The new rules will regulate activities like checking bank balance, processing autopayments and accessing bank details.

The new UPI rules is set to be implemented today, August 1. These regulations will further improve UPI apps and protect users from scams. They will be applied to all payment service providers, such as Google Pay, PhonePe, or Paytm, and are being implemented by the National Payments Corporation of India (NPCI).

Activities such as checking bank details, executing autopayments, and monitoring bank balances will be governed by the new regulations. All of these modifications would enhance the functionality of UPI applications, according to a circular released by NPCI on May 21.

How to check the balance?

Users will be able to check their bank balance 50 times a day using each UPI app. In order to lessen the strain on UPI during busy hours, UPI apps will also have the ability to restrict or halt balance inquiry requests. Users will be able to view their account's available balance with each transaction starting in August.

Automatic payment

Banks can automatically deduct a specific amount from customers' accounts regularly by using auto payments. Autopayments, however, might put more strain on the Application Programming Interface (API) system if they are made during busy times. As a result, NPCI has ordered that these transactions can only be completed before 10 am, between 1 and 5 pm, and after 9:30 pm. This implies that an autopayment that is due at 11 am may be deducted either before or after that time. Furthermore, if the auto pay deduction is successful, retries will be offered; otherwise, the auto payment will be terminated.

Bank details

The list of banks associated with their cellphone number will be visible to customers. They are limited to 25 daily checks of the bank's information. Customers must begin requests after choosing the issuer's bank via the UPI app, and they will only be allowed to view their bank details during specific hours.

Transaction details

Transactions are frequently made at busy times, when clients frequently feel that funds have been taken out of their accounts but have not yet been received by the recipient. These unconfirmed payments will no longer appear as pending after August; instead, they will have a time window to update within seconds. There will be a 90-second lag between the user's three attempts to check the payment status.

Recipient's details

Before every transaction, the sender will be presented with the recipient's name. This is to prevent fraud or money being sent to the incorrect person. On the UPI app, the transaction ID will be displayed beside the recipient's registered name.

The circular also states that NPCI may take any required steps, such as restricting access to the UPI API, imposing fines, suspending new clients or onboarding, or taking other appropriate action, in the event that these instructions are not followed. By implementing these regulations, NPCI hopes to improve online payment efficiency and lower the number of fraud incidents.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. This Amitabh Bachchan film was released just four days after Coolie accident, Parveen Babi was in therapy, superhit movie was...

