Rs 1 crore may not ensure financial security in 2050 due to inflation's impact on purchasing power.

Will Rs 1 crore be enough in 2050?

A sum of Rs 1 crore might sound like a lot of money today, and you may feel that achieving this amount through investments over 25 years will ensure financial security. However, due to inflation, this might not be entirely true. Inflation reduces the purchasing power of money over time, meaning what costs Rs 1 lakh today could cost Rs 2-3 lakh in 15-20 years. So, if the inflation rate stays at 5%, how much will Rs 1 crore be worth in 2050?

How Inflation Affects Your Savings

Suppose you are investing in savings schemes like Fixed Deposits (FDs), Public Provident Fund (PPF), National Pension Scheme (NPS), or Employees' Provident Fund (EPF). In that case, it is essential to consider whether their returns can beat inflation. In the past few years, India's inflation rate has hovered between 4% to 6%. Assuming an average inflation rate of 5% for the next 25 years, the real value of your savings will decrease over time.

Investment Options vs. Inflation

Fixed Deposit (FD) – Estimated Return: 6.5%

FDs are considered safe investments, but their returns are only slightly above inflation. With a 6.5% return and 5% inflation, your wealth effectively grows by just 1.5% per year. To accumulate Rs 1 crore in 25 years, you would need to invest Rs 20 lakh in 2025 at a 6.5% return. However, since the maximum tenure for an FD is 10 years, you would need to reinvest your funds twice over the 25 years.

Public Provident Fund (PPF) – Estimated Return: 7.1%

PPF offers slightly better returns than FDs, but the margin over inflation is still not significant. To build a Rs 1 crore corpus in 25 years, you must invest Rs 1,46,000 annually.

Employees' Provident Fund (EPF) – Estimated Return: 8.25%

EPF is a safe option with an 8.25% return, but with 5% inflation, your real gains are limited. To reach Rs 1 crore in 25 years, you need to invest Rs 7,080 monthly as an employee contribution, along with Rs 2,165 as the employer’s contribution. This requires a salary (basic + DA) of Rs 59,000 per month.

The Real Value of Rs 1 Crore in 2050

Considering a consistent 5% inflation rate over the next 25 years, the actual purchasing power of Rs 1 crore will be approximately Rs 29.36 lakh in 2050. This significant reduction shows how inflation can weaken your savings.

What Should You Do?

To ensure your savings maintain their real value, focus on investments that offer returns higher than inflation. Instead of just saving, emphasize growth by exploring options like:

Stock Market and Mutual Funds: These options often provide higher returns over the long term, helping to combat inflation.

Balanced Asset Allocation: Diversify investments across FDs, PPF, NPS, and equity to manage risk and returns effectively.

Monitor Inflation Impact: When choosing an investment, consider not just the returns but also how inflation will affect them.

While Rs 1 crore might seem substantial today, its real value could diminish significantly by 2050 if inflation remains at 5%. Only with the right planning and smart investments can you preserve the strength of your savings in the long run.

Earth is spinning faster today, marking second-shortest day in history; here's why

Earth is spinning faster today, marking second-shortest day in history; here's why Actor Malcolm-Jamal Warner drowns at Costa Rica beach during family vacation, dies tragically

Actor Malcolm-Jamal Warner drowns at Costa Rica beach during family vacation, dies tragically Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next...

Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next... 'Goliyan chali, ek white gaadi...': Rapper Fazilpuria breaks his silence after being shot in Gurugram

'Goliyan chali, ek white gaadi...': Rapper Fazilpuria breaks his silence after being shot in Gurugram Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs...

Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs... NASA shares 7 majestic images of 'Star War' planets in solar system

NASA shares 7 majestic images of 'Star War' planets in solar system Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it Want healthy liver? Ditch these 7 foods immediately

Want healthy liver? Ditch these 7 foods immediately What is a buffalo hump? Here are 7 ways to treat it naturally and effectively

What is a buffalo hump? Here are 7 ways to treat it naturally and effectively Anushka Sharma's Indian-Chinese, Kangana Ranaut's 'Gol Gappa' and more: Here are Bollywood celebs' favourite street foods

Anushka Sharma's Indian-Chinese, Kangana Ranaut's 'Gol Gappa' and more: Here are Bollywood celebs' favourite street foods Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News

Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News

Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs...

Narayana Murthy's Infosys offers this much starting salary for freshers in 2025, it starts from Rs... Another masterstroke by Mukesh Ambani, Isha Ambani, Reliance enters fast fashion delivery market with...

Another masterstroke by Mukesh Ambani, Isha Ambani, Reliance enters fast fashion delivery market with... Sebi lifts ban on Jane Street, allows US firm to resume trading but...

Sebi lifts ban on Jane Street, allows US firm to resume trading but... HUGE blow to Anil Ambani as SBI classifies him, RCom, as 'fraud'; to file complaint with...

