- Home

- Latest News

Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED

Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs...

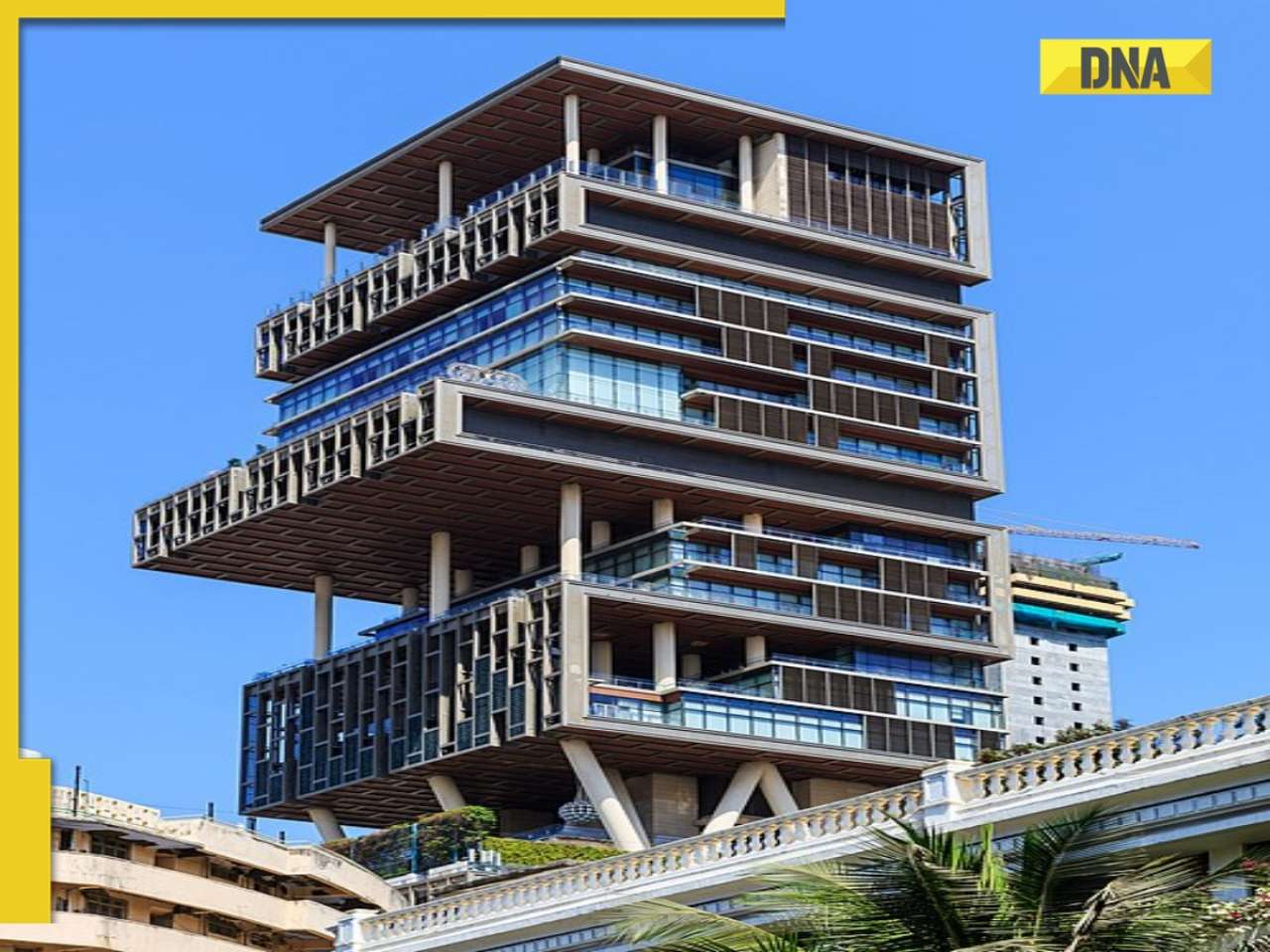