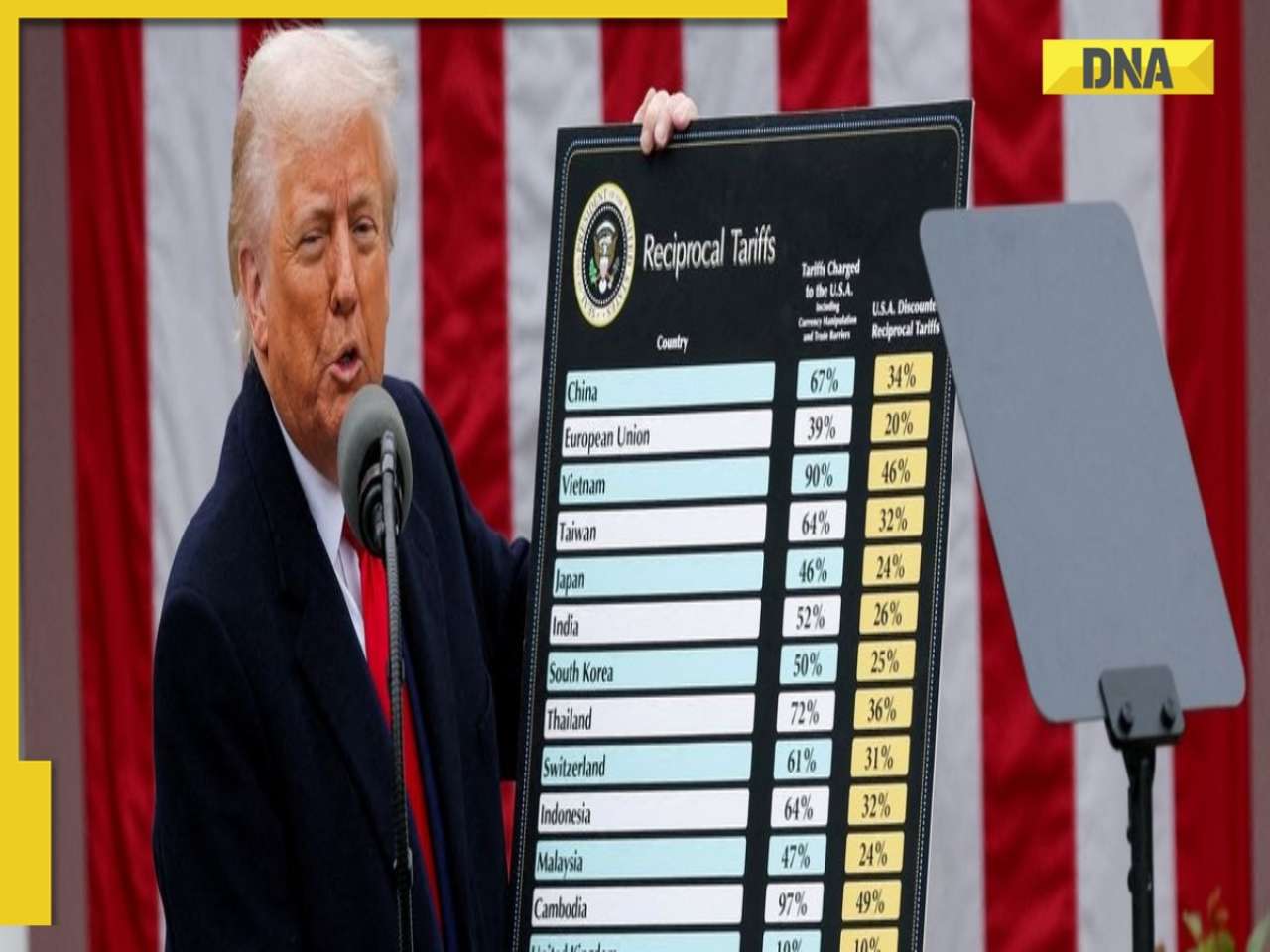

This Amitabh Bachchan film was released just four days after Coolie accident, Parveen Babi was in therapy, superhit movie was... DNA TV Show: Amid Donald Trump’s 25% tariff, India says it won’t purchase F-35 fighter jets

DNA TV Show: Amid Donald Trump’s 25% tariff, India says it won’t purchase F-35 fighter jets Shah Rukh Khan thanks 'Bharat Sarkar' for winning his first National Award in 33 years: 'It is a reminder that...'

Shah Rukh Khan thanks 'Bharat Sarkar' for winning his first National Award in 33 years: 'It is a reminder that...' Sanju Samson to CSK? Rajasthan Royals' latest video adds twist to transfer saga

Sanju Samson to CSK? Rajasthan Royals' latest video adds twist to transfer saga Why probiotic kanji rice is the ultimate gut detox you need to try

Why probiotic kanji rice is the ultimate gut detox you need to try Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor BIG move by BSNL as it rolls out new plan for just Re 1; check validity, offer, data limit and more

BIG move by BSNL as it rolls out new plan for just Re 1; check validity, offer, data limit and more Elon Musk's Tesla set to open 1st charging station in India on...; check charging speed, price

Elon Musk's Tesla set to open 1st charging station in India on...; check charging speed, price THIS consumer company earns profit of Rs 5,343,00,000,000, details here

THIS consumer company earns profit of Rs 5,343,00,000,000, details here How may US tariff hit pharmaceuticals, smartphone, farm sectors of India? It may cause loss of ...

How may US tariff hit pharmaceuticals, smartphone, farm sectors of India? It may cause loss of ... Meet man who shut down his AI startup despite BIG funding, even Perplexity's Aravind Srinivas backed off due to...

Meet man who shut down his AI startup despite BIG funding, even Perplexity's Aravind Srinivas backed off due to... 5 stunning cities that went underwater due to...; they are...

5 stunning cities that went underwater due to...; they are... 12th Fail, Jawan, Animal, Ullozhukku, Parking, Sam Bahadur: Where to watch 71st National Awards 2025-winning films on OTT

12th Fail, Jawan, Animal, Ullozhukku, Parking, Sam Bahadur: Where to watch 71st National Awards 2025-winning films on OTT Meet Mrunal Thakur, TV actress who became a Bollywood star, now lives luxuriously, has swanky car collection, her net worth is...

Meet Mrunal Thakur, TV actress who became a Bollywood star, now lives luxuriously, has swanky car collection, her net worth is... From Ajay Devgan, Jaideep Ahlawat to Manoj Bajpayee: Meet India's highest-paid OTT actors

From Ajay Devgan, Jaideep Ahlawat to Manoj Bajpayee: Meet India's highest-paid OTT actors Kiara Advani Birthday Special: 5 ethnic looks that prove she’s true style icon

Kiara Advani Birthday Special: 5 ethnic looks that prove she’s true style icon Encounter breaks out between security forces, terrorists in J-K's Kulgam

Encounter breaks out between security forces, terrorists in J-K's Kulgam  India acknowledges ties with US has 'weathered several challenges', expresses commitment to take relationship...

India acknowledges ties with US has 'weathered several challenges', expresses commitment to take relationship... SHOCKING! IndiGo passenger assaulted mid-air due to..., accused handed over to CISF

SHOCKING! IndiGo passenger assaulted mid-air due to..., accused handed over to CISF  Muhammad Yunus' daughter funding secession of India to create 'Greater Bangladesh'? Is Turkey behind Saltanat-e-Bangla?

Muhammad Yunus' daughter funding secession of India to create 'Greater Bangladesh'? Is Turkey behind Saltanat-e-Bangla? Delhi News: Traffic movement on this key flyover to be suspended for 30 days from...; police issue advisory

Delhi News: Traffic movement on this key flyover to be suspended for 30 days from...; police issue advisory Meet woman, 3.5 feet tall IAS officer who was once made fun of, later graduated from DU, cracked UPSC exam on her first attempt, she is...

Meet woman, 3.5 feet tall IAS officer who was once made fun of, later graduated from DU, cracked UPSC exam on her first attempt, she is... CLAT 2026 Notification: Registration begins at consortiumofnlus.ac.in, check application process, eligibility,

CLAT 2026 Notification: Registration begins at consortiumofnlus.ac.in, check application process, eligibility, Meet Noida's first woman DM, Medha Roopam's husband, IIT grad, who cracked UPSC exam with AIR..., now posted as...

Meet Noida's first woman DM, Medha Roopam's husband, IIT grad, who cracked UPSC exam with AIR..., now posted as... IIM CAT 2025 Notification: Registration begins at iimcat.ac.in, check application process, eligibility, other details

IIM CAT 2025 Notification: Registration begins at iimcat.ac.in, check application process, eligibility, other details Meet one of Vikas Divyakirti’s favourite students, farmer's son who cracked UPSC twice, then became IAS officer in…, his name is…

Meet one of Vikas Divyakirti’s favourite students, farmer's son who cracked UPSC twice, then became IAS officer in…, his name is… Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)