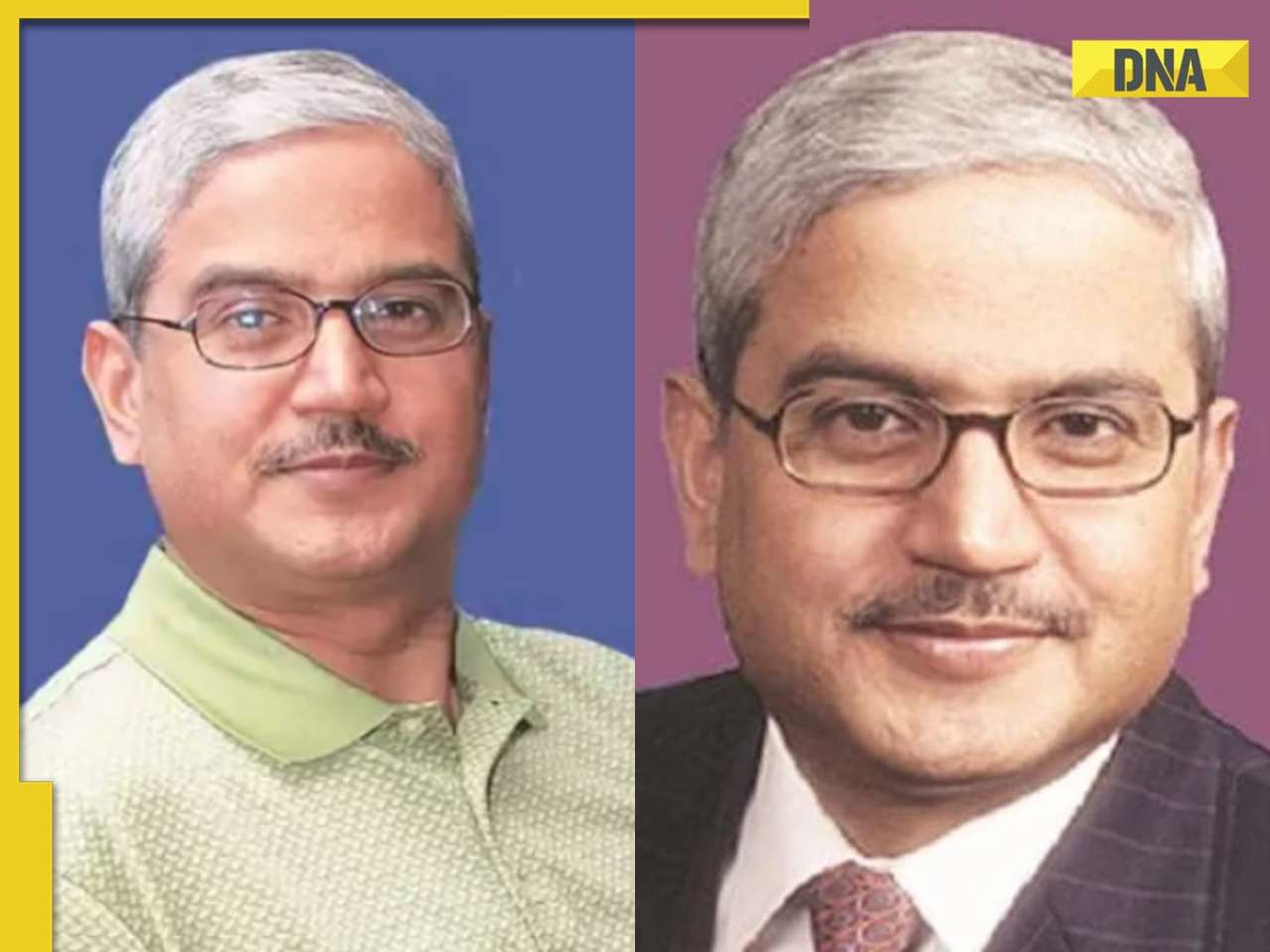

In a move that has reignited accusations of a relentless smear campaign against Anil Ambani by corporate rivals, the State Bank of India (SBI) has branded Reliance Communications’ (RCom) loan account as “fraud” without giving any hearing to the former telecoms tycoon.

