Earlier, the deadline was extended from July 31 to September 15, so more than 50 days are left. Will the Income Tax Department once again extend the deadline for ITR filing for AY 2025-26 or the FY 2024-

Income Tax Return Filing (Representative Image)

Will the Income Tax Department once again extend the deadline for ITR filing for AY 2025-26 or FY 2024-25? Earlier, the deadline was extended from July 31 to September 15, so more than 50 days are left. However, income tax experts believe the deadline may be extended once again. The main reason for this is that the Income Tax Department has not yet issued both online and offline utilities for Forms 5, 6, and 7.

Income Tax Department yet to release ITR Forms

First, the government released ITR forms by the end of May and made certain structural changes. Later, the Excel-based utility was gradually released. However, the online (JSON) utility of ITR-3 is still not available, and the utility of ITR-5, 6, and 7 has also not been released yet. Though only a limited number of taxpayers use these forms to file ITR through an Excel-based utility. Besides, Forms 5, 6, and 7 are generally for trusts, partnership firms, and companies, and their number is in lakhs. However, these taxpayers have not been able to start their ITR filing till now due to the absence of the utility.

Will CBDT extend ITR filing deadline?

The Central Board of Direct Taxes has not yet said anything on the extension of the deadline for filing Income Tax Returns (ITRs) for Assessment Year 2025–26 in Forms 5, 6, or 7. However, as the required utilities have not been made available, the compliance window would be squeezed for the taxpayers. As the utility for ITR-3 is currently available only in Excel format and the JSON-based online filing option is still pending, it is logical that the Income Tax Department extend the deadline.

It is interesting to note that the repeated delay in technical preparations and late release of utilities by the government has made this tax season confusing. The IT Department will be left with no option but to extend the deadline if the utilities for Forms 5, 6 and 7 are not released in the coming days.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Donald Trump issues BIG statement on Gaza, says US will partner with Israel to...

Donald Trump issues BIG statement on Gaza, says US will partner with Israel to... Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...'

Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...' Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film

Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film Aamir Khan reveals why he decided not to release Sitaare Zameen Par on OTT: 'I never liked that model, I believe...'

Aamir Khan reveals why he decided not to release Sitaare Zameen Par on OTT: 'I never liked that model, I believe...' UK Prime Minister Keir Starmer says Britain will recognize state of Palestine before UN unless..., discusses issue with Donald Trump

UK Prime Minister Keir Starmer says Britain will recognize state of Palestine before UN unless..., discusses issue with Donald Trump  Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this

New Income Tax Bill 2025 to change tax rates on LTCG? I-T dept said this Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs...

Ratan Tata's TCS loses Rs 28149 crore in 48 hours after layoff announcement, market cap declines to Rs... Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from...

