As of September 30, Wipro reported Rs 56,808 crore in reserves, including free reserves, securities premium, and the capital redemption reserve

Wipro Ltd shares began trading ex-bonus today following the company’s 1:1 bonus issue. Adjusted for the corporate action, the stock opened on the BSE at Rs 295.50, reflecting a 1.09% rise. However, compared to the unadjusted closing price of Rs 584.55 on the previous day, the stock appeared to drop by 49.45%. This discrepancy might confuse some investors, as certain trading platforms may still display the unadjusted price, erroneously suggesting a sharp decline.

December 3 marks the record date for Wipro’s bonus issue, determining the shareholders eligible for the additional shares. Investors will soon receive their bonus shares, issued in a 1:1 ratio—one new share for every share held. While bonus issues increase the total number of outstanding shares, they reduce the share price proportionately. The objective is to enhance liquidity and make the stock more accessible to investors.

As of September 30, Wipro reported Rs 56,808 crore in reserves, including free reserves, securities premium, and the capital redemption reserve. Following the bonus issue, Wipro’s paid-up equity share capital will rise to approximately Rs 2,092.59 crore, comprising over 10.46 billion equity shares of Rs 2 each. The exact number of bonus shares will depend on the paid-up equity share capital as of today’s record date.

This marks Wipro's first bonus issue since 2019, when shares were issued in a 1:3 ratio. The company had previously issued bonus shares in 2017 (1:1), 2010 (2:3), 2005 (1:1), 2004 (2:1), and in multiple instances in the 1990s. The current move continues Wipro’s tradition of rewarding shareholders through bonus shares.

Despite the bonus announcement, Wipro has faced challenges in the IT sector, including client-specific issues. However, analysts see early signs of recovery in the BFSI (Banking, Financial Services, and Insurance) segment. With a favorable portfolio, the leadership of new CEO Srini Pallia, and attractive valuations, analysts believe Wipro presents a promising risk-reward opportunity.

Last year, Wipro also returned value to shareholders through a share buyback program.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

