- Home

- Latest News

India issues fresh travel advisory, asks citizens to avoid going to THIS country: 'Carefully consider...'

India issues fresh travel advisory, asks citizens to avoid going to THIS country: 'Carefully consider...' THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs...

THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs... This city is world’s most student friendly, 4 Indian cities also feature in list with the most affordable city being...

This city is world’s most student friendly, 4 Indian cities also feature in list with the most affordable city being...  Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here

Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here Donald Trump makes BIG proposal to Ukraine over Russia war, asks Zelenskyy, 'Can you hit...'

Donald Trump makes BIG proposal to Ukraine over Russia war, asks Zelenskyy, 'Can you hit...'

- WAA 2025

- Webstory

What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025

Our Golden Days, My Lovely Journey, Beyond the Bar: 8 must-watch K-dramas in August 2025 Parents-to-be Rajkummar Rao and Patralekhaa: What makes their family ties so strong

Parents-to-be Rajkummar Rao and Patralekhaa: What makes their family ties so strong

- Videos

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student

Odisha Girl Self Immolation Case: Odisha CM Announces Rs 20 Lakh Aid For Kin Of Balasore Student Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies

Odisha Girl Self-Immolation Case: BJD leader Slams Odisha Govt After Balasore Student Dies President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh

President Murmu Appoints New Governors For Haryana, Goa; Kavinder Gupta Named LG Of Ladakh Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building'

Bombay Stock Exchange Receives Bomb Threat From 'Comrade Pinarayi Vijayan', '4 RDX IED In Building' India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

India Pakistan News: New Paramilitary Force In Pakistan Sparks Crackdown Fears

- Business

THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs...

THIS govt company in HUGE debt, defaults on bank loans worth whopping Rs... Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here

Tesla cars will be priced cheaper in Delhi and Mumbai than Gurugram, here’s why, check cost difference here Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to...

Mukesh Ambani's Reliance's BIG win as Delhi HC directs e-commerce platforms to... UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...'

UIDAI shares BIG update on children above 7 with Aadhaar: 'To face risk of...' Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...

Meet woman who started as trainee, will now become CEO of..., won major award at Cannes, she is...

- Photos

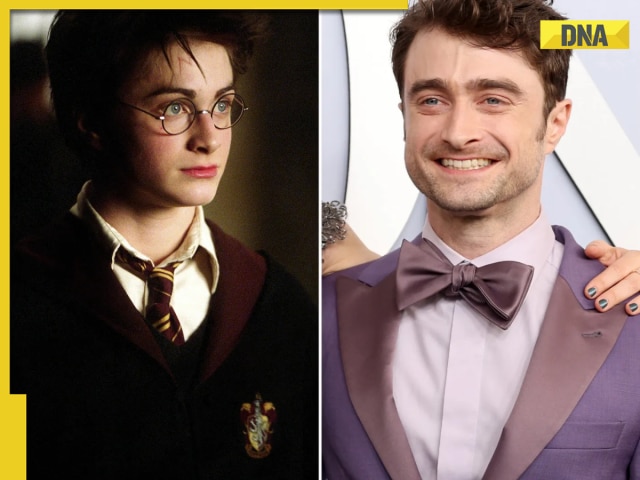

Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now?

Then and now: What Daniel Radcliffe, Emma Watson, Rupert Grint and more Harry Potter cast members doing now? Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs

Which Visa lets you travel to multiple countries? Learn about Visas that fit your needs Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show

Chhoriyan Chali Gaon contestants list out: Anita Hassanandani, Aishwarya Khare, and others join Rannvijay Singha's show Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series

Laapataa Ladies' Pratibha Ranta returns in Revolutionaries with Bhuvam Bham, Rohit Saraf: All you need to know about Nikkhil Advani's series Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes

Ananya Panday's vacation photos go viral: A peek into her sun-kissed moments, beach outfits, and carefree vibes

