The framework comes days after Sebi came out with its study on Futures & Option (F&O) segment.

To curb speculative trading, markets regulator, Sebi has put in place a stricter framework for equity index derivatives by increasing the minimum contract size and mandating upfront collection of option premiums. Other measures announced by Sebi included intra-day monitoring of position limits, removal of calendar spread benefit on expiry day, rationalisation of weekly index derivatives and increased tail risk coverage.

These measures, aimed at protecting investors and maintaining market stability, particularly in the high-risk environment of index options trading on expiry days, will become effective in a phased manner starting November 20, Sebi said in its circular. The framework comes days after Sebi came out with its study on Futures & Option (F&O) segment.

Sebi study on F&O

A recent Sebi study found that 93 per cent of over 1 crore individual traders in the F&O segment lost an average of around Rs 2 lakh each (including transaction costs) between FY22 and FY24. The total losses of these traders exceeded Rs 1.8 lakh crore during this period. The report also highlighted that the percentage of loss-making traders increased from 89 per cent in FY22.

Sebi's new circular

In its circular issued on Tuesday, Sebi has increased the minimum contract size for index derivatives to Rs 15-20 lakh, up from Rs 5-10 lakh, which was last set in 2015. This was aimed at better aligning with market growth.

"It has been decided that a derivative contract shall have a value not less than Rs 15 lakh at the time of its introduction in the market. Further, the lot size shall be fixed in such a manner that the contract value of the derivative on the day of review is within Rs 15 lakh to Rs 20 lakh," Sebi said.

READ | Days after reducing debt, Anil Ambani's company clears Rs 2930 crore plan

On rationalisation of weekly index derivatives, Sebi said exchanges can offer weekly expiry derivatives only for one benchmark index to curb speculative trading. Further, an additional 2 per cent margin (ELM) will be levied on short options contracts on the day of expiry to address speculative risks. This adjustment, effective from November 20 ensures that the higher leverage and risks in derivatives align with market growth and maintain suitability for participants.

Additionally, Sebi said option buyers will need to pay the full premium upfront to avoid excessive leverage, besides benefit of offsetting positions across different expiries will not be allowed on the day of expiry from February 1. Further, stock exchanges will monitor position limits during the day, with at least four random snapshots to detect breaches, starting April 1. However, the circular was silent on rationalisation of strike prices proposed in the consultation paper.

(Except for the headline, this story has not been edited by DNA staff and is published from PTI)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Dhamaal 4 on the floors, Ajay Devgn shares first look of Adi Arshad Warsi, Manav Javed Jaffrey, team wraps first schedule

Dhamaal 4 on the floors, Ajay Devgn shares first look of Adi Arshad Warsi, Manav Javed Jaffrey, team wraps first schedule Tahawwur Rana, 26/11 Mumbai attack plotter, lands in India; MHA appoints Narender Mann as special public prosecutor

Tahawwur Rana, 26/11 Mumbai attack plotter, lands in India; MHA appoints Narender Mann as special public prosecutor Meet man who sells Rs 34 lakh watches worn by Anant Ambani, Salman Khan with Lord Ram, Lord Hanuman motifs, he is not Hindu, Muslim, Christian, his religion is…

Meet man who sells Rs 34 lakh watches worn by Anant Ambani, Salman Khan with Lord Ram, Lord Hanuman motifs, he is not Hindu, Muslim, Christian, his religion is… Homeopathy: Your first line of treatment

Homeopathy: Your first line of treatment US man uses 7 tigers as 'emotional support' animals at home, says he doesn't need permits; arrested

US man uses 7 tigers as 'emotional support' animals at home, says he doesn't need permits; arrested किसी भी वक्त दिल्ली पहुंच सकता है आतंकी तहव्वुर राणा, राजधानी में सख्त पहरा, इस मेट्रो स्टेशन के 2 गेट बंद

किसी भी वक्त दिल्ली पहुंच सकता है आतंकी तहव्वुर राणा, राजधानी में सख्त पहरा, इस मेट्रो स्टेशन के 2 गेट बंद कौन हैं नरेंद्र मान? तहव्वुर राणा के खिलाफ सरकारी वकील नियुक्त, केंद्रीय गृह मंत्रालय ने सौंपी बड़ी जिम्मेदारी