HUGE blow to Anil Ambani as SBI classifies him, RCom, as 'fraud'; to file complaint with... India's largest govt bank raises Rs 25000 crore to fund...; over 6 crore shares bought by...; not Mukesh Ambani, Adani

India's largest govt bank raises Rs 25000 crore to fund...; over 6 crore shares bought by...; not Mukesh Ambani, Adani From Amitabh Bachchan in Fakt Purusho Maate to Ranbir Kapoor in Ramayana: 7 actors who’ve played gods on-screen

From Amitabh Bachchan in Fakt Purusho Maate to Ranbir Kapoor in Ramayana: 7 actors who’ve played gods on-screen Before Ibrahim Ali Khan's Sarzameen, 7 must-watch iconic patriotic films

Before Ibrahim Ali Khan's Sarzameen, 7 must-watch iconic patriotic films iPhone 17 Pro vs iPhone 16 Pro: 5 major upgrades you shouldn't ignore before buying

iPhone 17 Pro vs iPhone 16 Pro: 5 major upgrades you shouldn't ignore before buying Tesla opens first showroom in Mumbai; but is new Model Y worth it?

Tesla opens first showroom in Mumbai; but is new Model Y worth it? New mom Kiara Advani’s go-to meals: From her favourite sindhi dal chawal to nutritious oat berry bowls

New mom Kiara Advani’s go-to meals: From her favourite sindhi dal chawal to nutritious oat berry bowls Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next...

Weather update: Heavy rainfall lashes parts of Delhi-NCR, IMD predicts more showers for next... British F-35B fighter jet leaves Kerala after being stranded for 5 weeks: Know how much the airport may have earned from parking

British F-35B fighter jet leaves Kerala after being stranded for 5 weeks: Know how much the airport may have earned from parking Rahul Gandhi in legal trouble, court accepts plea against Congress leader over...

Rahul Gandhi in legal trouble, court accepts plea against Congress leader over... Who will be the next Vice President of India after Jagdeep Dhankhar resigns?

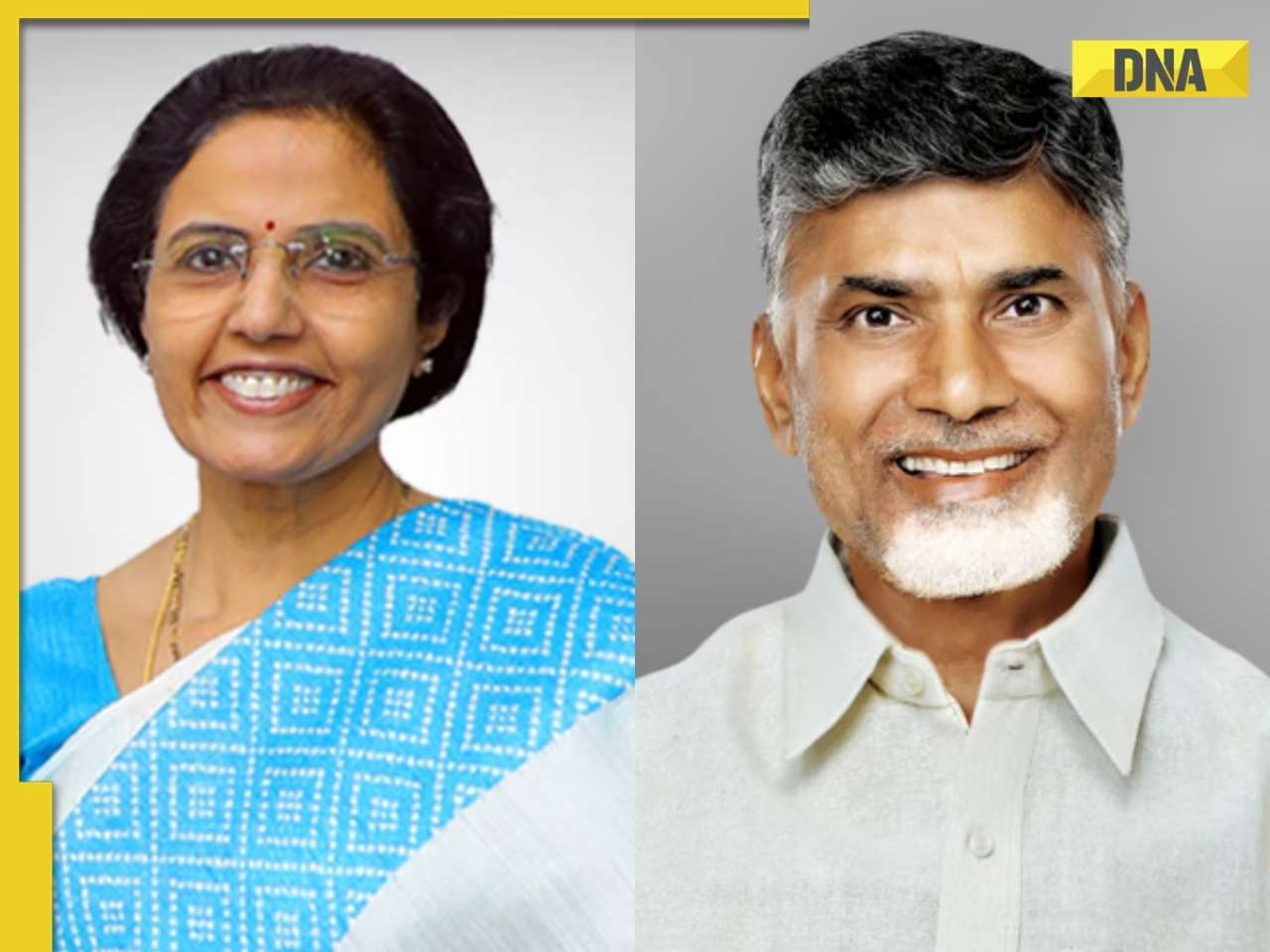

Who will be the next Vice President of India after Jagdeep Dhankhar resigns? Election Commission: This state becomes first in India to have electors less than 12,000

