Several everyday and other items will get more expensive if a new government proposal to amend the GST system is passed. Under the proposal, the expiring compensation cess will be replaced with a fresh levy. Read on to know more.

GST collection this June surged over 6.2 percent to cross Rs 1.85 lakh crore, compared to the same period last year.

Several everyday and other items will get more expensive if a new government proposal to amend the Goods and Services Tax system is passed. Under the proposal, the expiring compensation cess will be replaced with fresh cesses, particularly targeting tobacco products and costly automobiles. A cess is an additional tax levied on select goods and services over and above the applicable GST. According to a report by NDTV, a panel comprising a group of ministers chaired by the junior Finance Minister Pankaj Chaudhary is expected to discuss the matter later this month.

Cess to target 'sin' goods

The new cess will apply to the so-called "sin" goods -- referring to products usually taxed at higher rates due to their perceived negative impact on the society -- as well as others in the higher 28 percent GST bracket. These include tobacco products such as cigarettes, and carbonated beverages like cola. The cess will also target high-end cars and coal, in alignment with Prime Minister Narendra Modi-led government's overall push towards renewable energy sources, which are more environment-friendly. The group of ministers is close to an agreement as most state governments are expected to accept the proposal.

Relief for middle class on the cards

Meanwhile, reports say that talks underway over reducing the number of GST slabs, possibly by doing away with the 12 percent tax slab. If passed, this will mean some products currently taxed at 12 percent will fall into the lower tax bracket of five per cent, while others will be taken into the higher 18 percent slab. Everyday products such as toothpaste and footwear will likely become cheaper as a result, bringing much relief for the middle class and economically weaker sections.

GST collection this June surged more than 6.2 percent to cross Rs 1.85 lakh crore, compared to about Rs 1.74 lakh crore in the same period last year, according to official data released on Tuesday.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. PAC cosmetics: Performance meets the Indian beauty requirements

PAC cosmetics: Performance meets the Indian beauty requirements Good news for Indians, THIS country is offering visa for just Rs 7500 to live and work for..., not France, US, UK, Spain, it is..., check how to apply

Good news for Indians, THIS country is offering visa for just Rs 7500 to live and work for..., not France, US, UK, Spain, it is..., check how to apply KKR star all-rounder announces retirement from international cricket, his name is....

KKR star all-rounder announces retirement from international cricket, his name is.... Day after Indian tourist arrested for shoplifting, US embassy in India issues BIG warning, says visa can be revoked, if...

Day after Indian tourist arrested for shoplifting, US embassy in India issues BIG warning, says visa can be revoked, if... 'Don’t think Ranveer Singh has...': R Madhavan explains why his Dhurandhar co-star is not going anywhere despite failures

'Don’t think Ranveer Singh has...': R Madhavan explains why his Dhurandhar co-star is not going anywhere despite failures 7 stunning images of supernova captured by NASA Hubble Telescope

7 stunning images of supernova captured by NASA Hubble Telescope 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Sharjah Woman Death: New Details Emerge in Kerala Woman’s Suicide, In-Laws Named In FIR

Sharjah Woman Death: New Details Emerge in Kerala Woman’s Suicide, In-Laws Named In FIR Russia-Ukraine War: Zelenskyy Slams Russia Over Deadly Dobropillia Bombing | Putin | World News

Russia-Ukraine War: Zelenskyy Slams Russia Over Deadly Dobropillia Bombing | Putin | World News CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93

CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93 Air India Plane Crash: No Fault Found In Boeing 787 Fuel Control Switches After Inspections

Air India Plane Crash: No Fault Found In Boeing 787 Fuel Control Switches After Inspections Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming

Shubhanshu Shukla News: What Astronaut Shubhanshu Shukla's Wife Has Planned For His Homecoming No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details

No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through...

Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through... ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps...

ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps... Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here

Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here  After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India

After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India  From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers

From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers  Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films Raksha Bandhan 2025 date, time: When is Rakhi this year? Check shubh muhurat and significance

Raksha Bandhan 2025 date, time: When is Rakhi this year? Check shubh muhurat and significance World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes

World Snake Day 2025: Why are cobras the most dangerous snakes? List of world's 10 deadliest snakes Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of...

