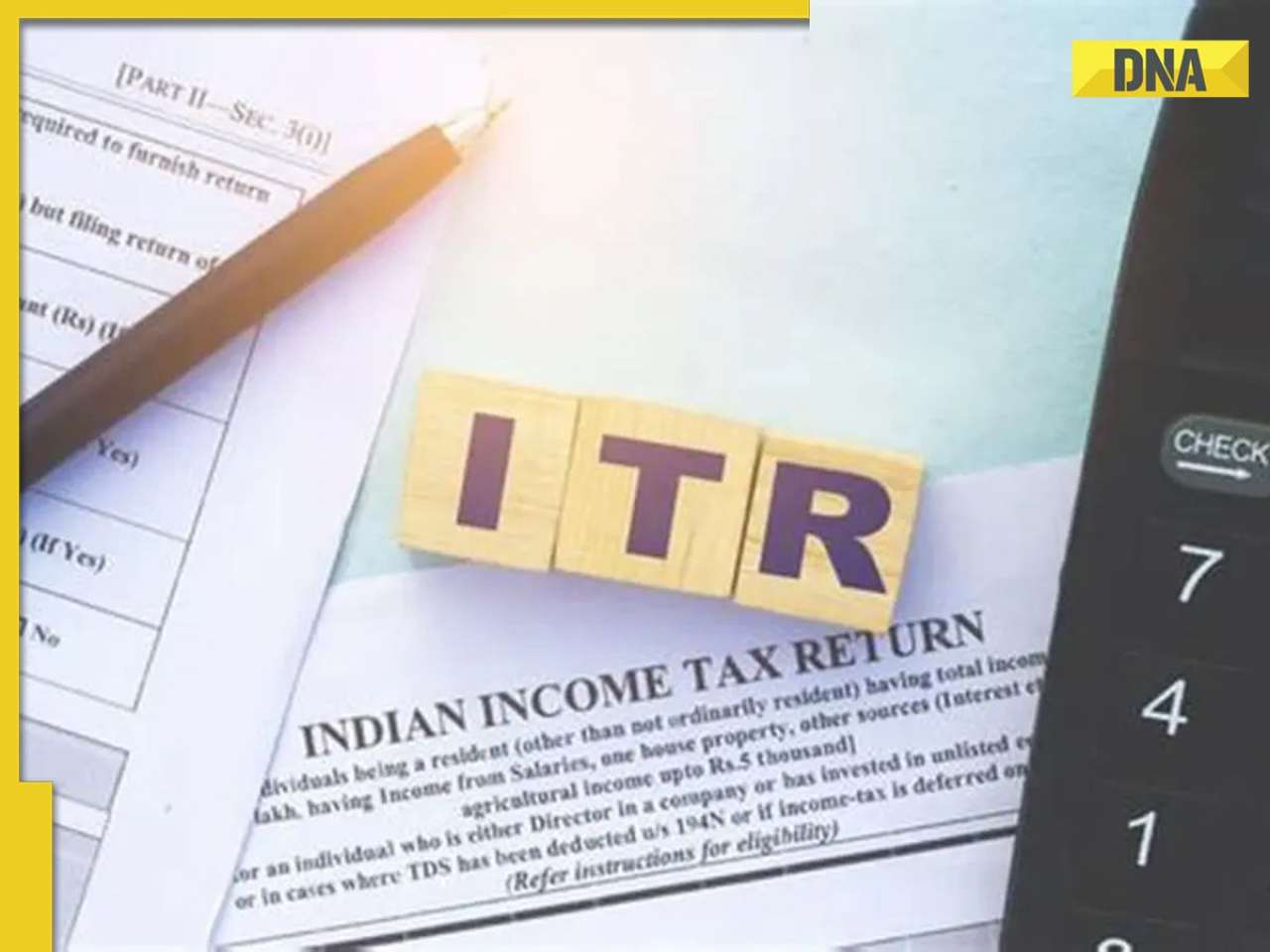

ITR filing FY 2024-25: The income tax (I-T) department has started filing returns of ITR-2 through online mode, that is, individuals can now e-file ITR-2 on the Income Tax Portal incometax.gov.in/iec/foportal/. This comes with pre-filled data at the e-filing portal.