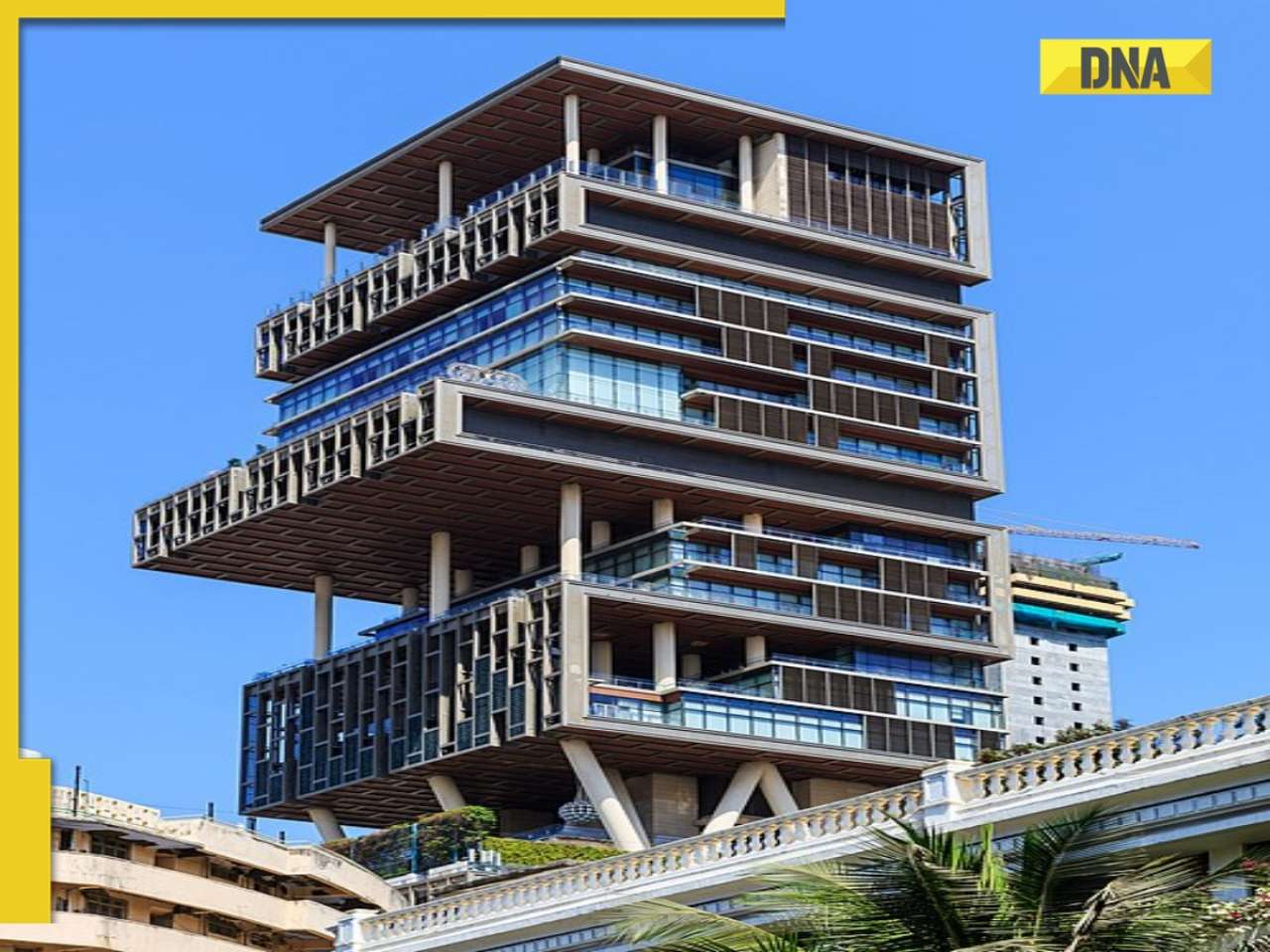

Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs... Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building

Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building Gauahar Khan and Zaid Darbar announce second pregnancy 2 years after welcoming son Zehaan: 'Need your prayers and love'

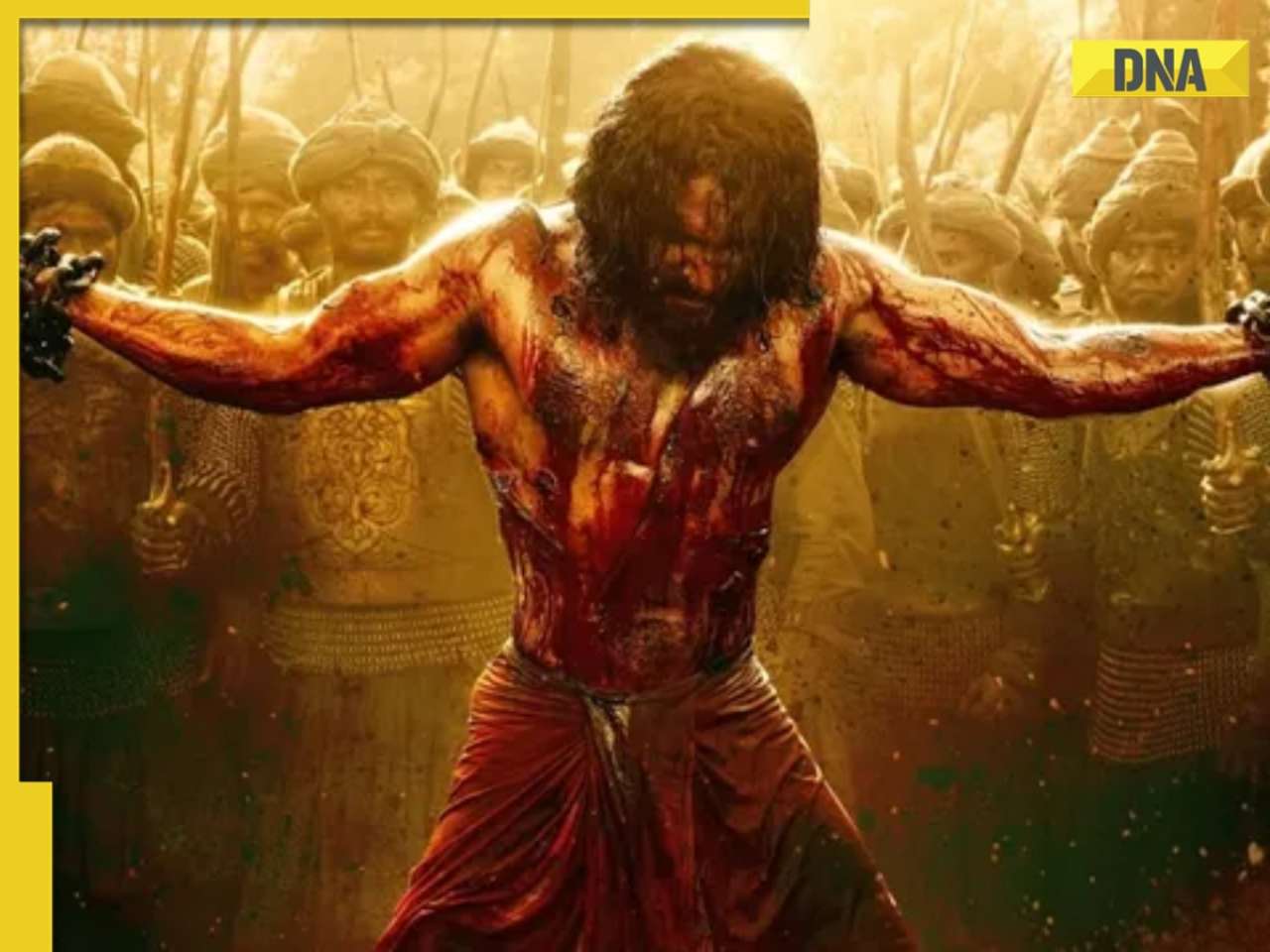

Gauahar Khan and Zaid Darbar announce second pregnancy 2 years after welcoming son Zehaan: 'Need your prayers and love' Chhaava OTT release: Here's when and where you can watch Vicky Kaushal, Rashmika Mandanna, Akshaye Khanna's blockbuster that earned Rs 804 crore

Chhaava OTT release: Here's when and where you can watch Vicky Kaushal, Rashmika Mandanna, Akshaye Khanna's blockbuster that earned Rs 804 crore

- Webstory

- DNA Hindi

किसी भी वक्त दिल्ली पहुंच सकता है आतंकी तहव्वुर राणा, राजधानी में सख्त पहरा, इस मेट्रो स्टेशन के 2 गेट बंद

किसी भी वक्त दिल्ली पहुंच सकता है आतंकी तहव्वुर राणा, राजधानी में सख्त पहरा, इस मेट्रो स्टेशन के 2 गेट बंद कौन हैं नरेंद्र मान? तहव्वुर राणा के खिलाफ सरकारी वकील नियुक्त, केंद्रीय गृह मंत्रालय ने सौंपी बड़ी जिम्मेदारी

कौन हैं नरेंद्र मान? तहव्वुर राणा के खिलाफ सरकारी वकील नियुक्त, केंद्रीय गृह मंत्रालय ने सौंपी बड़ी जिम्मेदारी  चीन पर टैरिफ को 125% तक बढ़ाने के पीछे ट्रंप की मंशा क्या, ड्रैगन की कमर तोड़ने या अपने पैर पर कुल्हाड़ी मारने की तैयारी

