Whether you are an individual, a business owner, or part of a government office, this December 2024 tax calendar outlines key dates and responsibilities.

As the year comes to a close, December is a crucial month for taxpayers to meet their financial and compliance obligations. With important deadlines for tax deductions, advance tax payments, and filing returns approaching, proactive planning is vital to avoid penalties and ensure smooth compliance. Whether you are an individual, a business owner, or part of a government office, this December 2024 tax calendar outlines key dates and responsibilities.

In December 2024, important deadlines for income tax filings in India are as follows:

Income Tax Return Filing Deadline: The Central Board of Direct Taxes (CBDT) has extended the deadline for filing income tax returns for the financial year 2023-24 (assessment year 2024-25) to December 15, 2024. This extension specifically applies to taxpayers who are required to furnish reports under Section 92E of the Income Tax Act, which pertains to international transactions.

Form 24G Submission: Government offices must submit Form 24G where TDS/TCS for November 2024 has been paid without a challan.

Third Instalment of Advance Tax: The deadline for the third instalment of advance tax for the assessment year 2025-26.

Issuance of TDS Certificates:

TDS certificates for tax deducted under Section 194-IA for October 2024 must be issued.

TDS certificates for tax deducted under Section 194-IB for October 2024 must be issued.

TDS certificates for tax deducted under Section 194M for October 2024 must be issued.

TDS certificates for tax deducted under Section 194S (by a specified person) for October 2024 must be issued.

Form No. 3BB Submission: Stock exchanges are required to submit the statement in Form No. 3BB regarding transactions with modified client codes registered in the system for November 2024.

General Filing Deadline: For most taxpayers, the original deadline for filing income tax returns was November 30, 2024. However, those who missed this date and are not subject to the special reporting requirements can still file a belated return by December 31, 2024.

Revised Returns: Taxpayers who need to file revised returns can do so until December 31, 2024.

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. Meet IIT grad who worked with Google, now owns company worth Rs 8617 crore, his business is...

Meet IIT grad who worked with Google, now owns company worth Rs 8617 crore, his business is... Meet woman, daughter of street chaat vendor, an IIT graduate who quit job to crack UPSC with AIR..., she is...

Meet woman, daughter of street chaat vendor, an IIT graduate who quit job to crack UPSC with AIR..., she is... IND vs ENG: Gautam Gambhir lauds Ravindra Jadeja's gritty 61 at Lord's, calls him 'difficult to replace'

IND vs ENG: Gautam Gambhir lauds Ravindra Jadeja's gritty 61 at Lord's, calls him 'difficult to replace'  Meet billionaire, son of Padma Bhushan awardee who acquired Sahyadri Hospitals for Rs 6,000 cr; is biggest shareholder of Byju's Aakash, he is...

Meet billionaire, son of Padma Bhushan awardee who acquired Sahyadri Hospitals for Rs 6,000 cr; is biggest shareholder of Byju's Aakash, he is... Rishabh Pant to miss Manchester Test against England? Former head coach Ravi Shastri gives shocking verdict, says...

Rishabh Pant to miss Manchester Test against England? Former head coach Ravi Shastri gives shocking verdict, says... Why do you lose your temper after drinking alcohol, eating Meat? Know 7 ways to manage it

Why do you lose your temper after drinking alcohol, eating Meat? Know 7 ways to manage it Want a healthy liver? Ditch these 7 foods immediately.

Want a healthy liver? Ditch these 7 foods immediately. 7 ancient, powerful Indian superfoods to help you live a longer, healthier life

7 ancient, powerful Indian superfoods to help you live a longer, healthier life What is bathroom camping and why everyone is talking about it

What is bathroom camping and why everyone is talking about it 7 sacred Indian temples where meat, alcohol are offered as 'prasad'

7 sacred Indian temples where meat, alcohol are offered as 'prasad' Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story

Saiyaara: Who Is Ahaan Panday, Ananya’s Cousin, To Debut In YRF’s Mohit Suri Love Story Axiom-4 Mission: Shubhanshu Shukla’s Proud Parents Await His Return Home | ISRO | NASA

Axiom-4 Mission: Shubhanshu Shukla’s Proud Parents Await His Return Home | ISRO | NASA Odisha Girl Self-Immolation Case: 'No Moral Right' BJP's Aparajita Sarangi Slams BJD, Congress

Odisha Girl Self-Immolation Case: 'No Moral Right' BJP's Aparajita Sarangi Slams BJD, Congress Air India Crash: WSJ Report On Air India Crash Sparks Controversy, Ahmedabad Plane Crash

