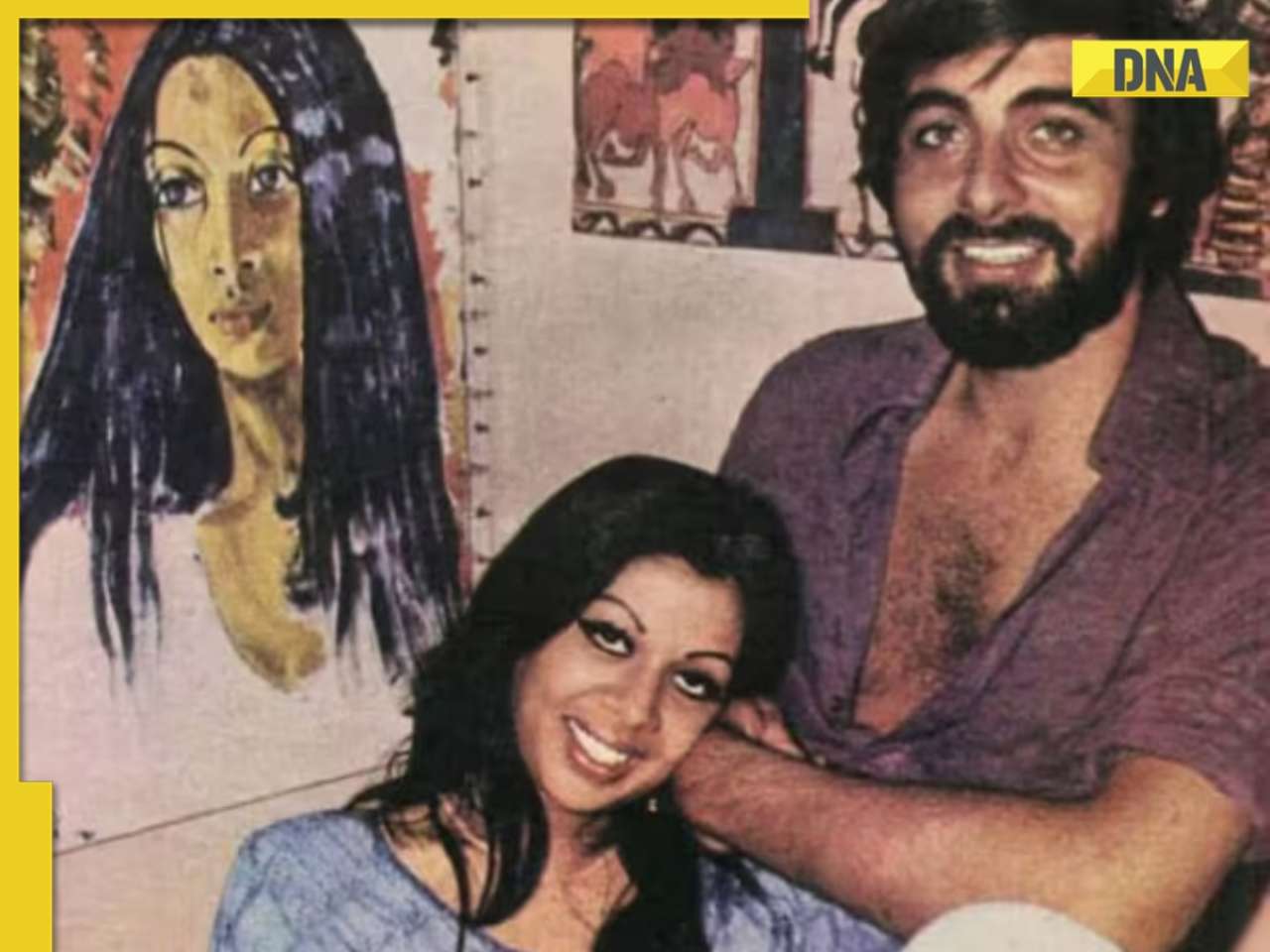

Anupam Kher says he has hurt Kirron Kher, admits not being in best marriage: 'That’s why I have...'

