UPI transaction values have seen an exponential increase, growing from Rs 21.3 lakh crore in 2019-20 to Rs 260.56 lakh crore by March 2025. Specifically, P2M transactions have reached Rs 59.3 lakh crore, reflecting growing merchant adoption and consumer confidence in digital payment methods.

Representative Image (iStock)

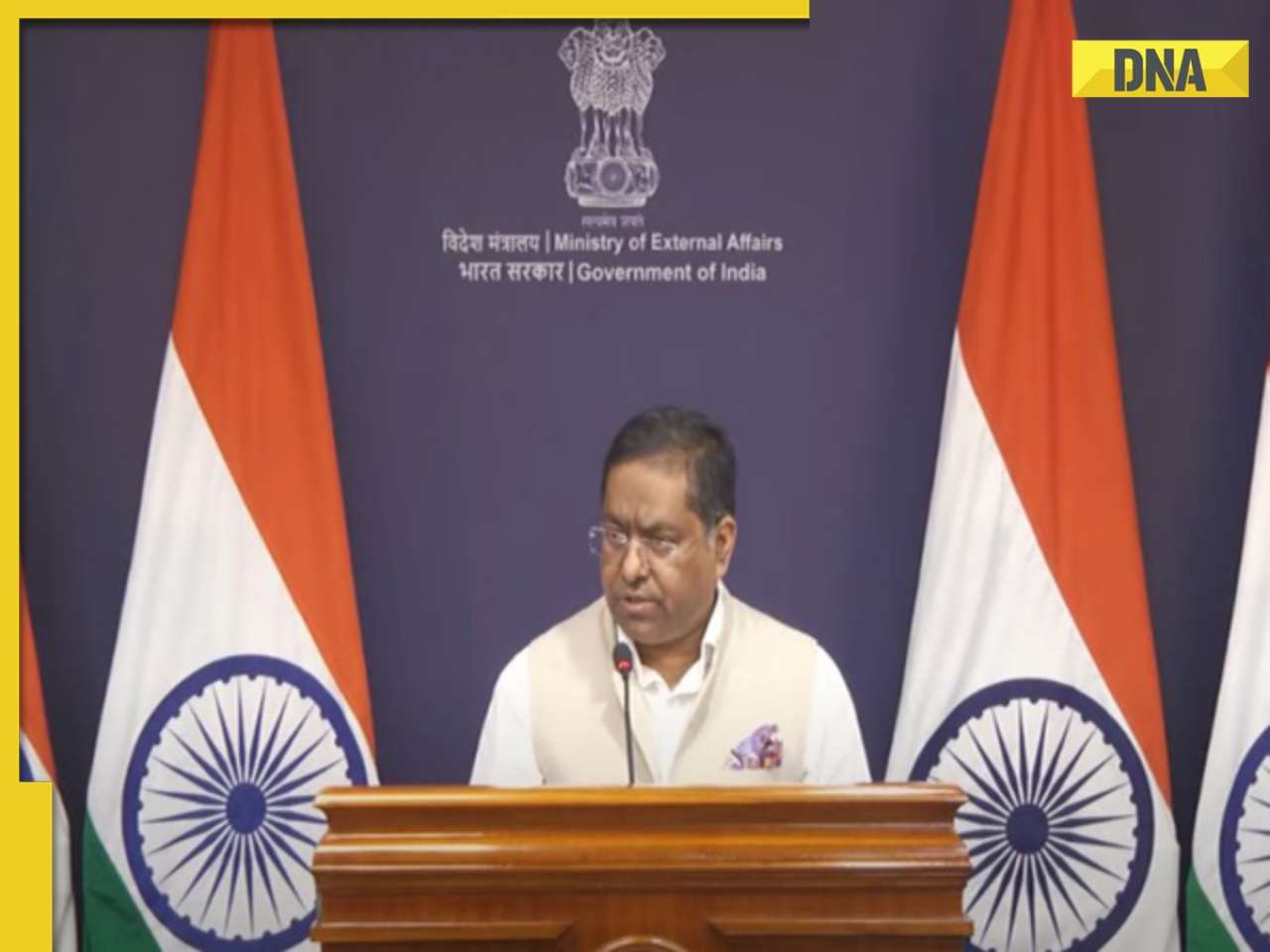

The claims that the government is considering levying Goods and Services Tax (GST) on UPI transactions over Rs 2,000 are completely false, misleading, and without any basis, said the Ministry of Finance in a statement Friday.