- India

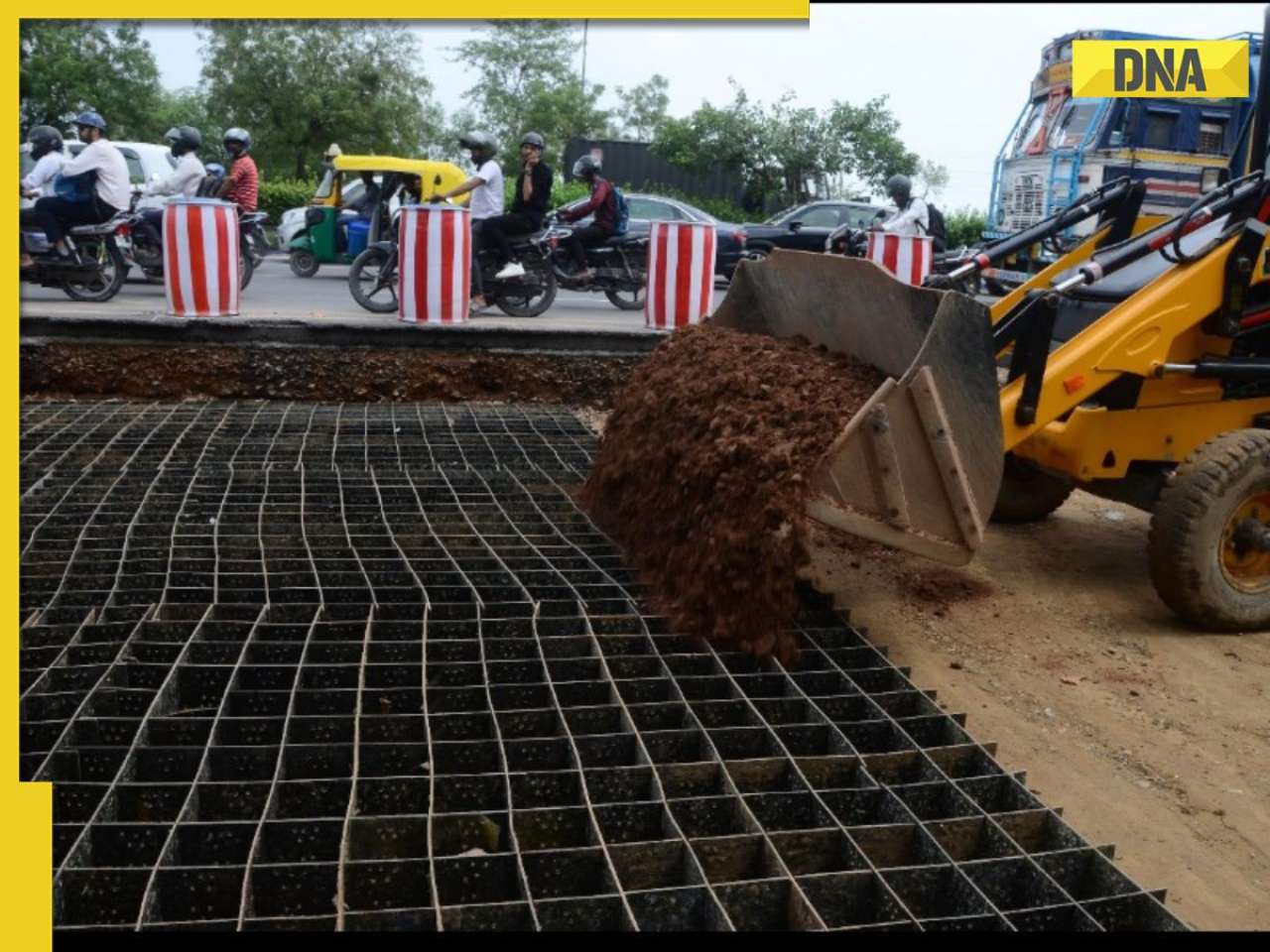

India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative

India's first plastic road to be built with Geocell Technology in..., know all about this sustainable initiative  Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway

Golden Temple receives bomb threat again, second RDX email in 24 hours, probe underway Rs 10000000000: Indians losing huge amount of money every month due to...

Rs 10000000000: Indians losing huge amount of money every month due to... DNA Verified: Samosa, jalebi, other Indian snacks to carry health warning labels? Know the truth here

