Union Finance Minister Nirmala Sitharaman on Friday convened a high-level meeting with the Managing Directors and CEOs of Public and Private sector banks and insurance companies amidst emerging security concerns arising from tensions at the western border. Senior officials from the Department of Financial Services (Ministry of Finance), CERT-In, RBI, IRDAI and NPCI attended the meeting, which focused on reviewing the banking sector's operational and cybersecurity preparedness, including digital public-facing applications such as internet banking and UPI, as per a statement from the Ministry of Finance.

Amid India Pakistan conflict Finance Minister Nirmala Sitharaman says, 'Banks must...'

Union Finance Minister Nirmala Sitharaman on Friday convened a high-level meeting with the Managing Directors and CEOs of Public and Private sector banks and insurance companies amidst emerging security concerns arising from tensions at the western border. Senior officials from the Department of Financial Services (Ministry of Finance), CERT-In, RBI, IRDAI and NPCI attended the meeting, which focused on reviewing the banking sector's operational and cybersecurity preparedness, including digital public-facing applications such as internet banking and UPI, as per a statement from the Ministry of Finance.

Banks security ready amid India Pakistan tension

The Managing Directors and CEOs of all the Banks and Insurance Companies apprised the Union Finance Minister about the measures they are undertaking, given the ongoing tensions at the border. Bank MDs and CEOs informed that cybersecurity measures have been reinforced throughout the banking system. Anti-DDoS (Distributed Denial-of-Service) systems have been implemented by banks to protect against massive cyber-attacks. To guarantee institutional readiness, mock drills have been held encompassing cybersecurity and disaster recovery scenarios at the highest levels.

They apprised that phishing attempts are being actively watched, and staff members have received several internal alerts to increase awareness. Bank officials stated that their Security Operations Centre (SOC) and Network Operations Centres are fully operational and on high alert. These centres are coordinating closely with CERT-In and the National Critical Information Infrastructure Protection Centre (NCIIPC), facilitating real-time data sharing and threat monitoring.

Finance Minister Sitharaman reviews banking security

During the meeting, the Finance Minister stressed the critical role of the banking and financial sector in ensuring economic stability during heightened geopolitical tensions and challenging times. She directed all banks to remain fully alert and prepared to deal with any eventuality or crisis, ensuring uninterrupted access to banking and financial services for citizens and businesses across the country, especially in border areas. She remarked that banking services, both physical and digital, must function without disruption and glitches.

The Union Finance Minister remarked that emergency protocols should be updated and tested to handle any arising contingencies. The Finance Minister expressed deep concern about the safety of bank employees and their families working at branches around the border areas. She directed banks to ensure their adequate safety by effectively coordinating with the security agencies.

She asked Banks to ensure that citizens and businesses do not suffer under any circumstances, and priority must be given to seamless cash availability at ATMs, uninterrupted UPI and internet banking services, and continued access to essential banking facilities. Nirmala Sitharaman directed banks to conduct regular audits of their cybersecurity systems and data centres and ensure that all digital and core banking infrastructure is fully firewalled and monitored round the clock to prevent breaches or any hostile cyber activity.

The FM instructed banks to designate two dedicated senior officials identified at the headquarters, one for reporting all cyber-related matters and the other to ensure operational matters, including the functioning of bank branches and the availability of cash in ATMs. Both dedicated officers should report any incident to CERT-In / relevant agencies and DFS on a real-time basis. In this regard, Banks were also asked to coordinate in real time with the Reserve Bank of India, CERT-In and relevant Government agencies to ensure robust and agile information exchange and response.

The Finance Minister also directed insurance companies to ensure timely claim settlements and uninterrupted customer service. The Finance Minister mentioned that the Sponsor Banks should ensure that RRBs are well-supported during these times and hand-hold them for any issues that they are facing. Nirmala Sitharaman reiterated that the Government is firmly committed to national security and economic stability, noting that the country's banking and financial system remains robust and resilient.

(Except for the headline, this story has not been edited by DNA staff and is published from ANI)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Big tension for Pakistan, China, as India tests THIS new hypersonic missile, which is 8X faster than speed of sound, can strike enemy at a range of...

Big tension for Pakistan, China, as India tests THIS new hypersonic missile, which is 8X faster than speed of sound, can strike enemy at a range of... Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway

Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway BCCI's BIG statement on weather Virat Kohli, Rohit Sharma were forced to retire from Tests: 'The decision was made...'

BCCI's BIG statement on weather Virat Kohli, Rohit Sharma were forced to retire from Tests: 'The decision was made...' Ranbir Kapoor, Sai Pallavi's Ramayana Rs 4000 crore budget draws fire from this filmmaker: 'Hollywood films like...'

Ranbir Kapoor, Sai Pallavi's Ramayana Rs 4000 crore budget draws fire from this filmmaker: 'Hollywood films like...' Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies

Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh

President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building'

Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building' India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs...

THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs... Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here

Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to...