ITR-2 can now be filed online

ITR filing FY 2024-25: The income tax (I-T) department has started filing returns of ITR-2 through online mode, that is, individuals can now e-file ITR-2 on the Income Tax Portal incometax.gov.in/iec/foportal/. This comes with pre-filled data at the e-filing portal. Individuals who want to file tax returns of income from sources such as salary, pension, capital gains and others can opt for ITR-2 filing. For those involved in business or profession have the option of filing ITR-3.

Who can file ITR-2?

The department opened the system online for submission of Form ITR-2 on July 18, 2025. This initiative has opened options for those earning through salaries, those with taxable capital gains, and cryptocurrency, to file their income tax returns through the e-filing ITR portal using ITR-2. The Income Tax Department released Excel Utilities for ITR-2 and ITR-3 on July 11. The deadline for Income Tax Return (ITR) filing for FY 2024-25, assessment year 2025-26 is September 15, 2025.

The Income Tax Department announced the news on X writing, “Kind Attention Taxpayers!Income Tax Return Form of ITR-2 is now enabled for filing through online mode with pre-filled data at the e-filing portal. Visit: https://incometax.gov.in/iec/foportal/”

For Assessment Year 2025-26 (Financial Year 2024-25), ITR-2 filing requirements apply to specific categories of taxpayers. ITR-2 is applicable for individuals or HUF (Hindu Undivided Family) receiving income from various sources like salary or pension earnings, revenue from one or multiple house properties, more income sources like lottery winnings, horse racing proceeds, or specially taxed income. Holders of unlisted equity shares can also file ITR-2.

Which ITR to file?

ITR-1 is for those individuals with a total income of up to Rs 50 lakh.

ITR-2 is meant for individuals who belong to Hindu Undivided Families (HUFs) or those who are not eligible to file ITR-1 (Sahaj).

ITR-3 can be filed by those HUFs and others who are involved in business or profession that require large books of accounts.

ITR-4 is for Resident Individual/ HUF/ Firm (other than LLP) with income not more than Rs 50 lakh during the financial year, income from business and profession computed on a presumptive basis u/s 44AD, 44ADA or 44AE, income from salary/pension, one house property, agricultural income (up to Rs 5,000) and other sources.

ITR-5 form is meant for firms, Limited Liability Partnership (LLP), Association of Persons (AOP), Body of Individuals (BOI), and Artificial Juridical Person (AJP).

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. US President Donald Trump threatens 'little group' BRICS of 10% tariffs AGAIN, says, 'dominance of...'

US President Donald Trump threatens 'little group' BRICS of 10% tariffs AGAIN, says, 'dominance of...' Good news for Delhi-Gurgaon commuters! New link on this highway to cut travel time by 30 mins, to be completed by...., know which areas will benefit

Good news for Delhi-Gurgaon commuters! New link on this highway to cut travel time by 30 mins, to be completed by...., know which areas will benefit  Australia announce Playing XI for 1st ODI against West Indies, THIS Delhi Capitals star batter makes unexpected return to squad

Australia announce Playing XI for 1st ODI against West Indies, THIS Delhi Capitals star batter makes unexpected return to squad Good News for UP commuters: Two new six-lane expressways announced, to have special facilities like....

Good News for UP commuters: Two new six-lane expressways announced, to have special facilities like.... India plans to takeover this key island for defence purposes, its name is...

India plans to takeover this key island for defence purposes, its name is... Stop 'Kuch Mitha Ho Jaye'? 7 signs to ditch sugar

Stop 'Kuch Mitha Ho Jaye'? 7 signs to ditch sugar Fasting in Shravan? 7 healthy and wholesome foods to boost your energy

Fasting in Shravan? 7 healthy and wholesome foods to boost your energy Why do you lose your temper after drinking alcohol, eating Meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol, eating Meat? Know 7 ways to manage it Want a healthy liver? Ditch these 7 foods immediately.

