New Income Tax Bill 2025: FM Nirmala Sitharaman tables the new income tax bill in Lok Sabha

New Income Tax Bill 2025: The government on Thursday tabled the New Income Tax Bill, 2025, which aims to simplify tax laws, modernize definitions, and provide more clarity on various tax-related matters.

This new bill, tabled in Lok Sabha by Finance Minister Nirmala Sitharaman, seeks to replace the existing Income Tax Act, 1961 and introduce changes that affect different categories of taxpayers, including individuals, businesses, and non-profit organizations.

After presenting the income tax bill the Finance Minister asked Lok Sabha Speaker to nominate members for a standing committee to reviewing the newly tabled income tax bill One of the significant changes in the new bill is the introduction of simplified language and modern terminology. It replaces outdated terms and brings in new ones to align with today's economy. For example, it introduces the term "tax year" instead of the existing terms like financial year and assessment year systems. It also defines "virtual digital asset" and "electronic mode", reflecting the growing importance of digital transactions and cryptocurrency in today's financial landscape.

In terms of scope of total income, the new bill makes certain clarifications while maintaining the existing tax principles. Under the previous law, Sections 5 and 9 of the Income Tax Act, 1961, stated that Indian residents were taxed on their global income, while non-residents were taxed only on the income they earned in India. The new bill, in Clauses 5 and 9, retains this rule but provides a clearer definition of deemed income, such as payments made to specific individuals, making tax rules more transparent for non-residents.

The bill also brings changes to deductions and exemptions. Earlier, Sections 10 and 80C to 80U of the Income Tax Act, 1961, allowed deductions for investments, donations, and specific expenses. The new bill, under Clauses 11 to 154, consolidates these deductions and introduces new provisions to support startups, digital businesses, and renewable energy investments.

Changes have also been made to the term capital gains tax. Under the previous law, Sections 45 to 55A categorized capital gains into short-term and long-term based on holding periods, with special tax rates for securities. The new bill, in Clauses 67 to 91, keeps the same categorization but introduces explicit provisions for virtual digital assets and updates beneficial tax rates. This ensures that digital assets, such as cryptocurrency, are covered under a proper tax framework.

For non-profit organizations, the previous law, under Sections 11 to 13, provided income tax exemptions for certain charitable purposes but had limited compliance guidelines. The new bill, in Clauses 332 to 355, establishes a more detailed framework, clearly defining taxable income, compliance rules, and restrictions on commercial activities. This introduces a stricter compliance regime while also providing well-defined exemptions.

Overall, the Income Tax Bill, 2025 aims to simplify tax laws, encourage digital and startup investments, and bring greater clarity in taxation policies for businesses and non-profits. The government believes these changes will make tax compliance easier while ensuring a fair tax structure for all categories of taxpayers.

(ANI)

Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here

Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here Barack Obama and Michelle Obama finally address divorce rumors, say 'It was...'

Barack Obama and Michelle Obama finally address divorce rumors, say 'It was...' Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

