The Adani company is the largest private thermal power producer in India. It has a market cap of Rs 2.19 lakh crore.

India's second richest man, Gautam Adani-led Adani Power Ltd (APL) has reported nearly 16 per cent (15.53) decline in consolidated net profit at Rs 3,305 crore for the June quarter. This was mainly impacted by lower merchant tariffs and elevated operating expenses. The Adani Group entity had a net profit (profit after tax) of Rs 3,913 crore in April-June period of 2024-25 financial year, a company statement said.

The profit in the quarter slipped "on account of lower merchant tariffs and elevated operating expenses following acquisitions," it said. However, on a quarter-on-quarter basis, the net profit was higher by 27.1 per cent due to higher one-time income and continuing EBITDA on a sequential basis. In the first quarter, the company said its "continuing total revenue" fell to Rs 14,167 crore from Rs 15,052 crore a year ago, primarily due to lower merchant tariff realisation and import coal prices year-on-year.

Adani Power EBITDA

EBITDA was at Rs 5,744 crore in Q1 FY26 as compared to Rs 6,290 crore in Q1 FY25 supported by moderation in fuel costs despite lower tariffs and higher operating costs on account of recent acquisitions. The company's operating capacity grew from 15,250 MW to 17,550 MW in Q1 FY26 on account of acquisition of the 1,200 MW Moxie Power Generation Ltd (MPGL), 600 MW Korba Power Limited [KPL], and 500 MW Adani Dahanu Thermal Power Station (ADTPS).

It further grew to 18,150 MW in July 2025 upon completion of the acquisition of the 600 MW Vidarbha Industries Power Ltd. The company achieved a plant load factor (PLF) of 67 per cent during the quarter. The Godda power plant has started receiving regular payments from the Bangladesh Power Development Board after the release of USD 437 million in June 2025 and USD 75 million in July 2025.

READ | This IT firm beats Ratan Tata's TCS, Narayana Murthy's Infosys in revenue growth, profit rises 14% to Rs...

Adani Power stock split

It has announced its first-ever stock split in the ratio of 1:5. This means that every single share held by its eligible shareholders will be split into five, without changing the overall value of their holding. In an exchange filing, Adani Power announced that its board of directors has considered and approved the split of one existing equity share of the company with a face value of Rs 10 each into five equity shares with a face value of Rs 2 per share.

Adani Power market cap

Adani Power is a part of the Adani portfolio and is the largest private thermal power producer in India. The company has a market cap of Rs 2.19 lakh crore, as of August 1. Its shares closed at Rs 565.40 on Friday.

(With inputs from PTI)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Indian embassy in Ireland issues BIG advisory for students, citizens amid rise in brutal physical violence, says 'take reasonable...'

Indian embassy in Ireland issues BIG advisory for students, citizens amid rise in brutal physical violence, says 'take reasonable...' Meet woman who left medical to fulfill father’s wish, cracked UPSC, became IPS, then IAS, with AIR...

Meet woman who left medical to fulfill father’s wish, cracked UPSC, became IPS, then IAS, with AIR... ‘She treated him like...': Mumtaz says Rajesh Khanna would have been alive if THIS actress had been in his life

‘She treated him like...': Mumtaz says Rajesh Khanna would have been alive if THIS actress had been in his life Donald Trump orders nuclear submarines to 'appropriate regions' after remarks by former Russian President Medvedev

Donald Trump orders nuclear submarines to 'appropriate regions' after remarks by former Russian President Medvedev US President Donald Trump supports India's possible move to halt Russian oil imports, calls it 'a good step'

US President Donald Trump supports India's possible move to halt Russian oil imports, calls it 'a good step' Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor BIG move by BSNL as it rolls out new plan for just Re 1; check validity, offer, data limit and more

BIG move by BSNL as it rolls out new plan for just Re 1; check validity, offer, data limit and more Elon Musk's Tesla set to open 1st charging station in India on...; check charging speed, price