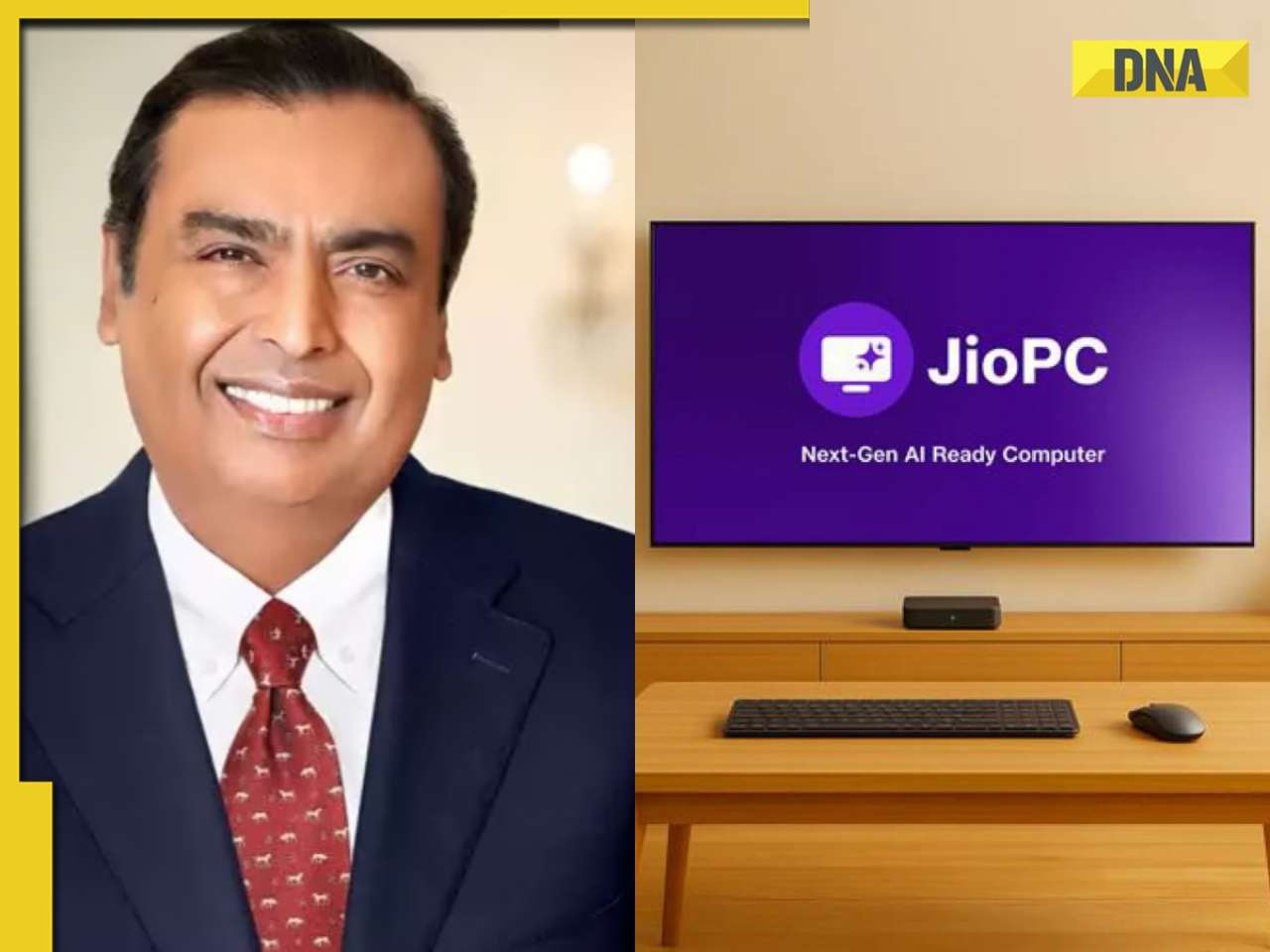

Mukesh Ambani-owned RIL signs deal with ONGC, to explore ... from... Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more

Mukesh Ambani launches JioPC AI cloud computer at Rs...; check plans, benefits, more Elon Musk's Tesla set to open another flagship showroom in this Indian city, not Noida, Bengaluru, Chennai

Elon Musk's Tesla set to open another flagship showroom in this Indian city, not Noida, Bengaluru, Chennai Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond

Raksha Bandhan 2025: Top 5 getaways to celebrate sibling bond Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid

Narayana Murthy’s parenting advice: 7 common mistakes every parent should avoid  Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more

Jr NTR’s net worth: A peek into his Rs 500 crore fortune, luxury cars, investments and more Step inside Virender Sehwag’s Rs 130 crore Delhi mansion with 12 lavish rooms, trophy room, private temple, and luxury garage

Step inside Virender Sehwag’s Rs 130 crore Delhi mansion with 12 lavish rooms, trophy room, private temple, and luxury garage Like Ahaan Panday, these Bollywood stars have private Instagram handles

Like Ahaan Panday, these Bollywood stars have private Instagram handles Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...'

Rahul Gandhi slams PM Modi over his Parliament speech on Operation Sindoor, says, 'He never said...' Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film

Meet Daya Nayak, Mumbai Police 'encounter specialist' promoted to ACP rank, he inspired THIS Bollywood film PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...'

PM Modi makes BIG statement during speech in Parliament, says, 'No world leader...' Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025

Renowned Indian astrologer predicts another temple stampede, warns against traveling to these areas in 2025 Pakistan-Bangladesh nexus exposed, India's neighbours allow visa-free entry for each other, how will it affect

Pakistan-Bangladesh nexus exposed, India's neighbours allow visa-free entry for each other, how will it affect RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here

RRB NTPC UG 2025: City intimation slip out, know exam details, direct link here Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become...

Meet woman who is from small town, didn't settle for IRTS, cracked UPSC again to become... UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more

UPSC EPFO 2025 recruitment begins for 230 vacancies; check steps to apply, eligibility, last date, and more Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now?

Where is Nalin Khandelwal, the 2019 NEET UG topper? What is he doing now? Delhi University UG admissions 2nd allotment list released, here's how you can download it

Delhi University UG admissions 2nd allotment list released, here's how you can download it Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)