One of the major changes is a cap on how many times users can check their account balance through a UPI app.

Starting August 1, using UPI will come with a set of new rules aimed at improving transaction speed, reducing system load, and making payments safer. The National Payments Corporation of India (NPCI) has issued fresh guidelines for all members of the UPI ecosystem, including banks and payment apps, which must be implemented by July 31.

NPCI issues fresh guidelines for UPI users

One of the major changes is a cap on how many times users can check their account balance through a UPI app. From next month, each app will allow a maximum of 50 balance enquiries per customer per day, within a rolling 24-hour period. This limit is per app, meaning a user can still check their balance separately on different UPI apps. Importantly, these requests must be initiated by the user, not automatically by the app, as per the circular.

Banks will also be required to display the available account balance after every successful UPI payment. For auto-pay transactions, NPCI has fixed specific time slots to avoid network congestion. Scheduled payments will only be processed before 10 am, between 1 pm and 5 pm, or after 9:30 pm. Peak hours — when UPI usage is highest — are defined as 10 am to 1 pm. and 5 pm to 9:30 pm, during which auto-pay executions will not take place.

NPCI warns of violation of rules

The number of times users can view the list of bank accounts linked to their UPI profile will also be limited to 25 times per day. For pending transactions, users can check the payment status only three times, with at least a 90-second gap between each attempt. Payment reversal requests will also be capped at 10 per month, with a maximum of five per sender. In a step to prevent fraud and payment mistakes, UPI apps will now display the recipient’s registered bank name before a transaction is completed. This will help users verify they are sending money to the right person or business.

NPCI has warned that failure to implement these rules could lead to strict action, including penalties, suspension of new customer onboarding, or even restrictions on API access for UPI services.

(With inputs from IANS)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film

Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film Aamir Khan reveals why he decided not to release Sitaare Zameen Par on OTT: 'I never liked that model, I believe...'

Aamir Khan reveals why he decided not to release Sitaare Zameen Par on OTT: 'I never liked that model, I believe...' UK Prime Minister Keir Starmer says Britain will recognize state of Palestine before UN unless..., discusses issue with Donald Trump

UK Prime Minister Keir Starmer says Britain will recognize state of Palestine before UN unless..., discusses issue with Donald Trump  Kyunki Saas Bhi Kabhi Bahu Thi S2 premiere episode review: Smriti Irani, Amar Upadhyay's show wallops nostalgia, Ekta Kapoor might bring back glory to TV

Kyunki Saas Bhi Kabhi Bahu Thi S2 premiere episode review: Smriti Irani, Amar Upadhyay's show wallops nostalgia, Ekta Kapoor might bring back glory to TV DNA TV Show: Putin’s security guards spotted with high-tech anti-drone weapon amid rising drone threats

DNA TV Show: Putin’s security guards spotted with high-tech anti-drone weapon amid rising drone threats Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this

New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs...

Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs... Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from...