चीन पर टैरिफ को 125% तक बढ़ाने के पीछे ट्रंप की मंशा क्या, ड्रैगन की कमर तोड़ने या अपने पैर पर कुल्हाड़ी मारने की तैयारी 'ब्लॉक हूं फिर भी हर तीन दिन में...', बेटे से अलग होने पर इमोशनल हुए शिखर धवन, बात न होने पर ऐसे किया रिएक्ट

'ब्लॉक हूं फिर भी हर तीन दिन में...', बेटे से अलग होने पर इमोशनल हुए शिखर धवन, बात न होने पर ऐसे किया रिएक्ट अपूर्वा मुखीजा ने इंडियाज गॉट लेटेंट शो को लेकर जारी किया वीडियो, काले जादू से लेकर आत्महत्या तक, रो-रोकर सुनाई आपबीती

अपूर्वा मुखीजा ने इंडियाज गॉट लेटेंट शो को लेकर जारी किया वीडियो, काले जादू से लेकर आत्महत्या तक, रो-रोकर सुनाई आपबीती

- IPL 2025

RCB vs DC IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Royal Challengers Bengaluru vs Delhi Capitals

RCB vs DC IPL 2025 Dream11 prediction: Fantasy cricket tips, probable playing XIs, team news, injury updates for Royal Challengers Bengaluru vs Delhi Capitals Royal Challengers Bengaluru vs Delhi Capitals IPL 2025 LIVE Streaming Details: When and where to watch RCB vs DC match 24 live on TV, online?