Want a healthy liver? Ditch these 7 foods immediately. 7 ancient, powerful Indian superfoods to help you live a longer, healthier life

7 ancient, powerful Indian superfoods to help you live a longer, healthier life Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News

Odisha News: Minor Burnt To Death In Puri Family Reveals Shocking Attack Details | Puri News Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News

Odisha News: Minor Girl Burnt By 3 Men Days After Balasore Self-Immolation | Puri News Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Good news for Anil Ambani, Reliance Power delivers net profit of Rs 446800000 in…

Good news for Anil Ambani, Reliance Power delivers net profit of Rs 446800000 in… ITR filing FY 2024-25: Good news for taxpayers! ITR-2 now enabled for filing online, check details

ITR filing FY 2024-25: Good news for taxpayers! ITR-2 now enabled for filing online, check details Astronomer CEO Andy Byron resigns after Coldplay kiss cam outs 'affair'; company says, 'Our leaders are...'

Astronomer CEO Andy Byron resigns after Coldplay kiss cam outs 'affair'; company says, 'Our leaders are...' Meta AI researcher calls out Mark Zuckerberg-led company's culture in exit email: 'It's not just dysfunction, it's...'

Meta AI researcher calls out Mark Zuckerberg-led company's culture in exit email: 'It's not just dysfunction, it's...' Meet Indian-origin techie, ex-Google employee, leading OpenAI's new ChatGPT Agent tool, he studied at...

Meet Indian-origin techie, ex-Google employee, leading OpenAI's new ChatGPT Agent tool, he studied at... Anupam Kher’s Fitness Routine at 70: How Metro In Dino actor stays active with gym, swimming, and discipline

Anupam Kher’s Fitness Routine at 70: How Metro In Dino actor stays active with gym, swimming, and discipline From Anushka Shetty to Tamannaah Bhatia: 7 South Indian divas proving success doesn’t require a wedding ring

From Anushka Shetty to Tamannaah Bhatia: 7 South Indian divas proving success doesn’t require a wedding ring From Sidharth Malhotra, Virat Kohli to Ranbir Kapoor: 7 celebrities who are doting girl dads

From Sidharth Malhotra, Virat Kohli to Ranbir Kapoor: 7 celebrities who are doting girl dads From Karisma Kapoor to Rekha: 5 Bollywood actresses who chose singlehood after divorce

From Karisma Kapoor to Rekha: 5 Bollywood actresses who chose singlehood after divorce Sara Ali Khan’s inspiring fitness journey: Lost 45kg through discipline, cardio, and no-sugar diet despite PCOS

Sara Ali Khan’s inspiring fitness journey: Lost 45kg through discipline, cardio, and no-sugar diet despite PCOS Good news for Delhi-Gurgaon commuters! New link on this highway to cut travel time by 30 mins, to be completed by...., know which areas will benefit

Good news for Delhi-Gurgaon commuters! New link on this highway to cut travel time by 30 mins, to be completed by...., know which areas will benefit  Good News for UP commuters: Two new six-lane expressways announced, to have special facilities like....

Good News for UP commuters: Two new six-lane expressways announced, to have special facilities like.... India plans to takeover this key island for defence purposes, its name is...

India plans to takeover this key island for defence purposes, its name is... Two Indians killed, one abducted in terror attack in Niger; Indian Mission in touch with local authorities

Two Indians killed, one abducted in terror attack in Niger; Indian Mission in touch with local authorities Rajasthan government transfers 12 IAS, 91 IPS in major bureaucratic reshuffle, check full list here

Rajasthan government transfers 12 IAS, 91 IPS in major bureaucratic reshuffle, check full list here MHT CET 2025: Provisional merit list released, check steps to download, direct link here

MHT CET 2025: Provisional merit list released, check steps to download, direct link here  Meet man, who works as horse handler in Kedarnath, cracked IIT-JAM 2025, know his inspiring journey

Meet man, who works as horse handler in Kedarnath, cracked IIT-JAM 2025, know his inspiring journey Delhi University releases first seat allocation list for UG admissions, here's how you can download it

Delhi University releases first seat allocation list for UG admissions, here's how you can download it Meet woman, failed to crack NEET, couldn't succeed in UPSC exam; later bagged Rs 72.3 lakh job at Rolls-Royce, became youngest girl to...

Meet woman, failed to crack NEET, couldn't succeed in UPSC exam; later bagged Rs 72.3 lakh job at Rolls-Royce, became youngest girl to... Meet man, an actor who appeared in popular Star Plus series, later joined Microsoft, quit job to crack UPSC exam with AIR..., he is...

Meet man, an actor who appeared in popular Star Plus series, later joined Microsoft, quit job to crack UPSC exam with AIR..., he is... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)