Choosing between the old and new tax regimes depends on factors like home loan deductions, income level, and personal financial goals, with the old regime benefiting those with high deductions and the new regime favoring simplicity and lower taxes for incomes up to Rs12 lakh.

Home Loan Benefits: Which tax regime works best for you?

Choosing between the old and new profit tax regimes may be puzzling, especially when you have a home loan. According to professionals, domestic mortgage benefits frequently play a crucial role in making this decision, especially for people with large housing loans.

What the Old Regime Offers

Under the old tax regime, taxpayers can revel in numerous deductions on home loans:

Section 24(b) lets in a deduction of as much as Rs 2 lakh on interest paid for a self-occupied house. There’s no restriction on interest deductions for allow-out or deemed let-out homes.

Section 80C provides an extra Rs 1.5 lakh deduction on major reimbursement.

First-time homebuyers may additionally get greater advantages beneath Sections 80EE or 80EEA, relying on the house’s value and loan quantity.

These deductions make the old regime attractive, especially for those still repaying loans, in particular in the early years while interest payments are excessive.

What the New Regime Offers (And Misses)

The new tax regime comes with lower and easier tax slabs. But it additionally gets rid of most deductions, including those related to domestic loans. So, in case you’re nonetheless paying off a mortgage, this regime may not give you an awful lot of relief.

However, Budget 2025 brought a better rebate underneath Section 87A—from Rs 25,000 to Rs 60,000. Because of this, taxpayers with incomes as much as Rs 12 lakh a year may not need to pay any income tax under the new regime, even though they have a home loan. This makes the new regime more attractive to middle-income groups.

What About High-Income Taxpayers?

If your income is above Rs 12 lakh, the old regime is probably better. That’s because the price of home loan deductions starts to outweigh the advantage of lower tax rates inside the new regime. For people with excessive interest outgo, the old regime reduces average tax liability more effectively.

More Than Just Loans

It’s no longer just about domestic loans. The vintage regime also offers deductions for:

Health coverage (Section 80D)

Donations (Section 80G)

House rent (HRA)

These can similarly lessen your tax burden in case you’re eligible.

Final Thoughts

Experts suggest the selection relies upon on greater than just your mortgage. If you’re a high earner with many investments like PPF, ELSS, or NPS, the old regime is in all likelihood higher. But if you need easier submitting and greater cash in hand, the brand new regime might fit you better.

In short, there’s no single exceptional answer. Look at your profits, mortgage repute, investments, and deductions. Do the math for each regime—or speak to a tax marketing consultant. Don’t let just one thing like a home mortgage decide your tax route—make a clever and complete choice.

Not Mumbai, Delhi, Bengaluru, Chennai, Kolkata, Srinagar; Ed Sheeran says this Indian city is his favourite, it is located in...

Not Mumbai, Delhi, Bengaluru, Chennai, Kolkata, Srinagar; Ed Sheeran says this Indian city is his favourite, it is located in... War 2: Yash Raj Films to celebrate the legacy of Hrithik Roshan, Jr NTR by launching the trailer on...

War 2: Yash Raj Films to celebrate the legacy of Hrithik Roshan, Jr NTR by launching the trailer on... Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs...

Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs... ‘CEO personality, Arijit’s singing’: This IAS officer made internet obsessed with his singing skills, watch viral video

‘CEO personality, Arijit’s singing’: This IAS officer made internet obsessed with his singing skills, watch viral video  Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... Glutathione boost to skin naturally with spinach, avocados and more

Glutathione boost to skin naturally with spinach, avocados and more Warren Buffett's 5 success lessons every young Indian should know

Warren Buffett's 5 success lessons every young Indian should know What are risks of taking Vitamin D shots? Know how it links to blocked arteries

What are risks of taking Vitamin D shots? Know how it links to blocked arteries NASA shares 7 majestic images of 'Star War' planets in solar system

NASA shares 7 majestic images of 'Star War' planets in solar system Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol or eating meat? Know 7 ways to manage it Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News

Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News

Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs...