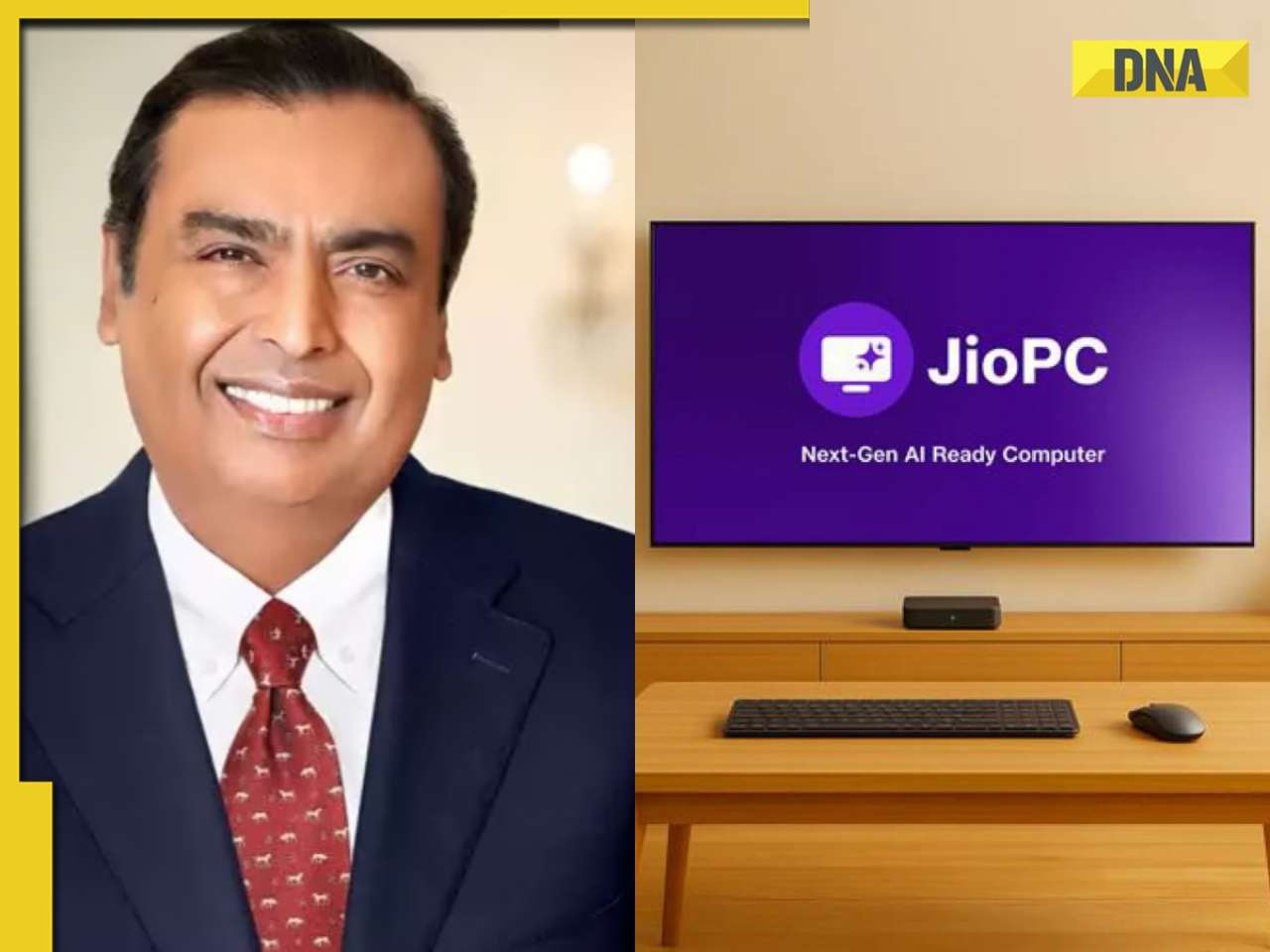

Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from... Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more

Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more Elon Musk's Tesla set to open another flagship showroom in this Indian city, not Noida, Bengaluru, Chennai

Elon Musk's Tesla set to open another flagship showroom in this Indian city, not Noida, Bengaluru, Chennai Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond

Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid

Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid  Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more

Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more Step inside Virender Sehwag’s Rs 130 crore Delhi mansion with 12 lavish rooms, trophy room, private temple, and luxury garage

Step inside Virender Sehwag’s Rs 130 crore Delhi mansion with 12 lavish rooms, trophy room, private temple, and luxury garage Like Ahaan Panday, these Bollywood stars have private Instagram handles

Like Ahaan Panday, these Bollywood stars have private Instagram handles Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film

Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...'

PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...' Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025

Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025 Pakistan-Bangladesh nexus exposed, India's neighbours allow visa-free entry for each other, how will it affect

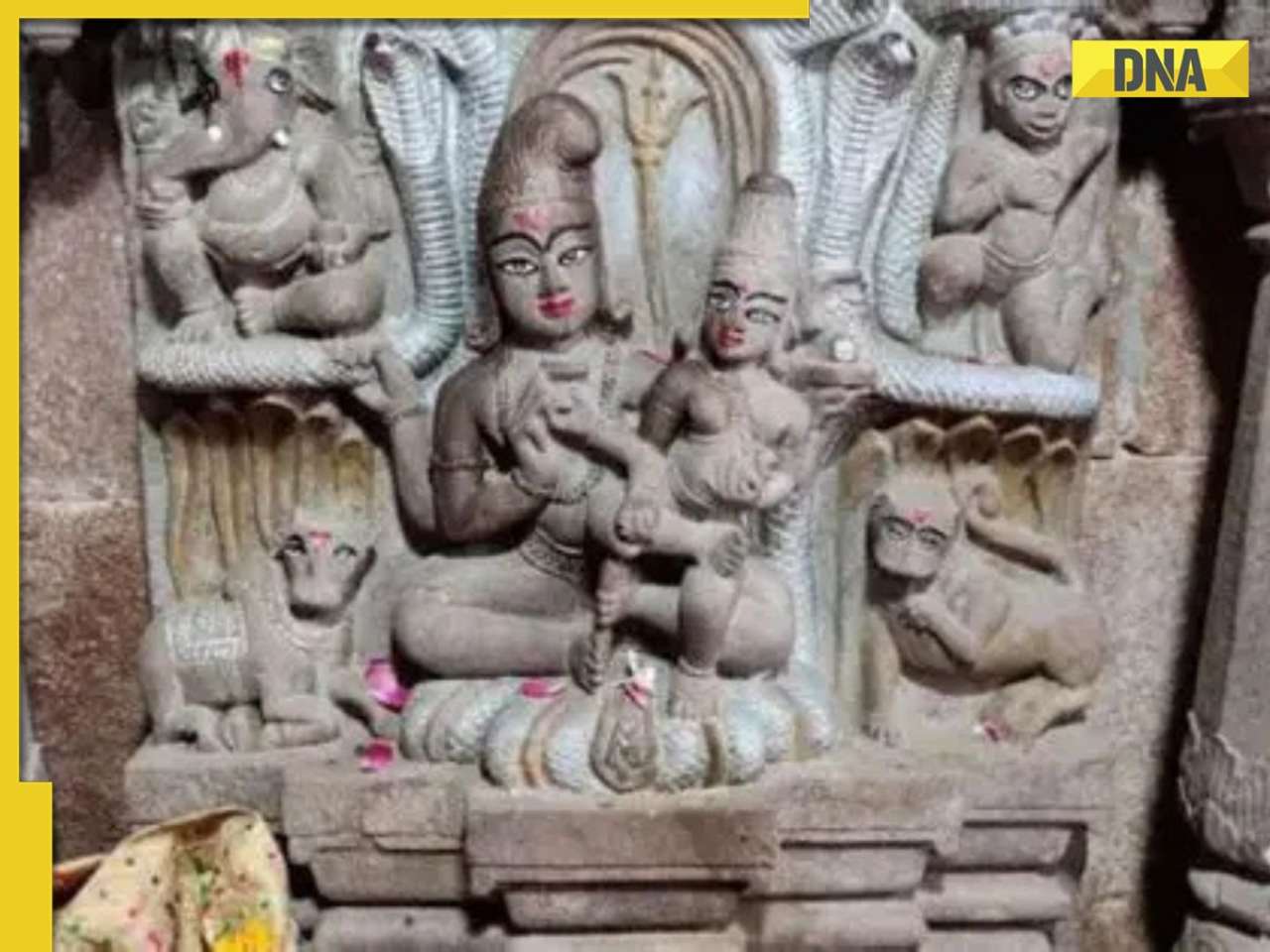

Pakistan-Bangladesh nexus exposed, India's neighbours allow visa-free entry for each other, how will it affect This temple opens only on Nag Panchmi, know reason behind, significance

This temple opens only on Nag Panchmi, know reason behind, significance RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here

RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become...

Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become... UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more

UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now?

Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now? Delhi University UG admissions 2nd allotment list released, here's how you can download it

Delhi University UG admissions 2nd allotment list released, here's how you can download it Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)