Both Anil Ambani's companies have asserted that ED actions have absolutely no impact on the business operations, financial performance, shareholders, employees, or any other stakeholders of the firms.

Anil Ambani, Reliance Group chairman, hit the headlines on Thursday after the Enforcement Directorate (ED) conducted searches at dozens of premises linked to the businessman in connection with an ongoing probe into an alleged Rs 3,000 crore loan fraud involving Yes Bank. Soon after the news, shares of Ambani's key companies, Reliance Infrastructure and Reliance Power, saw a decline. Reliance Power shares declined as much as 5.01 per cent to Rs 59.77 on the NSE. Its market cap stands at Rs 24687 crore, as of July 24. While Reliance Infra shares slid 4.99 per cent to Rs 359.85 on Thursday, with a market cap of Rs 14679 crore.

ED raids Anil Ambani-linked premises

The central agency on Thursday conducted simultaneous raids as part of an alleged Rs 3,000 crore worth bank loan fraud linked money laundering case against the companies of Reliance Group chairman Anil Ambani, official sources said. More than 35 premises in Mumbai belonging to 50 companies and 25 persons are being searched under the Prevention of Money Laundering Act (PMLA), they said.

A Delhi-based investigation unit of the ED is carrying out the investigation. ED sources said they are probing allegations of illegal loan diversion of around Rs 3,000 crore, given by Yes Bank, to the group companies of Anil Ambani between 2017 and 2019.

Anil Ambani's firms respond

Both Reliance Infra and Reliance Power have asserted that the said actions have absolutely no impact on the business operations, financial performance, shareholders, employees, or any other stakeholders of the firms. "The said actions have absolutely no impact on the business operations, financial performance, shareholders, employees, or any other stakeholders of Reliance Power," a BSE filing said.

READ | Gautam Adani earns Rs 5380000000 profit as this company announces Q1 results, revenue rises by...

The media reports appear to pertain to allegations concerning transactions of Reliance Communications Limited (RCOM) or Reliance Home Finance Limited (RHFL), which are over 10 years old, the filing said. It is clarified that Reliance Power is a separate and independent listed entity with no business or financial linkage to RCOM or RHFL, the company noted. The filing further said that RCOM is undergoing a corporate insolvency resolution process as per the Insolvency and Bankruptcy Code, 2016, for over 6 years.

The filing also said Anil Ambani is not on the Board of Reliance Power. Accordingly, any action taken against RCOM or RHFL has no bearing or impact on the governance, management, or operations of Reliance Power. Reliance Power continues to focus on its business plans and remains committed to creating value for all stakeholders, the filing added. In a separate filing, Reliance Infrastructure also clarified that the company is a separate and independent listed entity with no business or financial linkage to RCOM or RHFL.

(With inputs from PTI)

Find your daily dose of All

Latest News including

Sports News,

Entertainment News,

Lifestyle News, explainers & more. Stay updated, Stay informed-

Follow DNA on WhatsApp. What is the story behind Ben Stokes' folded finger celebration after scoring century against India in Manchester Test?

What is the story behind Ben Stokes' folded finger celebration after scoring century against India in Manchester Test? Pakistan takes BIG U-turn on terror group tag for TRF, Deputy PM Ishaq Dar says, 'We welcome...'

Pakistan takes BIG U-turn on terror group tag for TRF, Deputy PM Ishaq Dar says, 'We welcome...' 'Reminds me of India and Pakistan': US President Donald Trump's BIG warning to Thailand, Cambodia; says 'Won't do trade with...'

'Reminds me of India and Pakistan': US President Donald Trump's BIG warning to Thailand, Cambodia; says 'Won't do trade with...' India, Pakistan to potentially face each other thrice in Asia Cup 2025; here's how

India, Pakistan to potentially face each other thrice in Asia Cup 2025; here's how Rashmika Mandanna 'sends love' to rumoured beau Vijay Deverakonda, shares their unseen photos from..., says 'I keep looking back...'

Rashmika Mandanna 'sends love' to rumoured beau Vijay Deverakonda, shares their unseen photos from..., says 'I keep looking back...' Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods

Other than heart attacks or BP : 7 hidden heart conditions triggered by oily foods 7 most captivating space images captured by NASA you need to see

7 most captivating space images captured by NASA you need to see AI-remagined famous Bollywood father-son duos will leave you in splits

AI-remagined famous Bollywood father-son duos will leave you in splits 7 superfoods that boost hair growth naturally

7 superfoods that boost hair growth naturally Confused between Forex and Credit cards for your international trip? Learn which saves more

Confused between Forex and Credit cards for your international trip? Learn which saves more Tata Harrier EV Review | Most Advanced Electric SUV from Tata?