Meet woman who failed four times in UPSC exam and finally cracked it with AIR..., is now CEO of... Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here

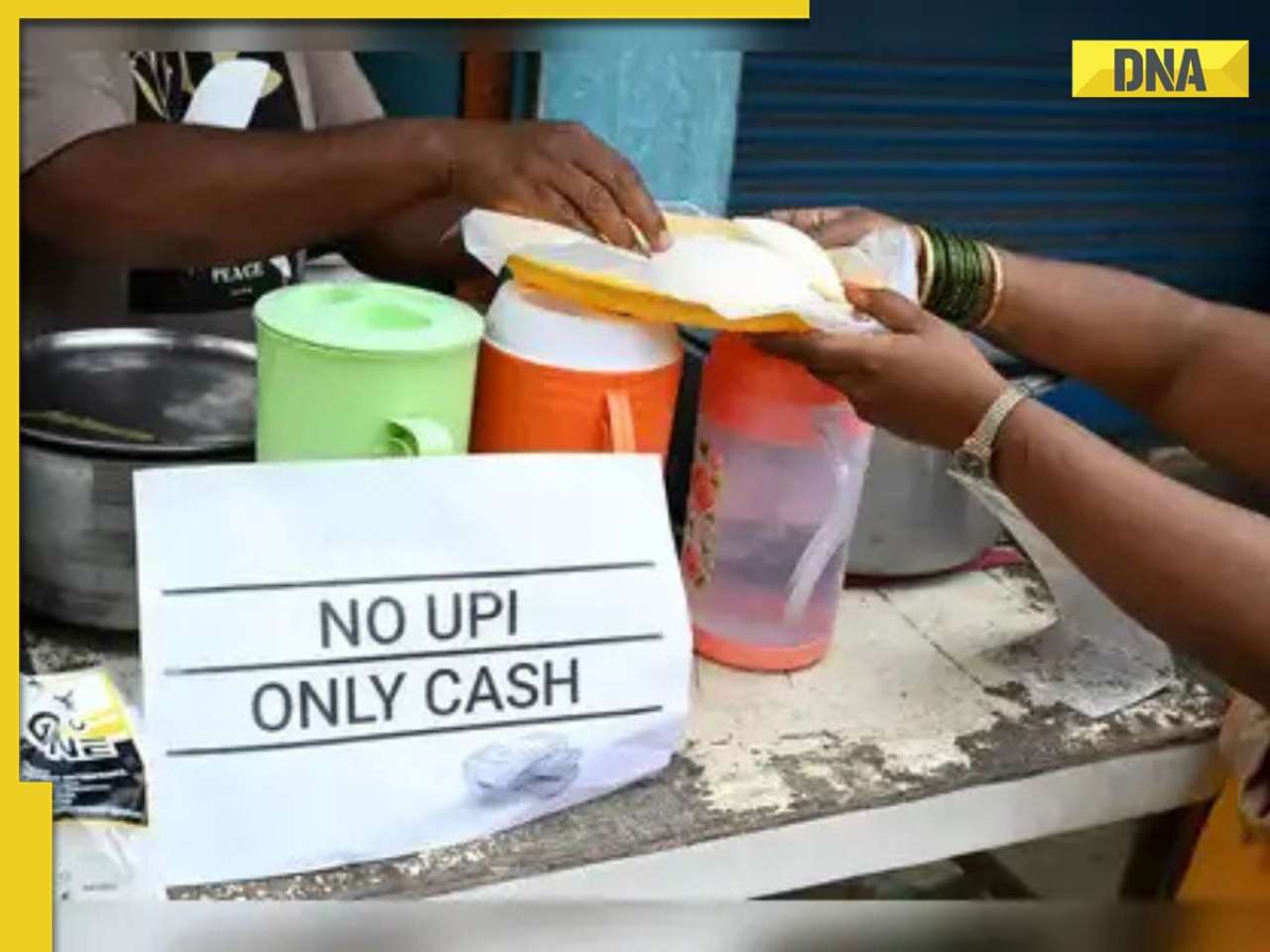

Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to...

Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to... Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is..

Meet woman, first IAS officer to officially appoint a female driver, she is from…, her name is.. What is 'PAN-PAN' call that Delhi-Goa IndiGo flight pilot made before diverting flight to Mumbai?

What is 'PAN-PAN' call that Delhi-Goa IndiGo flight pilot made before diverting flight to Mumbai? UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for...

UIDAI deactivates Aadhar of deceased persons, disables over 1 crore numbers, starts new service for... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)