Earning less, spending more? If yes, Billionaire Warren Buffett, hailed as 'Oracle of Omaha' has a pro tip for you. He emphasizes that building wealth is not just about earning more, it's about spending smartly.

Earning less, spending more? If yes, Billionaire Warren Buffett, hailed as 'Oracle of Omaha' has a pro tip for you. He emphasizes that building wealth is not just about earning more, it's about spending smartly. Warren Buffet, has net worth of 14,200 crores USD (Rs 1190000000000) at the age of 94. So, it is better to listen to his advice, i.e. 'avoid these five common money traps' to secure a strong financial future. Let's dig deeper into these 5 things.

1. Buying a brand new car

The first thing we do after we start earning is to buy a new car, for comfort, for convenience or often for show off. But, Warren Buffett says, no, as it is not the most financially fit decision for many people. Why? As soon as you take the car out of the showroom, it's value begins to depreciate, often by 20-20% in the very first year. And 5 years down the line, the car's original value depreciate up to 60%. Even Warren Buffett follows the same rule, he is known to drive a modest car, a 2014 Cardillac XTS, which he bough on discount. A better investment option is assets, where value appreciates.

2. Credit Card interest

Credit card is often a 'debt trap', where high-interest debt becomes one of he biggest wealth killers. Let's take example of India, here credit card interest rates can exceed 30% annually. This means that carrying a balance of ₹1 lakh could cost you ₹30,000 or more in interest alone each year. Buffet advises that "If you're smart, you don't need to borrow." He says to use credit card for convenience no consumption, a good advice amid the rise of consumerism culture.

3. Say no to Gambling or lottery tickets.

Warren Buffett warns against investing money in gamble or lottery tickets, and refers them a "tax on ignorance", paid by those who don't understand probability. These are just blind bets on luck, and obsession with 'get-wuick-rich' schemes, where people wait for some miracles to occur. They do give momentary thrills but are usually against the players.

4. Houses bigger than you need

Houses are a necessity, but a house bigger than you need is a best way to waste money to boost your ego. Bigger houses mean higher property taxes, maintenance costs, utility bills, and staffing requirements. Warren Buffet says, 'A home should serve your needs, not your ego.' He still lives in the same Omaha house he bought in 1958 for $31,500.

5. Complex investment products

Warren Buffett says, “Never invest in a business you cannot understand.” he says do no invest in financial instruments, convoluted mutual funds, or new-age investment schemes or any related things, if you do not have a full clarity about it. He says investment should have simplicity, focusing on low-cost, long-term investment have more predictable outcomes. So before investing, have a clear knowledge and understanding about it.

Joe Root surpasses Ricky Ponting to become 2nd highest run-scorer in Test history; trails Sachin Tendulkar by...

Joe Root surpasses Ricky Ponting to become 2nd highest run-scorer in Test history; trails Sachin Tendulkar by... Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires

Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires 65-year-old actor and his 37-year-old son have made their directorial debut in 2025, they are...., their first films are...

65-year-old actor and his 37-year-old son have made their directorial debut in 2025, they are...., their first films are... Good news for first-time employees, set to get Rs…; check eligibility and other details

Good news for first-time employees, set to get Rs…; check eligibility and other details 'I was so scared': Woman credits ChatGPT for saving her mother’s life after doctors fail to diagnose

'I was so scared': Woman credits ChatGPT for saving her mother’s life after doctors fail to diagnose Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods

Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods 7 most captivating space images captured by NASA you need to see

7 most captivating space images captured by NASA you need to see AI-remagined famous Bollywood father-son duos will leave you in splits

AI-remagined famous Bollywood father-son duos will leave you in splits 7 superfoods that boost hair growth naturally

7 superfoods that boost hair growth naturally Confused between Forex and Credit cards for your international trip? Learn which saves more

Confused between Forex and Credit cards for your international trip? Learn which saves more Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires

Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires After India-UK FTA, New Delhi to begin talks with THIS country, because...