In a move that has reignited accusations of a relentless smear campaign against Anil Ambani by corporate rivals, the State Bank of India (SBI) has branded Reliance Communications' (RCom) loan account as “fraud” without giving any hearing to the former telecoms tycoon. SBI said it had reported Anil Ambani as a fraud to the Reserve Bank of India (RBI) on July 1, 2025. Surprisingly, the SBI may have misused its powers of an ex-parte order, issued without a personal hearing, which cites a 2020 forensic audit alleging Rs 12,692.31 crore in fund diversions from a Rs 31,580 crore loan dating back to 2016. Ex-parte orders are issued in emergency and SBI's reliance on the forensic audit report available with it for 5 years shows no emergency.

SBI's action echoes a failed attempt by Canara Bank in November 2024, which was stayed by the Bombay High Court in February 2025 for procedural violations. Ambani’s legal team has slammed SBI’s move as a “gross violation” of natural justice, RBI guidelines, and judicial precedents, pointing to a pattern of regulatory overreach that consistently overshadows positive developments in Ambani’s business ventures.

The SBI's fraud classification has been affected by procedural errors, such as the failure to disclose the whole forensic audit report and the use of a SCN from December 2023 that was issued in accordance with out-of-date RBI guidelines that were replaced by updated standards in July 2024. Ambani's lawyer contends that the selective targeting of Ambani - while SCNs against other non-executive directors were withdrawn—suggests a vendetta potentially motivated by corporate rivalries, and that SBI's inability to reply to contacts for almost a year led him to believe the situation was handled.

Reliance Power was accused of submitting fake SBI guarantees for a government tender in May 2025, which resulted in a temporary blacklisting; however, Ambani was not held personally liable. This is not a isolated incident. Similarly, Ambani and 24 other firms were barred from the stock market by SEBI in August 2024 due to alleged fund misappropriation at Reliance Home Finance; this decision is presently being appealed. These events - which are frequently amplified by media - occur in coincidence with significant achievements, including Reliance Power's debt-free status and a joint venture with a US defense contractor in July 2025, which feed rumors of a concerted attempt to damage Ambani's legacy.

The pattern of regulatory and legal actions against Ambani is striking, particularly as they often emerge during periods of business recovery. For instance, the SEBI ban followed Reliance Infrastructure’s reported net worth recovery to Rs 33,000 crore, while SBI’s fraud tag came amid Reliance Power’s expansion into clean energy and defense, including a deal to supply artillery shells to a German firm. The 2020 UK bankruptcy declaration, where Ambani claimed to have “nothing meaningful” in personal wealth, garnered global headlines, yet subsequent court reliefs, like the Delhi High Court’s 2021 status quo order on RCom’s fraud classifications, received less attention. Critics argue that these actions, often stalled by courts for procedural lapses—as seen in the Bombay High Court’s rebuke of Canara Bank’s “cut, copy, paste” fraud order—reflect a broader agenda, possibly linked to Ambani’s past rivalry.

SBI’s latest move also disregards protections under the Insolvency and Bankruptcy Code (IBC), particularly Section 32A, which shields companies under the Corporate Insolvency Resolution Process (CIRP) from pre-insolvency liabilities once a resolution plan is approved. RCom, managed by a Resolution Professional since May 2018 with a debt of Rs 48,216 crore as of March 2025, awaits National Company Law Tribunal (NCLT) approval for its resolution plan. Yet, SBI persists in targeting Ambani for pre-CIRP loans, a move critics say undermines the IBC framework and risks derailing RCom’s revival.