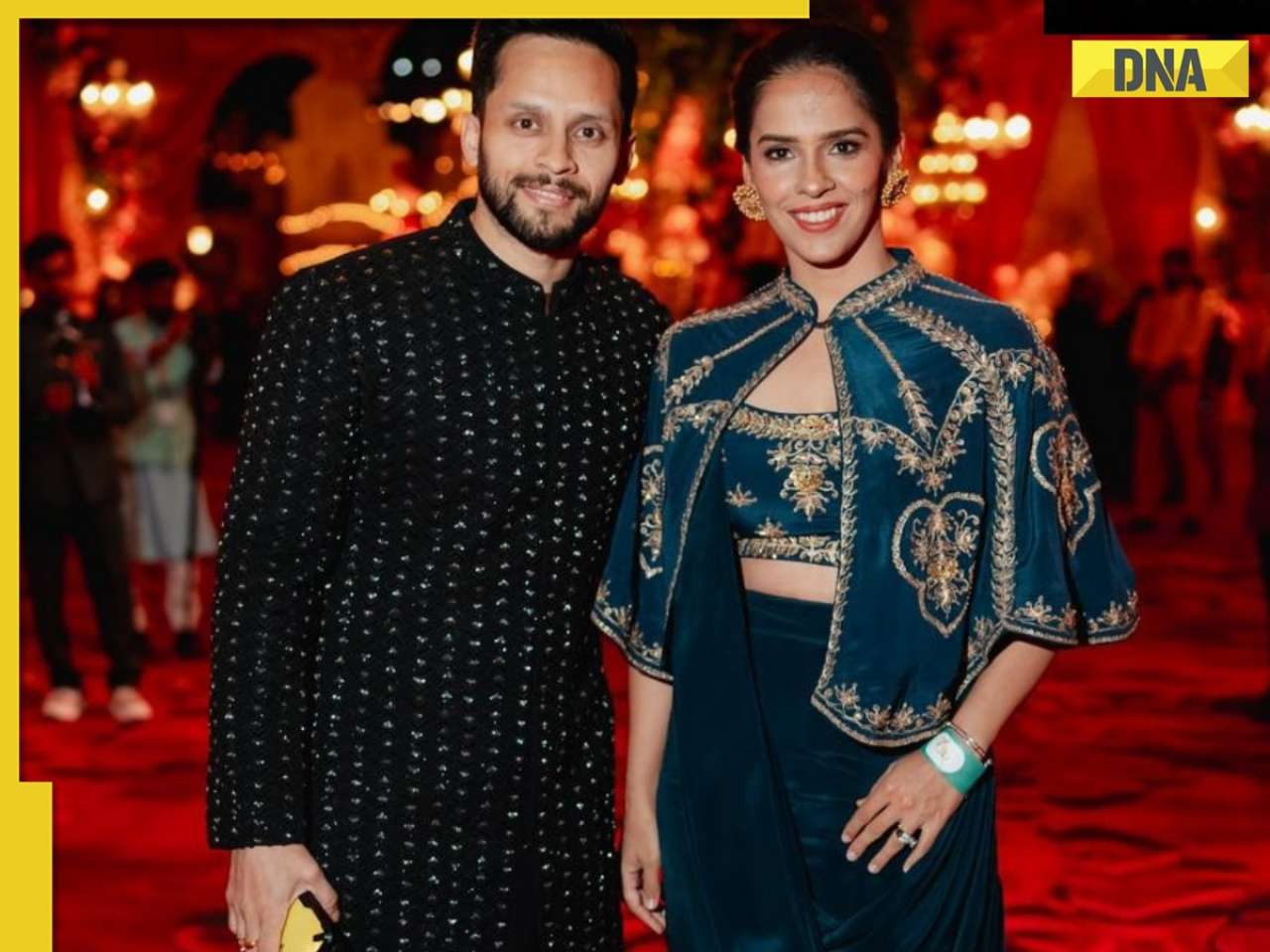

Anupam Kher says he has hurt Kirron Kher, admits not being in best marriage: 'That’s why I have...' Kabir Bedi breaks silence on his failed open marriage with first wife Protima, admits being bothered by her...: 'I had hoped that it...'