Royal Challengers Bengaluru vs Delhi Capitals IPL 2025 LIVE Streaming Details: When and where to watch RCB vs DC match 24 live on TV, online? GT vs RR, IPL 2025: Sai Sudharsan, Prasidh Krishna shine as Gujarat Titans beat Rajasthan Royals by 58 runs in Ahmedabad

GT vs RR, IPL 2025: Sai Sudharsan, Prasidh Krishna shine as Gujarat Titans beat Rajasthan Royals by 58 runs in Ahmedabad ‘Pretty similar...’: Famous cricket anchor hopes Prithvi Shaw’s return after Shubman Gill, Riyan Parag and Arshdeep Singh stage victories

‘Pretty similar...’: Famous cricket anchor hopes Prithvi Shaw’s return after Shubman Gill, Riyan Parag and Arshdeep Singh stage victories 'Bawaal ho jayega': KKR captain Ajinkya Rahane takes a dig at Eden Gardens pitch curator after defeat against LSG

'Bawaal ho jayega': KKR captain Ajinkya Rahane takes a dig at Eden Gardens pitch curator after defeat against LSG

- Videos

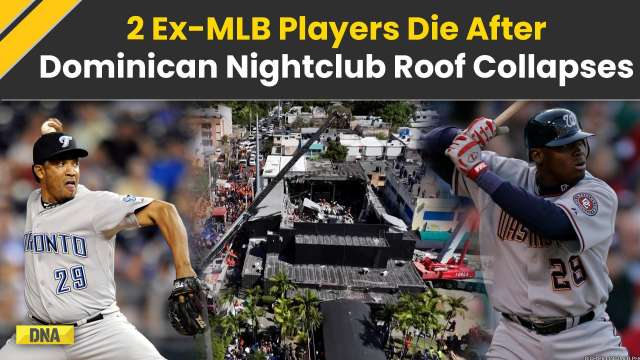

Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased

Dominican Republic Nightclub Collapse: Former MLB Players Octavio Dotel & Tony Blanco Among Deceased Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals

Trump Tariffs: How Much Money Will the US Make From Tariffs? President Donald Trump Reveals Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline

Trump Tariffs: US Slaps 104% Tariff On China After Beijing Misses President Trump's Deadline Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident

Pawan Kalyan Shares Son Mark Shankar’s Health Update Injured In Singapore School Fire Incident Waqf Bill: Chirag Paswan Calls It Pro-Poor As Lok Sabha Passes Amendment

Waqf Bill: Chirag Paswan Calls It Pro-Poor As Lok Sabha Passes Amendment

- Business

Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building

Mukesh Ambani's Rs 1500 crore house Antilia: Number of rooms, helipad, gym, luxury cinema hall, everything about Mumbai's iconic building Iphone maker Apple loses crown as world’s most valuable company, know what went wrong

