The New Jeevan Shanti Plan is a single premium scheme, meaning you invest once and enjoy a regular pension for the rest of your life

The LIC Jeevan Shanti Plan policy is available to individuals aged 30 to 79

Imagine a plan where you invest just once and receive a pension for life. It sounds like a dream, but it’s real. Life Insurance Corporation of India (LIC) has introduced a revolutionary policy, the New Jeevan Shanti Plan, which promises to turn your dreams into reality.

In today's world, everyone saves a portion of their earnings, hoping to invest it wisely to secure a stable income post-retirement. Financial security is a universal concern, and to address this, LIC offers numerous plans that guarantee lifelong pensions. Among these, the New Jeevan Shanti Policy stands out. With this policy, a single investment guarantees you a regular pension for life.

LIC's retirement plans cater to all age groups and have gained immense popularity due to their reliability and attractive returns. The New Jeevan Shanti Plan is a single premium scheme, meaning you invest once and enjoy a regular pension for the rest of your life. For instance, if a 55-year-old invests ₹11 lakh, they will receive an annual pension of ₹1,02,850 starting at age 60. This amount can be received annually, semi-annually, or monthly, depending on the investor's preference.

The policy is available to individuals aged 30 to 79. It offers two options: Deferred Annuity for Single Life and Deferred Annuity for Joint Life. This flexibility allows investors to choose between a solo plan or a combined option with a partner.

Beyond the guaranteed pension, the New Jeevan Shanti Plan offers additional benefits. It includes death cover, ensuring that if the policyholder passes away, the nominee receives the entire deposit amount. For example, on an investment of ₹11 lakh, the nominee would get ₹12,10,000. The policy is also flexible, allowing surrender at any time and a minimum investment of ₹1.5 lakh with no maximum limit.

This plan not only secures your financial future but also offers peace of mind with its guaranteed returns and comprehensive benefits. With LIC's New Jeevan Shanti Policy, financial stability after retirement is just a one-time investment away.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. 29 soldiers killed in BLA attack, Is Pakistan Army losing war against militants in Balochistan

29 soldiers killed in BLA attack, Is Pakistan Army losing war against militants in Balochistan At least 50 killed in massive fire at Iraq shopping mall, horrific video surfaces

At least 50 killed in massive fire at Iraq shopping mall, horrific video surfaces Will Joe Root break Sachin Tendulkar's historic Test record at Old Trafford? England's star all-rounder set to become...

Will Joe Root break Sachin Tendulkar's historic Test record at Old Trafford? England's star all-rounder set to become... Good news for Delhi commuters, Rekha Gupta government set to change transport system, smart travel cards, new bus routes, and...

Good news for Delhi commuters, Rekha Gupta government set to change transport system, smart travel cards, new bus routes, and... BIG tension for China, Pakistan, as Indian Army successfully test Akash Prime air defence system, it can engage multiple targets in...

BIG tension for China, Pakistan, as Indian Army successfully test Akash Prime air defence system, it can engage multiple targets in... 7 stunning images of supernova captured by NASA Hubble Telescope

7 stunning images of supernova captured by NASA Hubble Telescope 7 mesmerising images of star formation captured by NASA

7 mesmerising images of star formation captured by NASA What is brain fog? 7 Ways to overcome it

What is brain fog? 7 Ways to overcome it Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs

Sawan 2025: Move beyond Tip Tip Barsa Paani, this rainy season groove on these sizzling songs Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently

Kang Seo‑ha to Kim Sae‑ron: K‑drama, K-pop icons we lost recently Odisha Bandh: Normal Life Affected As Congress, Other Party Leaders Hit Streets Over Student Suicide