This echoes earlier controversies, such as the 2018 allegations of fund diversion at Reliance Naval and Engineering, which led to insolvency proceedings but no conclusive evidence against Ambani personally. The recurring cycle of high-profile accusations, followed by judicial stays or dismissals, as seen in the Canara Bank case and SEBI’s ongoing appeal, underscores a pattern of regulatory aggression that legal experts predict will face another judicial rebuke, further exposing the apparent witch hunt against Anil Ambani.

Pattern of Smear Campaign

The SBI fraud tag, SEBI ban, and Reliance Power tender controversy illustrate a pattern where regulatory actions coincide with Ambani’s business recovery efforts, such as Reliance Power’s debt-free status and defense contracts. These incidents, often amplified by the media, are frequently stalled by courts due to procedural flaws.

Procedural Violations

SBI’s ex-parte order, like Canara Bank’s failed fraud tag, violates RBI’s Master Directions on Frauds and principles of natural justice by denying Ambani a hearing and full audit disclosure. The SEBI ban also faces challenges for similar reasons.

Selective Targeting

SBI’s withdrawal of SCNs against other RCom directors while pursuing Ambani, despite his non-executive role, mirrors the selective scrutiny in the Reliance Power tender case, where only the SECI chief faced consequences.

Judicial Precedents

The Bombay High Court’s February 2025 stay on Canara Bank’s fraud tag and the Delhi High Court’s 2021 order highlight a judiciary critical of banks’ overreach. The SEBI ban’s appeal and SBI’s order are likely to follow suit.

Corporate Rivalry

While speculative, the timing of actions against Anil Ambani is often linked to his rivalry.

IBC Protections

SBI’s pursuit of pre-CIRP liabilities disregards IBC Section 32A, aligning with criticisms of banks undermining insolvency processes, as seen in Reliance Naval’s case.

Other Incidents

The 2024 SEBI ban and 2025 Reliance Power tender controversy, alongside earlier issues like Reliance Naval’s insolvency, reflect a consistent pattern of regulatory scrutiny that often lacks conclusive evidence against Ambani personally but generates significant negative publicity.

Pa Ranjith breaks silence after stunt artist Mohan Raj dies on his film set: 'Inspite of all our precautions...'

Pa Ranjith breaks silence after stunt artist Mohan Raj dies on his film set: 'Inspite of all our precautions...' Nimisha Priya case: One day before execution, BIG relief for Kerala nurse jailed in Yemen

Nimisha Priya case: One day before execution, BIG relief for Kerala nurse jailed in Yemen Want to start a company? Telegram’s CEO picks top subject for future leaders, Elon Musk, Bill Gates call it...

Want to start a company? Telegram’s CEO picks top subject for future leaders, Elon Musk, Bill Gates call it... Dhadak 2: Triptii Dimri opens up about her electrifying chemistry with Siddhant Chaturvedi, says 'you don't need to force chemistry...'

Dhadak 2: Triptii Dimri opens up about her electrifying chemistry with Siddhant Chaturvedi, says 'you don't need to force chemistry...' Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla

Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla 7 stunning cosmic photos captured by NASA James Webb Telescope

7 stunning cosmic photos captured by NASA James Webb Telescope Soya Bean vs Soya Chunks: 8 key differences, nutritional profile, health benefits, more

Soya Bean vs Soya Chunks: 8 key differences, nutritional profile, health benefits, more Improve gut health naturally: 7 foods to improve your bowel movement

Improve gut health naturally: 7 foods to improve your bowel movement  Which vitamin deficiency causes gum bleeding and why?

Which vitamin deficiency causes gum bleeding and why? Sawan Somwar 2025: 7 do’s and don’ts of offering prayers to Lord Shiva

Sawan Somwar 2025: 7 do’s and don’ts of offering prayers to Lord Shiva Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies

Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh

President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building'

Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building' India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%...