कौन हैं नरेंद्र मान? तहव्वुर राणा के खिलाफ सरकारी वकील नियुक्त, केंद्रीय गृह मंत्रालय ने सौंपी बड़ी जिम्मेदारी  एयर इंडिया एक्सप्रेस के पायलट की कार्डियक अरेस्ट से मौत, हाल ही में हुई थी शादी, श्रीनगर से दिल्ली फ्लाइट कराई थी लैंड

एयर इंडिया एक्सप्रेस के पायलट की कार्डियक अरेस्ट से मौत, हाल ही में हुई थी शादी, श्रीनगर से दिल्ली फ्लाइट कराई थी लैंड चीन पर टैरिफ को 125% तक बढ़ाने के पीछे ट्रंप की मंशा क्या, ड्रैगन की कमर तोड़ने या अपने पैर पर कुल्हाड़ी मारने की तैयारी

चीन पर टैरिफ को 125% तक बढ़ाने के पीछे ट्रंप की मंशा क्या, ड्रैगन की कमर तोड़ने या अपने पैर पर कुल्हाड़ी मारने की तैयारी 'ब्लॉक हूं फिर भी हर तीन दिन में...', बेटे से अलग होने पर इमोशनल हुए शिखर धवन, बात न होने पर ऐसे किया रिएक्ट

'ब्लॉक हूं फिर भी हर तीन दिन में...', बेटे से अलग होने पर इमोशनल हुए शिखर धवन, बात न होने पर ऐसे किया रिएक्ट RCB vs DC IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Royal Challengers Bengaluru vs Delhi Capitals Royal Challengers Bengaluru vs Delhi Capitals IPL 2025 LIVE Streaming Details: When and where to watch RCB vs DC match 24 live on TV, online?

Royal Challengers Bengaluru vs Delhi Capitals IPL 2025 LIVE Streaming Details: When and where to watch RCB vs DC match 24 live on TV, online? GT vs RR, IPL 2025: Sai Sudharsan, Prasidh Krishna shine as Gujarat Titans beat Rajasthan Royals by 58 runs in Ahmedabad

GT vs RR, IPL 2025: Sai Sudharsan, Prasidh Krishna shine as Gujarat Titans beat Rajasthan Royals by 58 runs in Ahmedabad ‘Pretty similar...’: Famous cricket anchor hopes Prithvi Shaw’s return after Shubman Gill, Riyan Parag and Arshdeep Singh stage victories

‘Pretty similar...’: Famous cricket anchor hopes Prithvi Shaw’s return after Shubman Gill, Riyan Parag and Arshdeep Singh stage victories 'Bawaal ho jayega': KKR captain Ajinkya Rahane takes a dig at Eden Gardens pitch curator after defeat against LSG

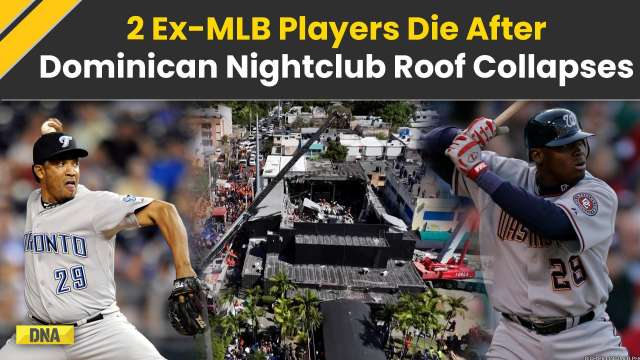

'Bawaal ho jayega': KKR captain Ajinkya Rahane takes a dig at Eden Gardens pitch curator after defeat against LSG  Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased

Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals

Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline

Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident

Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident Waqf Bill: Chirag Paswan Calls It Pro-Poor As Lok Sabha Passes Amendment