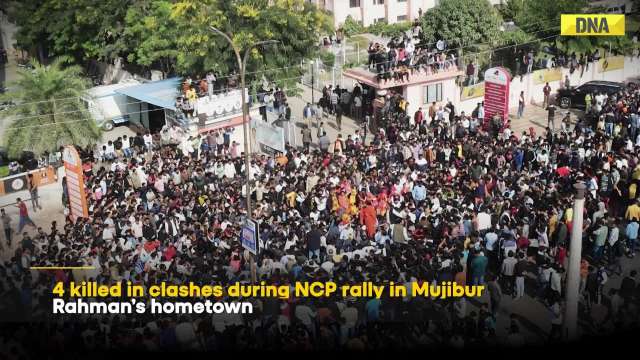

Odisha Bandh: Normal Life Affected As Congress, Other Party Leaders Hit Streets Over Student Suicide Bangladesh Unrest: 4 Killed in Clashes During NCP Rally in Mujib’s Hometown, Curfew Imposed

Bangladesh Unrest: 4 Killed in Clashes During NCP Rally in Mujib’s Hometown, Curfew Imposed Sharjah Woman Death: New Details Emerge in Kerala Woman’s Suicide, In-Laws Named In FIR

Sharjah Woman Death: New Details Emerge in Kerala Woman’s Suicide, In-Laws Named In FIR Russia-Ukraine War: Zelenskyy Slams Russia Over Deadly Dobropillia Bombing | Putin | World News

Russia-Ukraine War: Zelenskyy Slams Russia Over Deadly Dobropillia Bombing | Putin | World News CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93

CV Padmarajan, Congress Stalwart And Former Kerala Minister, Dies At 93 No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details

No OTP, no Tatkal ticket: Indian Railways makes Aadhaar OTP verification mandatory for online Tatkal booking; check details Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through...

Anil Ambani's Reliance Infra, RPower make BIG move to raise Rs 18000 crore through... ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps...

ITR Filing 2025: Don't panic if you receive Income Tax Department notice, take THESE steps... Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here

Good news for TCS employees as Ratan Tata's firm announces 100 percent variable pay for THESE employees, check here  After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India

After approval, Starlink to offer fastest internet speed ranging from..., know what more it offers in India  Sara Tendulkar’s effortless elegance in green steals the spotlight at Wimbledon 2025; SEE PICS

Sara Tendulkar’s effortless elegance in green steals the spotlight at Wimbledon 2025; SEE PICS Meet superstar who came to Mumbai with just Rs 500, earned only Rs 5000 from his debut, now owns 11 luxurious properties, has net worth of Rs...

Meet superstar who came to Mumbai with just Rs 500, earned only Rs 5000 from his debut, now owns 11 luxurious properties, has net worth of Rs... From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers

From Sheila Ki Jawani, Kala Chashma to Kamli: Katrina Kaif unforgettable dance numbers  Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films

Is Katrina Kaif 'Runaway Bride' of Bollywood? 5 times actress has run away from weddings in films Raksha Bandhan 2025 date, time: When is Rakhi this year? Check shubh muhurat and significance

Raksha Bandhan 2025 date, time: When is Rakhi this year? Check shubh muhurat and significance At least 50 killed in massive fire at Iraq shopping mall, horrific video surfaces

At least 50 killed in massive fire at Iraq shopping mall, horrific video surfaces Good news for Delhi commuters, Rekha Gupta government set to change transport system, smart travel cards, new bus routes, and...

Good news for Delhi commuters, Rekha Gupta government set to change transport system, smart travel cards, new bus routes, and... BIG tension for China, Pakistan, as Indian Army successfully test Akash Prime air defence system, it can engage multiple targets in...