Kabir Bedi breaks silence on his failed open marriage with first wife Protima, admits being bothered by her...: 'I had hoped that it...' Salt consumption among Indians is 2.2 times more than WHO limit: ICMR

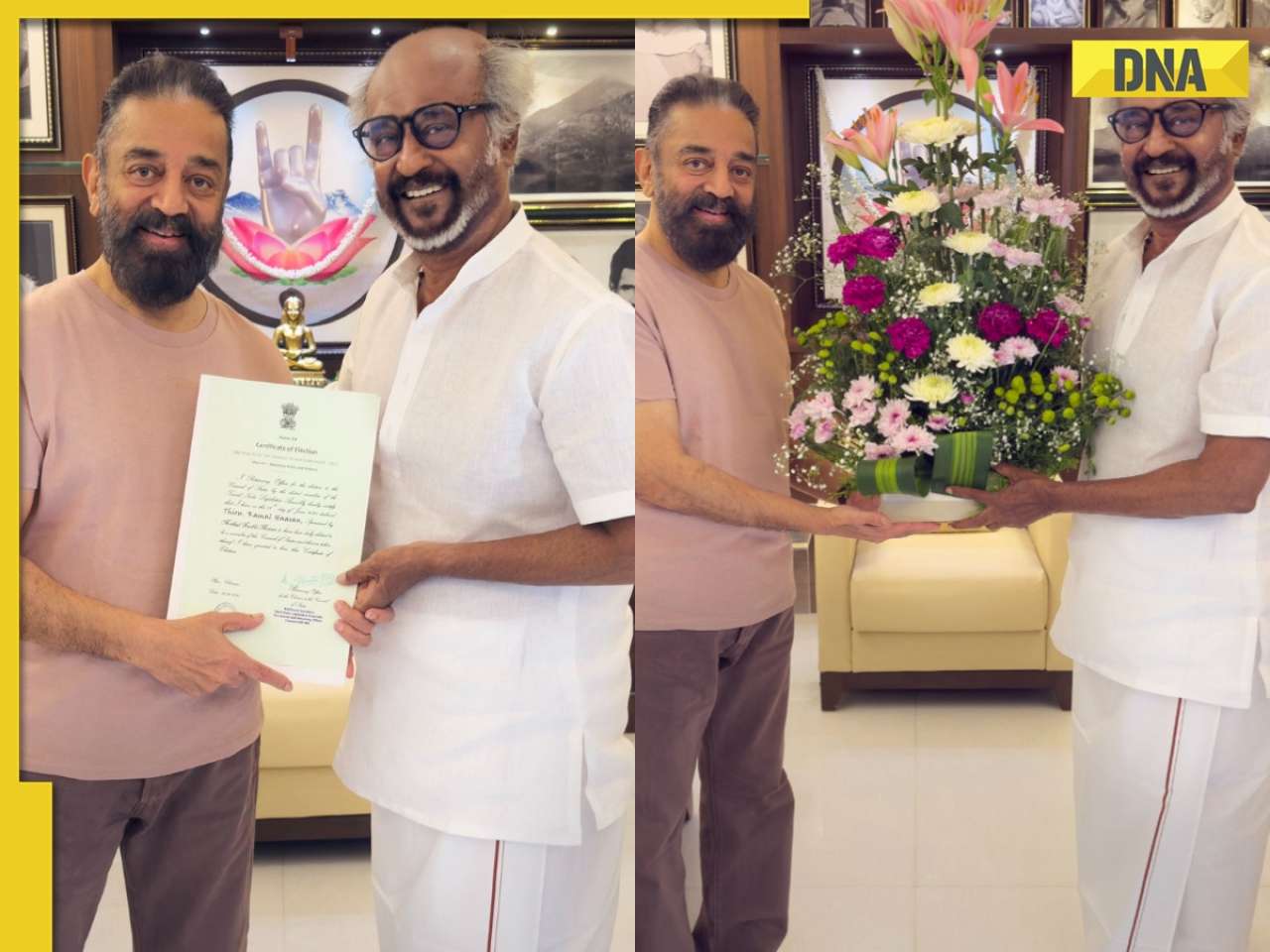

Salt consumption among Indians is 2.2 times more than WHO limit: ICMR Ahead of his Rajya Sabha oath-taking ceremony, Kamal Haasan meets friend Rajinikanth; see viral photos

Ahead of his Rajya Sabha oath-taking ceremony, Kamal Haasan meets friend Rajinikanth; see viral photos Political shakeup in Pakistan? President Asif Ali Zardari to be forced to quit, Asim Munir to take over? Defence Minister says...

Political shakeup in Pakistan? President Asif Ali Zardari to be forced to quit, Asim Munir to take over? Defence Minister says...

- WAA 2025

- Webstory

7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

- Videos

Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case

Nimisha Priya Case: Who Was Talal Abdo Mahdi? Inside The Tragic Story Behind Nimisha Priya’s Case US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi

US News: Trump Confident On India Trade Deal | “We’re Going to Have Access Into India" | PM Modi CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics

CDS Anil Chauhan On Op Sindoor: Pakistani Drones Neutralised Using Kinetic, Non-Kinetic Tactics Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National

Nimisha Priya Case: Grand Mufti In Talks With Yemen Scholars, Urges For Release Of Indian National Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen

Nimisha Priya Case: How Nimisha Priya’s Life Took a ‘Dark Turn’ | From Nurse to Death Row In Yemen

