- Home

- Latest News

Not Aditya Roy Kapur, but THIS Mahesh Bhatt's discovery was OG choice for Aashiqui 2, he rejected blockbuster because...

Not Aditya Roy Kapur, but THIS Mahesh Bhatt's discovery was OG choice for Aashiqui 2, he rejected blockbuster because... Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by...

Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by... Panchayat actor Aasif Khan discharged from hospital, reveals he didn't suffer heart attack, but...: 'I’ve been told to stop...'

Panchayat actor Aasif Khan discharged from hospital, reveals he didn't suffer heart attack, but...: 'I’ve been told to stop...' Who is Kristin Cabot? Astronomer's HR head caught getting 'cozy' with CEO Andy Bryon at Coldplay concert, she is married to...

Who is Kristin Cabot? Astronomer's HR head caught getting 'cozy' with CEO Andy Bryon at Coldplay concert, she is married to... Saiyaara FIRST REVIEW out: Ahaan Panday, Aneet Padda are 'raw, real, powerful', Mohit Suri creates 'pure magic' with his love story

Saiyaara FIRST REVIEW out: Ahaan Panday, Aneet Padda are 'raw, real, powerful', Mohit Suri creates 'pure magic' with his love story

- WAA 2025

- Webstory

- Videos

Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!'

Russian Woman's Israeli Partner Makes Shocking Claims, Says 'A Daughter Was Born In Goa Cave!' Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News

Delhi Earthquake News: Jhajjar Jolted by Third Quake in a Week, NCS Shares Data | Breaking News Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row

Odisha Bandh Today | Congress-Led Odisha Bandh: What You Need to Know? | Odisha News | College Row Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall

Amarnath Yatra News: Why Amarnath Yatra Suspended From Pahalgam Today? | Baltal Base Camp | Rainfall Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video

Bengaluru Stampede: Karnataka Blames RCB For Stampede, Cites Virat Kohli's Video

- Business

Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in...

Indian billionaire Gautam Adani gets richer by Rs 7150 crore after selling 20% stake in... SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by...

SHOCKING! Microsoft lays off popular game 'Candy Crush' developers due to..., set to be replaced by... Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to...

Bad news for Azim Premji as Delhi HC directs Wipro to pay Rs 200000 to ex-employee due to... ITR Filing 2025: When will you get your refund? What should you do to avoid late refund?

ITR Filing 2025: When will you get your refund? What should you do to avoid late refund? Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in...

Mukesh Ambani's company's profit rises to Rs 325 crore days after acquiring entire stake of India's largest govt bank in...

- Photos

OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar

OTT Releases This Week: Special Ops 2, Kuberaa, Vir Das Fool Volume; latest films, web series to binge-watch on Netflix, Prime Video, JioHotstar Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics

Bollywood actress Ananya Panday steals spotlight in pink Athleisure wear: See Pics In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions

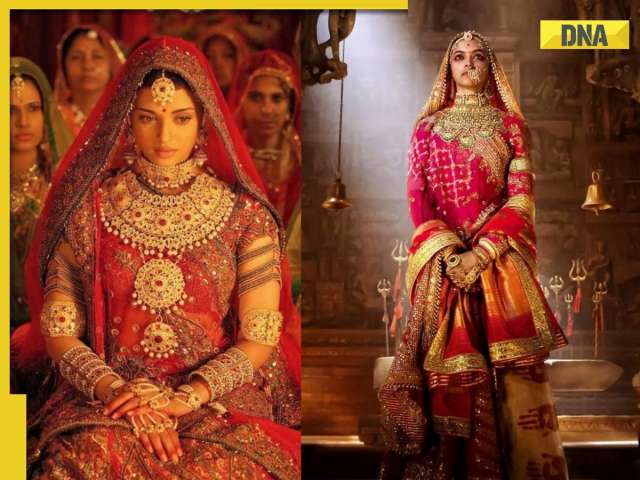

In PICS: Keerthy Suresh turns heads in bold colour rainbow lehenga for upcoming film promotions From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels

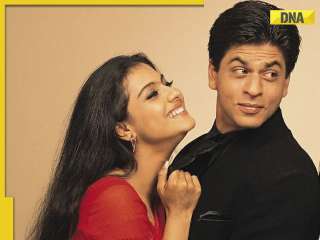

From Padmaavat to Devdas: 5 Bollywood movies that spent crores on costumes and jewels Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple

Shah Rukh Khan-Kajol’s 5 iconic love stories that had 90s kids convinced they were real couple

- India

Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by...

Big tension for Pakistan, China, Indian Army to receive next batch of AK-203 assault rifles, will be delivered by... US takes BIG step on Pahalgam terror attack, declares LeT proxy The Resistance Front as...

US takes BIG step on Pahalgam terror attack, declares LeT proxy The Resistance Front as... India strengthens defence with successful launch of Prithvi-II, Agni-I missiles

India strengthens defence with successful launch of Prithvi-II, Agni-I missiles Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH

Deleted Virat Kohli's video resurfaces after Karnataka government blames RCB for Chinnaswamy stampede, WATCH What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened...

What is Kanwar Yatra, how did it begin? Lord Shiva gulped poison, then THIS happened...

- Education

Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from...

Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from... 'Factory of IAS': This family produced 6 civil servants through generations, it is based in...

'Factory of IAS': This family produced 6 civil servants through generations, it is based in... Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to...

Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to... Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is...

Student from this college bags record-breaking salary package of Rs 1.45 crore first time in 25 years, not IIT Bombay, IIT Delhi, IIM Ahmedabad, it is... Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

Meet woman, as beautiful as any Bollywood actress, cracked UPSC exam but did not become IAS officer due to...

- Automobile

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)