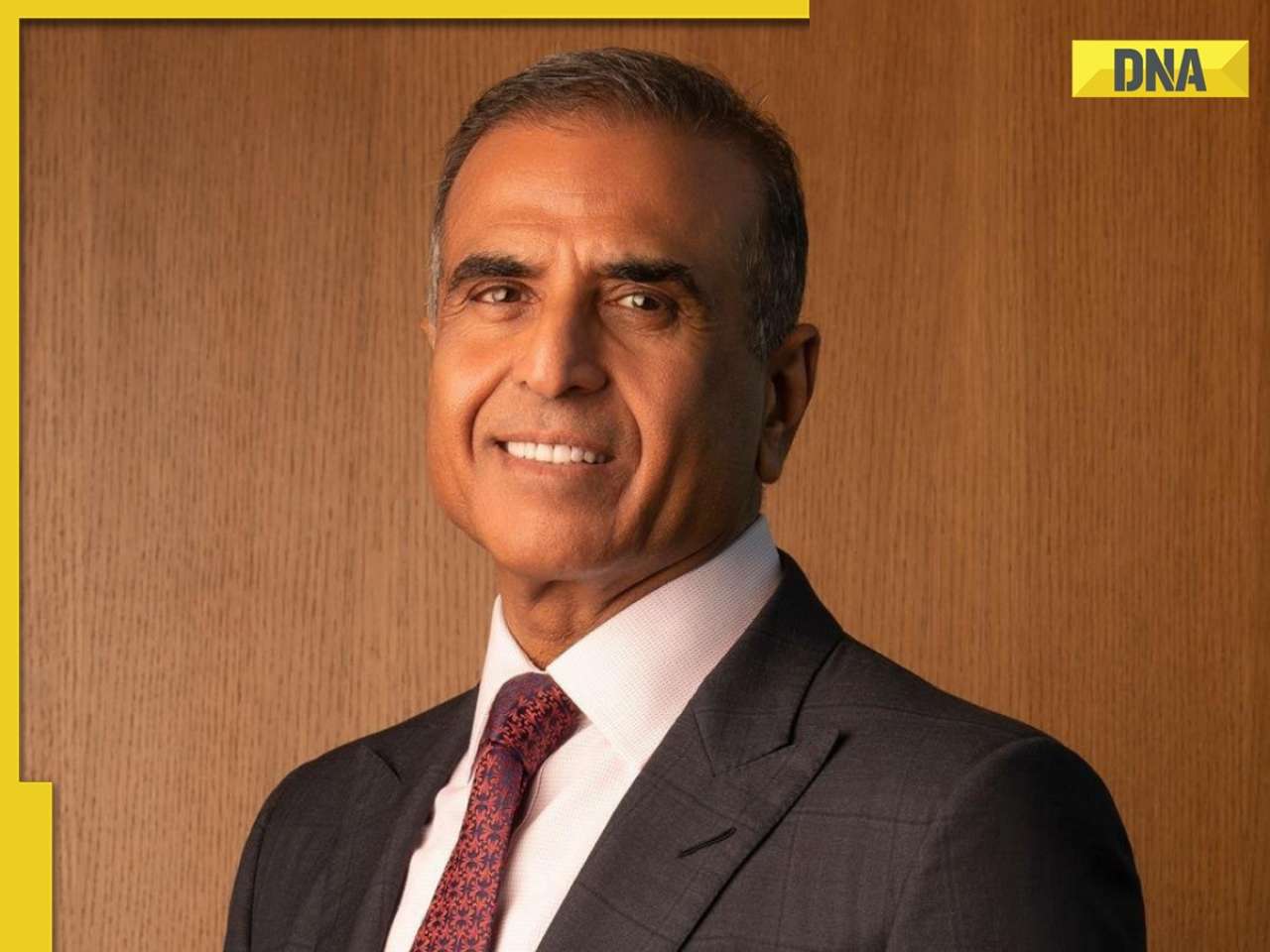

After India-UK FTA, New Delhi to begin talks with THIS country, because... Indian billionaire Sunil Mittal earns Rs 13499163600 profit from this country, not India, UK; net worth reaches Rs...