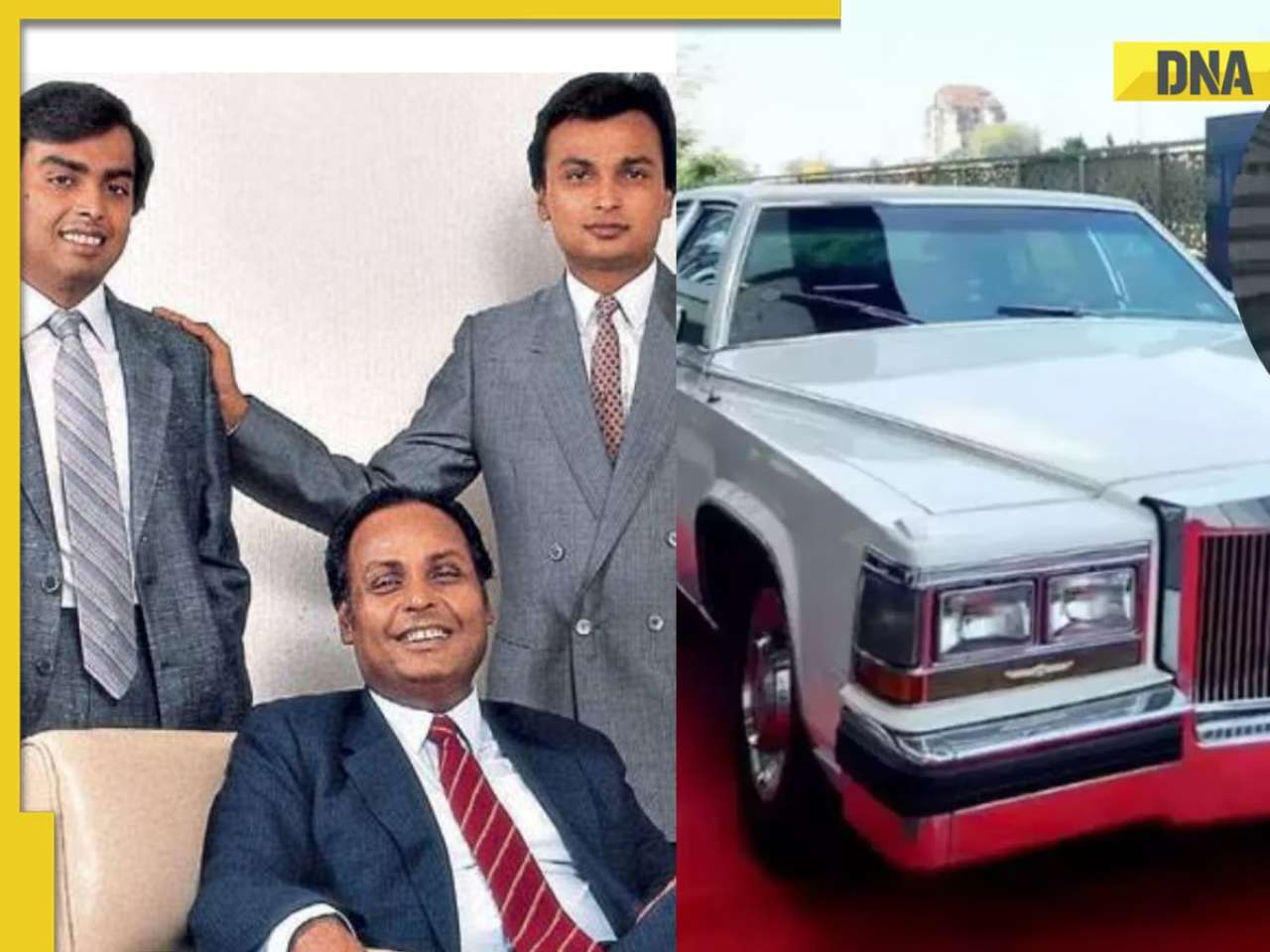

Iphone maker Apple loses crown as world’s most valuable company, know what went wrong Who owns Dhirubhai Ambani's luxury car Cadillac? Not Mukesh Ambani, Anil Ambani but this superstar

Who owns Dhirubhai Ambani's luxury car Cadillac? Not Mukesh Ambani, Anil Ambani but this superstar After Trump tariff pause, Elon Musk, Mark Zuckerberg, Jeff Bezos gain this huge amount in single day