BIG tension for China, Pakistan, as Indian Army successfully test Akash Prime air defence system, it can engage multiple targets in... Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here

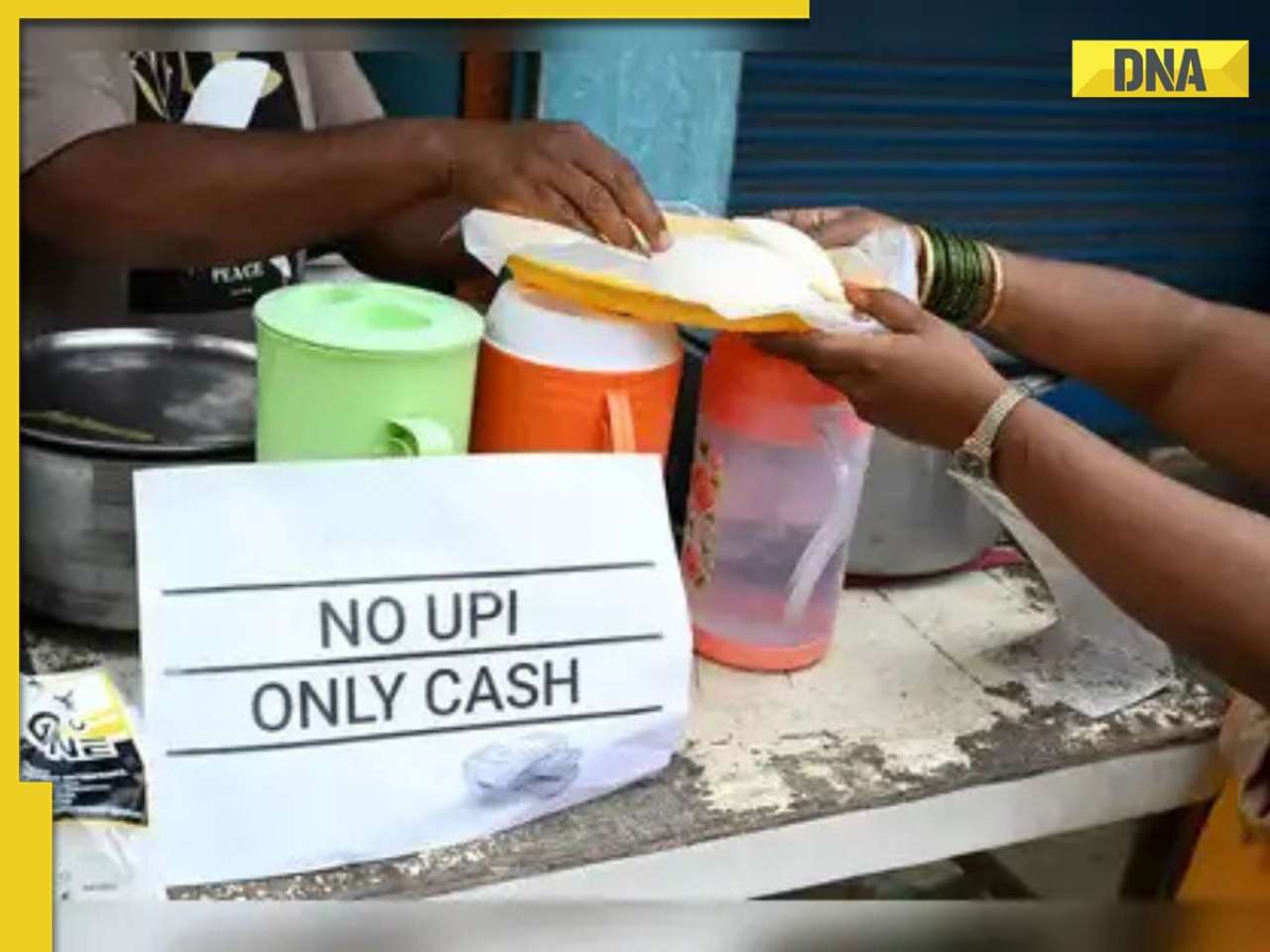

Bihar Elections: CM Nitish Kumar announces 125 units of 'free electricity' from..., check details here Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to...