Indian billionaire Sunil Mittal earns Rs 13499163600 profit from this country, not India, UK; net worth reaches Rs... UPI Alert! New UPI rules to come in effect from..., know how it will affect GPay, PhonePe, Paytm users

UPI Alert! New UPI rules to come in effect from..., know how it will affect GPay, PhonePe, Paytm users  RBI Governor Sanjay Malhotra makes BIG statement on free UPI transactions, says 'some cost...'

RBI Governor Sanjay Malhotra makes BIG statement on free UPI transactions, says 'some cost...' Ashish Chanchlani looks dashing as he drops latest photos from Italy, fans say 'Tom Cruise fail hai aapke saamne'

Ashish Chanchlani looks dashing as he drops latest photos from Italy, fans say 'Tom Cruise fail hai aapke saamne' Are these five vintage car museums in India a must-visit for every automobile lover?

Are these five vintage car museums in India a must-visit for every automobile lover? Riddhima Kapoor Sahni looks dreamy in pastel gold embroidered ensemble as she walks for Suneet Varma at IWC 2025; SEE PICS

Riddhima Kapoor Sahni looks dreamy in pastel gold embroidered ensemble as she walks for Suneet Varma at IWC 2025; SEE PICS Malaika Arora grabs attention with her street style moment, dons oversized denims, white tank top, luxurious mini bag worth Rs…

Malaika Arora grabs attention with her street style moment, dons oversized denims, white tank top, luxurious mini bag worth Rs… Raksha Bandhan 2025: Bollywood's sweetest 'muh-bole' sibling bonds that celebrate rakhi beyond blood

Raksha Bandhan 2025: Bollywood's sweetest 'muh-bole' sibling bonds that celebrate rakhi beyond blood Good news for first-time employees, set to get Rs…; check eligibility and other details

Good news for first-time employees, set to get Rs…; check eligibility and other details Air India sees another mid-air scare as Mumbai-bound flight returns to Jaipur minutes after takeoff due to...

Air India sees another mid-air scare as Mumbai-bound flight returns to Jaipur minutes after takeoff due to... Delhi-Meerut RRTS: Namo Bharat train timings changed for July 27 due to...; to start at...

Delhi-Meerut RRTS: Namo Bharat train timings changed for July 27 due to...; to start at... Indian Railways takes BIG step, successfully tests country's first-ever...; Ashwini Vaishnaw shares update, check details

Indian Railways takes BIG step, successfully tests country's first-ever...; Ashwini Vaishnaw shares update, check details J-K: Agniveer loses life, two soldiers injured in landmine blast near LoC in Poonch

J-K: Agniveer loses life, two soldiers injured in landmine blast near LoC in Poonch Meet woman, daughter of vegetable vendor who cracked UPSC, her mother mortgaged gold for her education, her AIR is…

Meet woman, daughter of vegetable vendor who cracked UPSC, her mother mortgaged gold for her education, her AIR is… Meet woman, who cracked IIT with full-time job, secured impressive AIR of...; now works at Bill Gates' Microsoft as...

Meet woman, who cracked IIT with full-time job, secured impressive AIR of...; now works at Bill Gates' Microsoft as... Meet woman, couldn't speak English, once worked at Ratan Tata's TCS, cleared ISRO, BARC exams; later cracked UPSC with AIR..., she is...

Meet woman, couldn't speak English, once worked at Ratan Tata's TCS, cleared ISRO, BARC exams; later cracked UPSC with AIR..., she is... Meet woman, 'beauty with brain', who left medical studies, cracked UPSC exam not once but twice with AIR..., she is from...

Meet woman, 'beauty with brain', who left medical studies, cracked UPSC exam not once but twice with AIR..., she is from... SBI PO Admit Card 2025 to be released soon at sbi.co.in, know how to download hall tickets

SBI PO Admit Card 2025 to be released soon at sbi.co.in, know how to download hall tickets Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)