Oxfam reports the world's richest one percent gained $42 trillion in the past decade as taxes on their wealth hit historic lows, urging G20 nations to impose higher taxes.

World's richest 1% increased fortunes by Rs 35164227 crore

Oxfam reported on Thursday that the world’s richest one percent have increased their wealth by a staggering $42 trillion over the past decade. This announcement comes just before the G20 summit in Brazil, where the primary agenda item is taxing the super-rich.

Despite their growing fortunes, taxes on the wealthy have reached "historic lows," according to Oxfam, leading to "obscene levels" of inequality. The rest of the world, Oxfam warned, is left to "scrap for crumbs."

Brazil, currently presiding over the G20—a group representing 80 percent of the world’s GDP—has prioritized international cooperation on taxing the super-rich. The upcoming summit in Rio de Janeiro will see finance ministers from the G20 countries discussing ways to impose higher taxes on the ultra-wealthy and prevent billionaires from dodging tax systems.

The initiative includes developing methods to tax billionaires and other high-income earners effectively. This proposal is expected to be hotly debated at the summit on Thursday and Friday. Countries such as France, Spain, South Africa, Colombia, and the African Union are in favor of the proposal, while the United States stands firmly against it.

Oxfam described the upcoming discussions as a "real litmus test for G20 governments," urging them to implement an annual net wealth tax of at least eight percent on the "extreme wealth" of the super-rich. Max Lawson, Oxfam International’s head of inequality policy, emphasized, "Momentum to increase taxes on the super-rich is undeniable. Do they have the political will to strike a global standard that puts the needs of the many before the greed of an elite few?".

Oxfam highlighted that the $42 trillion amassed by the richest one percent is nearly 36 times more than the wealth accumulated by the poorer half of the world's population. Despite this enormous wealth, billionaires are paying an effective tax rate of less than 0.5 percent of their wealth globally, the NGO noted.

Oxfam also pointed out that nearly four out of five of the world’s billionaires reside in G20 nations, further emphasizing the importance of coordinated action by these countries to address global wealth inequality. The decisions made at the summit could significantly impact the global economic landscape, determining whether the needs of the many are prioritized over the wealth of the few.

The DNA app is now available for download on the Google Play Store. Please download the app and share your feedback with us.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway

Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway BCCI's BIG statement on weather Virat Kohli, Rohit Sharma were forced to retire from Tests: 'The decision was made...'

BCCI's BIG statement on weather Virat Kohli, Rohit Sharma were forced to retire from Tests: 'The decision was made...' Ranbir Kapoor, Sai Pallavi's Ramayana Rs 4000 crore budget draws fire from this filmmaker: 'Hollywood films like...'

Ranbir Kapoor, Sai Pallavi's Ramayana Rs 4000 crore budget draws fire from this filmmaker: 'Hollywood films like...' Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till...

Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till... 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies

Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh

President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building'

Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building' India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs...

THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs... Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here

Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to...

Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to... UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...'

UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...' Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...

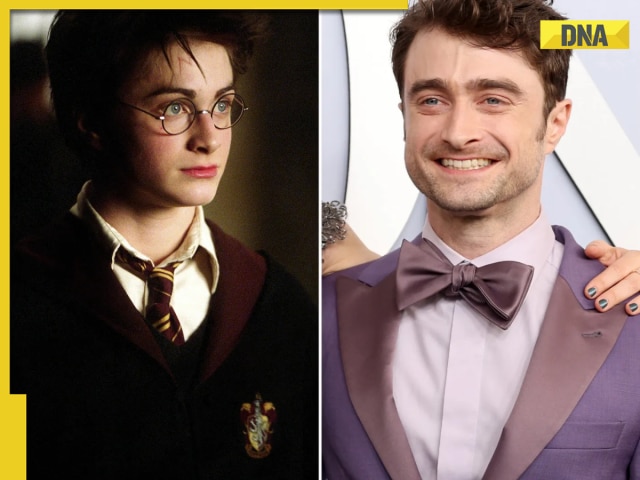

Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...  Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now?

Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now? Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs

Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show

Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series

Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes

Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway

Delhi school bomb threats: St. Thomas School, Vasant Valley School receive bomb threat via email, probe underway Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till...

Bad news for Pakistan! India develops world's most dangerous artillery gun, can directly target Lahore from Amritsar, to be procured till... India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative

India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative  Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway

Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway Rs 10000000000: Indians losing huge amount of money every month due to...

Rs 10000000000: Indians losing huge amount of money every month due to... Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR...

Meet man, who worked as waiter, later cracked UPSC exam in 7th attempt with AIR... Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...

Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...  Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now...

Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now... Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest...

Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest... This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)