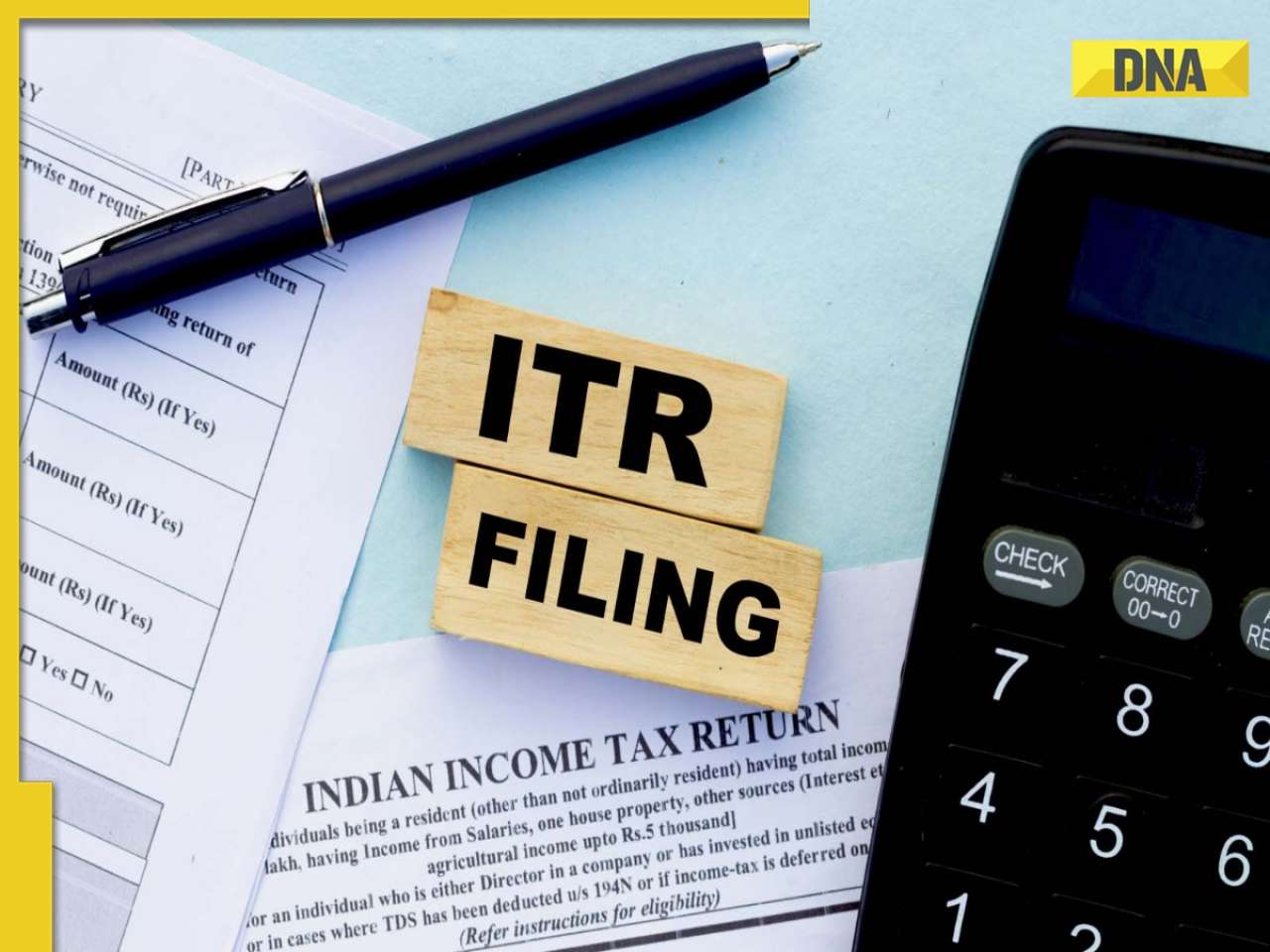

Over 7.28 crore income tax returns were filed for FY 2023-24 by the July 31 deadline, a 7.5% increase from the previous year, according to the Ministry of Finance.