Tata Harrier EV Review | Most Advanced Electric SUV from Tata? Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested!

Vida VX2 Plus Electric Scooter Review: Range, Power & Real-World Ride Tested! MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons

MG M9 Electric Review | Luxury EV with Jet-Style Rear Seats! Pros & Cons Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7

Iphone Fold: Apple’s iPhone Fold Could Solve Samsung’s Biggest Foldable Problem | Samsung Z Fold 7 Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor

Trump News: Congress Seeks Answers On Trump's Alleged Mediation In Operation Sindoor OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are...

OpenAI CEO Sam Altman issues CHILLING warning, says conversations with ChatGPT are... This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at...

This man becomes world's highest-earning billionaire in 2025, beats Elon Musk and Jeff Bezos, Mukesh Ambani is at... Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs...

Meet man who built Rs 200,000,000 empire after two failed ventures, his business is..., net worth is Rs... Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is...

Meet man, founder of app under govt lens, also owns Rs 1000000000 business, he is..., his educational qualification is... Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires

Jinnah wanted THIS Muslim man to be first Finance Minister of Pakistan, he refused, his son is on Forbes list of billionaires Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara

Inside Ahaan Panday’s academic journey before his Bollywood debut in Saiyaara From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style

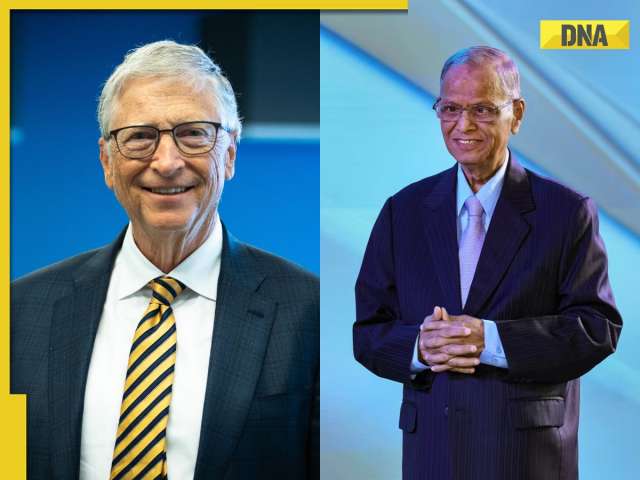

From Alia Bhatt to Anushka Sharma: 5 Bollywood moms who are redefining style Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others

Want to think like a billionaire? Try these 5 habits followed by Bill Gates, Narayana Murthy and others In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025

In Pics: Tara Sutaria brings fairytale magic to ramp in a shimmering golden gown at ICW 2025 From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas

From Love in the Moonlight to Moon Embracing the Sun: 7 must-watch K-dramas India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...'

India appeals to Thailand, Cambodia to prevent escalation of hostilities: 'Closely monitoring...' NCERT to introduce dedicated module on 'Operation Sindoor' for students of Class...

NCERT to introduce dedicated module on 'Operation Sindoor' for students of Class... Mumbai Pune Expressway: 1 killed, many injured after nearly 20 vehicles crash in major accident

Mumbai Pune Expressway: 1 killed, many injured after nearly 20 vehicles crash in major accident Carrying too much luggage on trains? Here's what Indian Railways may do; check weight limit, penalty

Carrying too much luggage on trains? Here's what Indian Railways may do; check weight limit, penalty Indian Army to transform into ‘future oriented force’, chief announces new all-arms brigades called..., it is equipped with...,know details inside

Indian Army to transform into ‘future oriented force’, chief announces new all-arms brigades called..., it is equipped with...,know details inside Indian Army Agniveer CEE 2025 result declared, here's how you can download it

Indian Army Agniveer CEE 2025 result declared, here's how you can download it Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS...