Currently, there is no such proposal before the government, the Finance Ministry clarified. GST is levied on charges, such as the Merchant Discount Rate (MDR), relating to payments made using certain instruments.

Effective January 2020, the Central Board of Direct Taxes (CBDT) removed the Merchant Discount Rate (MDR) on Person-to-Merchant (P2M) UPI transactions through a Gazette Notification dated December 30, 2019. Since currently no MDR is charged on UPI transactions, there is consequently no GST applicable to these transactions.

The government remains committed to promoting digital payments via UPI, the Finance Ministry said.To support and sustain the growth of UPI, an Incentive Scheme has been operational from 2021-22. This scheme specifically targets low-value UPI (P2M) transactions, benefiting small merchants by alleviating transaction costs and promoting wider participation and innovation in digital payments. The total incentive payouts under this scheme over the years reflect the Government's sustained commitment to promoting UPI-based digital payments.

Allocation under the scheme over the years has been: FY2021-22: Rs 1,389 crore; FY2022-23: Rs 2,210 crore; and FY2023-24: Rs 3,631 crore.

"These measures have significantly contributed to India's robust digital payments ecosystem," the ministry said. According to the ACI Worldwide Report 2024, India accounted for 49 per cent of global real-time transactions in 2023, reaffirming its position as a global leader in digital payments innovation.

UPI transaction values have seen an exponential increase, growing from Rs 21.3 lakh crore in 2019-20 to Rs 260.56 lakh crore by March 2025. Specifically, P2M transactions have reached Rs 59.3 lakh crore, reflecting growing merchant adoption and consumer confidence in digital payment methods.

Except for the headline, the story has not been edited by DNA staff and is published from ANI

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Vaani Kapoor breaks silence on her film Abir Gulaal co-starring Fawad Khan getting banned in India: 'This whole cancel culture...'

Vaani Kapoor breaks silence on her film Abir Gulaal co-starring Fawad Khan getting banned in India: 'This whole cancel culture...' DNA TV Show: Israel to 'tear up' Donald Trump's vision for Syria with Damascus strikes?

DNA TV Show: Israel to 'tear up' Donald Trump's vision for Syria with Damascus strikes? India strengthens defence with successful launch of Prithvi-II, Agni-I missiles

India strengthens defence with successful launch of Prithvi-II, Agni-I missiles Kaun Banega Crorepati 17: Amitabh Bachchan's quiz show to premiere on this date, KBC 17 tagline is...

Kaun Banega Crorepati 17: Amitabh Bachchan's quiz show to premiere on this date, KBC 17 tagline is... Not Jasprit Bumrah! India coach hails THIS 31-year-old pacer as team's 'Lion'

Not Jasprit Bumrah! India coach hails THIS 31-year-old pacer as team's 'Lion' Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!'

Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!' Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News

Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row

Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall

Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video

Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in...

Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in... SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by...

SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by... Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to...

Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to... ITR Filing 2025: When will you get your refund? What should you do to avoid late refund?

ITR Filing 2025: When will you get your refund? What should you do to avoid late refund? Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in...

Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in... OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar

OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics

Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions

In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels

From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple

Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple India strengthens defence with successful launch of Prithvi-II, Agni-I missiles

India strengthens defence with successful launch of Prithvi-II, Agni-I missiles Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH

Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened...

What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened... India cautions against 'double standards' over NATO Chief's sanction warning for trade with Russia, says, 'Energy needs for our people...'

India cautions against 'double standards' over NATO Chief's sanction warning for trade with Russia, says, 'Energy needs for our people...' India's BIG statement on US President Donald Trump, NATO's sanction threat on Russian imports, says, 'Not worried at all...'

India's BIG statement on US President Donald Trump, NATO's sanction threat on Russian imports, says, 'Not worried at all...' Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from...

Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from... 'Factory of IAS': This family produced 6 civil servants through generations, it is based in...

'Factory of IAS': This family produced 6 civil servants through generations, it is based in... Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to...

Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to... Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is...

Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)