Deepinder Goyal gets richer by Rs 2348 crore as Zomato parent Eternal shares rise by...; net worth reaches Rs... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... Mukesh Ambani, Nita Ambani fan of this special sweet, private helicopters sent to get it from UP village, it's name is...

Mukesh Ambani, Nita Ambani fan of this special sweet, private helicopters sent to get it from UP village, it's name is... Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is...

Big move by Ratan Tata-owned company, acquires 67% stake in this UAE-based brand for Rs 160000000, its name is... Meet Gita Gopinath, Indian-origin IMF’s first woman economist, studied at Delhi’s LSR, did PhD from Princeton University, quits job to join...

Meet Gita Gopinath, Indian-origin IMF’s first woman economist, studied at Delhi’s LSR, did PhD from Princeton University, quits job to join... From CarryMinati to Nischay Malhan: Top 5 Indian gamers who earn in crores

From CarryMinati to Nischay Malhan: Top 5 Indian gamers who earn in crores NISAR satellite launch 2025: Why it is NASA-ISRO’s biggest Earth mission?

NISAR satellite launch 2025: Why it is NASA-ISRO’s biggest Earth mission? Meet men behind Saiyaara’s hit title track, who resigned civil engineering jobs to pursue music, convinced parents to go to Mumbai for 14 days to...

Meet men behind Saiyaara’s hit title track, who resigned civil engineering jobs to pursue music, convinced parents to go to Mumbai for 14 days to... Not MS Dhoni, Hardik Pandya, Rohit Sharma but THIS Indian cricketer has record-breaking followers on Instagram, he is...

Not MS Dhoni, Hardik Pandya, Rohit Sharma but THIS Indian cricketer has record-breaking followers on Instagram, he is... Kajol and Twinkle Khanna set to host 'Two Much...': A look at other B-town actresses who owned talk show game

Kajol and Twinkle Khanna set to host 'Two Much...': A look at other B-town actresses who owned talk show game Good news for Olympic winners as Delhi govt hikes cash awards, gold medallist to get Rs…

Good news for Olympic winners as Delhi govt hikes cash awards, gold medallist to get Rs… How did Jagdeep Dhankhar become most controversial vice president? About Sonia, Rahul, SC, RSS, he said...

How did Jagdeep Dhankhar become most controversial vice president? About Sonia, Rahul, SC, RSS, he said... Big tension for Pakistan, China, Indian Army receives first batch of Apache helicopters, it can carry..., is capable of delivering...

Big tension for Pakistan, China, Indian Army receives first batch of Apache helicopters, it can carry..., is capable of delivering... President accepts Jagdeep Dhankhar's resignation as Vice President, confirms Rajya Sabha chair

President accepts Jagdeep Dhankhar's resignation as Vice President, confirms Rajya Sabha chair Jagdeep Dhankhar resigns as Vice President: Know how much pension, what facilities will he get? Who will handle his duties now?

Jagdeep Dhankhar resigns as Vice President: Know how much pension, what facilities will he get? Who will handle his duties now? Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in...

Meet woman who cracked UPSC exam in first attempt at the age of 21 with AIR..., but did not become IAS, IPS due to..., currently she is working in... CBSE takes BIG step to ensure safety of students, directs all affiliated schools to...

