- Home

- Latest News

When will tsunami arrive in Hawaii, California, Washington and other areas?

When will tsunami arrive in Hawaii, California, Washington and other areas? Japan, Russia Tsunami: 'Japanese Baba Vanga' had predicted huge disaster for Japan in July 2025, what else did she predict?

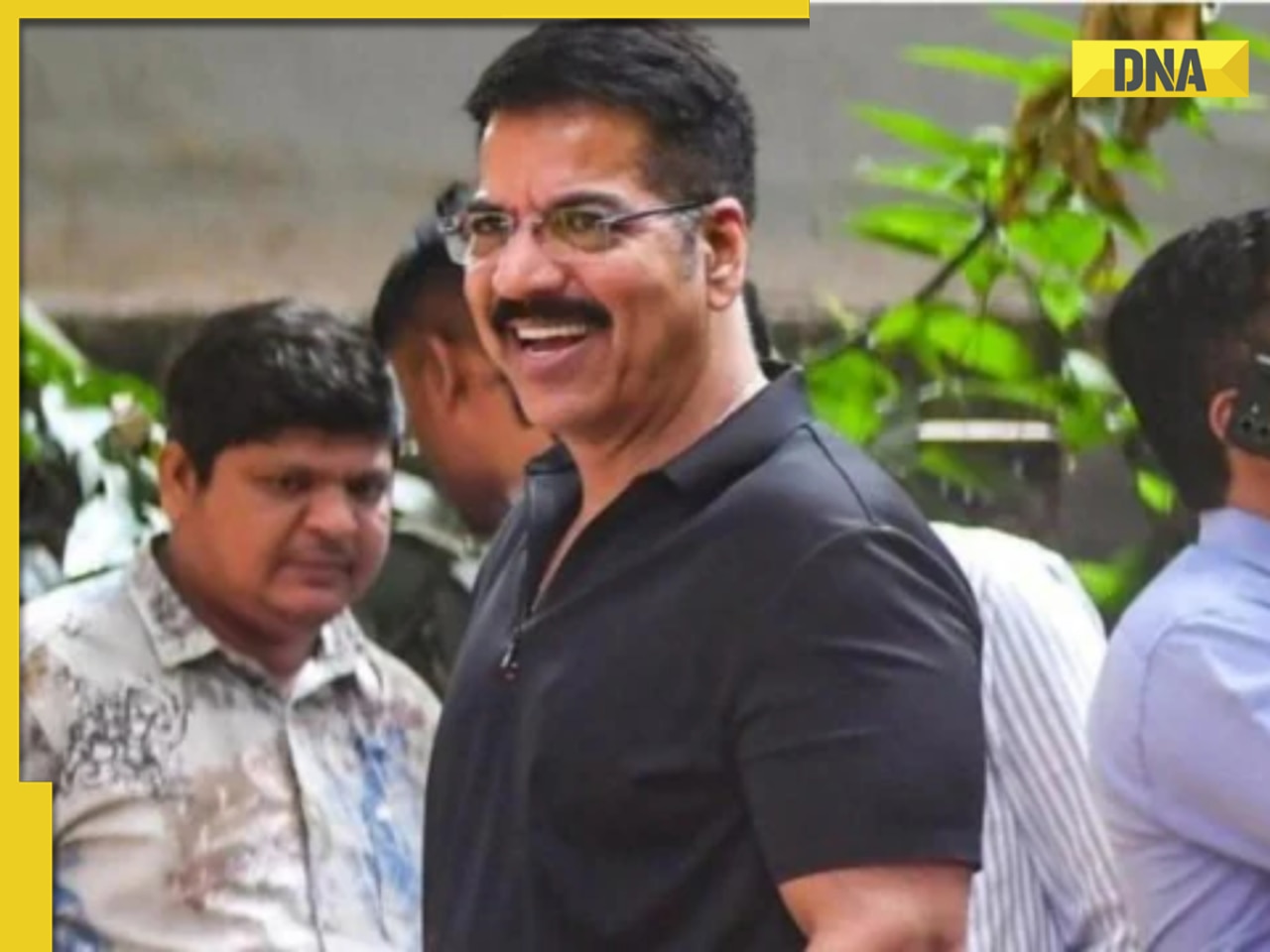

Japan, Russia Tsunami: 'Japanese Baba Vanga' had predicted huge disaster for Japan in July 2025, what else did she predict? Prakash Raj appears before ED in connection with betting app case

Prakash Raj appears before ED in connection with betting app case Meet man, IIM alumnus, who studied with Microsoft's Satya Nadella, now set to become first Indian CEO of THIS US manufacturing giant, his net worth is Rs...