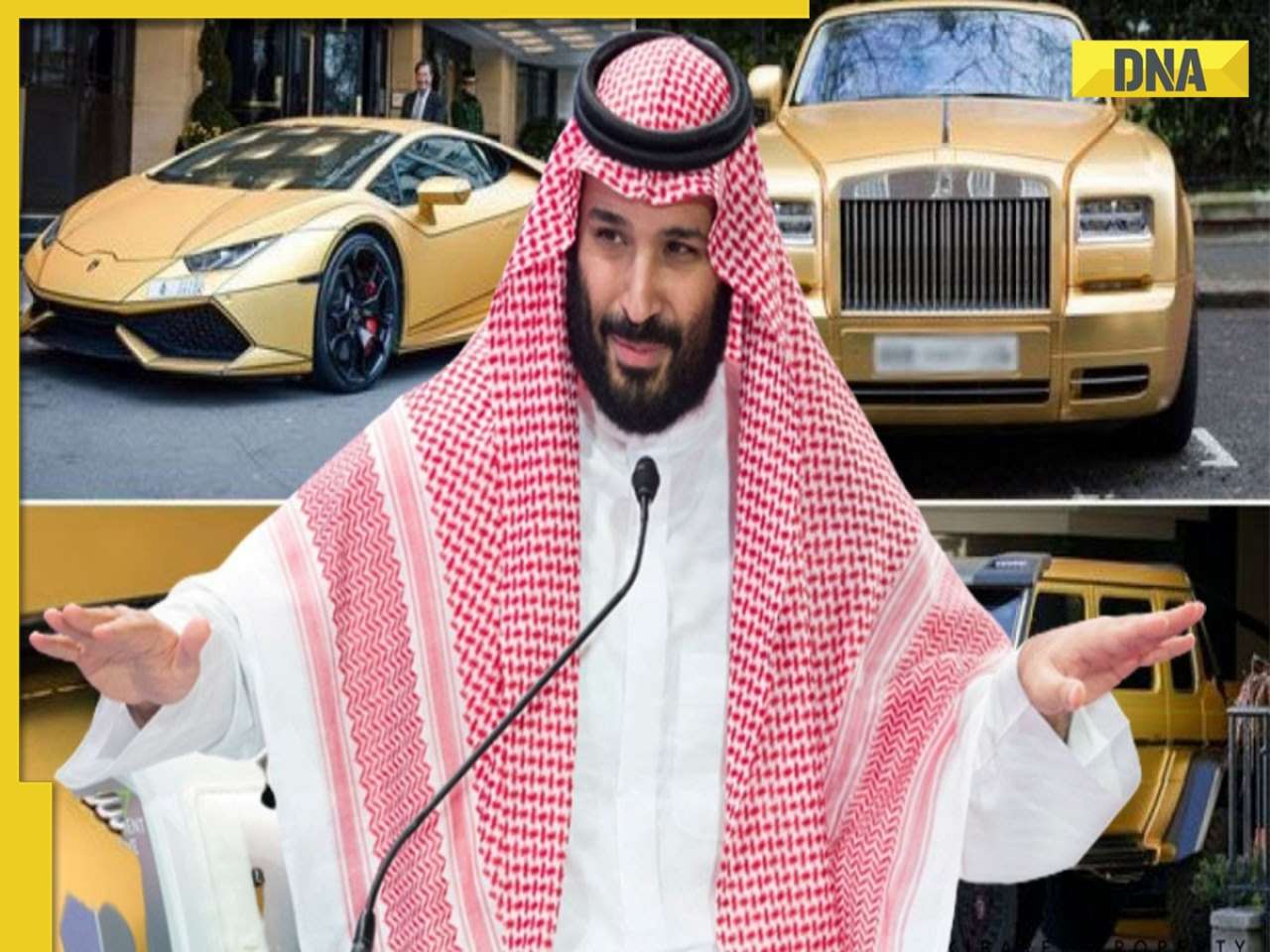

After Trump tariff pause, Elon Musk, Mark Zuckerberg, Jeff Bezos gain this huge amount in single day Meet Saudi Prince MBS, who owns gold-plated supercars, palaces, private jets, his net worth is..., no match for Mukesh Ambani, Elon Musk, Jeff Bezos, Mark Zuckerberg

Meet Saudi Prince MBS, who owns gold-plated supercars, palaces, private jets, his net worth is..., no match for Mukesh Ambani, Elon Musk, Jeff Bezos, Mark Zuckerberg

- Photos

From Kriti Sanon, Anuskha Sharma to Priyanka Chopra: Female Bollywood actors who have turned producers

From Kriti Sanon, Anuskha Sharma to Priyanka Chopra: Female Bollywood actors who have turned producers Ozempic speculations rise: 6 Bollywood celebrities' drastic weight loss sparks concern