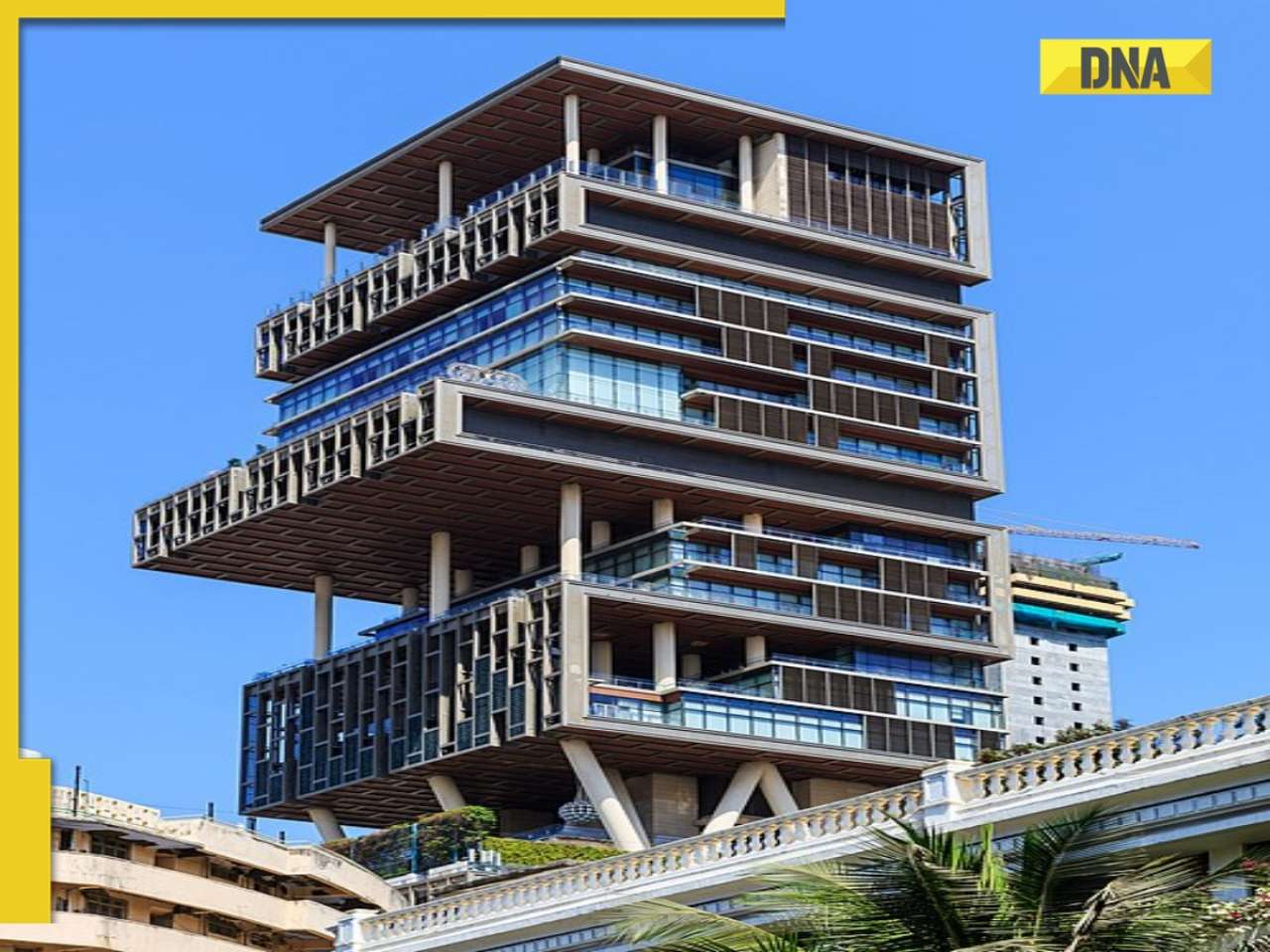

Waqf Bill: Chirag Paswan Calls It Pro-Poor As Lok Sabha Passes Amendment Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building

Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building Iphone maker Apple loses crown as world’s most valuable company, know what went wrong