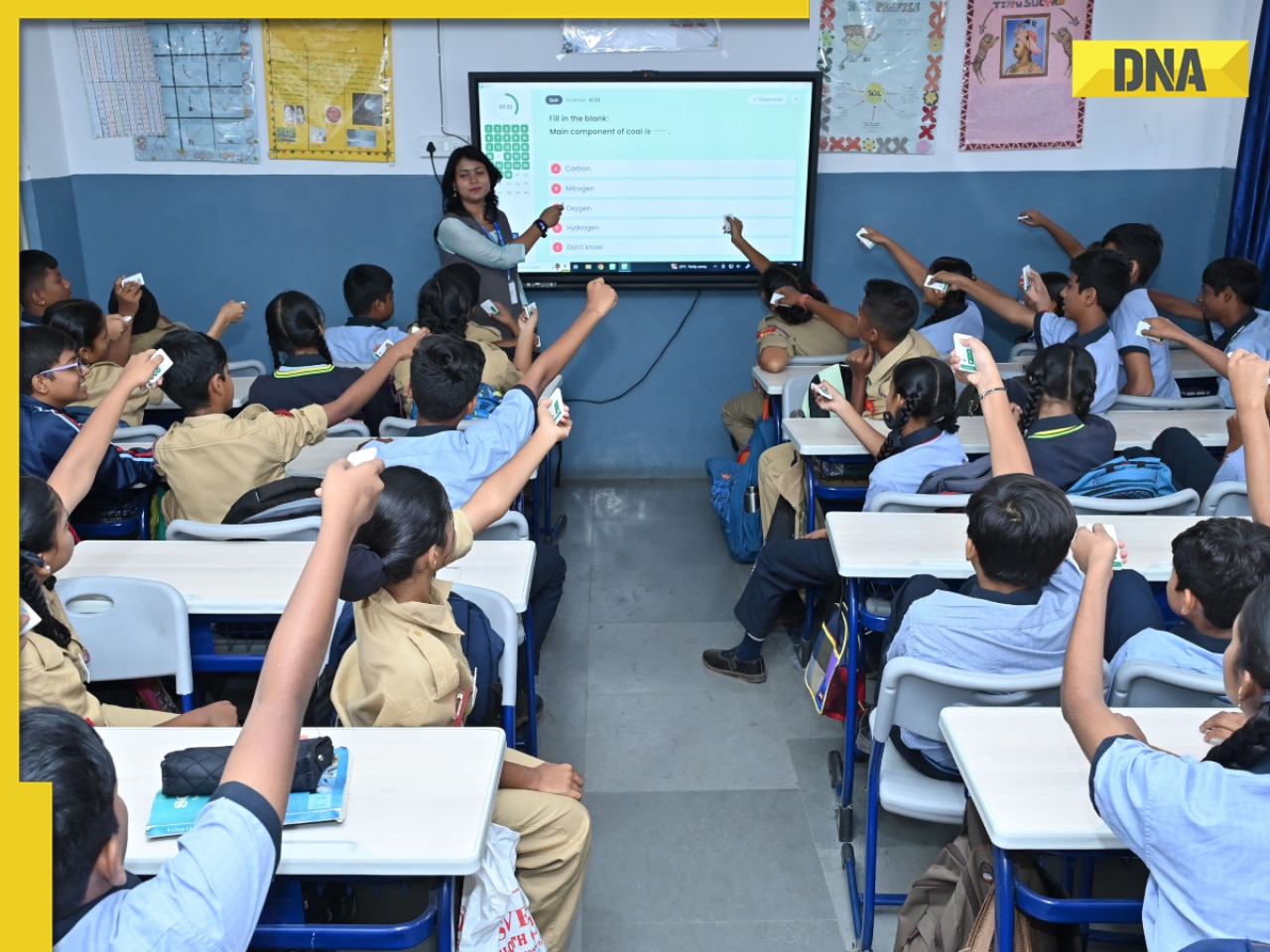

CBSE takes BIG step to ensure safety of students, directs all affiliated schools to... UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here

UGC NET June 2025 result released at ugcnet.nta.ac.in; get direct link, steps to download scorecard here NEET PG 2025 City Intimation Slip out today, here's how you can download it

NEET PG 2025 City Intimation Slip out today, here's how you can download it Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was...

Meet IAS Shreyans Gomes, son of station master, who cracked UPSC in third attempt without any coaching, his AIR was... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)