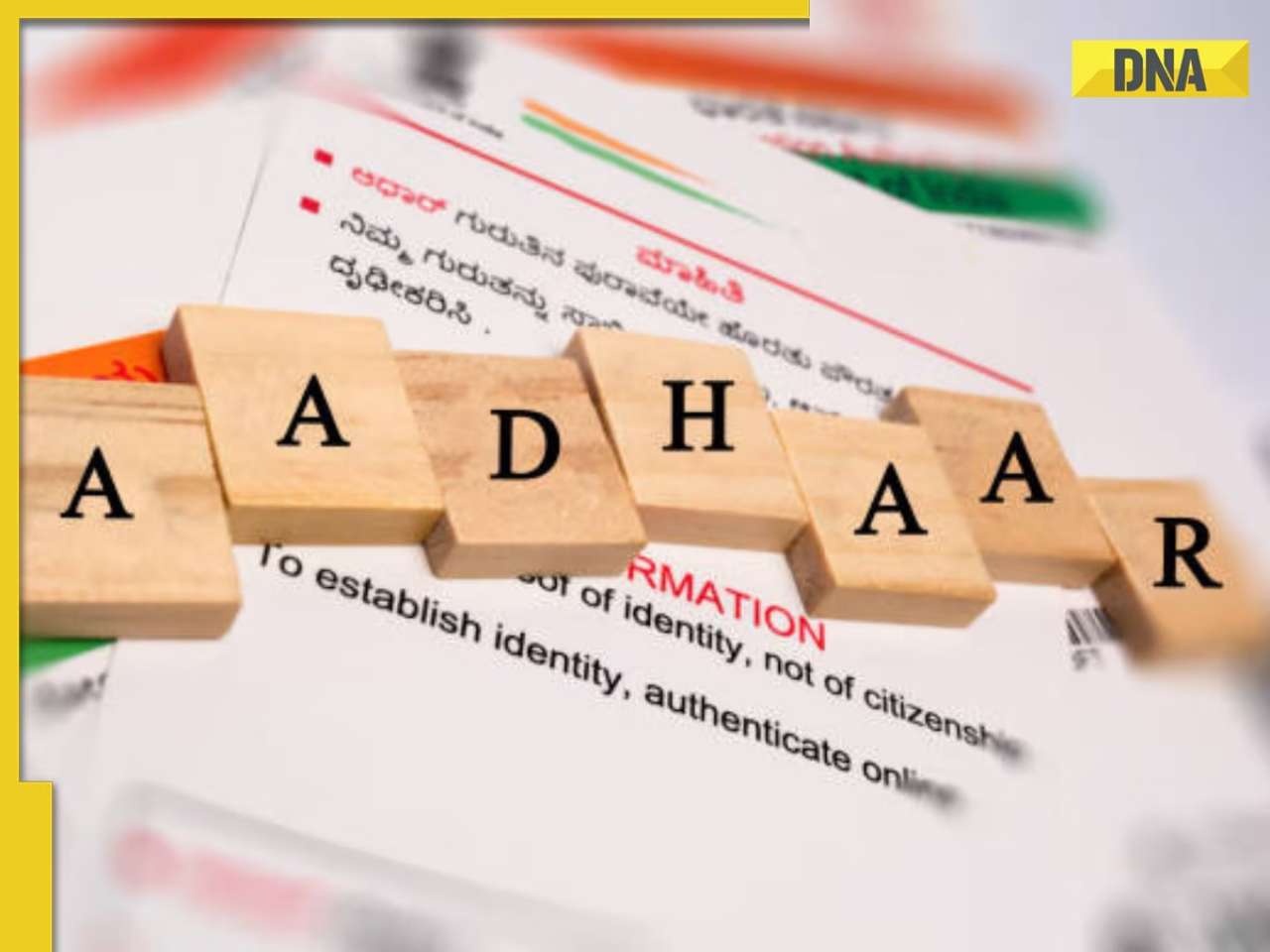

Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to... UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...'

UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...' Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...

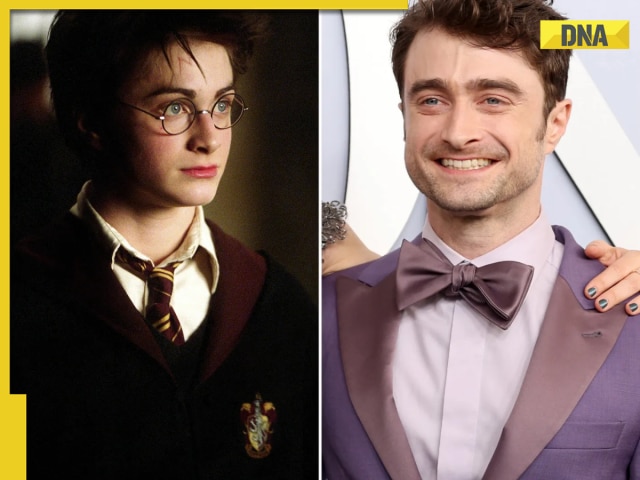

Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...  Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now?

Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now? Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs

Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show

Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series

Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes

Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes Big tension for Pakistan, China, as India tests THIS new hypersonic missile, which is 8X faster than speed of sound, can strike enemy at a range of...

Big tension for Pakistan, China, as India tests THIS new hypersonic missile, which is 8X faster than speed of sound, can strike enemy at a range of... Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway

Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till...

Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till... India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative

India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative  Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway

Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...

Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...  Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now...

Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now... Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest...

Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest... This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)