The government’s increased stake over the years was a result of necessary capital infusions to mitigate significant debt-related losses

Initially a financial institution, IDBI transitioned into a bank, with the government now planning to sell a 60.7% stake

A looming question over the financial world: who will take control of IDBI Bank? As the suspense builds, the path to privatisation of this government sector bank is now clear. Three potential buyers have emerged, each receiving fit and proper certificates from the Reserve Bank of India (RBI). The front-runners in this high-stakes race are Fairfax Financial, led by Indian-origin Canadian banker Prem Watsa, Emirates NBD, and Kotak Mahindra Bank. Among these, Fairfax Financial is leading the charge.

IDBI Bank, with the government holding a 45.5% stake and LIC owning more than 49%, has long been on the privatisation list. Initially a financial institution, IDBI transitioned into a bank, with the government now planning to sell a 60.7% stake—comprising 30.5% from the government and 30.2% from LIC. Currently valued at around Rs 1,08,814.31 crore, experts suggest that privatisation will proceed smoothly given IDBI's private entity status. The government’s increased stake over the years was a result of necessary capital infusions to mitigate significant debt-related losses.

Eyes are now on the Department of Investment and Public Asset Management (DIPAM) Secretary Tuhin Kant Pandey’s recent announcement. In a recent interview, Pandey indicated that the strategic sale of IDBI Bank is on track to conclude this year. The RBI is currently evaluating the shortlisted bidders for their fit and proper status. Once cleared, these bidders will gain access to exclusive IDBI Bank information in a virtual data room to conduct due diligence.

With the financial year's end approaching, the strategic sale of IDBI Bank is expected to reach its conclusion, marking a significant shift in India's banking landscape. The suspense continues as stakeholders and the public await the final decision that will shape the future of IDBI Bank.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Cheating case filed against Malayalam actor Nivin Pauly, director Abrid Shine for this reason

Cheating case filed against Malayalam actor Nivin Pauly, director Abrid Shine for this reason Good news for Azim Premji as Wipro beats estimates, its Q1 FY26 net profit rises to Rs...

Good news for Azim Premji as Wipro beats estimates, its Q1 FY26 net profit rises to Rs... IND vs ENG 4th Test: No win in 89 years, dismissed twice in a day; Can Shubman Gill's men end India's Old Trafford jinx?

IND vs ENG 4th Test: No win in 89 years, dismissed twice in a day; Can Shubman Gill's men end India's Old Trafford jinx? Connie Francis, whose 1962 song Pretty Little Baby is now a viral sensation, dies at 87

Connie Francis, whose 1962 song Pretty Little Baby is now a viral sensation, dies at 87 Pepe Price Prediction: 10x Still In Sight, But Analysts Say This Token Has More Room To Run

Pepe Price Prediction: 10x Still In Sight, But Analysts Say This Token Has More Room To Run Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!'

Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!' Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News

Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row

Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall

Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video

Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video Good news for Azim Premji as Wipro beats estimates, its Q1 FY26 net profit rises to Rs...

Good news for Azim Premji as Wipro beats estimates, its Q1 FY26 net profit rises to Rs... Tata Sons carries forward Ratan Tata's legacy, to invest $400 million in ..., details here

Tata Sons carries forward Ratan Tata's legacy, to invest $400 million in ..., details here Meet woman, daughter of Malaysia’s richest man, who studied at Harvard, now set to lead Rs 18852 crore empire as...