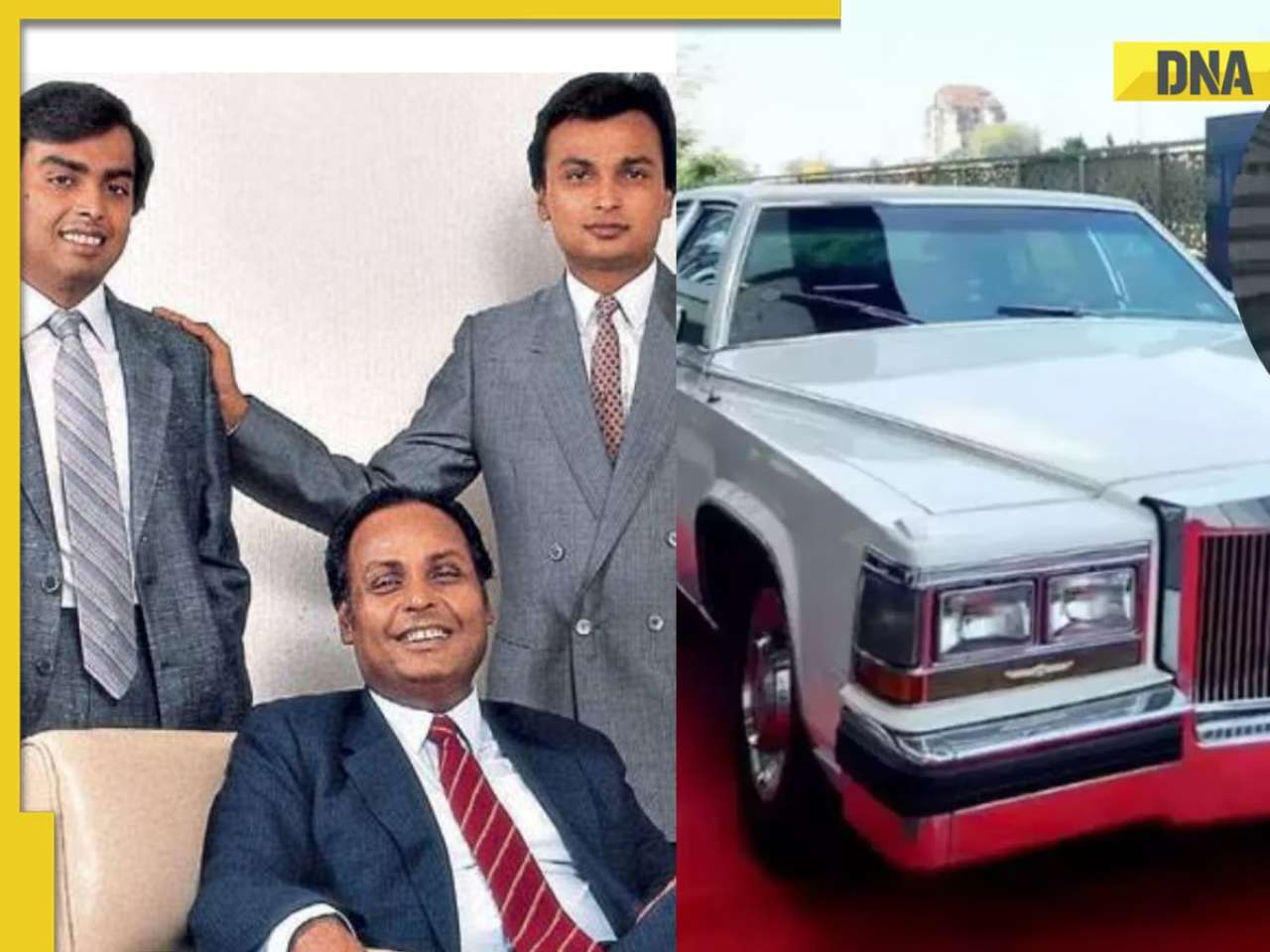

Iphone maker Apple loses crown as world’s most valuable company, know what went wrong Who owns Dhirubhai Ambani's luxury car Cadillac? Not Mukesh Ambani, Anil Ambani but this superstar

Who owns Dhirubhai Ambani's luxury car Cadillac? Not Mukesh Ambani, Anil Ambani but this superstar After Trump tariff pause, Elon Musk, Mark Zuckerberg, Jeff Bezos gain this huge amount in single day