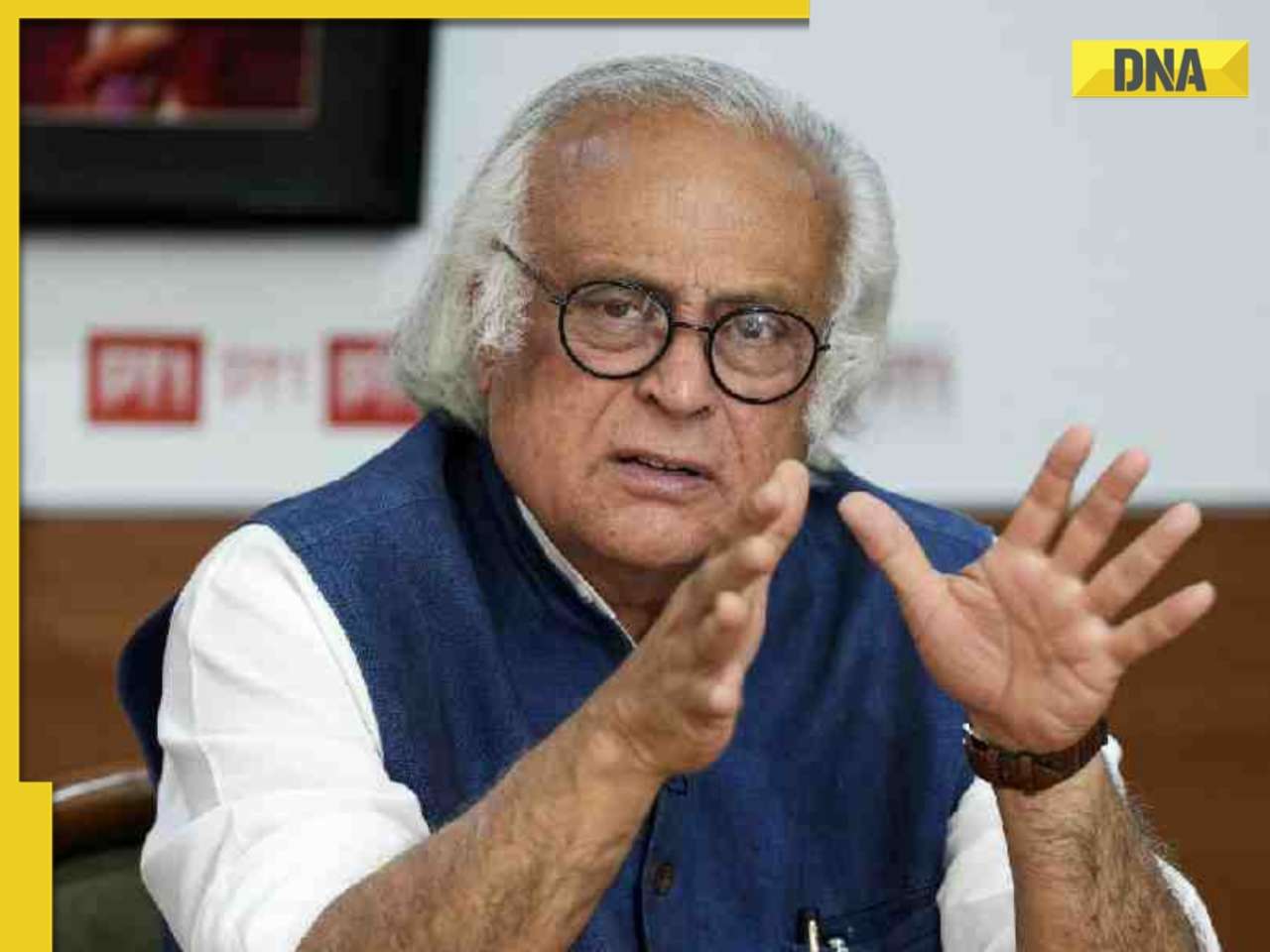

DNA Verified: Samosa, jalebi, other Indian snacks to carry health warning labels? Know the truth here '65 days, 22 times’: Congress leader Jairam Ramesh slams BJP as US President Trump again claims credit for India-Pakistan ceasefire

'65 days, 22 times’: Congress leader Jairam Ramesh slams BJP as US President Trump again claims credit for India-Pakistan ceasefire

- Education

Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...

Who is IAS officer Arpit Sagar who Fined NHAI for..., served in high-ranking administrative roles, she’s from...  Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now...

Meet woman who left high-paying job in Switzerland for UPSC exam, secured AIR...; married to IAS, she is now... Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest...

Meet woman who failed in NEET, UPSC exams, later secured Rs 72 LPA job at THIS aviation giant to become the youngest... This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for..

This auto driver speaks 7 languages, did double MA, worked in MNCs, wanted to become IAS officer then..., is now going viral for.. Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to...

Meet 19-year-old boy who took family responsibilities after his father's demise, cracked JEE Main with 9 to 5 job, his AIR was..., he wants to...

- Automobile

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)