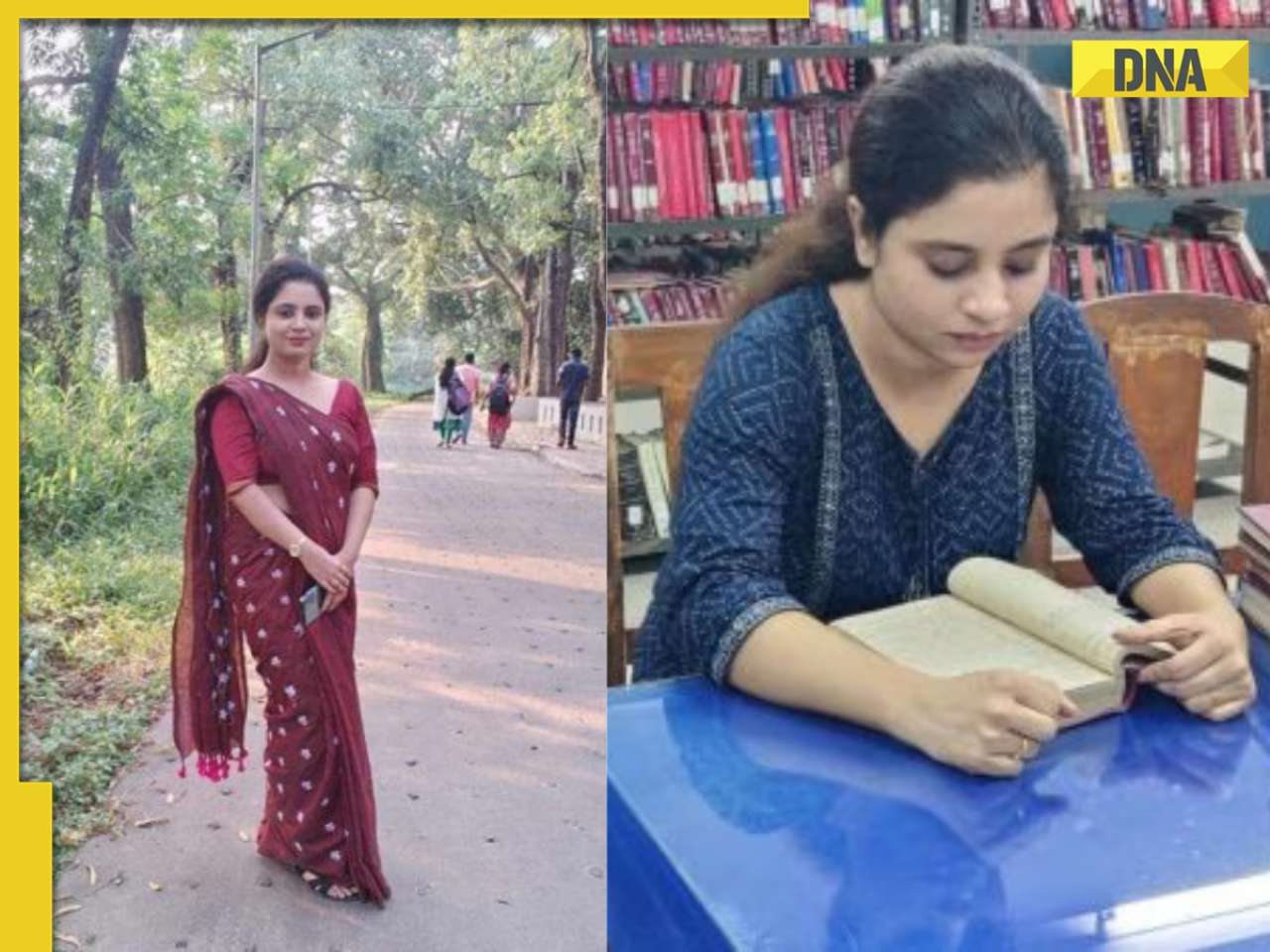

Meet IPS officer, DU grad, who cracked UPSC exam in her third attempt, secured 992 out of 2025 marks with AIR..., now married to IAS... Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from...

Meet woman, who studied MBBS, later cracked UPSC with AIR..., became popular IAS officer for these reasons, shares similarities with IAS Tina Dabi, she is from... Meet Nilufa Yasmine, who topped UGC NET June exam, failed twice before scoring a perfect 100, she is from...

Meet Nilufa Yasmine, who topped UGC NET June exam, failed twice before scoring a perfect 100, she is from... Meet woman, daughter of vegetable vendor who cracked UPSC, her mother mortgaged gold for her education, her AIR is…

Meet woman, daughter of vegetable vendor who cracked UPSC, her mother mortgaged gold for her education, her AIR is… Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on...

Maruti Suzuki's e Vitara set to debut electric market at Rs..., with range of over 500 km, to launch on... This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in...

This is world’s most expensive wood, cost of 1kg wood is more than gold, its name is..., is found in... This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is...

This luxury car is first choice of Indians, even left BMW, Jaguar, Audi behind in sales, it is... Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on...

Kia India unveils Carens Clavis: Check features, design changes, price and more; bookings open on... Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

Tesla CEO Elon Musk launches most affordable Cybertruck, but it costs Rs 830000 more than older version, it is worth Rs...

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)