- Business

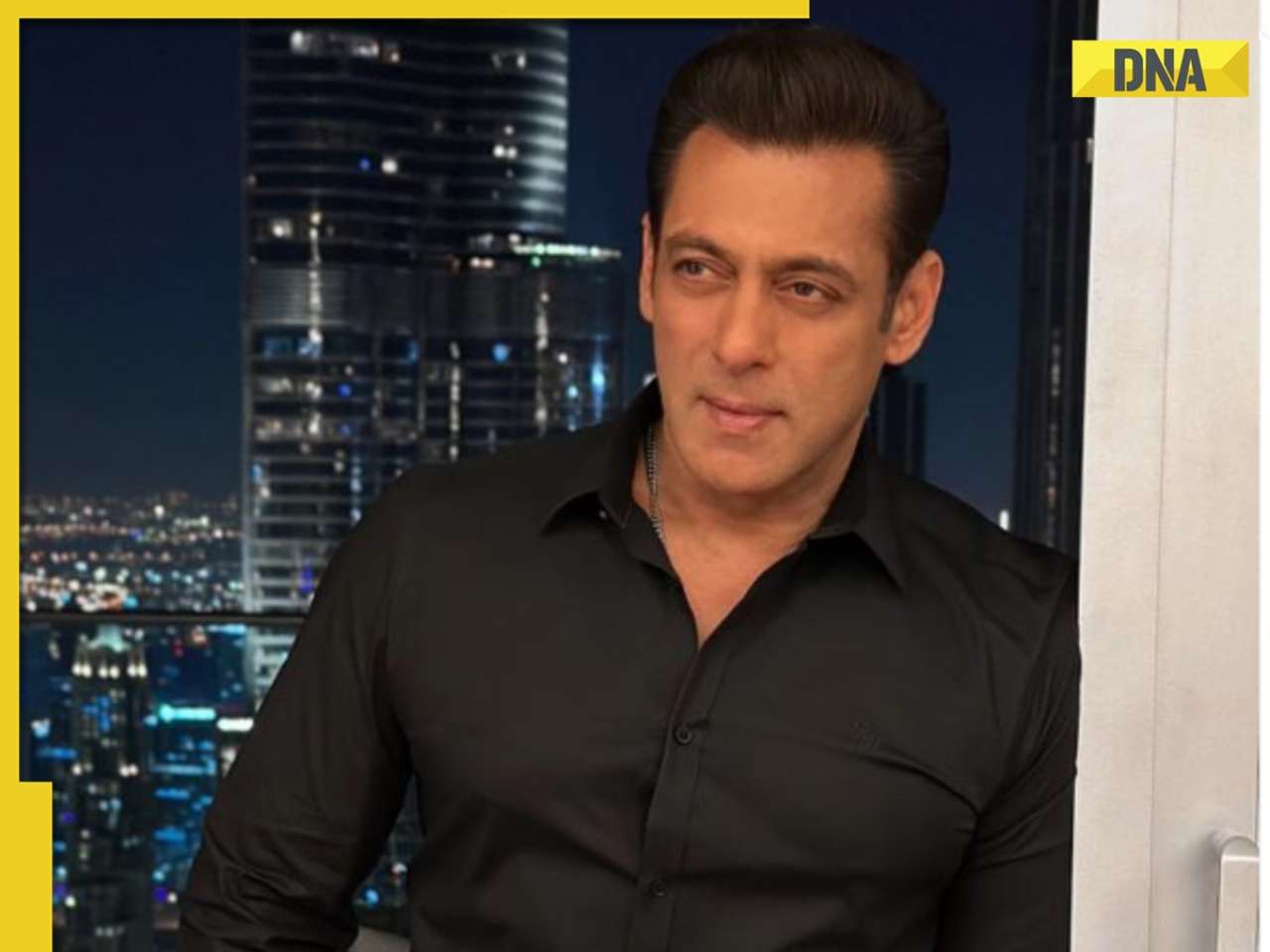

Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in...

Salman Khan makes BIG move, sells his 1318 sq ft apartment for Rs...; it is located in... Tesla vs BYD: Long before Tesla’s entry in India, BYD introduced self-driving tech in budget cars, will now integrate DeepSeek in entry level cars

Tesla vs BYD: Long before Tesla’s entry in India, BYD introduced self-driving tech in budget cars, will now integrate DeepSeek in entry level cars  Not Elon Musk's Tesla, Apple: Most bought US stocks by Indians in last 3 months are...

Not Elon Musk's Tesla, Apple: Most bought US stocks by Indians in last 3 months are... Anand Mahindra welcomes Elon Musk's Tesla in India: 'Looking forward to seeing you at...'

Anand Mahindra welcomes Elon Musk's Tesla in India: 'Looking forward to seeing you at...' India’s largest private bank worth Rs 1529000 crore plans to reward its shareholders with...

India’s largest private bank worth Rs 1529000 crore plans to reward its shareholders with...

- Photos

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes

World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of...

Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of... 10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1

10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1 Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen

Katrina Kaif hair secret at 42? A homemade oil from her mother-in-law’s kitchen

- India

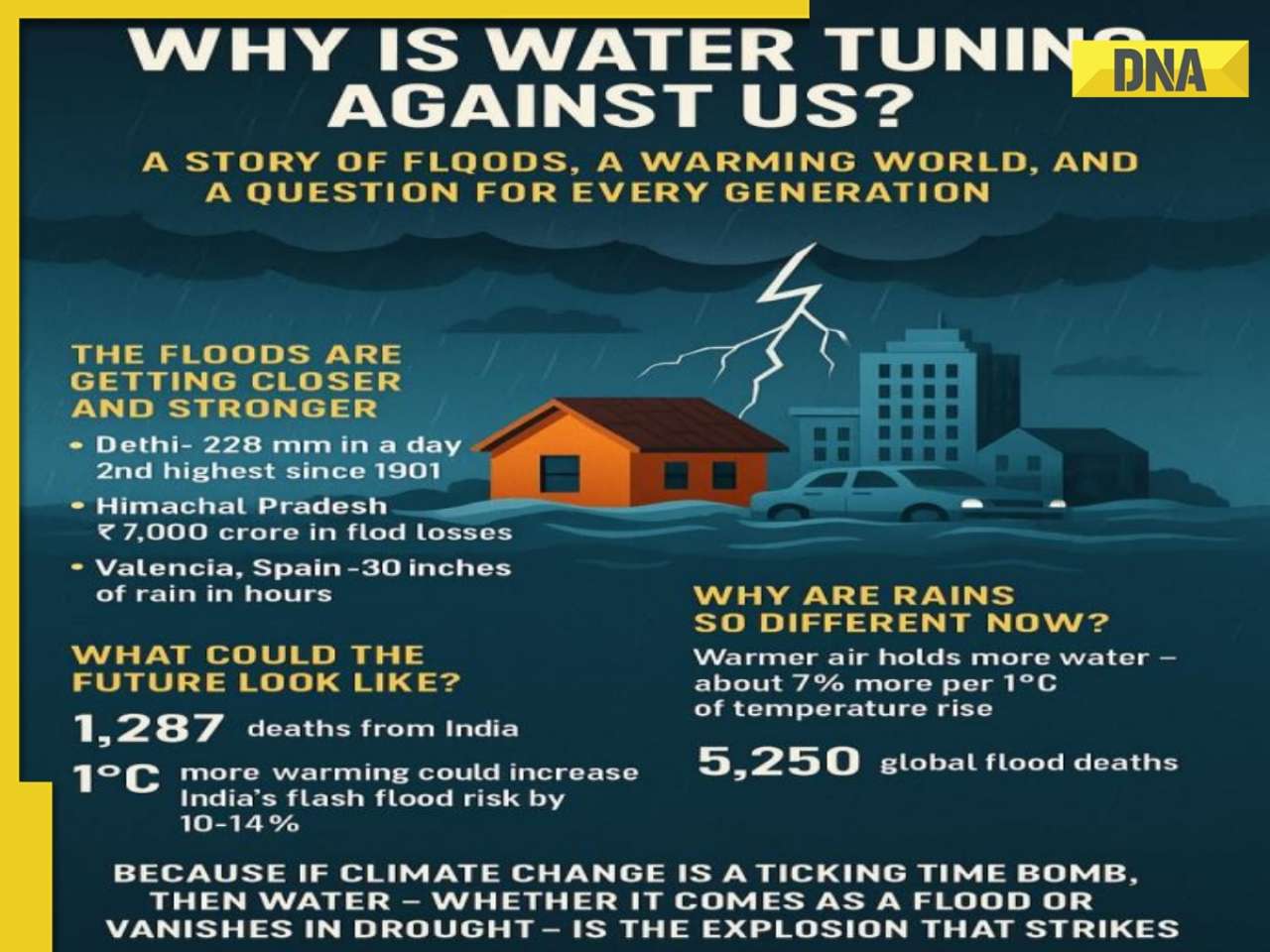

Why is water turning against us? A story of floods, a warming world, and a question for every generation

Why is water turning against us? A story of floods, a warming world, and a question for every generation Axiom-4 Mission: After returning to Earth from ISS, Shubhanshu Shukla will forget THESE things, check full list here

Axiom-4 Mission: After returning to Earth from ISS, Shubhanshu Shukla will forget THESE things, check full list here "Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says...