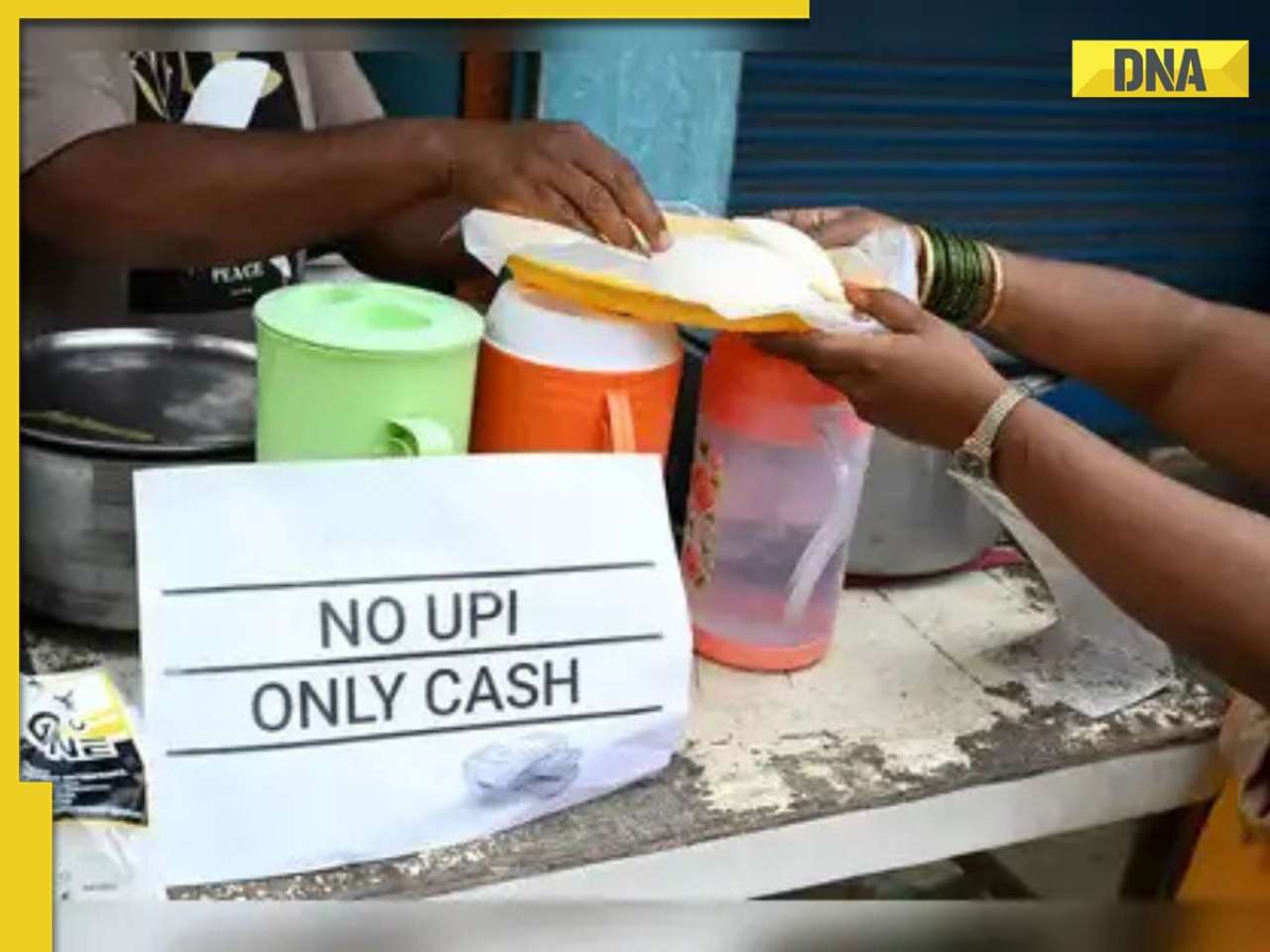

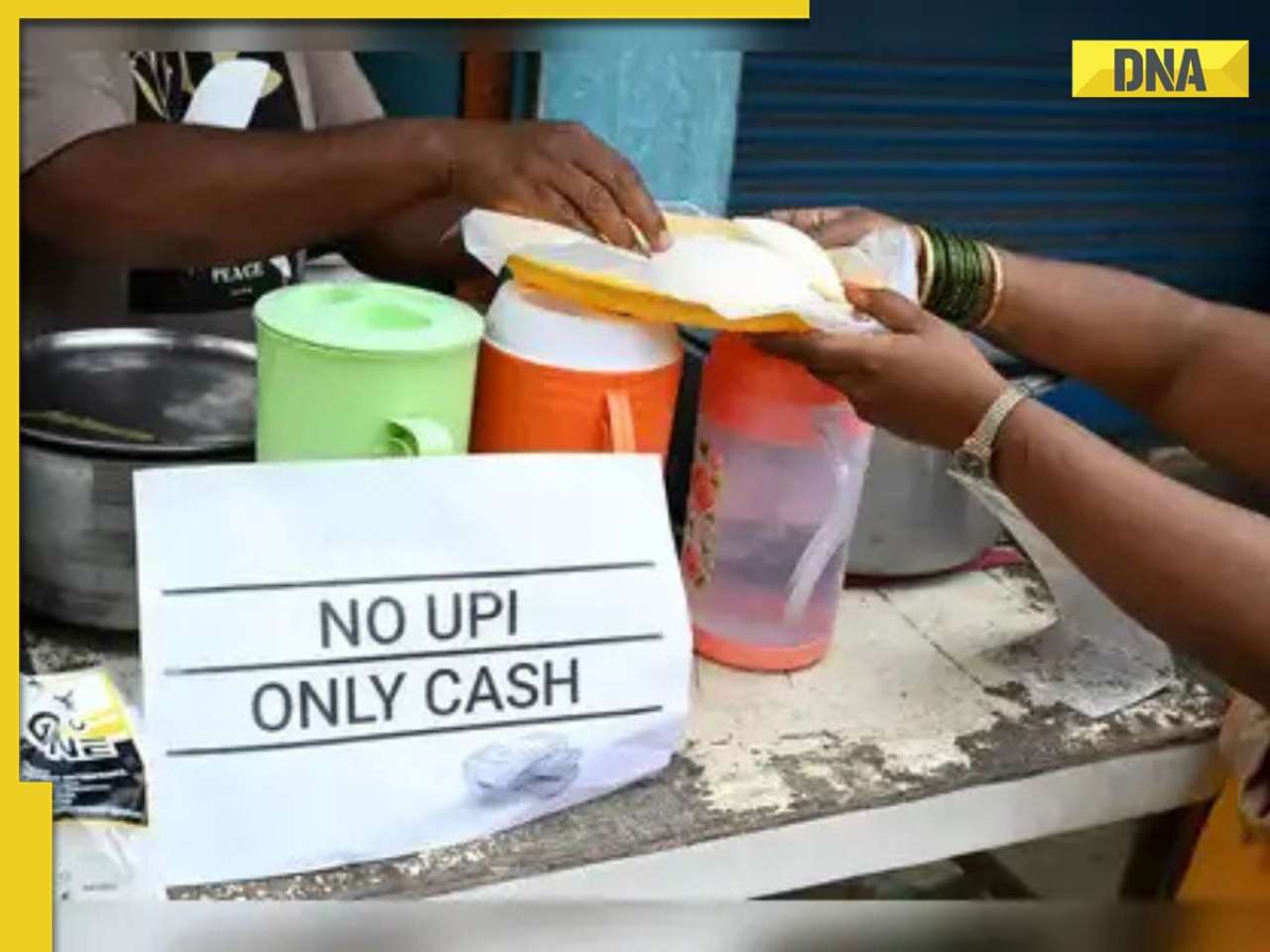

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to...

Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to... Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is..

Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is.. 7 stunning images of supernova captured by NASA Hubble Telescope

7 stunning images of supernova captured by NASA Hubble Telescope 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93

CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93 Air India Plane Crash: No Fault Found In Boeing 787 Fuel Control Switches After Inspections

Air India Plane Crash: No Fault Found In Boeing 787 Fuel Control Switches After Inspections Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming

Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming Israeli Man Seeks Custody Of Daughters Found In Karnataka Cave | Karnataka News

Israeli Man Seeks Custody Of Daughters Found In Karnataka Cave | Karnataka News Israel Attacks Syria: Trump Admin Voices Concern Over Syria Strikes | USA On Israel Syria

Israel Attacks Syria: Trump Admin Voices Concern Over Syria Strikes | USA On Israel Syria No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details

No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through...

Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through... ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps...

ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps... Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here

Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here  After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India

After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India  From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers

From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers  Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes

World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of...

Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of... 10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1

10 countries with most beautiful women in the world, Russia, USA, Greece, make it to the list, you won’t believe who’s number 1 Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here

Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to...

Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to... Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is..

Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is.. What is 'PAN-PAN' call that Delhi-Goa IndiGo flight pilot made before diverting flight to Mumbai?

What is 'PAN-PAN' call that Delhi-Goa IndiGo flight pilot made before diverting flight to Mumbai? UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for...

UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)