For the entire fiscal (FY25), revenue increased by 2 per cent to Rs 1,00,365 crore and consolidated profit before tax (PBT) up by 16 per cent to Rs 6,533 crore.

Indian billionaire Gautam Adani's flagship company, Adani Enterprises Ltd (AEL), has reported robust financial results. The Adani Group firm recorded net profit surging 7.5 times to Rs 3,845 crore in Q4 FY25 compared to Rs 449 crore in the same period in FY24. The company currently has a market cap of Rs 2.65 lakh crore. Its boss, Gautam Adani, continues to be the second richest man in India. He has a real-time net worth of USD 61.5 billion as per Forbes.

Profit in FY 2024-25

For the entire fiscal (FY25), revenue increased by 2 per cent to Rs 1,00,365 crore and consolidated profit before tax (PBT) up by 16 per cent to Rs 6,533 crore. EBITDA increased by 26 per cent to Rs 16,722 crore last fiscal, driven by continued strong operational performance from incubating businesses, the company said in a statement.

"At Adani Enterprises, we are building businesses that will define the way forward for India's infrastructure and energy sector," said Gautam Adani, Chairman of the Adani Group. "Our robust performance in FY25 is a direct outcome of our strengths in scale, speed and sustainability. Impressive growth across our incubating businesses reflects the power of disciplined execution, future-focused investments and a commitment to operational excellence, innovation and sustainability," said the billionaire industrialist.

READ | BIG blow to Deepinder Goyal as Zomato's Q4 net profit declines 77 per cent, earns only Rs...

In Q4 FY25, Adani New Industries Limited (ANIL) started further expansion of solar cell and module lines for an additional capacity of 6 GW with financial closure secured. In solar manufacturing, module sales increased by 59 per cent (year-on-year) basis to 4,263 MW with higher EBITDA margins on account of improved realisation and operational efficiency.

(With inputs from IANS)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Cambodia, Thailand agree to ceasefire after Donald Trump's intervention, latter has one condition