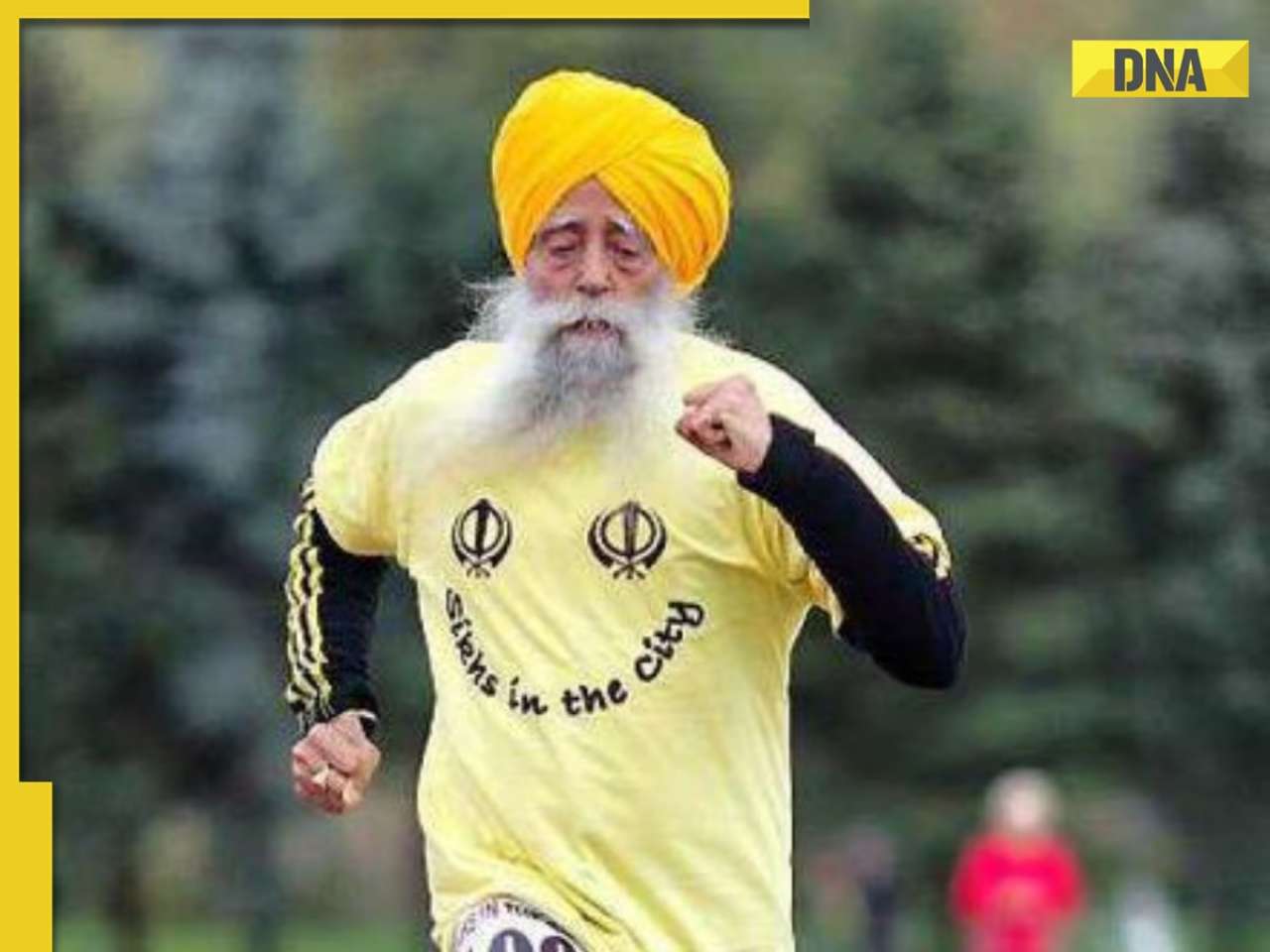

"Mughals were brutal and intolerant", "Babur slaughtered entire cities", claims NCERT, Class VIII book says... Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from...

Who is Amritpal Singh? 30-year-old arrested in legendary marathon runner Fauja Singh hit-and-run case, he had returned from... Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law?

Trouble mounts for Nimisha Priya, victim's kin refuse blood money, demand "qisas", what is it under Sharia Law?

- Education

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

- Automobile

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)