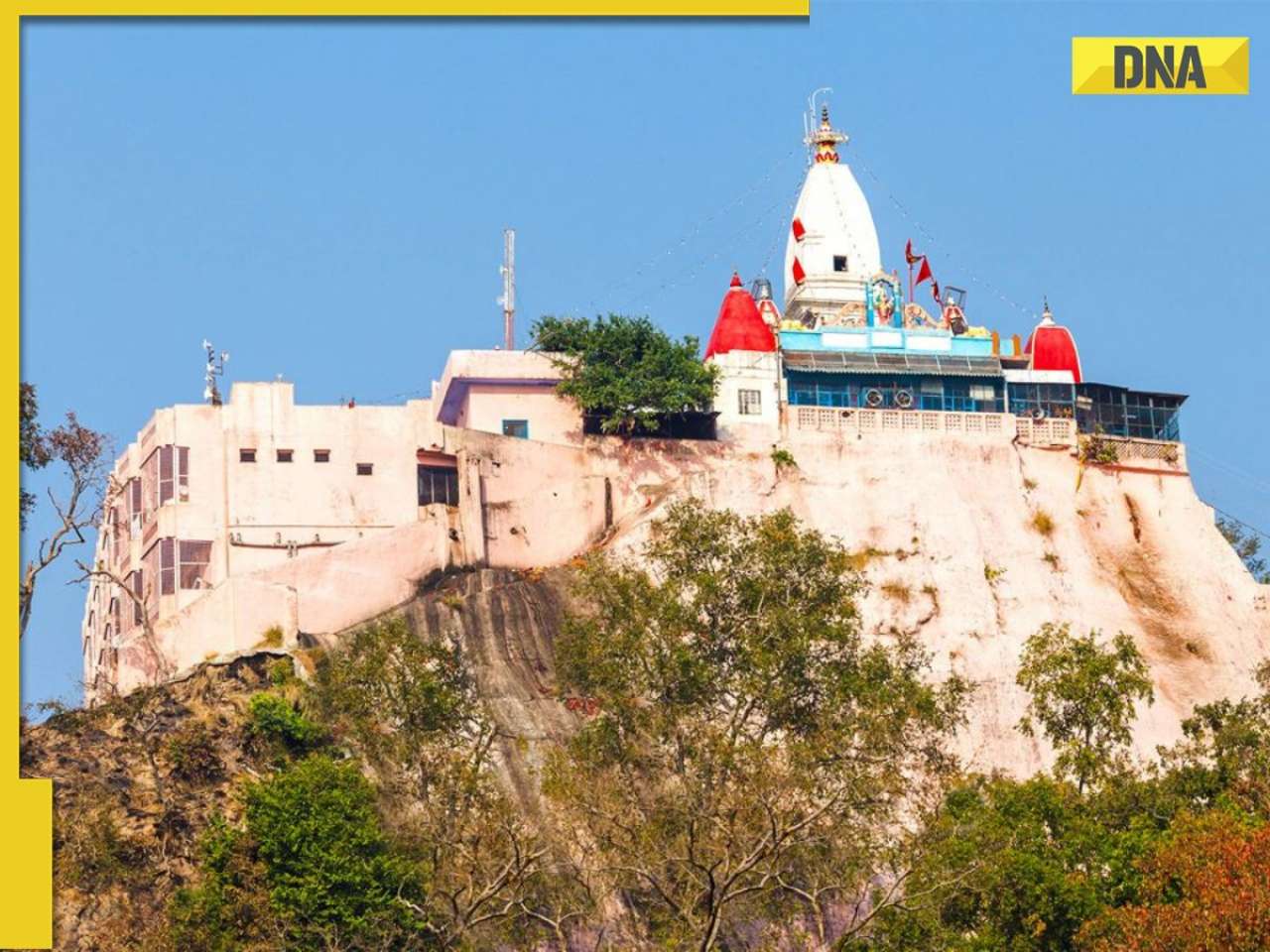

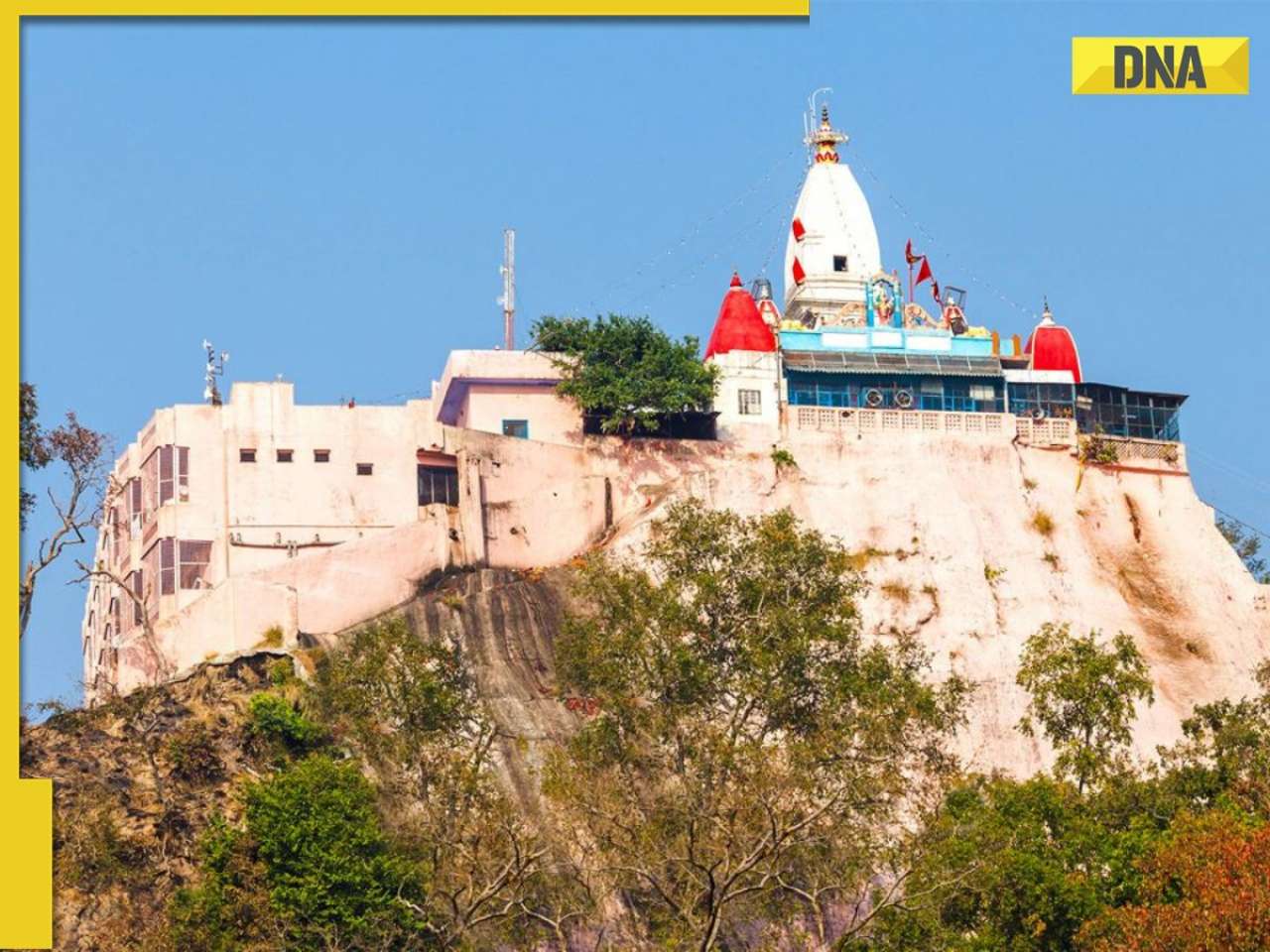

Follow DNA on WhatsApp. Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured

Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured Pakistan honours US General who praised it for...with prestigious Nishan-e-Imtiaz award, India opposed him for...

Pakistan honours US General who praised it for...with prestigious Nishan-e-Imtiaz award, India opposed him for... Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from...

Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from... Rishabh Pant to bat on day 5 of 4th Test vs England? Batting coach issues BIG update on India's vice captain's availability

Rishabh Pant to bat on day 5 of 4th Test vs England? Batting coach issues BIG update on India's vice captain's availability Kavya Maran's SRH's star player lands in legal trouble for non-payment of Rs 50000000 dues to his...; Here's what exactly happened

Kavya Maran's SRH's star player lands in legal trouble for non-payment of Rs 50000000 dues to his...; Here's what exactly happened 7 stunning images of Galactic 'Fossil' captured by NASA

7 stunning images of Galactic 'Fossil' captured by NASA Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods

Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods 7 most captivating space images captured by NASA you need to see

7 most captivating space images captured by NASA you need to see AI-remagined famous Bollywood father-son duos will leave you in splits

AI-remagined famous Bollywood father-son duos will leave you in splits 7 superfoods that boost hair growth naturally

7 superfoods that boost hair growth naturally Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are...