Election Commission: This state becomes first in India to have electors less than 12,000 Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in...

Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in... CBSE takes BIG step to ensure safety of students, directs all affiliated schools to...

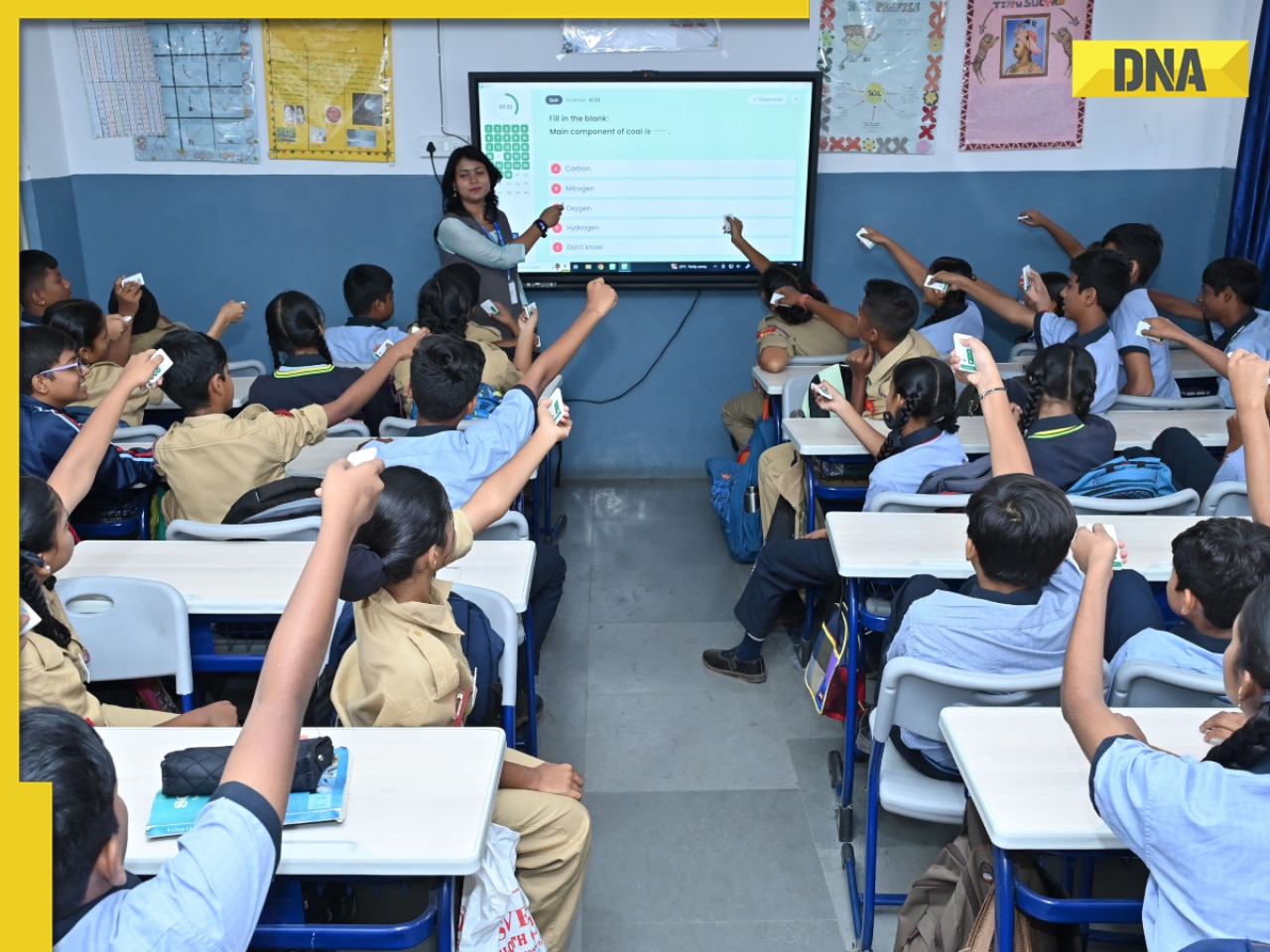

CBSE takes BIG step to ensure safety of students, directs all affiliated schools to... UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here

UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here NEET PG 2025 City Intimation Slip out today, here's how you can download it

NEET PG 2025 City Intimation Slip out today, here's how you can download it Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was...

Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)