Elon Musk's Tesla set to open 1st charging station in India on...; check charging speed, price THIS consumer company earns profit of Rs 5,343,00,000,000, details here

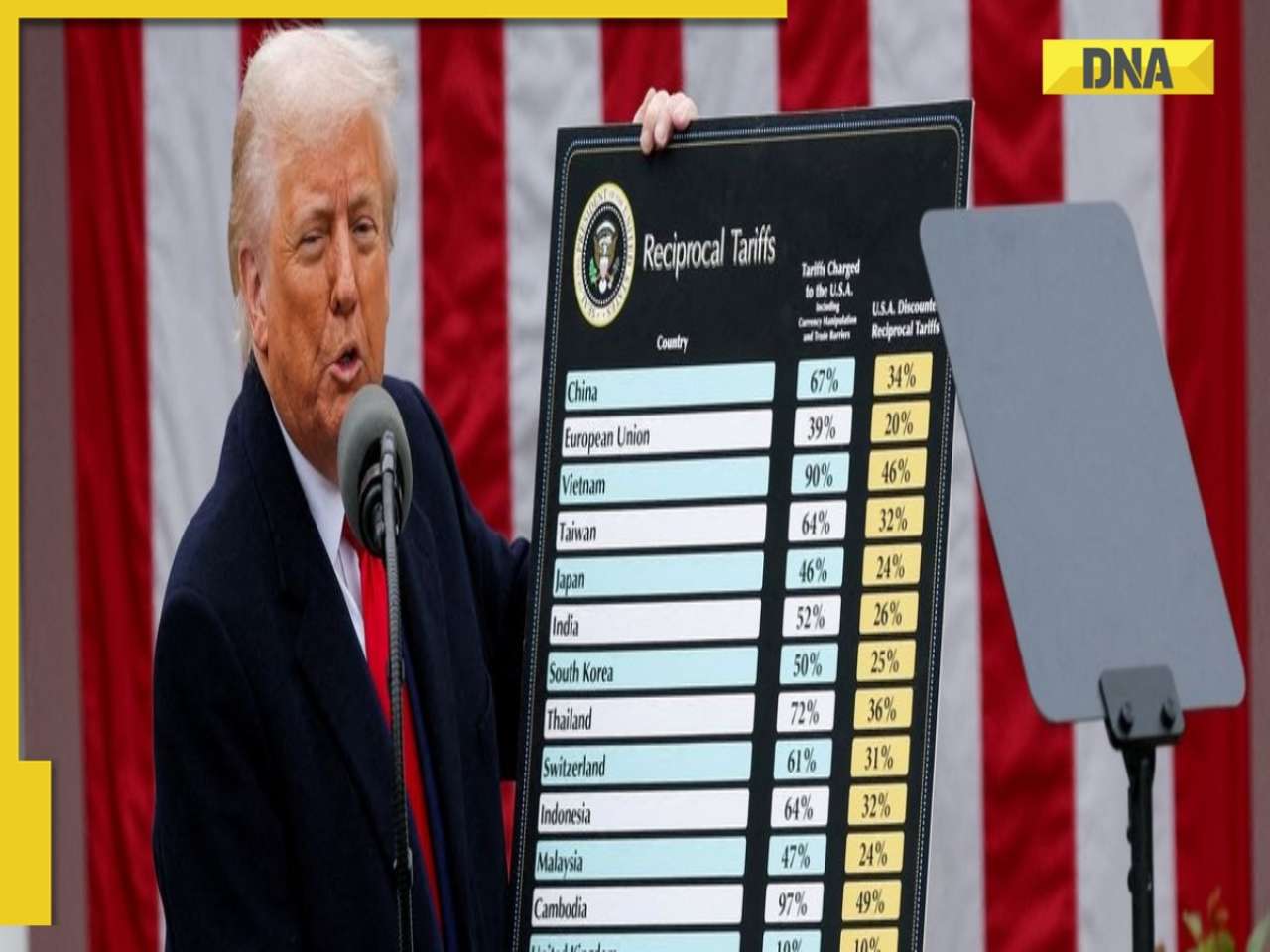

THIS consumer company earns profit of Rs 5,343,00,000,000, details here How may US tariff hit pharmaceuticals, smartphone, farm sectors of India? It may cause loss of ...