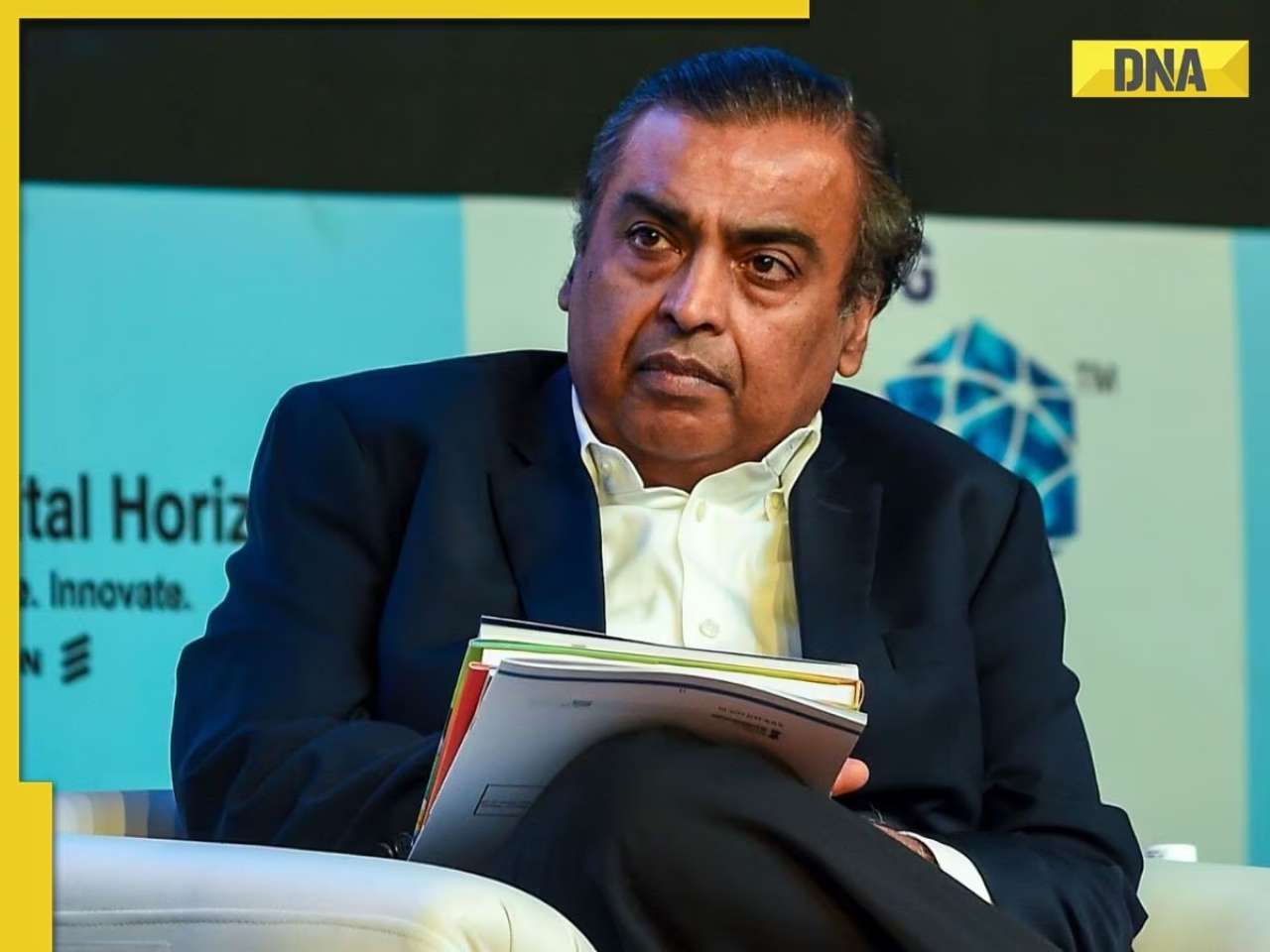

OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are... This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at...

This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at... Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs...

Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs... Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is...

Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is... Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires

Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara

Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style

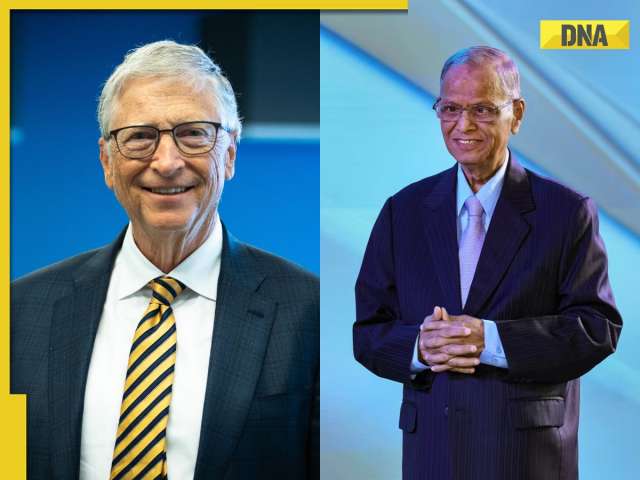

From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others

Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025

In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025 From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas

From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured

Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from...

Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from... PM Modi issues BIG statement on India-UK trade deal, says, 'It shows growing trust of...'

PM Modi issues BIG statement on India-UK trade deal, says, 'It shows growing trust of...' SHOCKING! 1-year-old child bites cobra to death in THIS state: 'He was spotted with...'

SHOCKING! 1-year-old child bites cobra to death in THIS state: 'He was spotted with...' India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...'

India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...' After IAS Jagrati Awasthi, marksheet of UPSC topper AIR 3 Donuru Ananya Reddy goes viral, she scored highest in...

After IAS Jagrati Awasthi, marksheet of UPSC topper AIR 3 Donuru Ananya Reddy goes viral, she scored highest in... Meet man, son of tea seller, who cracked UPSC exam thrice without any coaching to become IAS officer, his AIR was..., he is currently posted in...

Meet man, son of tea seller, who cracked UPSC exam thrice without any coaching to become IAS officer, his AIR was..., he is currently posted in... Indian Army Agniveer CEE 2025 result declared, here's how you can download it

Indian Army Agniveer CEE 2025 result declared, here's how you can download it Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS...

Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS... Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from...

Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)