As of the final deadline on July 31, more than 7.28 crore income tax returns (ITR) were filed for the financial year 2023-24, according to a statement from the Ministry of Finance. This marks a 7.5% increase compared to the 6.77 crore returns filed for the previous financial year, 2022-23. Taxpayers are reminded to verify their unverified income tax returns within 30 days of filing. Those who missed the deadline must complete their submissions as soon as possible.

In an interview with Livemint, Balwant Jain, a tax and investment expert based in Mumbai, discussed various aspects of income tax refunds under the Income Tax Act. Not all taxpayers are eligible for a tax refund; eligibility is determined by whether the taxes paid exceed the taxpayer's tax liability. This includes taxes deducted at source (TDS), taxes collected at source (TCS), as well as advance tax and self-assessment tax. Refund processing begins only after the taxpayer has e-verified their return and typically takes 4 to 5 weeks from the date of verification to be credited to the taxpayer's account. Jain emphasized the importance of ensuring that bank account details are correctly validated when filing the ITR since refunds are directly credited to the taxpayer's bank account.

For those who missed the July 31 deadline, Jain explained that it is still possible to claim a refund for up to six assessment years, as per circular no. 9/2015, provided certain conditions are met. Taxpayers must first apply for condonation of delay. Once this is approved, they can file their ITR online for the past six years, referencing the order that granted the condonation.

Additionally, Jain highlighted situations where refunds might be withheld. The income tax department is allowed to offset refunds against any outstanding demands from previous years. However, they must notify taxpayers before making such adjustments, which is not always followed. If a refund has been incorrectly adjusted, taxpayers can raise a grievance on the income tax website by logging into their account. While the department can adjust refunds for past demands, taxpayers cannot use refunds from previous years to cover taxes owed for subsequent years.

Overall, it is crucial for taxpayers to be aware of their refund eligibility, the process for claiming refunds, and the potential for refunds to be adjusted against past dues. Ensuring proper verification and addressing any discrepancies promptly can help in receiving refunds efficiently.

The DNA app is now available for download on the Google Play Store. Please download the app and share your feedback with us.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Not Aditya Roy Kapur, but THIS Mahesh Bhatt's discovery was OG choice for Aashiqui 2, he rejected blockbuster because...

Not Aditya Roy Kapur, but THIS Mahesh Bhatt's discovery was OG choice for Aashiqui 2, he rejected blockbuster because... Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by...

Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by... Panchayat actor Aasif Khan discharged from hospital, reveals he didn't suffer heart attack, but...: 'I’ve been told to stop...'

Panchayat actor Aasif Khan discharged from hospital, reveals he didn't suffer heart attack, but...: 'I’ve been told to stop...' Who is Kristin Cabot? Astronomer's HR head caught getting 'cozy' with CEO Andy Bryon at Coldplay concert, she is married to...

Who is Kristin Cabot? Astronomer's HR head caught getting 'cozy' with CEO Andy Bryon at Coldplay concert, she is married to... Saiyaara FIRST REVIEW out: Ahaan Panday, Aneet Padda are 'raw, real, powerful', Mohit Suri creates 'pure magic' with his love story

Saiyaara FIRST REVIEW out: Ahaan Panday, Aneet Padda are 'raw, real, powerful', Mohit Suri creates 'pure magic' with his love story Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!'

Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!' Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News

Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row

Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall

Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video

Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in...

Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in... SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by...

SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by... Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to...

Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to... ITR Filing 2025: When will you get your refund? What should you do to avoid late refund?

ITR Filing 2025: When will you get your refund? What should you do to avoid late refund? Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in...

Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in... OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar

OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics

Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions

In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels

From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple

Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by...

Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by... US takes BIG step on Pahalgam terror attack, declares LeT proxy The Resistance Front as...

US takes BIG step on Pahalgam terror attack, declares LeT proxy The Resistance Front as... India strengthens defence with successful launch of Prithvi-II, Agni-I missiles

India strengthens defence with successful launch of Prithvi-II, Agni-I missiles Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH

Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened...

What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened... Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from...

Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from... 'Factory of IAS': This family produced 6 civil servants through generations, it is based in...

'Factory of IAS': This family produced 6 civil servants through generations, it is based in... Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to...

Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to... Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is...

Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)