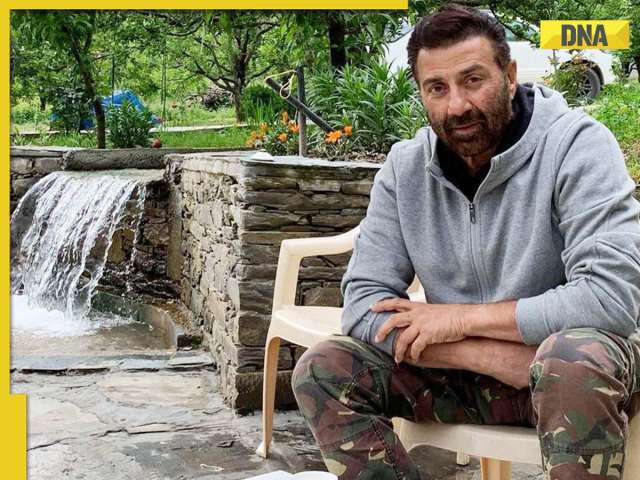

Ozempic speculations rise: 6 Bollywood celebrities' drastic weight loss sparks concern Jaat actor Sunny Deol's Rs 60 crore Mumbai house with private movie theatre, Rs 8 crore Manali farmhouse with wooden interiors and more: A look at his luxurious properties

Jaat actor Sunny Deol's Rs 60 crore Mumbai house with private movie theatre, Rs 8 crore Manali farmhouse with wooden interiors and more: A look at his luxurious properties From Aishwarya Rai Bachchan, Amitabh Bachchan to Vicky Kaushal: 7 Bollywood actors who were severely injured on film sets

From Aishwarya Rai Bachchan, Amitabh Bachchan to Vicky Kaushal: 7 Bollywood actors who were severely injured on film sets From Twinkle Khanna, Sameera Reddy to Sambhavna Seth, Debina Bonnerjee: 7 actors who turned full-time social media influencers

From Twinkle Khanna, Sameera Reddy to Sambhavna Seth, Debina Bonnerjee: 7 actors who turned full-time social media influencers

- India

Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED

Nagaland Lottery Result TODAY 1pm, 6 PM, 8 PM LIVE UPDATE: Dear Mahanadi Thursday 1 PM winners for April 10, 2025 DECLARED Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs...

Kerala Lottery Results 2025 LIVE UPDATE: Karunya Plus KN 568 Thursday April 10 TODAY; first prize is Rs... Tamil Nadu SHOCKER: Menstruating Class 8 girl forced to sit outside classroom for exam in Coimbatore

Tamil Nadu SHOCKER: Menstruating Class 8 girl forced to sit outside classroom for exam in Coimbatore Who is Kerala's self-styled preacher and YouTuber Sirajudheen, arrested after wife died during childbirth at home

Who is Kerala's self-styled preacher and YouTuber Sirajudheen, arrested after wife died during childbirth at home Meet Dr RK Nair, man behind world’s largest Miyawaki forest in India who left Anand Mahindra in awe

Meet Dr RK Nair, man behind world’s largest Miyawaki forest in India who left Anand Mahindra in awe

- Education

Meet IAS officer, daughter of a farmer, who cleared UPSC exam on her second attempt without coaching, her AIR was...

Meet IAS officer, daughter of a farmer, who cleared UPSC exam on her second attempt without coaching, her AIR was... Top US Universities report mass visa cancellations for students, know the reason here

Top US Universities report mass visa cancellations for students, know the reason here Meet woman who pursued civil services dream after engineering, cracked UPSC exam to become IPS officer at just...

Meet woman who pursued civil services dream after engineering, cracked UPSC exam to become IPS officer at just... Meet former Miss India who cracked CDS exam to become Indian Army officer, her AIR was...

Meet former Miss India who cracked CDS exam to become Indian Army officer, her AIR was... Who is IAS S Siddharth, whose videos of random school inspection go viral?

Who is IAS S Siddharth, whose videos of random school inspection go viral?

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)