Bengaluru small vendors are saying 'NO' to UPI, demands 'Only' cash, are in fear due to... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

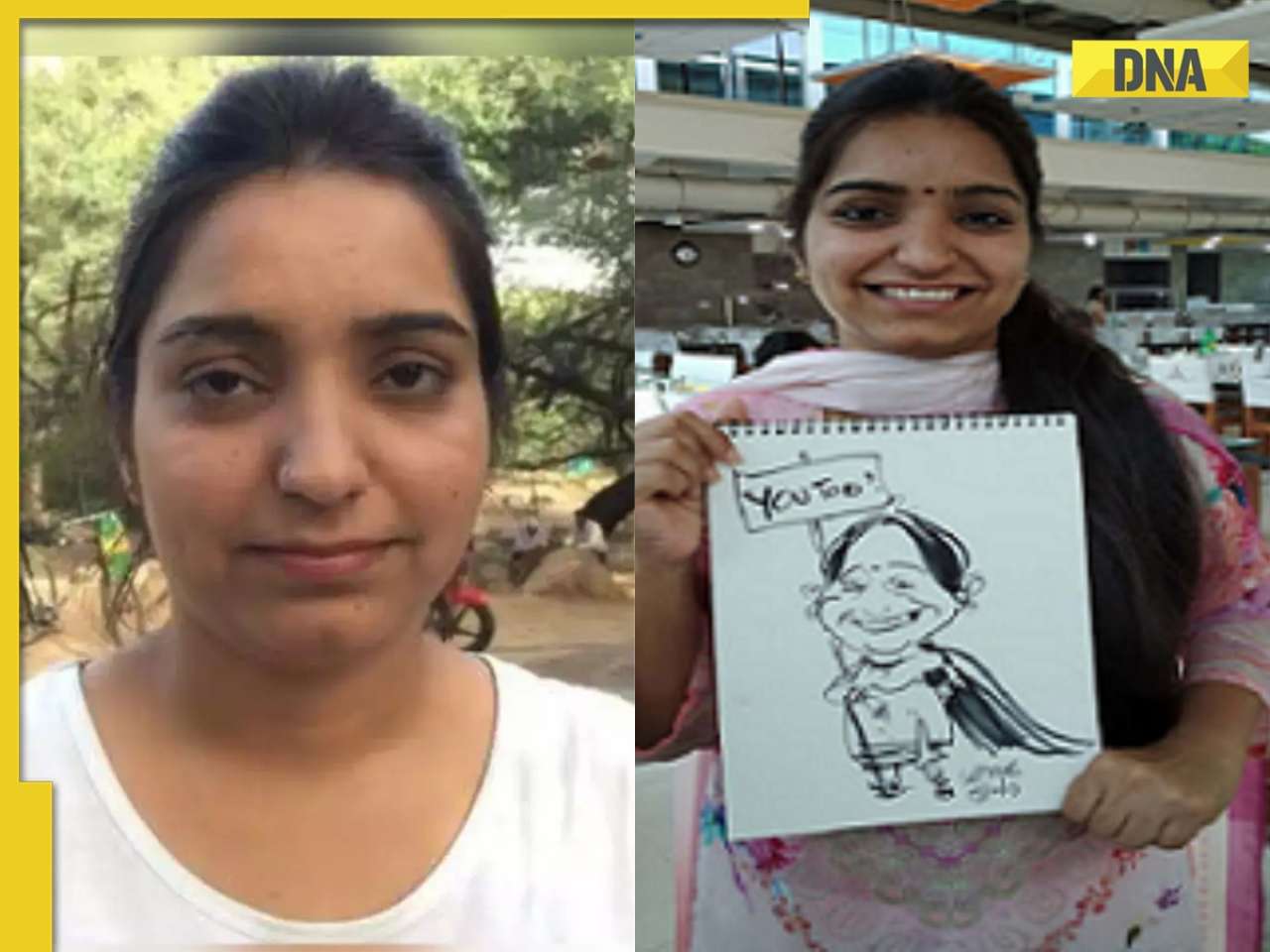

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is...

This college records Rs 10000000 placement package for 2025 batch, not IIT Delhi, IIT Bombay, IIM Ahmedabad, it is... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)