How may US tariff hit pharmaceuticals, smartphone, farm sectors of India? It may cause loss of ... Meet man who shut down his AI startup despite BIG funding, even Perplexity's Aravind Srinivas backed off due to...

Meet man who shut down his AI startup despite BIG funding, even Perplexity's Aravind Srinivas backed off due to... 5 stunning cities that went underwater due to...; they are...

5 stunning cities that went underwater due to...; they are... 12th Fail, Jawan, Animal, Ullozhukku, Parking, Sam Bahadur: Where to watch 71st National Awards 2025-winning films on OTT

12th Fail, Jawan, Animal, Ullozhukku, Parking, Sam Bahadur: Where to watch 71st National Awards 2025-winning films on OTT Meet Mrunal Thakur, TV actress who became a Bollywood star, now lives luxuriously, has swanky car collection, her net worth is...

Meet Mrunal Thakur, TV actress who became a Bollywood star, now lives luxuriously, has swanky car collection, her net worth is... From Ajay Devgan, Jaideep Ahlawat to Manoj Bajpayee: Meet India's highest-paid OTT actors

From Ajay Devgan, Jaideep Ahlawat to Manoj Bajpayee: Meet India's highest-paid OTT actors Kiara Advani Birthday Special: 5 ethnic looks that prove she’s true style icon