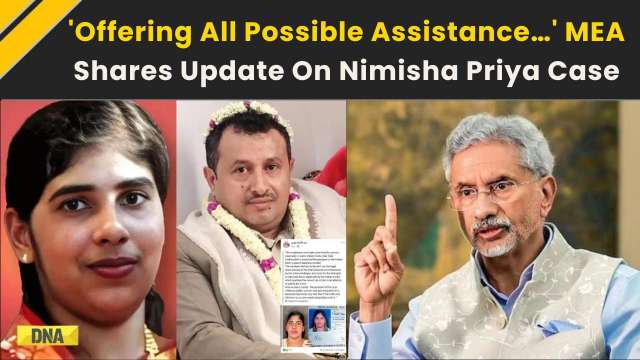

Air India Crash: WSJ Report On Air India Crash Sparks Controversy, Ahmedabad Plane Crash Nimisha Priya Case: MEA Update On Nimisha Priya Case; Yemen Execution Postponed

Nimisha Priya Case: MEA Update On Nimisha Priya Case; Yemen Execution Postponed Meet IIT grad who worked with Google, now owns company worth Rs 8617 crore, his business is...

Meet IIT grad who worked with Google, now owns company worth Rs 8617 crore, his business is... Meet billionaire, son of Padma Bhushan awardee who acquired Sahyadri Hospitals for Rs 6,000 cr; is biggest shareholder of Byju's Aakash, he is...

Meet billionaire, son of Padma Bhushan awardee who acquired Sahyadri Hospitals for Rs 6,000 cr; is biggest shareholder of Byju's Aakash, he is... Astronomer CEO net worth REVEALED: Andy Bryon caught in scandal with HR head on Coldplay's kiss cam, he earns Rs...