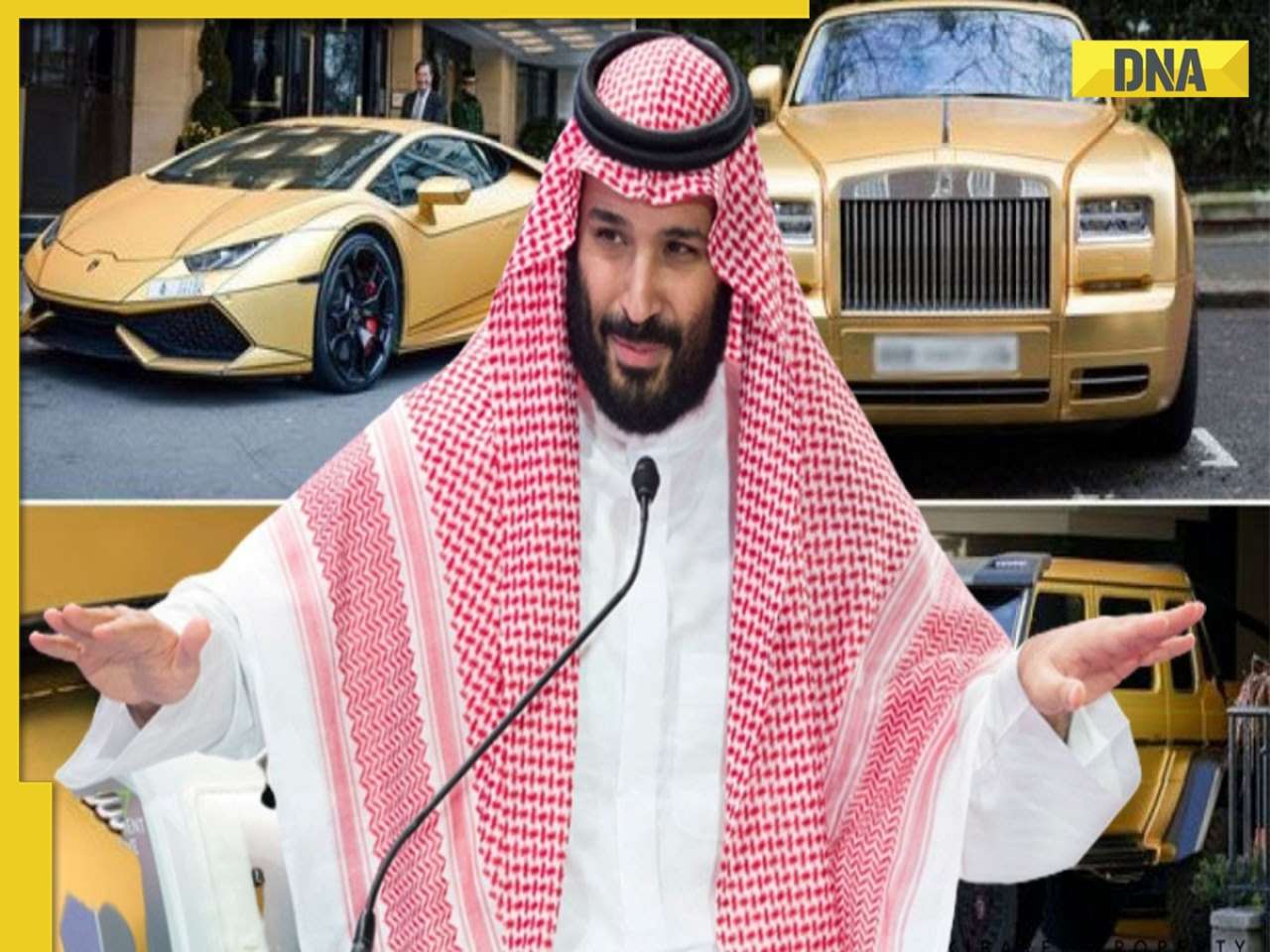

After Trump tariff pause, Elon Musk, Mark Zuckerberg, Jeff Bezos gain this huge amount in single day Meet Saudi Prince MBS, who owns gold-plated supercars, palaces, private jets, his net worth is..., no match for Mukesh Ambani, Elon Musk, Jeff Bezos, Mark Zuckerberg