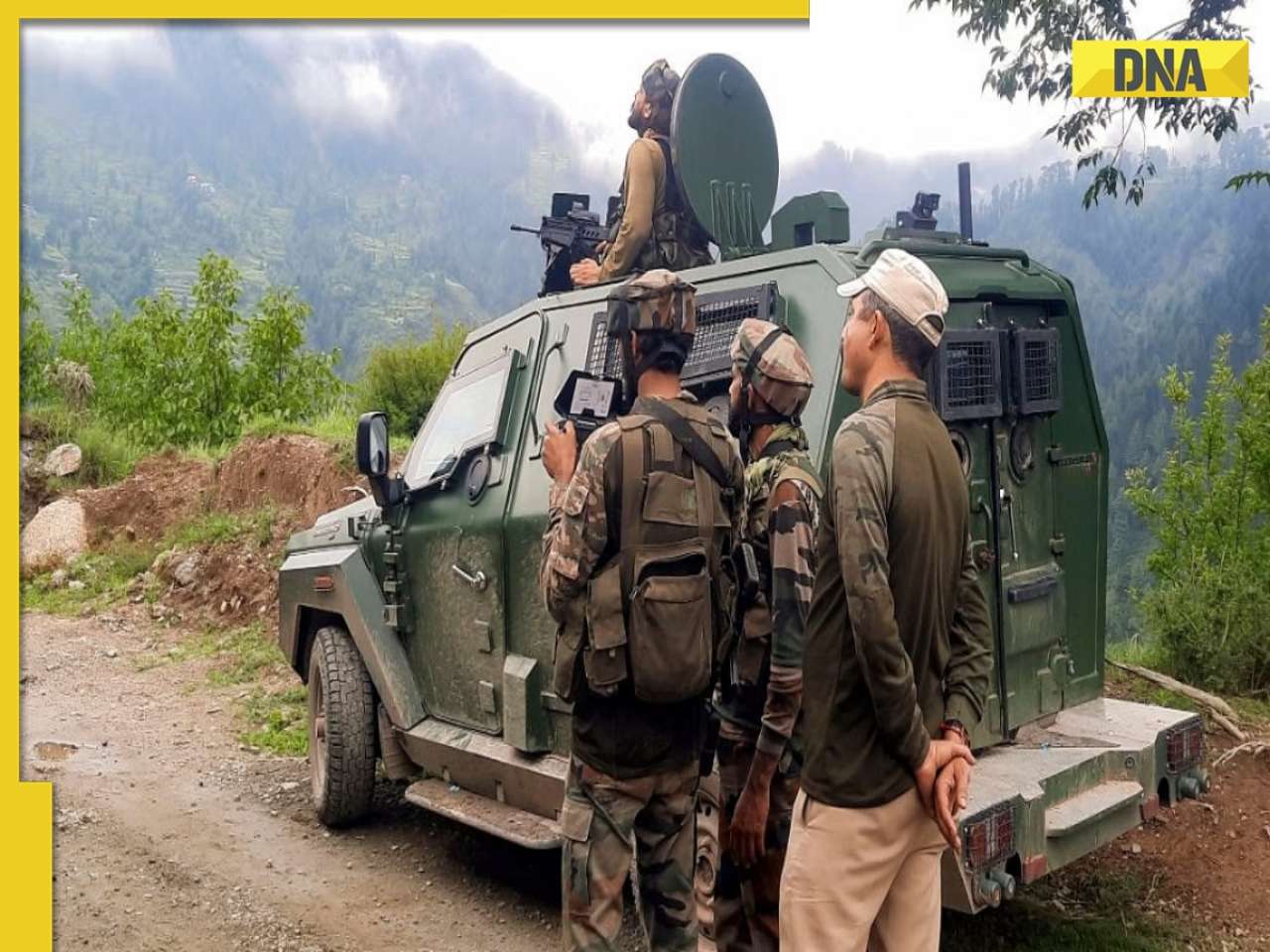

Kiara Advani Birthday Special: 5 ethnic looks that prove she’s true style icon Encounter breaks out between security forces, terrorists in J-K's Kulgam

Encounter breaks out between security forces, terrorists in J-K's Kulgam  India acknowledges ties with US has 'weathered several challenges', expresses commitment to take relationship...

India acknowledges ties with US has 'weathered several challenges', expresses commitment to take relationship... SHOCKING! IndiGo passenger assaulted mid-air due to..., accused handed over to CISF

SHOCKING! IndiGo passenger assaulted mid-air due to..., accused handed over to CISF  Muhammad Yunus' daughter funding secession of India to create 'Greater Bangladesh'? Is Turkey behind Saltanat-e-Bangla?

Muhammad Yunus' daughter funding secession of India to create 'Greater Bangladesh'? Is Turkey behind Saltanat-e-Bangla? Delhi News: Traffic movement on this key flyover to be suspended for 30 days from...; police issue advisory

Delhi News: Traffic movement on this key flyover to be suspended for 30 days from...; police issue advisory Meet woman who left medical to fulfill father’s wish, cracked UPSC, became IPS, then IAS, with AIR...

Meet woman who left medical to fulfill father’s wish, cracked UPSC, became IPS, then IAS, with AIR... Meet woman, 3.5 feet tall IAS officer who was once made fun of, later graduated from DU, cracked UPSC exam on her first attempt, she is...

Meet woman, 3.5 feet tall IAS officer who was once made fun of, later graduated from DU, cracked UPSC exam on her first attempt, she is... CLAT 2026 Notification: Registration begins at consortiumofnlus.ac.in, check application process, eligibility,

CLAT 2026 Notification: Registration begins at consortiumofnlus.ac.in, check application process, eligibility, Meet Noida's first woman DM, Medha Roopam's husband, IIT grad, who cracked UPSC exam with AIR..., now posted as...

Meet Noida's first woman DM, Medha Roopam's husband, IIT grad, who cracked UPSC exam with AIR..., now posted as... IIM CAT 2025 Notification: Registration begins at iimcat.ac.in, check application process, eligibility, other details

IIM CAT 2025 Notification: Registration begins at iimcat.ac.in, check application process, eligibility, other details Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)