Good News for TCS employees, amid uncertainty over wage hike, Ratan Tata's company now rolls out 100%... Bad news for employees of THIS comapny as it gives stern warning on return to office, has this Ratan Tata connection

Bad news for employees of THIS comapny as it gives stern warning on return to office, has this Ratan Tata connection Elon Musk launches Tesla's Model Y for Rs 60 lakh in India, check how much it costs in US, China, Germany and other countries

Elon Musk launches Tesla's Model Y for Rs 60 lakh in India, check how much it costs in US, China, Germany and other countries Elon Musk's Tesla opens first India showroom in Mumbai's BKC: Project took ... days to be completed

Elon Musk's Tesla opens first India showroom in Mumbai's BKC: Project took ... days to be completed Meet man, IndiGo co-founder, who is now on Forbes' 'America's Richest Immigrants 2025' list, his net worth is..., name is...

Meet man, IndiGo co-founder, who is now on Forbes' 'America's Richest Immigrants 2025' list, his net worth is..., name is... Step inside Rakul Preet Singh and Jackky Bhagnani's luxurious house with multiple living rooms, king-size kitchen and breathtaking terrace

Step inside Rakul Preet Singh and Jackky Bhagnani's luxurious house with multiple living rooms, king-size kitchen and breathtaking terrace Ali Fazal-Richa Chadha to Randeep Hooda-Lin Laishram, not just weddings but these Bollywood stars turned invites into art

Ali Fazal-Richa Chadha to Randeep Hooda-Lin Laishram, not just weddings but these Bollywood stars turned invites into art 5 times Salman Khan made moustache his signature statement, from Battle Of Galwan to Dabbang

5 times Salman Khan made moustache his signature statement, from Battle Of Galwan to Dabbang Shubhanshu Shukla to return Earth: Here are 7 experiments Axiom 4 crew conducted in space

Shubhanshu Shukla to return Earth: Here are 7 experiments Axiom 4 crew conducted in space Samantha Ruth Prabhu, Allu Arjun and other South Indian superstars took THIS much salary in their first-ever jobs

Samantha Ruth Prabhu, Allu Arjun and other South Indian superstars took THIS much salary in their first-ever jobs Nimisha Priya case: One day before execution, BIG relief for Kerala nurse jailed in Yemen

Nimisha Priya case: One day before execution, BIG relief for Kerala nurse jailed in Yemen Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla

Axiom-4 Dragon spacecraft lands safely on Earth, PM Modi welcomes Shubhanshu Shukla LoP Rahul Gandhi lashes out at S Jaishankar over meeting with Xi Jinping, says 'EAM running full blown circus'

LoP Rahul Gandhi lashes out at S Jaishankar over meeting with Xi Jinping, says 'EAM running full blown circus' Will India-China relations improve further after S Jaishankar meets Chinese President Xi Jinping?

Will India-China relations improve further after S Jaishankar meets Chinese President Xi Jinping? Mizoram's Bairabi-Sairang railway line: After 26 years, Aizawl set for rail boost, PM Modi to inaugurate 51.38 km railway line on...

Mizoram's Bairabi-Sairang railway line: After 26 years, Aizawl set for rail boost, PM Modi to inaugurate 51.38 km railway line on... This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to...

Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to... Meet IAS officer who was once mocked for not speaking English, left job at Ratan Tata's TCS, cracked UPSC exam, secured AIR..., she is...

Meet IAS officer who was once mocked for not speaking English, left job at Ratan Tata's TCS, cracked UPSC exam, secured AIR..., she is... Meet Hiamli Dabi, mother of IAS officer Tina Dabi and Ria Dabi, who also cracked UPSC exam, worked as..., but later quit job due to...

Meet Hiamli Dabi, mother of IAS officer Tina Dabi and Ria Dabi, who also cracked UPSC exam, worked as..., but later quit job due to... UPSC CSE Mains 2025 schedule out, to be held on THESE dates, check full timetable

UPSC CSE Mains 2025 schedule out, to be held on THESE dates, check full timetable This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)