Meet man, IIM alumnus, who studied with Microsoft's Satya Nadella, now set to become first Indian CEO of THIS US manufacturing giant, his net worth is Rs... MS Dhoni turns 'love guru', gives witty marriage advice to newly-weds, netizens say 'bro can be a...', watch viral video

MS Dhoni turns 'love guru', gives witty marriage advice to newly-weds, netizens say 'bro can be a...', watch viral video

- WAA 2025

- Webstory

- Videos

Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

- Business

Meet man, IIM alumnus, who studied with Microsoft's Satya Nadella, now set to become first Indian CEO of THIS US manufacturing giant, his net worth is Rs...

Meet man, IIM alumnus, who studied with Microsoft's Satya Nadella, now set to become first Indian CEO of THIS US manufacturing giant, his net worth is Rs... New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this

New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs...

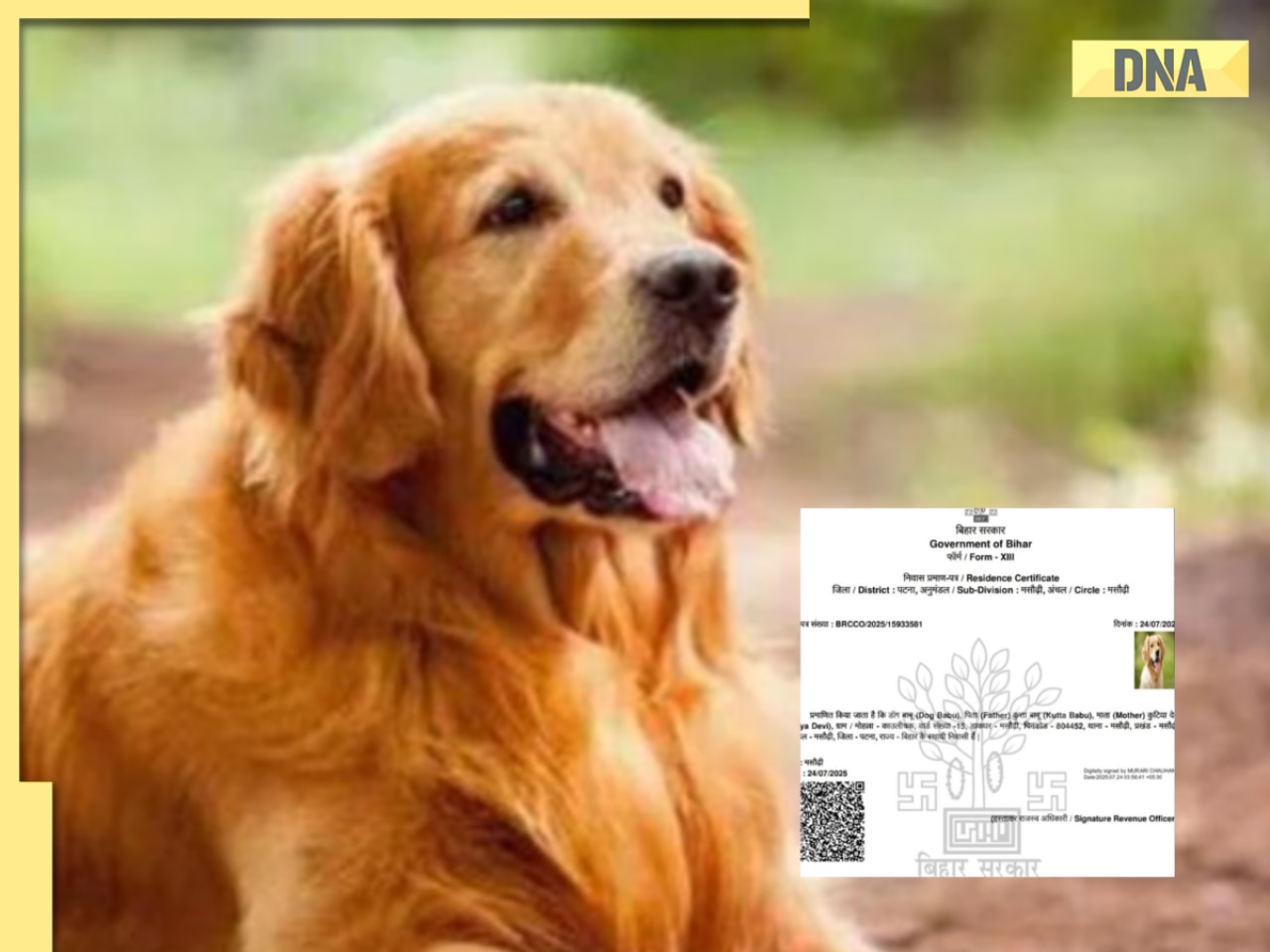

Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs... Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from...

Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from... Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more

Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more

- Photos

Nita Ambani, Isha Ambani embrace natural beauty at Vikas Khanna’s iconic New York restaurant, see pics

Nita Ambani, Isha Ambani embrace natural beauty at Vikas Khanna’s iconic New York restaurant, see pics When Life Gives You Tangerines, The Glory and other gripping K‑dramas that drew inspiration from real-life events

When Life Gives You Tangerines, The Glory and other gripping K‑dramas that drew inspiration from real-life events Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond

Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid

Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid  Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more

Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more

- India

NASA-ISRO mission: NISAR satellite set for launch today from Sriharikota check time, other details here

NASA-ISRO mission: NISAR satellite set for launch today from Sriharikota check time, other details here Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...'

Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...' Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film

Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...'

PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...' Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025

Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025

- Education

Meet man, whose father sold his house to fund his son's education, later cracked UPSC exam at the age of 23 in first attempt, his rank was..., he is from...

Meet man, whose father sold his house to fund his son's education, later cracked UPSC exam at the age of 23 in first attempt, his rank was..., he is from... RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here

RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become...

Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become... UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more

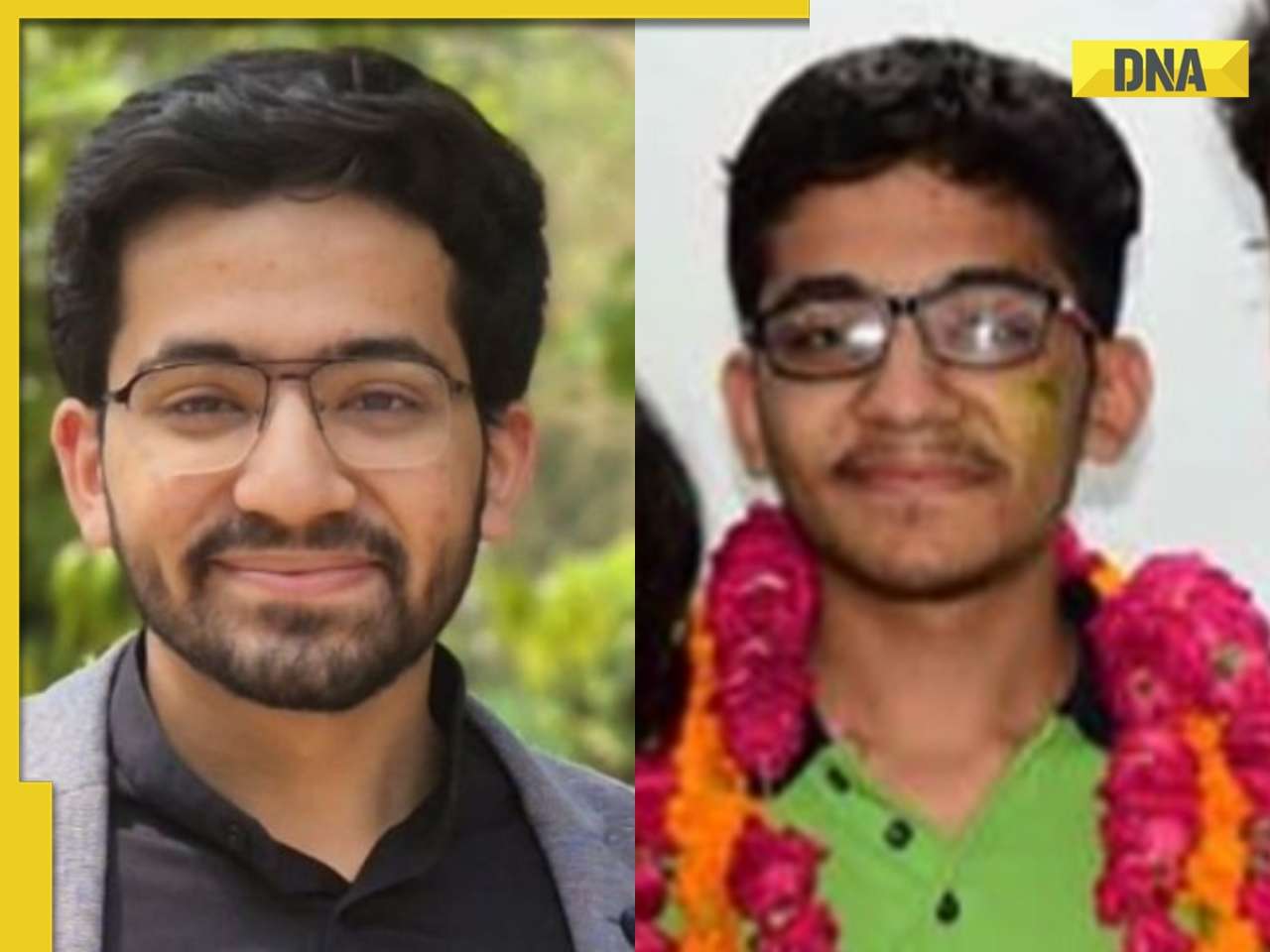

UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now?

Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now?

- Automobile

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

- Investors

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)