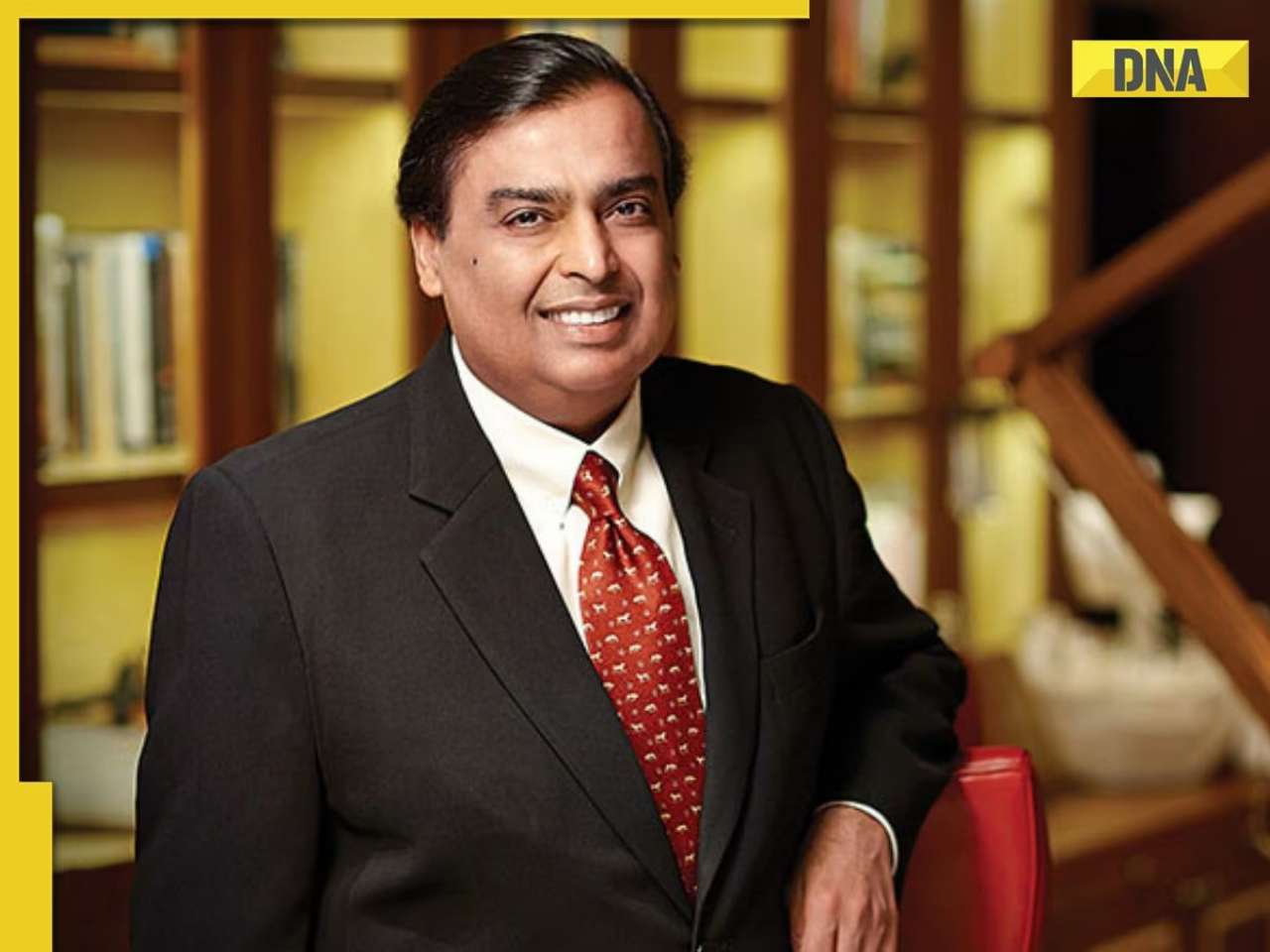

Astronomer CEO net worth REVEALED: Andy Bryon caught in scandal with HR head on Coldplay's kiss cam, he earns Rs... Another masterstroke by Mukesh Ambani, Reliance Retail acquires this company to expand presence in consumer durables, it is...

Another masterstroke by Mukesh Ambani, Reliance Retail acquires this company to expand presence in consumer durables, it is... Shah Rukh Khan, Sidharth Malhotra, Madhuri Dixit, and other big Bollywood stars have invested money in this Rs 36000 crore company, its name is..., founder is...

Shah Rukh Khan, Sidharth Malhotra, Madhuri Dixit, and other big Bollywood stars have invested money in this Rs 36000 crore company, its name is..., founder is... In PICS: Keerthy Suresh in bold rainbow colour lehenga screams 'sarpanch' swag

In PICS: Keerthy Suresh in bold rainbow colour lehenga screams 'sarpanch' swag Malaika Arora's Italy vacation with son Arhaan Khan is all about chic outfits, family time and scenic views, pics go viral

Malaika Arora's Italy vacation with son Arhaan Khan is all about chic outfits, family time and scenic views, pics go viral Sonam Kapoor borrows husband Anand Ahuja's luxurious watch for Wimbledon appearance, cost is Rs...

Sonam Kapoor borrows husband Anand Ahuja's luxurious watch for Wimbledon appearance, cost is Rs... Meet Clare Ratcliffe, beautiful wife of England skipper Ben Stokes, works as a...

Meet Clare Ratcliffe, beautiful wife of England skipper Ben Stokes, works as a... Aishwarya Rai, Karisma Kapoor and other top actresses rejected THIS Shah Rukh Khan film; it turned out to be massive hit, name is...

Aishwarya Rai, Karisma Kapoor and other top actresses rejected THIS Shah Rukh Khan film; it turned out to be massive hit, name is... 'Hounded by this government for last ten years': LoP Rahul Gandhi issues strong statement in support of Robert Vadra amid ED probe

'Hounded by this government for last ten years': LoP Rahul Gandhi issues strong statement in support of Robert Vadra amid ED probe Bad news for China as India hits big jackpot, finds massive deposits of 'Rare Earth Minerals' in this Indian state, it is...

Bad news for China as India hits big jackpot, finds massive deposits of 'Rare Earth Minerals' in this Indian state, it is... Chandan Mishra Murder Case: Who is Tauseef Badshah, gang leader behind killing of gangster in Patna hospital, know all about him

Chandan Mishra Murder Case: Who is Tauseef Badshah, gang leader behind killing of gangster in Patna hospital, know all about him What is INS Nistar? India's first indigenously diving support vessel set to boost Navy's capabilities, to serve as 'mother ship' to...

What is INS Nistar? India's first indigenously diving support vessel set to boost Navy's capabilities, to serve as 'mother ship' to... Bomb scare: More than 20 schools in Delhi receive bomb threats, here's what we know so far

Bomb scare: More than 20 schools in Delhi receive bomb threats, here's what we know so far Meet woman, daughter of street chaat vendor, an IIT graduate who quit job to crack UPSC with AIR..., she is...

Meet woman, daughter of street chaat vendor, an IIT graduate who quit job to crack UPSC with AIR..., she is... Meet woman who left high-paying job at Barclays, prepared for civil services exam, failed twice, later cracked UPSC exam and became IPS officer. her AIR was...

Meet woman who left high-paying job at Barclays, prepared for civil services exam, failed twice, later cracked UPSC exam and became IPS officer. her AIR was... Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from...

Meet woman who chose IFS over IAS even after securing AIR 13 in UPSC exam, she is from... 'Factory of IAS': This family produced 6 civil servants through generations, it is based in...

'Factory of IAS': This family produced 6 civil servants through generations, it is based in... Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to...

Meet man who cracked UPSC exam twice, became first IAS officer from his tribe, hailed as 'Miracle Man' due to... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs... Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from...

Planning to buy a Maruti Suzuki car? Prices set to rise by 4% from... Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

Audi launches Audi RS Q8 2025 in India: Know price, specifications and unique features

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)