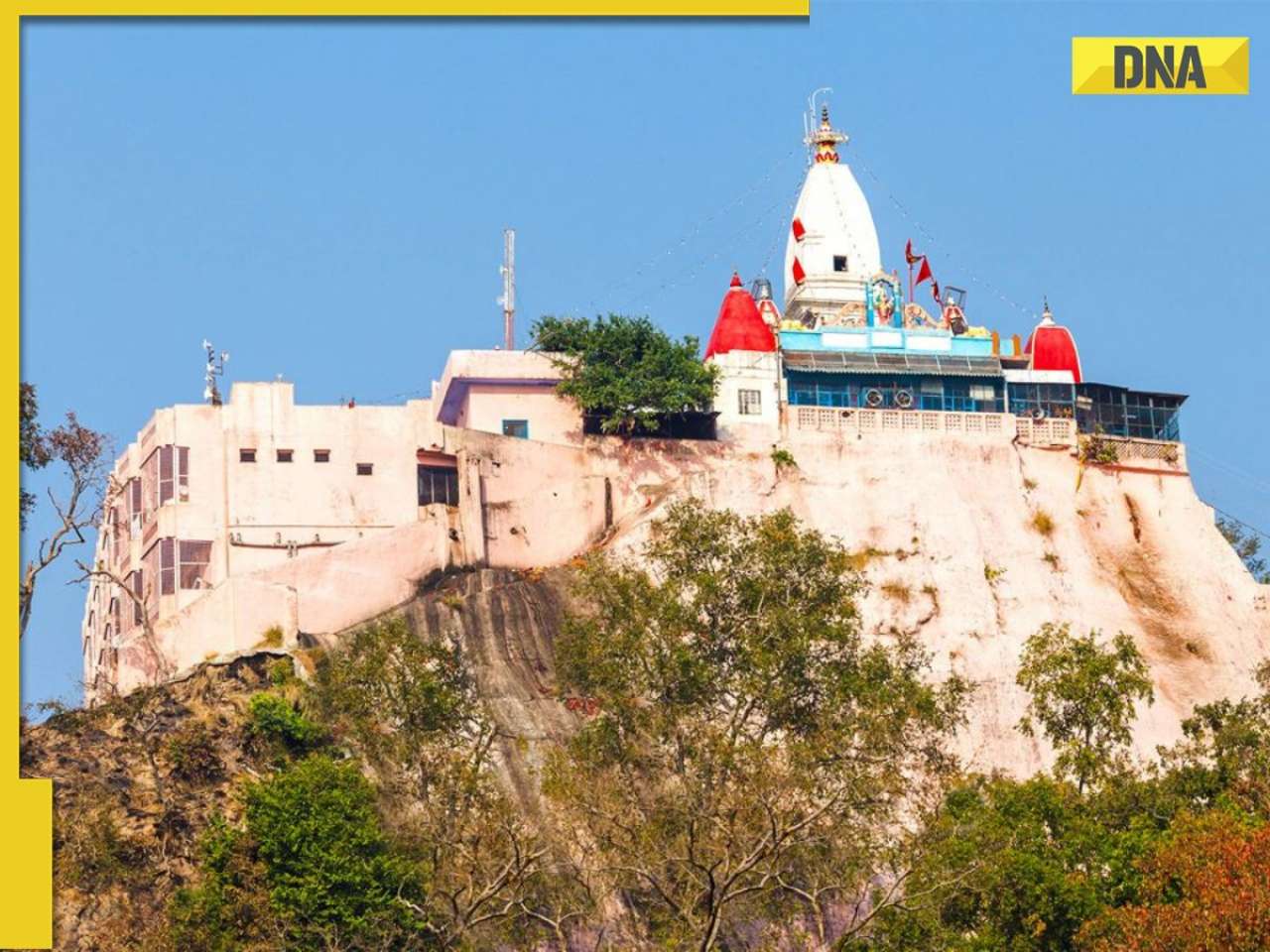

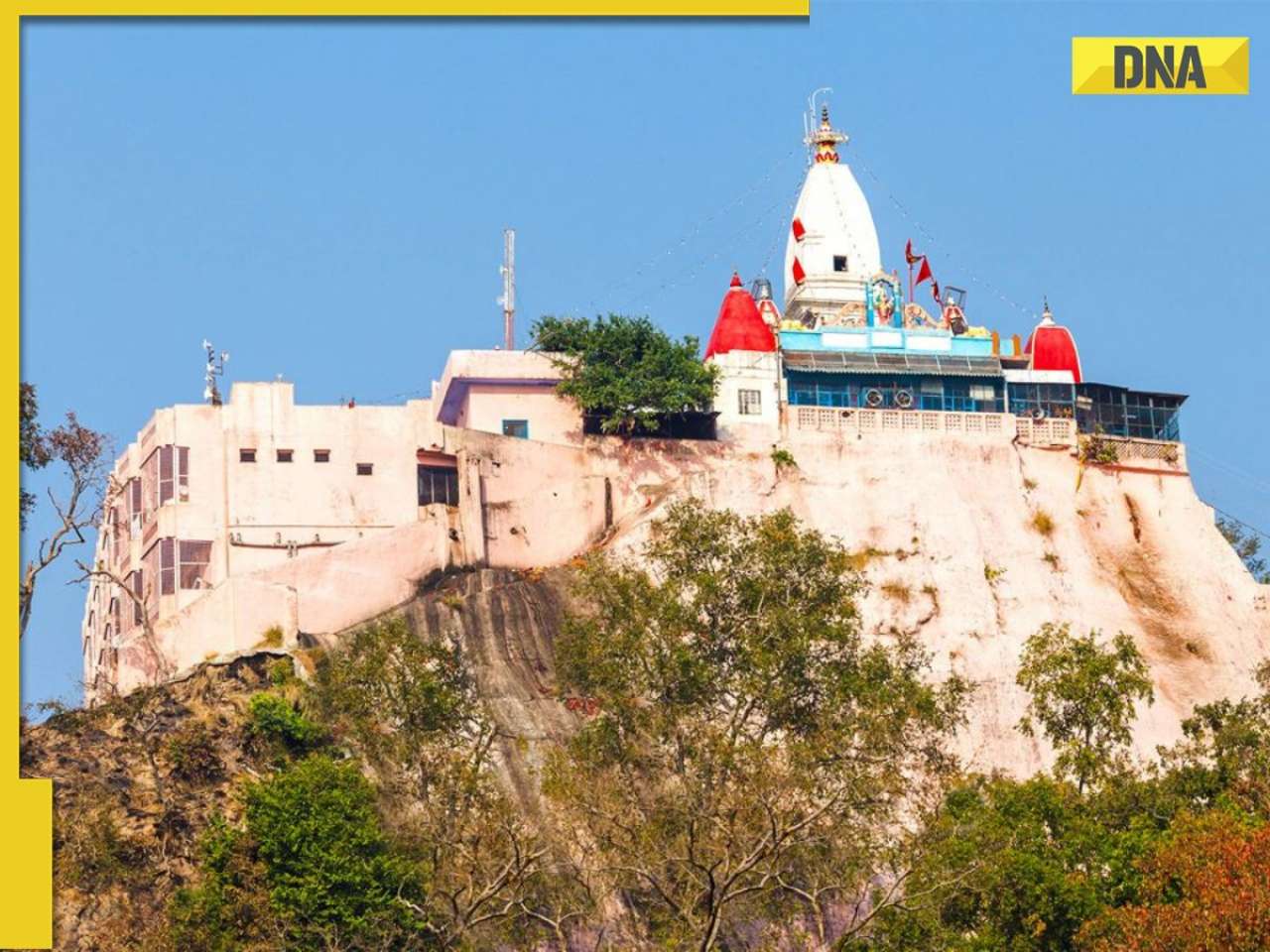

Cambodia, Thailand agree to ceasefire after Donald Trump's intervention, latter has one condition Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured

Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured Pakistan honours US General who praised it for...with prestigious Nishan-e-Imtiaz award, India opposed him for...

Pakistan honours US General who praised it for...with prestigious Nishan-e-Imtiaz award, India opposed him for... Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from...

Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from... Rishabh Pant to bat on day 5 of 4th Test vs England? Batting coach issues BIG update on India's vice captain's availability

Rishabh Pant to bat on day 5 of 4th Test vs England? Batting coach issues BIG update on India's vice captain's availability 7 stunning images of Galactic 'Fossil' captured by NASA

7 stunning images of Galactic 'Fossil' captured by NASA Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods

Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods 7 most captivating space images captured by NASA you need to see

7 most captivating space images captured by NASA you need to see AI-remagined famous Bollywood father-son duos will leave you in splits

AI-remagined famous Bollywood father-son duos will leave you in splits 7 superfoods that boost hair growth naturally

7 superfoods that boost hair growth naturally Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are...

OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are... This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at...

This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at... Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs...

Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs... Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is...

Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is... Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires

Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara

Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style

From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others

Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025

In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025 From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas

From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured

Stampede at Mansa Devi temple in Haridwar, 6 feared dead, several injured Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from...

Japan’s fastest bullet train can cover Delhi to Varanasi in just 3.5 hours, check stoppages, route, will be operational from... PM Modi issues BIG statement on India-UK trade deal, says, 'It shows growing trust of...'

PM Modi issues BIG statement on India-UK trade deal, says, 'It shows growing trust of...' SHOCKING! 1-year-old child bites cobra to death in THIS state: 'He was spotted with...'

SHOCKING! 1-year-old child bites cobra to death in THIS state: 'He was spotted with...' India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...'

India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...' After IAS Jagrati Awasthi, marksheet of UPSC topper AIR 3 Donuru Ananya Reddy goes viral, she scored highest in...

After IAS Jagrati Awasthi, marksheet of UPSC topper AIR 3 Donuru Ananya Reddy goes viral, she scored highest in... Meet man, son of tea seller, who cracked UPSC exam thrice without any coaching to become IAS officer, his AIR was..., he is currently posted in...

Meet man, son of tea seller, who cracked UPSC exam thrice without any coaching to become IAS officer, his AIR was..., he is currently posted in... Indian Army Agniveer CEE 2025 result declared, here's how you can download it

Indian Army Agniveer CEE 2025 result declared, here's how you can download it Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS...

Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS... Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from...

Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from... Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)