Meet Saudi Prince MBS, who owns gold-plated supercars, palaces, private jets, his net worth is..., no match for Mukesh Ambani, Elon Musk, Jeff Bezos, Mark Zuckerberg In pics: Step inside Bobby Deol’s Rs 60 crore luxurious Juhu mansion that he shares with Sunny Deol, Dharmendra

In pics: Step inside Bobby Deol’s Rs 60 crore luxurious Juhu mansion that he shares with Sunny Deol, Dharmendra From Kriti Sanon, Anuskha Sharma to Priyanka Chopra: Female Bollywood actors who have turned producers

From Kriti Sanon, Anuskha Sharma to Priyanka Chopra: Female Bollywood actors who have turned producers Ozempic speculations rise: 6 Bollywood celebrities' drastic weight loss sparks concern

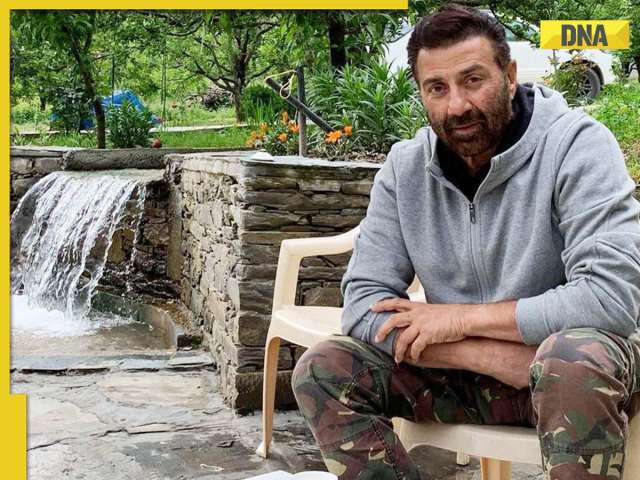

Ozempic speculations rise: 6 Bollywood celebrities' drastic weight loss sparks concern Jaat actor Sunny Deol's Rs 60 crore Mumbai house with private movie theatre, Rs 8 crore Manali farmhouse with wooden interiors and more: A look at his luxurious properties

Jaat actor Sunny Deol's Rs 60 crore Mumbai house with private movie theatre, Rs 8 crore Manali farmhouse with wooden interiors and more: A look at his luxurious properties From Aishwarya Rai Bachchan, Amitabh Bachchan to Vicky Kaushal: 7 Bollywood actors who were severely injured on film sets

From Aishwarya Rai Bachchan, Amitabh Bachchan to Vicky Kaushal: 7 Bollywood actors who were severely injured on film sets Tahawwur Rana, 26/11 Mumbai attack plotter, lands in India; MHA appoints Narender Mann as special public prosecutor

Tahawwur Rana, 26/11 Mumbai attack plotter, lands in India; MHA appoints Narender Mann as special public prosecutor Homeopathy: Your first line of treatment

Homeopathy: Your first line of treatment Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED

Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs...

Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs... Tamil Nadu SHOCKER: Menstruating Class 8 girl forced to sit outside classroom for exam in Coimbatore

Tamil Nadu SHOCKER: Menstruating Class 8 girl forced to sit outside classroom for exam in Coimbatore Meet IAS officer, daughter of a farmer, who cleared UPSC exam on her second attempt without coaching, her AIR was...

Meet IAS officer, daughter of a farmer, who cleared UPSC exam on her second attempt without coaching, her AIR was... Top US Universities report mass visa cancellations for students, know the reason here

Top US Universities report mass visa cancellations for students, know the reason here Meet woman who pursued civil services dream after engineering, cracked UPSC exam to become IPS officer at just...

Meet woman who pursued civil services dream after engineering, cracked UPSC exam to become IPS officer at just... Meet former Miss India who cracked CDS exam to become Indian Army officer, her AIR was...

Meet former Miss India who cracked CDS exam to become Indian Army officer, her AIR was... Who is IAS S Siddharth, whose videos of random school inspection go viral?

Who is IAS S Siddharth, whose videos of random school inspection go viral?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)