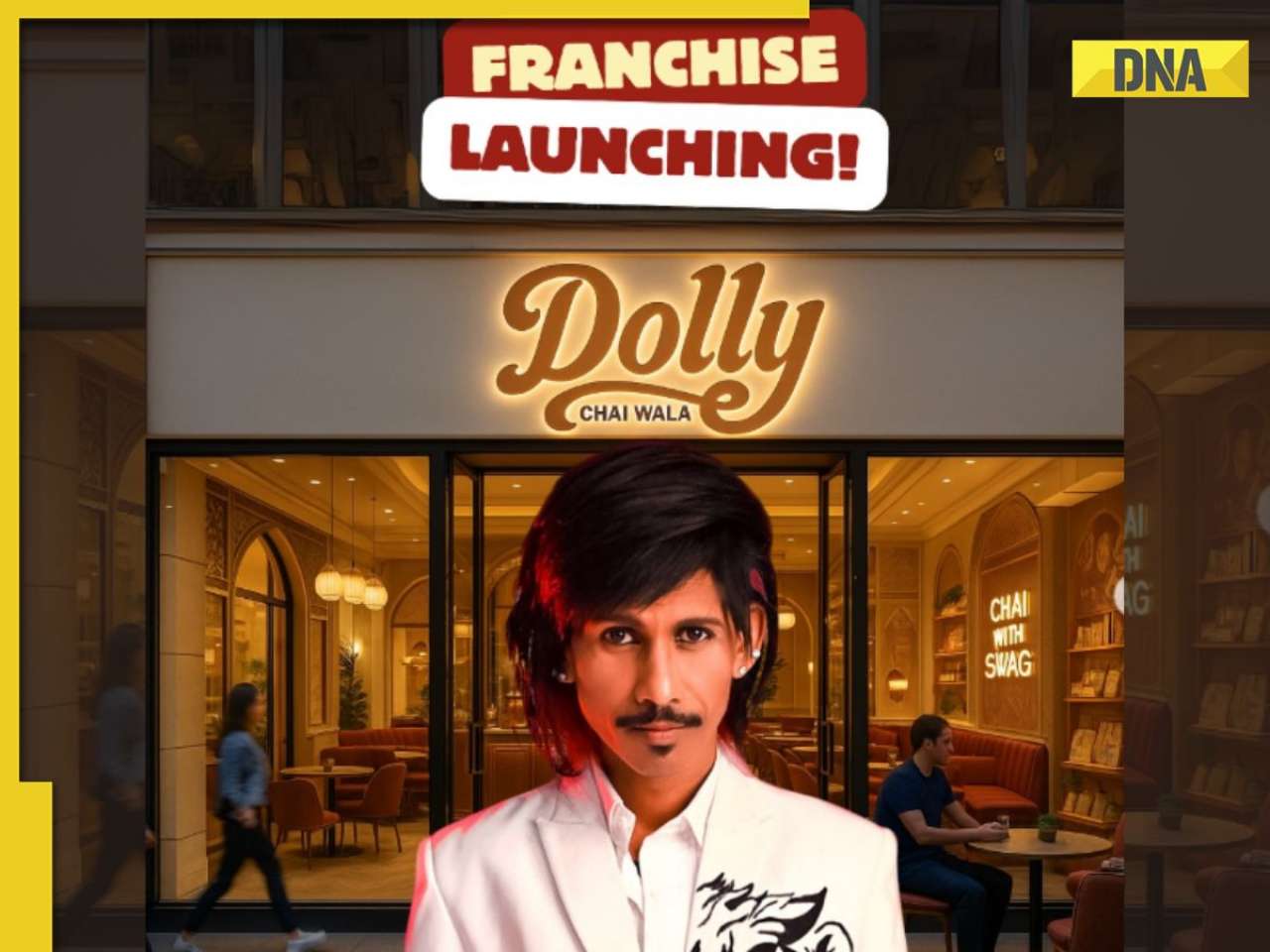

Meet woman, daughter of Malaysia’s richest man, who studied at Harvard, now set to lead Rs 18852 crore empire as... Dolly Chaiwala is expanding 'Dolly ki Tapri', over 1600 have applied in just 2 days, the cost of the franchise model is Rs...

Dolly Chaiwala is expanding 'Dolly ki Tapri', over 1600 have applied in just 2 days, the cost of the franchise model is Rs... Sunil Mittal makes BIG move as Airtel teams up with Perplexity offering FREE subscription of...; check details

Sunil Mittal makes BIG move as Airtel teams up with Perplexity offering FREE subscription of...; check details Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics

Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions

In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels

From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple

Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple Pehla Tu Duja Tu, Po Po and other Ajay Devgn’s most meme-worthy dance moments

Pehla Tu Duja Tu, Po Po and other Ajay Devgn’s most meme-worthy dance moments IndiGo Delhi-Imphal flight returns shortly after takeoff due to mid-air technical snag

IndiGo Delhi-Imphal flight returns shortly after takeoff due to mid-air technical snag  Who was Chandan Mishra? Bihar gangster who was shot dead by 5 gunmen in Patna hospital

Who was Chandan Mishra? Bihar gangster who was shot dead by 5 gunmen in Patna hospital Nimisha Priya case: Victim's family refuses to pardon her, will Kerala nurse be executed? Islamic Laws say...

Nimisha Priya case: Victim's family refuses to pardon her, will Kerala nurse be executed? Islamic Laws say... Uttar Pradesh flood alert: Ganga water level rises in Varanasi, Prayagraj and other districts of UP after heavy rainfall

Uttar Pradesh flood alert: Ganga water level rises in Varanasi, Prayagraj and other districts of UP after heavy rainfall At least 60 killed in massive fire at Iraq shopping mall, horrific video surfaces

At least 60 killed in massive fire at Iraq shopping mall, horrific video surfaces Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is...

Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

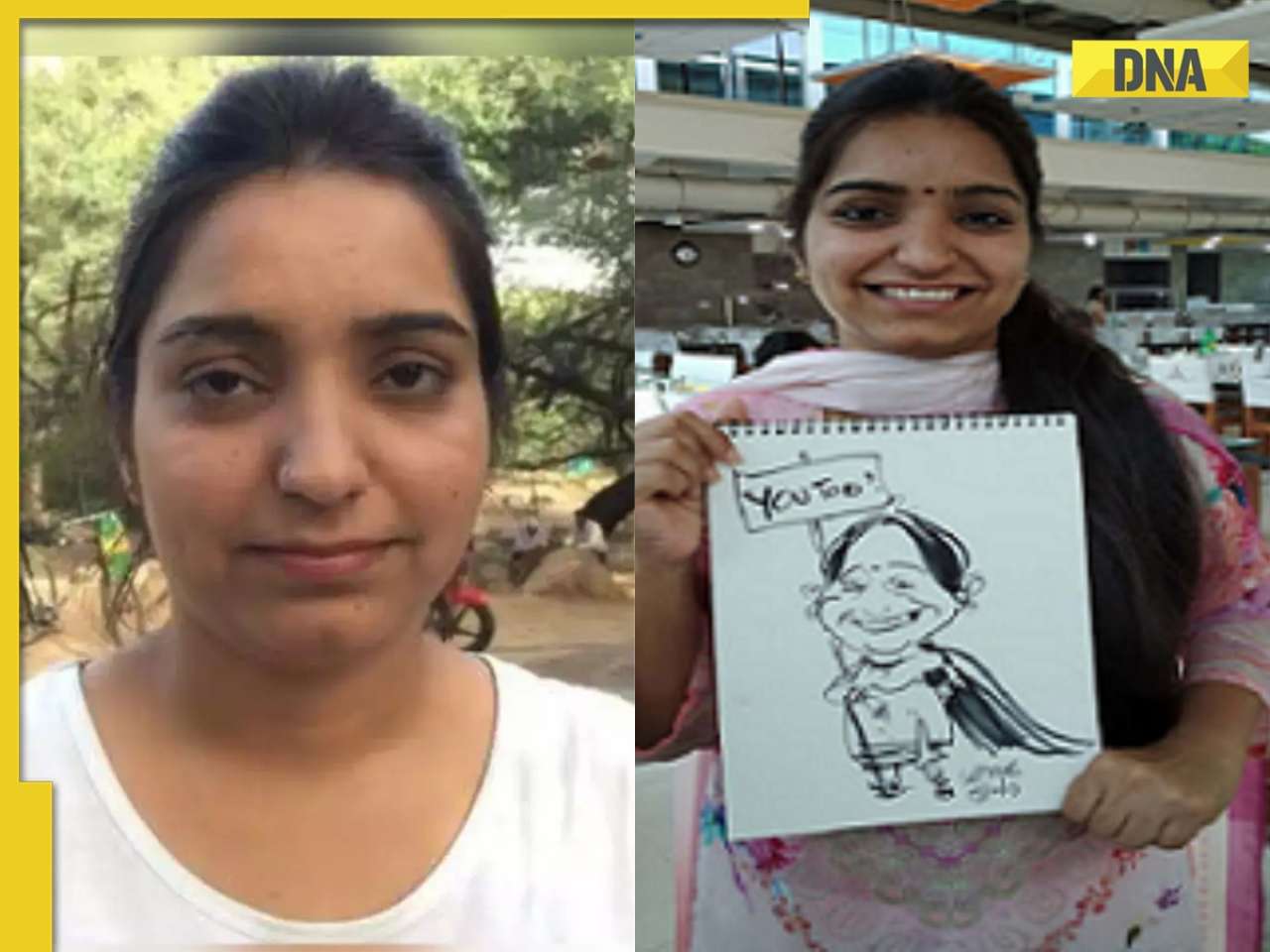

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to... Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is...

Meet woman, daughter of DTC bus driver, a JNU alumna who battled financial woes, later cracked UPSC with AIR..., she is... Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is...

Meet woman, DU grad, who cleared UPSC in her last attempt with AIR..., later became IAS officer, is 'perfect example of beauty with brain', she is... CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details

CBSE pushes for 'Oil Boards’, healthy meals in new circular to schools: Check details This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)